More From The “New Normal” (In 50 ‘Darker’ Headlines)

Despite the concise, well-intentioned and unavoidably ubiquitous nature of our previous Message, it seems some are still withholding their consent for necessary change.

Though all our Responsible Media Outlets are doing their duty, it appears some members of the public do not yet understand the reality of our situation. More distressing are the efforts of a Criminal Minority to misrepresent Policy, subvert The Message and engage in dangerous questions.

We hope the following collection – once again compiled by the good citizens at the Consent Factory – makes the nature of this new reality quite clear to all those who aren’t yet aware their lives will never be the same.

Remember, resisting the new normal will endanger your life.

One area of concern is that the powers detailed under the bill, as published, remain in force for two years … among the most draconian possible powers is for police, public health and immigration officers to detain people suspected of having Covid-19.”

UK’s emergency coronavirus bill ‘will put vulnerable at risk’, The Guardian (23rd March 2020)

People who intentionally spread the coronavirus could face criminal charges under federal terrorism laws, the Justice Department’s No. 2 official said Tuesday […] “Threats or attempts to use COVID-19 as a weapon against Americans will not be tolerated.””

Those who intentionally spread coronavirus could be charged as terrorists, Politico, (24th March 2020)

A police force has defended using a drone camera to shame people into not driving into a national park during the lockdown, while another force said it was introducing roadblocks to stop drivers heading to tourist hotspots.”

UK police use drones and roadblocks to enforce lockdown, The Guardian, (26th March 2020)

Humberside Police has created an online reporting portal where people can send details of those not following social distancing rules.”

Humberside police creates online report portal for people not social distancing, ITV news (26th March 2020)

An Austin, Texas based technology company is launching ‘artificially intelligent thermal cameras’ that it claims will be able to detect fevers in people, and in turn send an alert that they may be carrying the coronavirus.”

Surveillance Company Says It’s Deploying ‘Coronavirus-Detecting’ Cameras in US, VICE, (18th March 2020)

As the jogger struggled with police, screaming for help, she was filmed by residents who had absolutely zero sympathy for her plight. ‘What’s not fair is that you go out running, you bloody idiot!’, shouted the woman apparently filming the encounter.”

Coronavirus lockdown: Jogger resists arrest in Spain and is abused by onlookers, AS.com, (21st March 2020)

Gordon Brown has urged world leaders to create a temporary form of global government to tackle the Covid-19 pandemic … involving world leaders, health experts and international organisations that would have executive powers to coordinate the response.”

Gordon Brown calls for global government to tackle coronavirus, The Guardian, (26th March 2020)

South African police enforcing a coronavirus lockdown have fired rubber bullets towards hundreds of shoppers queueing outside a supermarket in Johannesburg … the police used whips to get the shoppers to observe social distancing rules.”

South African police fire rubber bullets at shoppers amid lockdown, The Guardian, (28th March 2020)

President Trump said Saturday he may announce later in the day a federally mandated quarantine on the New York metro region, placing “enforceable” travel restrictions on people planning to leave the New York tri-state area because of the coronavirus.”

U.S. coronavirus-related deaths double in two days, The Washington Post, (March 28th 2020)

Rhode Island police began stopping cars with New York plates Friday. On Saturday, the National Guard will help them conduct house-to-house searches to find people who traveled from New York and demand 14 days of self-quarantine.”

Rhode Island Police to Hunt Down New Yorkers Seeking Refuge, Bloomberg, (27th March 2020)

A Police force has had a surge in calls from people reporting neighbours for “going out for a second run” and “gathering in their back gardens.” … “We are getting (dozens of) calls from people who say ‘I want you to come and arrest them’.

Coronavirus: Exercise rule-breakers spark surge in police calls, BBC News, (26th March 2020)

Police with batons and guns have moved in to protect supermarkets on the Italian island of Sicily after reports of looting by locals who could no longer afford food.”

‘We have to eat’: Sicilian police crackdown on locals looting supermarkets, The Local, (29th March 2020)

The National Guard will be deployed to enforce a mile-radius coronavirus “containment area” in overwhelmed New Rochelle … the National Guard will enforce the mandated closure of ‘large gathering areas’ — including schools and houses of worship.”

National Guard deployed to NY community with nation’s ‘largest cluster’ of coronavirus, New York Post, (10th March 2020)

New York City residents who break social distancing rules will be subject to fines up to $500, Mayor de Blasio said Sunday … he also announced that NYPD and MTA workers would do checks of subway cars and force riders off cars that are too crowded.”

New Yorkers who break social distancing rules will now face fines up to $500, Politico, 29th March 2020)

Anyone who leaves their house without a reasonable excuse could spend up to 6 months in prison and face an $11,000 fine under a directive [that] gives police sweeping power to enforce restrictions designed to limit the spread of coronavirus in Australia.”

