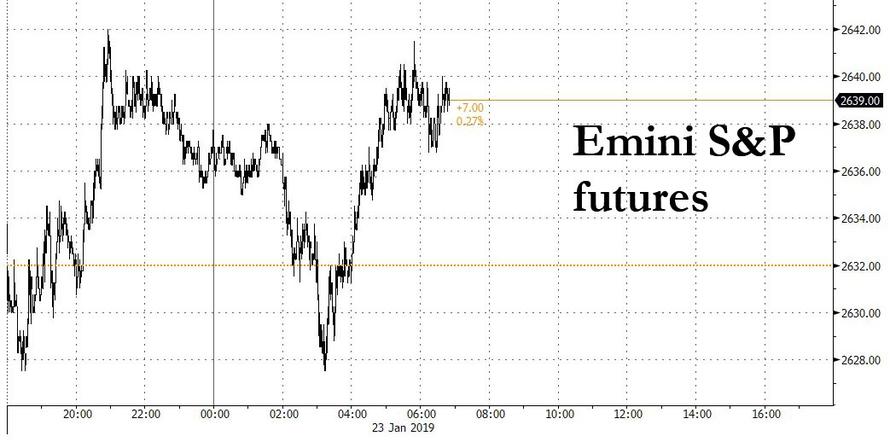

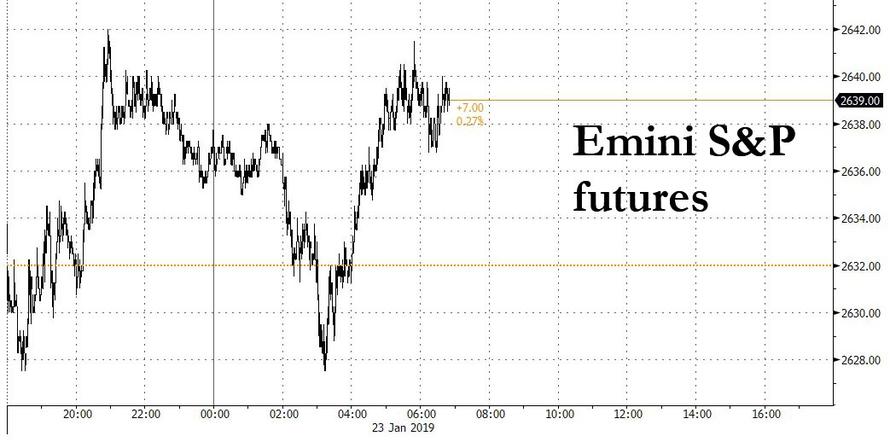

One day after the biggest S&P drop in a month, stocks have regained their composure putting trade and global growth concerns on the backburner, and global stock indices are generally a sea of green this morning.

Trading was initially choppy overnight as hopes of more stimulus measures from China to shore up economic growth clashed with worries over progress between Washington and Beijing to resolve a trade spat between the world’s top two economies. The MSCI world equity index was down 0.1 percent, with Asian equity markets choppy as the region attempted to shrug off the headwinds from the US, where stocks slumped on Tuesday as the risk averse tone and lingering global growth concerns caught up with the major US indices on return from their extended weekend.

The FT reported that the US turned down China’s offer for preparatory trade talks, which was later denied by NEC Director Larry Kudlow helping U.S. equities pare some losses though the fresh concerns about U.S.-China relations kept share prices in check. Early trade jitters pushed the MSCI index of Asia-Pacific shares ex-Japan lower by 0.2%, stalling after climbing to a seven-week high on Monday.

“The main culprit for the risk-off tone this morning is the change in sentiment around U.S.-China trade talks …. That seeped into Asia overnight and Europe this morning,” said Edward Park, deputy chief investment officer at Brooks MacDonald.

Australia’s ASX 200 (-0.3%) was subdued with underperformance in the energy sector after crude prices slipped by over 2% and Nikkei 225 (-0.1%) was dampened by disappointing trade data including the sharpest drop in exports since October 2016.

