Authored by James Howard Kunstler via Kunstler.com,

It’s conceivable, in a nation that absolutely can’t make sense of itself, that Mr. Trump’s annual report to congress will be as incomprehensible as this year’s Superbowl halftime show. Even the weather in Atlanta was a complete mystery with Maroon 5’s front man, Adam Levine, capering half-naked in tattoo drag amid artificial fires-of-hell, and then local hero rapper Big Boi’s triumphal entry in a limo, nearly lost inside what looked like the pelt of a giant ground sloth – an eight-year-old’s idea of what it means to be important. Or maybe it was just all code for two sides of the climate change debate.

You can be sure the atmosphere will be frosty to the max when the Golden Golem of Greatness lumbers down the aisle of congress’s house on Tuesday night. I wouldn’t be surprised if the Democratic majority turns its backs on him during the always excruciating preliminaries and then just walks out of the chamber. Don’t expect the usual excessive rounds of applause from the president’s own party this time, either, in the big, half-empty room. They don’t know what to do about him at this point… or what to do with themselves, for that matter.

The running theme for State of the Union (SOTU) messages going back to Ronald Reagan is American Wonderfulness, so expect at least forty minutes of national self-esteem therapy, which nobody will believe. Throw in another ten minutes of elevating sob stories about “special guests” up in the galleries. But leave a little time for Mr. Trump to roll a few cherry bombs down the aisles. He must be good and goddam sick of all the guff shoveled at him for two years.