Six months in jail, $11,000 fine for leaving home without a ‘reasonable excuse’, Sydney Morning Herald, (31st March 2020)

A coronavirus app that alerts people if they have recently been in contact with someone testing positive for the virus “could play a critical role” in limiting lockdowns … but the academics say no-one should be forced to enroll – at least initially.’

Coronavirus: UK considers virus-tracing app to ease lockdown, BBC News, (3st March 2020)

As coronavirus lockdowns have been expanded globally, police across the world have been given licence to control behaviour in a way that would normally be extreme even for an authoritarian state.”

Teargas, beatings and bleach: the most extreme Covid-19 lockdown controls around the world, The Guardian, (1st April 2020)

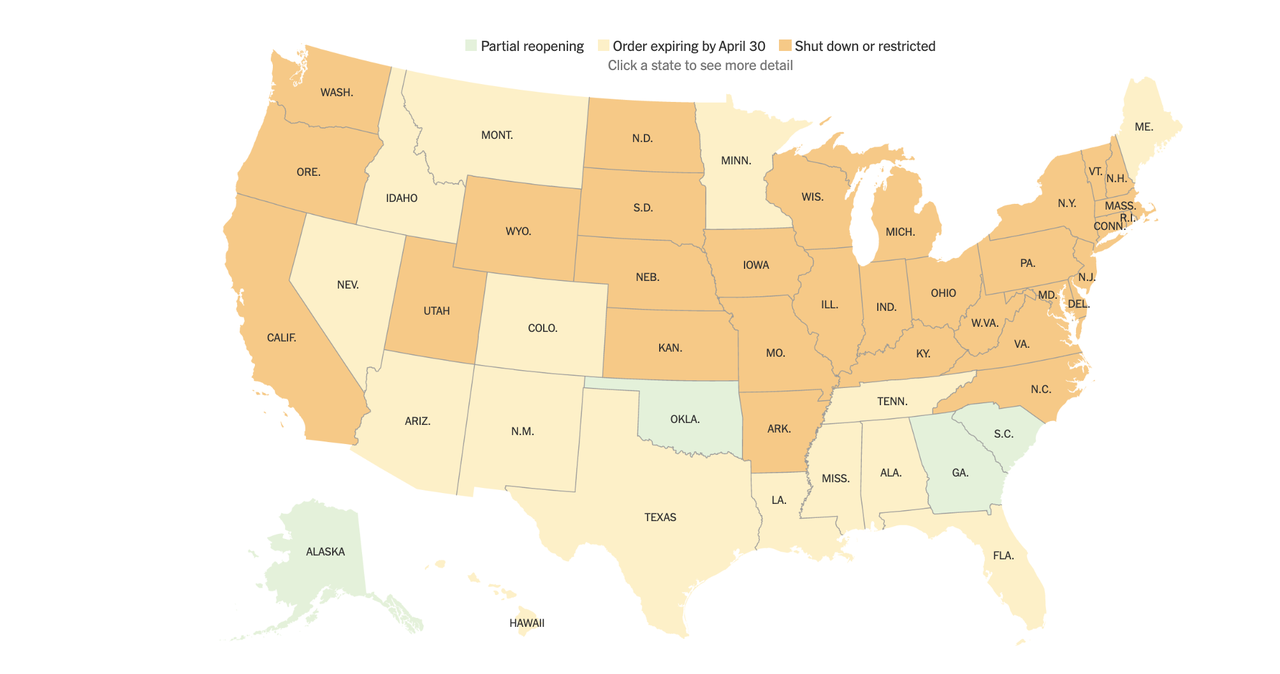

It is likely that we are not heading towards a general deconfinement in one go and for everyone,” Prime Minister Philippe told parliament … the interior minister noted 359,000 fines for violating the lockdown had been issued since lockdown began.”

French PM warns lockdown will not be lifted ‘in one go’, France24, (1st April 2020)

Philippine President Rodrigo Duterte has warned he would order the country’s police and military to shoot dead anyone “who creates trouble” during a month-long lockdown of the island of Luzon enforced to halt the spread of the coronavirus.’

‘Shoot them dead’: Duterte warns against violating lockdown, Al Jazeera, (2nd April 2020)

French interior minister Christophe Castaner warned that “roadblocks would be set up on major highways and axes and extra police, gendarmes or soldiers dispatched to train stations and airports to verify the documents of anyone stopped out and about.”‘

Confirmed cases pass 1 million – as it happened, The Guardian, (2nd April 2020)

Around the world, police forces are testing how far to go in punishing ordinary behavior.”

How Far Should Police Go in Enforcing Coronavirus Lockdowns?, New York Times (2nd April 2020)

Western governments aiming to relax restrictions on movement are turning to unprecedented surveillance to track people infected with the new coronavirus and identify those with whom they have been in contact.”