However, sentiment in Tokyo was propped up by a weaker currency after the BOJ cut its inflationary outlook slashing 2019 core CPI from 1.4% to 0.9%, even as it kept its monetary policy, sending the USDJPY to new highs and boosting local stocks while Japan Display shares surged on reports it is in investment discussions with TPK and Silk Road Fund. 10yr JGBs traded sideways throughout most the session amid the indecisive risk tone in stocks and then saw choppy trade in reflection of sentiment in the region and following an unsurprising BoJ decision to keep policy setting unchanged.

Elsewhere, Hang Seng and Shanghai Composite confirmed trader indecisiveness after mixed actions by the PBoC as it conducted a Targeted Medium-term Lending Facility for the first time ever which was at a lower rate than MLF rates and is aimed at spurring lending to small firms, but conversely refrained from reverse repo operations which resulted to a daily drain of CNY 350bln.

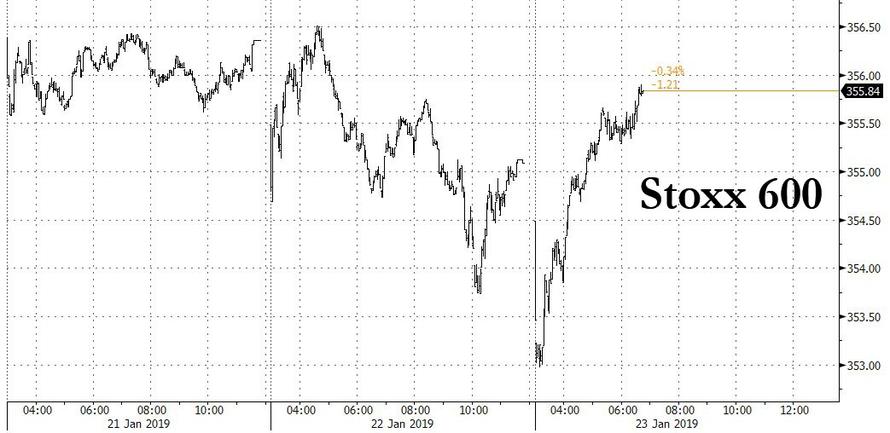

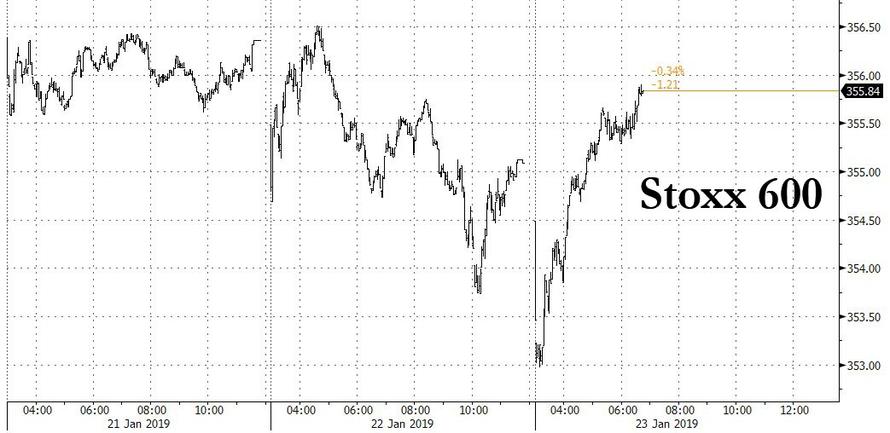

A fresh batch of disappointing corporate updates from European companies further knocked confidence about fourth-quarter earnings, pushing European stocks lower for a third session at the start of trading, with the Stoxx 600 down as much as 0.5%, with bourses all across Europe losing ground as a profit warning by Ingenico sent the French payment group down over 12 percent and hit the whole European tech sector.

However, sentiment reversed sharply just after the open, with most European equities trading mostly higher [Euro Stoxx 50 +0.2%], after recovering from opening losses, taking the lead from Wall Street.

