Authored by Jeffrey Snider via Alhambra Investments,

Behind The Blame Game

After what is all but certain to be the final “rate hike” in this cycle, Bloomberg reported that President Trump had previously explored all possible legal ramifications of demoting Federal Reserve Chairman Jay Powell. The issue has become a major one, in the media, anyway, now that Mr. Powell has indicated his error. There will be no further hikes this year, rate cuts now pretty much a done deal from here.

Given the situation, it’s at least understandable how no one is in much of a mood to talk about it publicly. The President’s Chief Economic Advisor, Larry Kudlow, said this week:

I’m not going to comment. It happened six months ago, and it’s not happening today, and therefore I have nothing to say about it. We are not taking actions to change his status.

The central bank is ostensibly independent, which has been its biggest error of all. Not because it is or isn’t attached to the government in some fashion, rather there is no accountability for anything. That’s all independence has meant; central bankers get to decide how well the central bank has performed.

Unsurprisingly, the most Chairman Powell would say recently about QE and the like was, “views differ on the effectiveness of these policies.” Interest rates and money curves are far more certain about them.

The President is saying that the Fed has made another policy error. But in making the claim he is also making an error. A policy error gives the central bank too much credit. It simply isn’t that powerful. If you really believe 2.40% federal funds crashed the economy, I doubt any amount of evidence would convince you otherwise.

It isn’t a policy error it is a forecast error. There’s a big difference. The policy is irrelevant. The Fed wasn’t tightening, it was raising rates believing the economy was so good it required some response. The problem isn’t the response it was the belief leading up to it.

Believing the central bank has that much influence, you’re likely to also believe rate cuts will help; or that a central banker will be in any way helpful. I wrote last July:

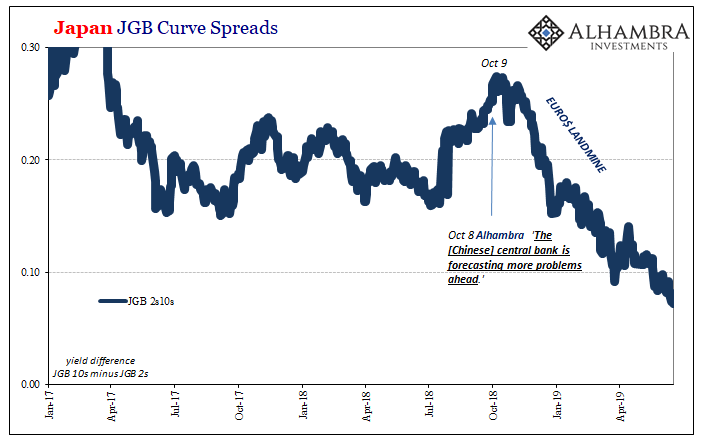

The shape of the current curve is saying the same thing now as it did in early 2000, only at such a diminished nominal level only a central banker could miss the curve’s primary message.

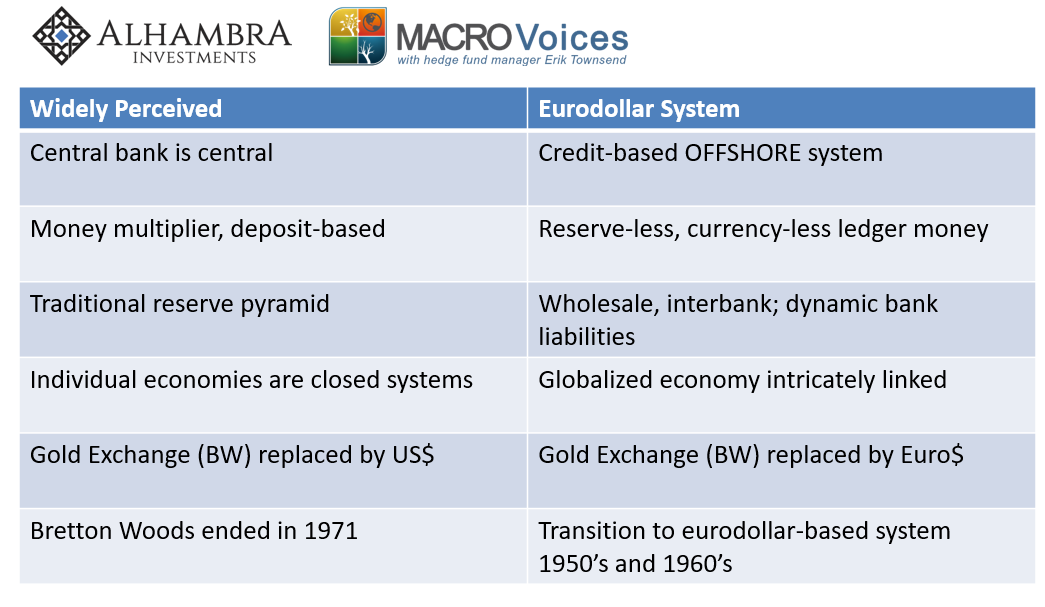

It’s the eurodollar, stupid.