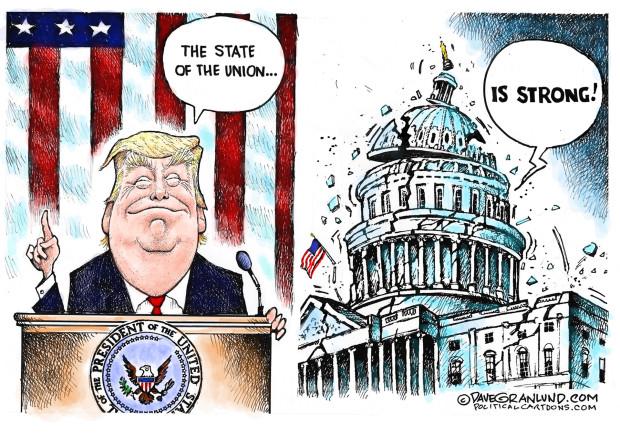

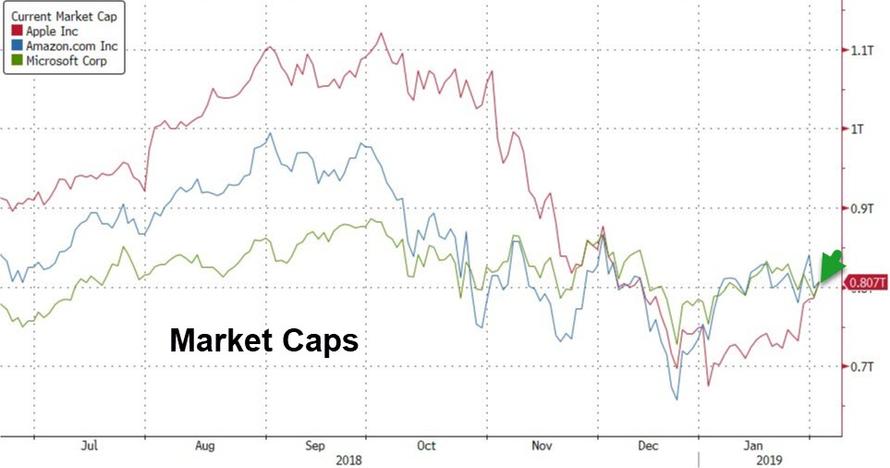

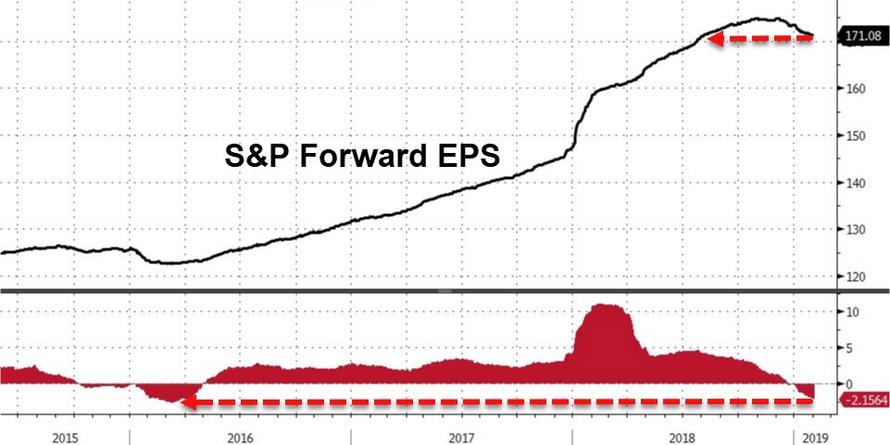

The hinge of the whole story will be how fabulous the US economy is. Mr. Trump performed miracles like unto Moses in Egyptland. The manufacturing economy that made America great in the 1950s is back (not). Unemployment has been vanquished (not). We are “energy independent” (not). The once-again rising stock market is proof-of-life for US business prospects (not). We have the best medical care and higher ed in the world (cough cough). It would all come as a surprise to the people dining on dog food with ketchup out in the flyover precincts – but they are not exactly the types to sit around and listen to Don Lemon and Jeffrey Toobin dissect the speech post-game.

Following the new-ish tradition of a designated opposition respondent to the SOTU, Democratic sore loser Stacy Abrams (Georgia Governor’s race, 2018), will virtue-signal her party’s dedication to identity politics, concealing its dark connection to the Wall Street / K Street grift machine, and to the Neocon war hawks so eager to manufacture failed states in parts of the world that are too bothersome to try to get along with. I suppose she will try to revive the Russian collusion angle, with a spin on how the Georgia election of 2018 was also rigged by malign forces to prevent her victory.

Mostly though, Ms. Abrams will extol the wonders and marvels of free health care and free college for all under the coming 2020 Democratic Party landslide, a comfy-cozy future of women-led caring-and-sharing, plus the promise of punishing taxes-to-come on super-rich toffs like Mr. Trump. The media will eat it up. Ms. Abrams will then be promoted as the next vice-president. The party’s strategy is to get every female voter in America on-board along with its supplemental People-of-Color-and-LBGTQ army for a surefire electoral victory. I can see that possibly working, but is it a good fate for the country to be literally divvied up between a women’s party and a men’s party?

It sounds like a recipe for Greek tragedy to me.

Anyway, both sides are marinated in delusion these days. Whatever Mr. Trump trumpets about the economy on Tuesday night will unwind stupendously in the months ahead. In private, he probably knows this, and I’m sure that he’s preparing to preside over some form of a national bankruptcy work-out. But even that won’t stop the roaring choo-choo train of the “democratic socialist” nirvana to come. The new religion of Modern Monetary Theory (MMT) they subscribe to says that the government can spend as much money as it feels like spending because, one way or another, they create the money. Of course, this is Karl Marx with all the humor removed. And when it comes rolling down the tracks, it won’t be much of a joke.

via ZeroHedge News http://bit.ly/2DbHJcL Tyler Durden

Virginia Lt. Governor Justin Fairfax (D) has denied that he sexually assaulted a woman at the 2004 Democratic National Convention.

Virginia Lt. Governor Justin Fairfax (D) has denied that he sexually assaulted a woman at the 2004 Democratic National Convention.

A power outage turned a Brooklyn federal detention center into a dark and frigid fortress in the midst of freezing temperatures last week. Now, federal public defense attorneys have responded with a

A power outage turned a Brooklyn federal detention center into a dark and frigid fortress in the midst of freezing temperatures last week. Now, federal public defense attorneys have responded with a

American politics at the moment can pretty much be explained by what you make of the record sixth Super Bowl victory by New England Patriots quarterback Tom Brady, coach Bill Belichick, and owner Robert Kraft.

American politics at the moment can pretty much be explained by what you make of the record sixth Super Bowl victory by New England Patriots quarterback Tom Brady, coach Bill Belichick, and owner Robert Kraft.