Echoing the rebound in Europe, U.S. futures pointed to a positive start for Wall Street after the S&P 500, Nasdaq and the Dow all posted their biggest one-day percentage drops since Jan. 3 on Tuesday.

Still, despite a modest return of bullish sentiment, the ride ahead will be bumpy: Justin Onuekwusi, a fund manager at Legal & General said central banks’ stimulus unwinding, China’s slowdown, the broader impact of trade wars and populist rhetoric from politicians were all keeping markets on edge. “All these issues have an impact on markets. Every time you have an increase in rhetoric, markets react. It feels like there is a greater political risk premium. The biggest near-term risk is that as you see markets fall, confidence drops and you get people not spending which becomes self-perpetuating. The near-term probability of that has increased.”

In FX, the U.S. dollar slumped to session lows having trading near a three-week high earlier after the Bank of Japan left monetary policy unchanged as expected, boosting risk appetite and sending the yen lower. The Bloomberg Dollar Spot Index fell for the first time in seven days in a rather muted session in currencies, with short-term positioning dictating price action. The yen weakened as the BOJ lowered its inflation outlook, while the kiwi advanced as consumer-price data beat estimates. Treasuries slipped as oil prices rose, while euro-area bonds were mixed as stocks in Europe and U.S. equity futures rebounded. Sterling rose as the U.K. parliament moved closer to ruling out a no-deal Brexit. The euro was a shade lower at $1.1358 but remained in close reach of a three-week low of $1.1336 set on Tuesday, weighed by recent weakness in the euro zone economy and worries about fallout from Brexit.

In the key central bank event overnight, the BoJ kept monetary policy settings unchanged as expected with NIRP held at -0.1% and 10yr JGB yield target at around 0%. Furthermore, the BoJ extended its lending scheme for 1 year and stated that economic momentum for reaching price goal is sustained but lacking strength, while it added that risks to price and economic outlooks are skewed to the downside. BoJ reduced Real GDP forecasts for FY18 but raised Real GDP forecasts for FY19 and FY20, while it reduced Core CPI forecasts on all years through to FY20. BoJ Governor Kuroda said the downward revision to price outlook is due to the temporary decline in oil prices, Kuroda expects inflation to pick up towards the 2% target. Adding that downside risks from overseas are heightening due to US-China trade friction and European problems.

In the latest Brexit developments, PM May is reportedly set to force ministers to keep a no deal Brexit on the table despite threats of ministerial resignations. This has been seen as a defence mechanism against the Labour Party’s potential support for the Cooper-Boles Brexit delay plan. UK Tory party Brexiteers concerned about prospects of a delay, have suggested they could be won over if UK PM May can get a serious concession from the EU on backstop. Following this, ITV’s Paul Brand tweets “Jacob Rees-Mogg will say in a speech today that the backstop remains “the one absolute obstacle” to backing PM’s deal BUT he’s “encouraged by signs of movement”. Sun’s Steve Hawkes reports “Labour has told second referendum campaigners it is backing the Cooper-Boles Amendment”. Has subsequently been confirmed by a Labour party source, stating it is ‘highly likely’ they will back the amendment.

In commodities, Brent (+0.8%) and WTI (+0.8%) prices have nursed initial losses and moved into positive territory due a turnaround in risk sentiment. Following on from Saudi Energy Minister Al Falih’s withdrawal from the WEF at Davos, Russian Energy Minister Novak has also cancelled his trip; Novak was due to speak on Friday on the Great Energy Race alongside IEA’s Birol. Separately, IEA’s Birol has stated that oil demand will grow by at least 1mln BPD. In terms of forecasting DNB have cut their 2019 Brent forecast to USD 70/bbl vs. Prev. USD 75/bbl. Of note API’s have been rescheduled to today due to Monday’s US market holiday.

Gold has marginally benefitted from the risk sentiment, with the yellow metal trading at the top of it’s narrow USD 4/oz range; currently just under USD 1285/oz. Elsewhere, China’s December scrap metals imports increased to 510k tonnes, their highest figure since May, ahead of China tightening waste imports in 2019.

