It’s the elephant in the room that nobody, especially Elon Musk, wants to talk about but analysts and investors may soon have to face the idea of “teflon” Elon’s Tesla stock approaching extremely uncomfortable territory. Not only does a falling stock price put pressure on the company when it eventually goes to sell equity (assuming it can), but it also calls into question the fate of hundreds of millions in stock that Elon Musk has personally borrowed against.

Here things are getting uglier by the day: the steady decline in analyst price targets for Tesla keeps inching closer to Musk’s inevitable margin call territory, which we believe is around $232. And this morning’s downgrade by Morgan Stanley slapped a price target on the company that is just several dollars away from a price that we, and others, believe will trigger Musk’s margin call.

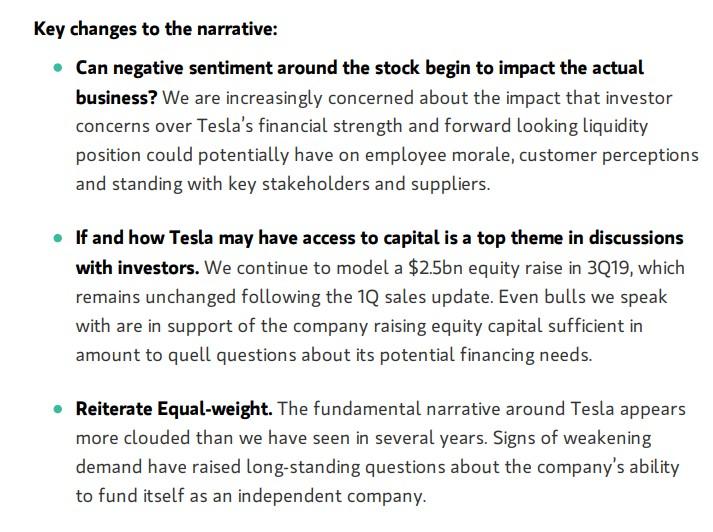

Morgan Stanley’s Monday note addressed delivery volume, paltry Model S and X sales and falling revenue while slashing EPS and automotive gross margins targets while calling into question the company’s liquidity (or lack thereof) profile.

“We expect the 45% YoY decline in 1Q Model S+X volume will largely continue throughout 2019, impacting mix, margin and cash flow. We mark to market our forecasts following disappointing 1Q deliveries and lower our target to $240. Reiterate Equal-weight,” Morgan Stanley analyst Adam Jonas said in a note out this morning.

On delivery volume, the one-time Tesla fanboy said:

We have cut our total company full year 2019 delivery forecast to 344k units vs.362k units previously. We are now below the low end of Tesla’s 360k to 400k range. Over 100% of our delivery reduction is from Model S and X, which we now expect to average 14,800/quarter through the remainder of the year.

Jonas then lowered his revenue forecast by 7.5%:

Our 2019 total company revenue forecast falls 7.5% on the delivery revision, exacerbated by mix degradation from Model S and X declines. Our revised auto revenue forecast calls for a 3% YoY decline in both 3Q19 and 4Q19 revenue.

He also slashed automotive gross margin to 18.4% from 22.3%:

We have revised our 1Q19 US GAAP auto gross margin forecast to 18.4% from 22.3% previously. Going forward, we forecast US GAAP auto gross margin to improve to 20.9% in 2Q,21.9% in 3Q and 22.2% in 4Q.For the full year, our 2019 GAAP auto gross margin has been revised down 150bps to 21.1%. Our FY forecast includes slightly more than $400mm of ZEV (zero emission vehicle) credit revenue, which is worth 140bps of margin.

Finally, Jonas took an absolute hatchet to GAAP EPS estimates for the year, revising to a negative $6.55 from a negative $3.59:

FY19 US GAAP EPS revised to negative $6.55 from negative $3.59 previously. Our 2020 EPS forecast falls to $0.21 from $2.64 previously. Our 2025 EPS forecast falls to $14.78 from $15.88 previously.

In addition, the note addressed what Jonas believes could be “key changes to the narrative” that could send the stock lower, including concerns over the company’s financial strength and whether or not the company has access to capital.

So just another downgrade? Why is any of this notable or material? Because back in April of 2018, we asked whether or not Musk would be the next high profile CEO to potentially face a margin call. We noted then that Musk’s loans were limited to 25% of the value of the pledged stock, a policy that seemingly did not exist when the 2017 proxy was issued. The figure we used for the value of Musk’s margin loans came from the registration statement for Tesla’s March 2017 stock sale, in which on p. S-9 it notes that he (at that time) owed a total of $624.3 million to various financial institutions, with the largest amount ($344.4 million) owed to Morgan Stanley.

We concluded that $232.30 could be a reasonable target for a Musk margin call:

“…if Musk owed $624.3 million over a year ago and subsequently paid interest on that loan while drawing a minimal salary ($49,920) and continuing his aforementioned luxurious lifestyle while pouring $100 million into his latest distraction, the Boring Company, it seems reasonable to guess that his current loans total approximately $800 million, which means—according to the new proxy—they’d need to be collateralized by $3.2 billion in Tesla shares. As the proxy notes Musk has currently pledged 13,774,897 of his 37,853,041 shares to support those loans, it implies that at a share price below $232.30 (assuming a current balance of $800 million), he’d face either a margin call or the need to post additional shares as collateral. (For some perspective, earlier this month the stock dipped as low as the $244s.)”

But for now, Tesla stock has still defied most analysts’ pessimistic expectations of it, despite finally breaking below the $300 level.

What Morgan Stanley refers to as negative sentiment we just refer to as reality, and the cold hard facts are that if reality ever hits this company, analysts won’t even matter at this point: it’s stock price may become a self fulfilling prophecy – in the wrong direction for Elon Musk.

via ZeroHedge News http://bit.ly/2U6bEJE Tyler Durden

A coalition of California local governments is suing the state’s top marijuana regulator for legalizing the home delivery of recreational cannabis.

A coalition of California local governments is suing the state’s top marijuana regulator for legalizing the home delivery of recreational cannabis. Here comes Peter Cottontail, hopping down the paper trail: Hard-boiled lawyers made sure no kids could participate in the University of California-Berkeley’s campus Easter egg hunt on Sunday without their parents first signing a waiver.

Here comes Peter Cottontail, hopping down the paper trail: Hard-boiled lawyers made sure no kids could participate in the University of California-Berkeley’s campus Easter egg hunt on Sunday without their parents first signing a waiver.