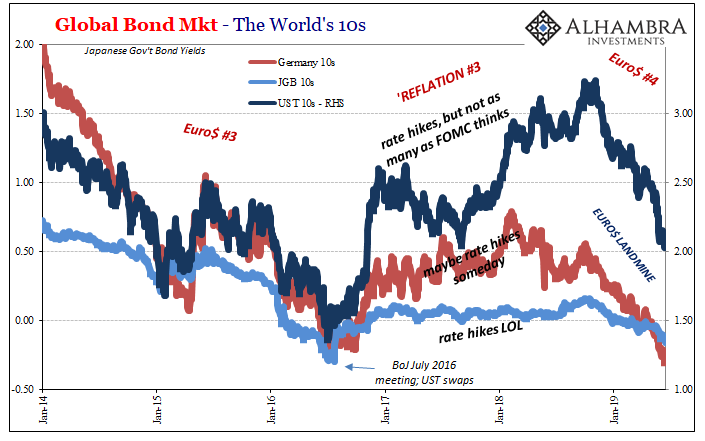

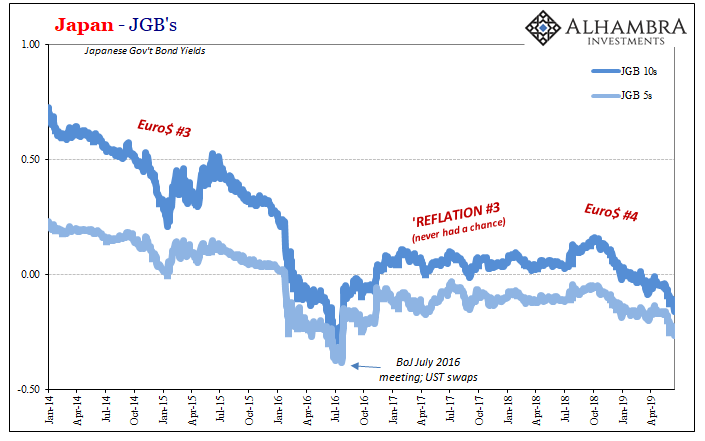

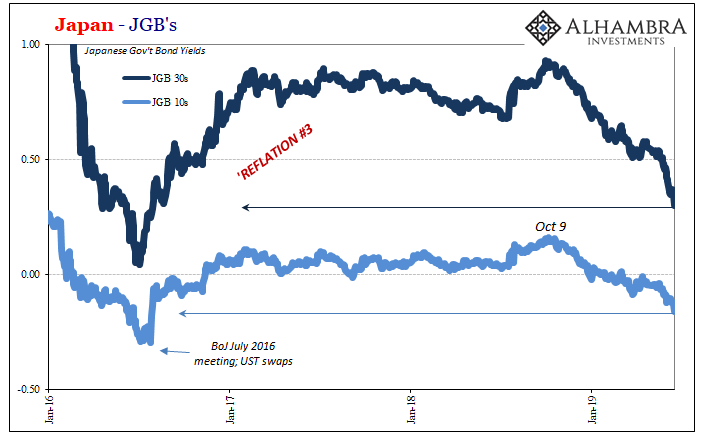

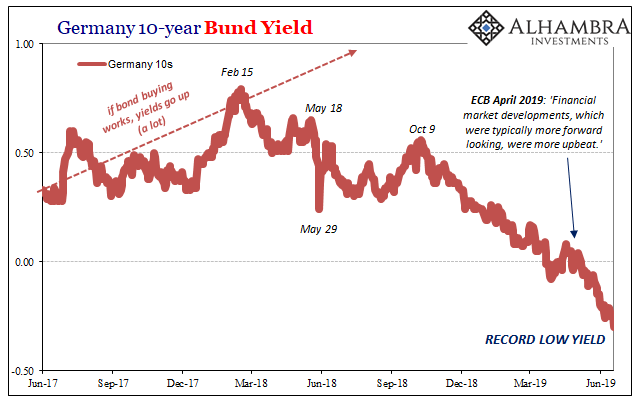

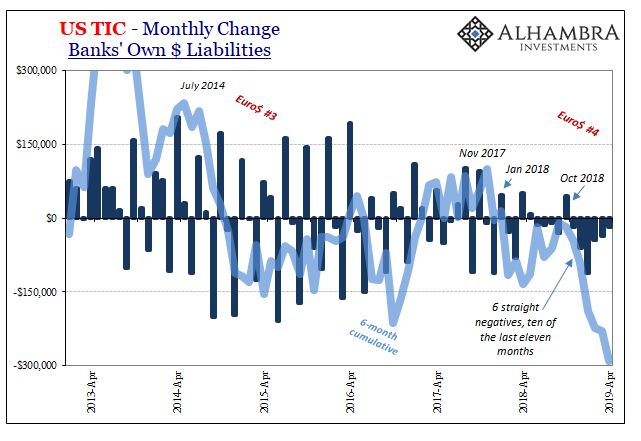

The reason there is so much constant forecast error, especially the last ten years, is that one. That’s why there is no economic growth nor inflation risk as both the eurodollar as well as the UST curves flatten out far closer to zero than normal. They call it R* or the neutral (and natural) interest rate, but all those things describe an economy that just isn’t going to grow and the deepest, most important markets that all believe (eurodollar futures plus UST’s) this isn’t about to change.