Expected data include mortgage applications. Abbott, Comcast, P&G, and Ford are among companies reporting earnings.

Market Snapshot

- S&P 500 futures up 0.2% to 2,636.25

- STOXX Europe 600 down 0.05% to 354.91

- MXAP down 0.3% to 152.23

- MXAPJ down 0.1% to 494.65

- Nikkei down 0.1% to 20,593.72

- Topix down 0.6% to 1,547.03

- Hang Seng Index up 0.01% to 27,008.20

- Shanghai Composite up 0.05% to 2,581.00

- Sensex down 0.6% to 36,217.48

- Australia S&P/ASX 200 down 0.3% to 5,843.72

- Kospi up 0.5% to 2,127.78

- German 10Y yield rose 0.3 bps to 0.239%

- Euro down 0.01% to $1.1359

- Italian 10Y yield fell 1.7 bps to 2.383%

- Spanish 10Y yield fell 1.3 bps to 1.321%

- Brent futures up 0.7% to $61.94/bbl

- Gold spot little changed at $1,285.00

- U.S. Dollar Index little changed at 96.36

Top Overnight News from Bloomberg

- The European Union is prepared to hit 20 billion euros ($22.7 billion) of U.S. goods with tariffs should President Donald Trump follow through on a threat to impose duties on EU cars and auto parts, said a senior trade official for the bloc

- The European Commission is pushing the Irish government to lay out its plans for the border in the event of a no-deal Brexit, a person familiar with the matter said

- The U.K. parliament is inching toward a plan to delay Brexit to prevent Britain dropping out of the European Union without a deal, with the opposition Labour Party now increasingly likely to support the proposal

- Debt levels in the U.K. aren’t necessarily a cause for concern, according to Bank of England Deputy Governor Ben Broadbent

- Investors are seeking record amounts of bonds from Southern Europe, emerging from the sidelines after last year’s political turmoil in Italy. Sovereign bond offerings from Italy, Spain and Portugal this month have all drawn unprecedented bidding for a total of 106 billion euros ($120 billion), up 14 percent from a year ago. That has helped drive a slide in peripheral euro-area yields in the past two weeks

- The chairman of Thailand’s Election Commission says a general election is to be held on March 24

Asian equity markets were choppy as the region attempted to shrug off the headwinds from Wall St, where stocks declined as the risk averse tone and lingering global growth concerns caught up with the major US indices on return from their extended weekend. Furthermore, it was also reported that the US turned down China’s offer for preparatory trade talks, which was later denied by NEC Director Kudlow. Nonetheless, ASX 200 (-0.3%) was subdued with underperformance in the energy sector after crude prices slipped by over 2% and Nikkei 225 (-0.1%) was dampened by disappointing trade data including the sharpest drop in exports since October 2016. However, sentiment in Tokyo was later propped up by a weaker currency, while Japan Display shares surged on reports it is in investment discussions with TPK and Silk Road Fund. Hang Seng (U/C) and Shanghai Comp. (U/C) conformed to the indecisiveness after mixed actions by the PBoC as it conducted a Targeted Medium-term Lending Facility for the first time ever which was at a lower rate than MLF rates and is aimed at spurring lending to small firms, but conversely refrained from reverse repo operations which resulted to a daily drain of CNY 350bln. Finally, 10yr JGBs traded sideways throughout most the session amid the indecisive risk tone in stocks and with participants side-lined prior to the BoJ policy announcement, but then saw choppy trade in reflection of sentiment in the region and following an unsurprising BoJ decision to keep policy setting unchanged.