U.S. and Europe Turn to Phone-Tracking Strategies to Slow Spread of Coronavirus, Wall Street Journal, (3rd April 2020)

If a person becomes infected, the app will automatically send a push notification to anyone they have crossed paths with in the past two weeks, to warn them of the risk of infection.”

Privacy-mad Germany turns to app to track coronavirus spread, The Local, (2nd April 2020)

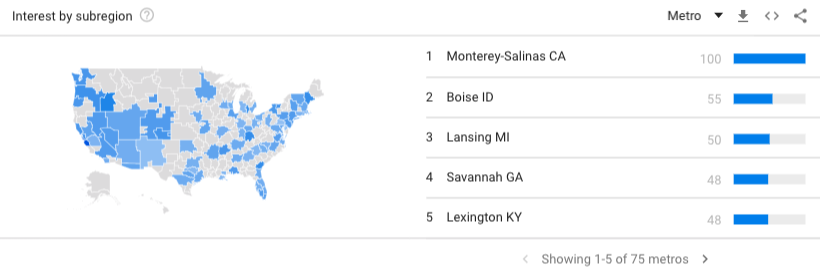

Google will use its mammoth collection of mobile location data to measure whether people across the globe are following government directives …”

Google wielding its vast troves of phone-tracking data in virus fight, Politico, (4th April 2020)

A 70-year-old township man was arrested twice on Saturday after police alleged he tried to enter two different Wawa convenience stores without a mask and became belligerent … he was charged with second-degree terroristic threats during an emergency.”

Coronavirus NJ: Unmasked Toms River man, 70, arrested twice in one day at Wawa stores, app.com, (13th April 2020)

Residents in Riverside County, CA, are now required to wear face coverings and could face a fine of $1,000 per violation per day if the mandate is ignored. ‘This is a valid order and enforceable by fine, imprisonment or both,’ said Sheriff Chad Bianco.”

CALIFORNIA COUNTY FINING RESIDENTS $1,000 FOR NOT WEARING FACE MASKS IN PUBLIC, Newsweek, (7th April 2020)

A family claimed a 500-mile round Lake District trip was acceptable if they wore masks and gloves, police said. The family were criticised as “absolute idiots” and called “clowns” after the force posted about it on Twitter.’

Coronavirus: Police stop family on 500-mile Lake District trip, BBC News, (14th April 2020)

A woman in Victoria says she was left feeling “heartbroken” and like a criminal after uniformed police officers carrying weapons interrupted her father’s funeral over the Easter long weekend to enforce social distancing rules.’

‘Totally disrespectful’: police interrupt funeral while enforcing social distancing rules over Easter weekend, The Guardian, (13th April 2020)

The coronavirus pandemic has led to an unprecedented global surge in digital surveillance, researchers and privacy advocates around the world have said, with billions of people facing enhanced monitoring that may prove difficult to roll back.’

Growth in surveillance may be hard to scale back after pandemic, experts say, The Guardian, (14th April 2020)

Protesters rallied to reopen North Carolina … at least one was arrested. “You are in violation of the executive order,” said police. “You are posing a risk to public health. If you do not disperse, you will be taken and processed at Wake County jail.”

Protesters rally for NC to reopen. One woman arrested for violating governor’s order., New Observer, (14th April 2020)

Officers have become public health police, breaking up crowds at stores … the department has mobilized the Citywide All-Out Task Force, which is usually assembled to flood high-crime areas and other assignments.”

New Role for New York Police: Breaking Up Crowds at Trader Joe’s, New York Times, (14th April 2020)

A South Australian couple was hit with a hefty fine from cops for nonessential travel amid the pandemic after the pair posted vacation snaps from 2019 on Facebook … the couple was warned that if they ‘posted any more photos,’ they would “be arrested.”

Couple mistakenly fined for posting old vacation photos during coronavirus lockdown, New York Post, (14th April 2020)

Attorney Beate Bahner challenged Germany’s coronavirus regulations in the Constitutional Court and failed. Now she has been taken to a psychiatric facility.”

Coronavirus: Anwältin Beate Bahner will gegen Verordnung klagen – und landet selbst vor Gericht, Heidelberg24.com, (24th April 2020)

Ms Bahner submitted a 36-page urgent motion to the Constitutional Court regarding the unlawfulness of all 16 German federal states’ Coronavirus measures … [her] interview for “incitement to commit criminal acts” is scheduled for Wednesday 15 April.

Coronavirus lockdown: German lawyer detained for opposition, UK Column, (14th April 2020)

Police in Berlin broke up a large birthday gathering in the early hours of Monday … a 16-year-old girl was celebrating with 31 other people … all 32 party attendees [are] being investigated for criminal offenses.”