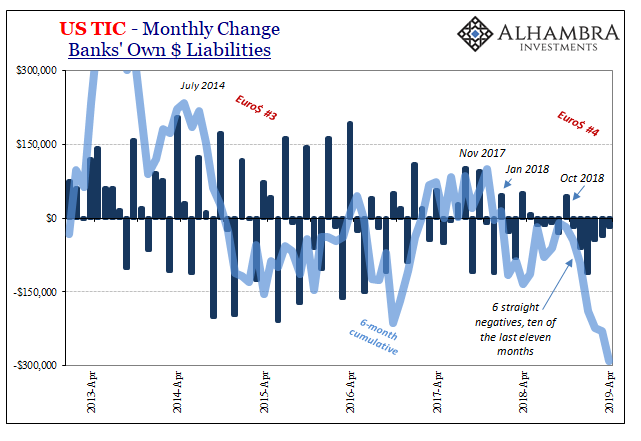

At that very moment, the FOMC’s forecasts were really starting to diverge from the reality pictured in the increasingly inverted eurodollar curve. While the projections remained fixed on growth and inflation acceleration, over the next several months the entire global economy moved closer to what really was a landmine.

There is no doubt what happened during October, November, and December at least as an economic matter (the technical details as to what exactly went wrong and where, those are much harder to pin down). The data keeps pointing in that direction.

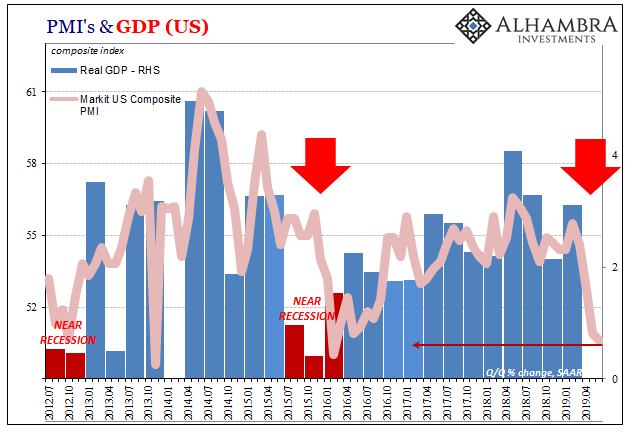

IHS Markit’s PMI estimates on the US economy (as well as others) reconstructs the aftermath of the detonation. The latest Composite PMI reading released today is now just above 50. At just 50.6, the flash estimate for June 2019 was is right in the same vicinity as the lowest point during Euro$ #3 three years ago in early 2016.

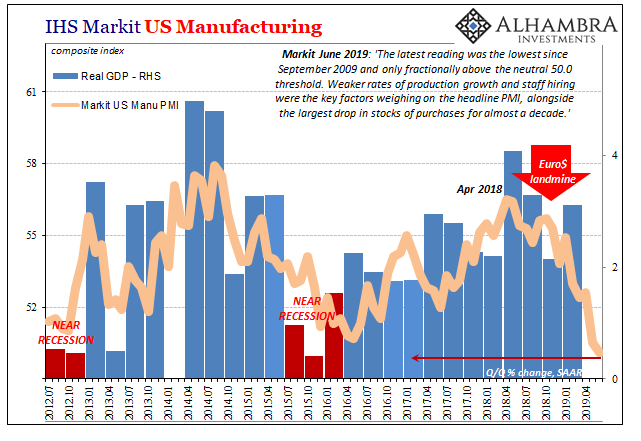

The manufacturing PMI came in at 50.1 – the lowest since 2009. Since it is trade in goods which requires so much financing and money, especially in global conditions, it is always the manufacturing sector which first picks up on the economic damage wrought by monetary explosion(s). Markit’s index topped out unsurprisingly last April, beginning its downward trend in the month that contained May 29.

The real plummet began in November and then like bond yields all over the world it sank in December, taking an almost straight line path downward ever since (making a fool out of my constant reminder of how things never go in a straight line; both bond yields and manufacturing PMI’s beg to differ).

The real issue for both President Trump and Chairman Powell isn’t rate hikes, nor is it trade wars. While the two are going to keep pointing fingers at each other, they and we would be so much better off heeding the advice of the bond market (for once). It was neither of those things which led us into this mess, and therefore focusing on them will only ensure there’s worse to come.

Which, by the way, is exactly how the curves are positioned right now. As I’ve been writing for a while, Euro$ #4 looks to be one of the nastier global monetary shortages. The composite PMI equals the low of Euro$ #3 while the manufacturing PMI is underneath already. By those viewpoints, the economy even now is in a state which is consistent with the last near recession.

And it’s just getting started. Matching the worst of the last one (and the one before that), the bond market is pricing how the worst of this one is yet to come.

It’s still the eurodollar, stupid.

via ZeroHedge News http://bit.ly/2RtEDaN Tyler Durden