Top Asian News

- China Meat Giant Surges as Founder Returns After Vanishing

- China Companies Suspected of Buying Own Bonds to Spur Demand

- Thailand to Hold First General Election Since Coup in 2014

- BOJ Leaves Stimulus Unchanged as It Cuts Inflation Outlook Again

- The January Rally Is Waning in Asia Stocks, Just Like Last Year

Major European equities are mostly higher [Euro Stoxx 50 +0.2%], after recovering from opening losses, taking the lead from Wall Street. US stocks were affected by growth concerns, alongside subsequently denied reports that the US turned down an offer by two Chinese vice-ministers to attend preparatory trade talks in the US. Sectors have strengthened somewhat from their negative opening, and are now mixed with underperformance in energy names and outperformance in utilities. Tech names have been underperforming following ASML (-1.8%) cutting Q1 sales guidance, with the likes of STMicroelectronics (-1.4%) down in sympathy. Other notable movers include Carrefour (+6.7%) are at the top of the Stoxx 600 following earnings where they confirmed all targets for their 2022 transformation plan. Separately, RPC Group (+4.6%) are firmly in the green after recommending a final cash offering of GBP 7.82/shr; with Co’s directors seeing the acquisition terms as fair and reasonable. In contrast, at the bottom of the Stoxx 600 are Ingenico (-13.2%) after reporting a FY18 EBITDA miss.

Top European News

- Still Here? Brexit Delay Might Worsen EU’s Election Headache; Fox Warns No-Deal Exit Is ‘Real Possibility’: Brexit Update

- Record Bidding for Southern Europe’s Debt Shows Pent-Up Demand

- Salvini Takes a Swing at Merkel and Forecasts Losses for Macron

- Apollo Seals $4 Billion Deal for Ketchup-to-Lotions Packager RPC

- Patisserie Valerie Collapses as Luke Johnson’s Rescue Fails

In FX, a relatively muted session for the Dollar thus far with the index hovering around the middle of a tight 96.268-378 range after NEC Director Kudlow dismissed reports that US turned down an offer from China for trade talks. The US government shutdown is now rolling onto its 33rd day, although there were reports overnight that US Senate are to vote on two separate bills on Thursday which could potentially bring an end to the shutdown. Meanwhile, BLS stated the January 2019 Employment Situation will be published as scheduled on February 1, 2019, at 1330GMT. ING noted that the 800k workers affected by the shutdown represent only 0.5% of the total US NFP, noting that the impact to the US economy will be modest but noticeable.

- JPY – On the backfoot in early EU trade following the BoJ rate decision in which the Central Bank kept the NIRP at -0.1% and the 10yr JGB yield target around 0% as expected while also reducing inflation forecasts, which was widely touted beforehand. Furthermore, Japan logged the first trade annual deficit in three years, as the cost of energy imports surged. As such USD/JPY breached its 100 and 50 HMAs (at 109.45 and 109.53 respectively) to a high of 109.73 (vs low of 109.33) with little to report on the options expiry front.

- GBP, EUR – The Pound continues on its upwards trajectory amid ongoing hopes of an Article 50 extension despite the UK Governments constant dismissal of the option, though the latest suggests that support for the Cooper amendment (to give Parliament power to extend Article 50) is stacking up, with reports of the Labour party also supporting the amendment. Lloyd’s notes that the recent Sterling strength was more than they anticipated, though a clean break through 1.3000 is still needed for “re-energised momentum” to the upside. GBP/USD remains closer to the top of a 1.2945-1.3000 range ahead of its 200 DMA at 1.3081. Meanwhile the EUR remains flat within

In commodities, Brent (+0.8%) and WTI (+0.8%) prices have nursed initial losses and moved into positive territory due a turnaround in risk sentiment. Following on from Saudi Energy Minister Al Falih’s withdrawal from the WEF at Davos, Russian Energy Minister Novak has also cancelled his trip; Novak was due to speak on Friday on the Great Energy Race alongside IEA’s Birol. Separately, IEA’s Birol has stated that oil demand will grow by at least 1mln BPD. In terms of forecasting DNB have cut their 2019 Brent forecast to USD 70/bbl vs. Prev. USD 75/bbl. Of note API’s have been rescheduled to today due to Monday’s US market holiday. Gold (Unch) has marginally benefitted from the risk sentiment, with the yellow metal trading at the top of it’s narrow USD 4/oz range; currently just under USD 1285/oz. Elsewhere, China’s December scrap metals imports increased to 510k tonnes, their highest figure since May, ahead of China tightening waste imports in 2019.