Berlin police bust 16th birthday party amid coronavirus lockdown, DW, (13th April 2020)

Extraordinary times require extraordinary measures and it is about protecting the public.”

Federal government open to new law to fight pandemic misinformation, CBC.com, 15th April 2020)

The UK’s health secretary, Matt Hancock, has suggested “something like an immunity certificate or a wristband” in the future.’

Coronavirus: Could biometric ID cards offer the UK a lockdown exit strategy?, Sky News, (10th April 2020)

Attempting to issue some kind of immunity certificate to millions of Americans would be unprecedented.”

What are ‘immunity passports’ and could they help us end the coronavirus lockdown?, The Hill, (10th April 2020)

The COVID-19 Credentials Initiative (CCI) is working on a digital certificate, [that] lets individuals prove (and request proof from others) they’ve recovered from the novel coronavirus or have received a vaccination, once one is available.”

COVID-19 ‘Immunity Passport’ Unites 60 Firms on Self-Sovereign ID Project, coindesk.com, (13th April 2020)

[T]he drones use computer vision systems to monitor temperatures and heart and respiratory rates of people from above and single out people sneezing or coughing … Draganfly also sees a possible security use around borders or critical infrastructure.”

‘Pandemic drones’ could single people out in a crowd for coughing, sneezing, or running a temperature, Business Insider, (11th April 2020)

Mobile phone tracking software could be compulsory if not enough Australians voluntarily download the application to help in coronavirus case tracing.”

Coronavirus: Mobile tracking app could be compulsory, Morrison says, 9 News, (17th April 2020)

The three-page document, entitled “what constitutes a reasonable excuse to leave the place where you live”, is designed to help police enforce the emergency restrictions that came into effect three weeks ago and are set to be extended.’

Coronavirus lockdown: Police guidelines give ‘reasonable excuses’ to go out, BBC News, (16th April 2020)

[T]here is a danger that these new, often highly invasive, measures will become the norm around the world …”

Compulsory selfies and contact-tracing: Authorities everywhere are using smartphones to track the coronavirus, Business Insider (14th April 2020)

Norway unveiled its Smittestop app, which will notify users if they have been less than 2 metres from an infected person for more than 15 minutes. “To get back to a more normal life … we all have to make an effort and use this app,” PM Solberg said. […] Developers in several European countries are working on similar apps to inform people quickly when they have been in contact with someone who is infected with the virus, as part of a pan-European privacy-preserving proximity tracing (Pepp-PT) initiative.

Coronavirus ‘under control’ in Germany, as some countries plan to relax lockdowns, The Guardian, (17th April 2020)

Officials say they routinely saw people visit the skatepark, even children accompanied by their parents, according to the San Clemente Times … city officials followed in the footsteps of other cities and filled the skatepark with 37 tons of sand.”

Coronavirus: San Clemente Fills Skatepark With 37 Tons Of Sand After Skaters Ignore ‘No Trespassing’ Signs, CBS Local, (17th April 2020)

In one [Michigan] county, anyone deemed a ‘carrier and health threat’ can be detained by police and taken to an Involuntary Isolation Facility.”

Michigan judge authorizes arresting people on suspicion of COVID-19 illness, Life Site News, (16th April 2020)

Technology firms are processing confidential UK patient information in a data-mining operation […] Palantir, founded by rightwing billionaire Peter Thiel, is working with Faculty, a UK artificial intelligence startup, to consolidate government databases.”

UK government using confidential patient data in coronavirus response, The Guardian, (12th April 2020)

‘Imagine an America divided into two classes […] “It will be a frightening schism,” a World Health Organization special envoy on Covid-19 predicted. “Those with antibodies will be able to travel and work, and the rest will be discriminated against.”’

The Coronavirus in America: The Year Ahead, The New York Times, 18th April 2020

Riots have broken out in Paris amid anger over police ‘heavy-handed’ treatment of ethnic minorities during the coronavirus lockdown.”

Riots break out in Paris amid anger at police ‘heavy-handed’ treatment of minorities during lockdown, The Daily Mail, (20th April 2020)

… law enforcers have killed 18 people in Nigeria since lockdowns began on 30 March. Coronavirus has killed 12 people, according to health ministry data.”

Coronavirus: Security forces kill more Nigerians than Covid-19, BBC News, (16th April 2020)

We call upon the degenerate few to cease endangering our new social order.

REMEMBER TO REPORT ANYONE DISPERSING ON ENDORSING MISINFORMATION OR CRITICISING THE STATE

The world is different now. Unfettered expression is a luxury of the pre-Covid society. Doubt is the weapon of the virus spreader.

Pro-Infection propaganda will not be tolerated.

Have a nice day.

Tyler Durden

Sat, 04/25/2020 – 20:00

via ZeroHedge News https://ift.tt/3cIDd5q Tyler Durden