US Event Calendar

- 7am: MBA Mortgage Applications, prior 13.5%

- 9am: FHFA House Price Index MoM, est. 0.3%, prior 0.3%

- 10am: Richmond Fed Manufact. Index, est. -2, prior -8

DB’s Jim Reid concludes the overnight wrap

Good morning from the highest city in Europe. Davos is very cold and please expect lots of Canada Goose jackets if you catch up with events on the telly over the rest of this week. I looked at buying one before I came out so as to fit in with the Davos set. When I saw how much they cost I realised I would rather not fit in. Actually, I got there late last night and the only non-restaurant places I found to eat were a kebab shop and a Co-op supermarket. I was wondering whether Bono has ever had a similar dilemma between the two choices. As I’m staying in a self-catering apartment and after much deliberation I opted for the latter and cooked myself a pizza. In nearly a quarter of a century it’s probably the first business trip that I’ve cooked for myself. I quite enjoyed it. Anyway, if you’re in town let me know, especially if you want to attend one of my sessions.

The cold air has obviously also infiltrated markets this week. US bourses reopening yesterday failed to stem the reversal of some of the new year optimism. Indeed, the latest headlines on the earnings and trade fronts weighed on sentiment. Equity markets failed to recover from heavy falls at the open with the S&P 500, DOW and NASDAQ closing down -1.42%, -1.22% and -1.91% respectively. The NYFANG index dropped -3.38% as Amazon and Netflix posted their worst days of the year.

Markets took another leg lower in the US afternoon session, after headlines broke that US negotiators declined a proposed meeting between with mid-level Chinese officials, apparently citing lack of progress on China’s industrial policies, especially the alleged forced technology transfers. The meeting would have been with Vice-Minister of Commerce Wang and Vice-Minister of Finance Liao, to lay groundwork for next week’s planned meeting between senior officials namely Vice-Premier Liu, US Trade Representative Lighthizer, and Treasury Secretary Mnuchin. Those talks are still scheduled to take place, but expectations for a breakthrough have now fallen. Late in the day, Trump Administration officials formally denied the reports however head of the National Economic Council Kudlow did add that “enforcement is absolutely crucial to the success of these talks. In any case the damage to markets had been done.

Earnings also played a part in the sogginess, as poor results from Halliburton, Johnson & Johnson and Stanley Black & Decker weighed on the industrials and consumer discretionary sectors (down -2.07% and -1.79% respectively). All three companies declined following their latest quarterly reports with the common denominator being management comments about a challenging outlook ahead, highlighted by Black & Decker CEO Loree saying “economic growth is slowing”. This more than offset gains to eBay (+6.13%) which rallied after one of its bigger shareholders, Elliot Management, proposed a five-step plan which in their view could result in eBay’s share price almost doubling. The energy sector also suffered (-2.20%), as WTI oil tumbled -1.91% however did at least pare a sharper slide earlier in the session. That move came despite there not really being an obvious catalyst aside from the various growth concerns which have been highlighted in recent days – none of which are particularly new news.

Meanwhile, here in Europe UBS also missed at both the earnings and sales lines following its quarterly report which resulted in shares falling -3.17% in Switzerland – albeit off the early lows. That weighed on the wider European Banks index which closed down -1.03% and for the fifth time in the last seven sessions while the STOXX 600 ended -0.36%. HY credit spreads widened +4bps and +12bps in Europe and the US respectively. In contrast bonds were slightly stronger, albeit only modestly so, with Bunds ending -2.0bps lower and Treasuries -4.5bps. The 2s10s curve also flattened -1.6 bps but the reality is that it still remains rooted in the 10-20bp range that it’s been in since the end of November.

Overnight the focus has turned to the BoJ where, as expected, there have been no changes to policy. Also as expected are the lower inflation forecasts in the BoJ’s outlook, the fourth consecutive quarter they have done so. For the fiscal year starting April, core CPI is expected to be 0.9% compared to 1.4% previously. With the backdrop of lower inflation and with the consumption tax looming, the hurdle to the BoJ contemplating adjusting policy continues to look high. JGBs are slightly weaker this morning post the decision with the 10y up less than a basis point to -0.004% with Kuroda due to speak shortly. The Yen has weakened -0.25% while the Nikkei (+0.04%) is broadly flat. That’s the case also for the Hang Seng (+0.06%) and Shanghai Comp (+0.07%) with the Kospi (+0.24%) outperforming. The good news is that the slide for US equity futures also appears to have come to an end with S&P 500 contracts up +0.15%. That may reflect the news that lawmakers in the Senate have agreed to hold separate votes today on rival proposals in order to reopen the government.

Moving on. There was some interest in the ECB’s bank lending survey yesterday which was softer compared to recent surveys. The net percentage of banks reporting tightening standards to enterprises was closer to even with -1 in Q4 compared to -6 in Q3. Demand for loans also continued its slowing trend from recent quarters with the net balance to enterprises falling to +9 versus +12 in Q3. It was a similar story for housing loans although demand for the latter did pick up. At a country level the softness was mostly reserved for Italy and Spain. Notably the outlook for Q1 also implies further moderation which fits in with lower growth expectations for the Euro Area this year. At a minimum the data should add to the anticipation levels for tomorrow’s PMIs and ECB policy meeting. Our economists’ preview for the meeting is available here. They don’t think any big policy changes are imminent, but think the council could shift its characterisation of the balance of risks to the downside. Apart from that, they’ll focus on any hints regarding new TLTROs and/or any discussion of a potential one-off deposit rate hike.

Here in the UK it was nice to get some rare positive news in the form of the latest labour report. Indeed there were positive surprises for the November unemployment rate (down one-tenth to 4.0% vs. 4.1% expected), average weekly earnings (up one-tenth to +3.4% 3m/yoy vs. +3.3% expected) and employment change (141k 3m/3m vs. 87k expected) prints. That of course compares to what have been weaker PMIs in the UK recently and the ongoing Brexit saga so this somewhat complicates the picture for the BoE with the supply side narrative of a tighter UK labour market very much intact. A hike by August is less than 50% priced however it will challenge the BoE not to sound overly dovish given the strength in the hard data.

The only other data worth flagging yesterday in Europe was the January ZEW survey in Germany where there was a big slump in the current situations component to 27.6 (vs. 43.0 expected) compared to 45.3 in December. However the expectations component did climb 2.5pts to -15.0 and bettered expectations for a fall to -18.5.

In the US, monthly existing home sales fell short of expectations, rising by 4.99 million in December compared to expectations for 5.25 million, the slowest pace and biggest downside miss since November 2015. Mortgage applications have picked up over the last couple weeks as long end interest rates have fallen, so there could be scope for a rebound in the near future. We’ll get the latest MBA mortgage application data later today.

In terms of the day ahead, this morning in Europe we’ll get January confidence indicators out of France followed later on by the January CBI survey in the UK. In the US this afternoon it’ll be worth keeping an eye on the January Richmond Fed manufacturing survey (-2 expected vs. -8 previously) in light of some weak regional Fed surveys so far this month, while the November FHFA house price index is also due out. This afternoon we’ll also get the January consumer confidence reading for the Euro Area. Away from that we’re due to hear from the BoE’s Broadbent while the second day of the Davos forum gets underway. Earnings wise we’re due to get quarterly reports from United Technology, Proctor & Gamble and Ford.

via ZeroHedge News http://bit.ly/2CBJn7g Tyler Durden

School choice is a noble cause, writes John Stossel. In much of America, parents have little or no control over where their kids attend school. Local governments assign schools by ZIP code.

School choice is a noble cause, writes John Stossel. In much of America, parents have little or no control over where their kids attend school. Local governments assign schools by ZIP code.

Ashim Mitra, a professor at the University of Missouri-Kansas City, has resigned following complaints from graduate students from India that he used them as

Ashim Mitra, a professor at the University of Missouri-Kansas City, has resigned following complaints from graduate students from India that he used them as