Zimbabwe is once again at the brink of economic collapse, making a mockery of President Emmerson Mnangagwa’s claim that the country is open for business.

As Bloomberg reports, many shops and factories have shut their doors because of a lack of customers and those that continue to trade are open to haggling over prices to secure hard currency. At an appliance shop in the capital, Harare, a salesman whispers that a Whirlpool Corp. washing machine priced at about $5,000 if paid for electronically will sell for $1,500 in cash, while at a nearby electrical warehouse, a $600 invoice is whittled down to $145 for payment in dollar bills.

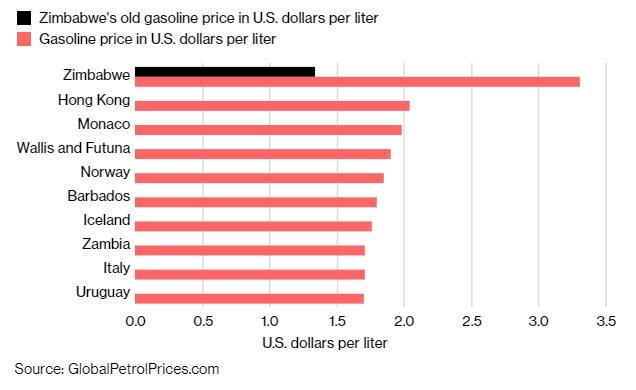

But, as OilPrice.com’s Tsvetana Paraskova reports, Zimbabwe is on a three-day nationwide strike and protests are erupting in the streets after the government of the southern African country doubled fuel prices, making gasoline sold in Zimbabwe the most expensive gasoline in the world.

Zimbabwe is in the midst of an economic crisis and a shortage of foreign exchange, which has led to fuel and bread shortages, and many companies have stopped working because they can’t import raw materials.

Following hyperinflation in 2009, Zimbabwe abolished its own currency and has been using the U.S. dollar and South African rand instead.

But the economic crisis and foreign currency shortages has prompted the government to say over the weekend that it would introduce a new currency of its own in the next 12 months.

However, the policy that really sparked protests and calls for a national stay-away was the sharp increase of fuel prices over the weekend.

According to Zimbabwe’s President Emmerson Mnangagwa – who succeeded the president of 38 years Robert Mugabe in November 2017 – the doubling of the fuel prices would help ease fuel shortages.

In a post on his official Facebook page, Mnangagwa wrote on Sunday:

“Following the current shortfall in the fuel market, we have chosen to act, and act decisively. The shortage, attributable to increased fuel usage in the growing economy, and compounded by rampant illegal currency and fuel trading activities, is unsustainable and Government has today decided on the following measures:

- A fuel pump price set at $3.11 per litre for diesel, and $3.33 per litre for petrol.”

The gasoline price of $3.33 per liter is now the world’s highest.

According to data from GlobalPetrolprices.com, as of January 7, 2019, the world’s average gasoline price was $1.08 per liter, or $4.09 per gallon. The most expensive gasoline in the world before the Zimbabwean price hike was in Hong Kong where a gallon of gas goes for $7.71.

In Zimbabwe, the trade unions and the main confederation of industries called for the three-day strike and say it has been a success so far.

“So far the stay-away has been effective,” Peter Mutasa, president of the Zimbabwe Congress of Trade Unions, told Bloomberg on the phone.

The Confederation of Zimbabwe Industries said in a letter to the Industry Ministry that “The house is burning,” as many businesses are collapsing or on the verge of collapsing due to the lack of foreign exchange funds and economic chaos.

According to Bloomberg, here’s what Zimbabweans have to deal with on a daily basis:

-

The official inflation rate stands at 31 percent, well short of 2008 levels but still high enough to drive consumers to the black market or import their own food and other basics.

-

Goods paid for electronically cost as much as four-and-a-half times more than if cash were used. Retailers have resorted to a dual-pricing policy and offering cash discounts, defying the government’s threats to act against them.

-

Supermarkets have stopped selling a number of goods and stock outages of everything from bread to coffee are commonplace. Zimvine, a Facebook group, is being used to request and share information on where to find food, fuel and other goods and how to contact lawyers specializing in immigration.

-

The head of Zimbabwe’s main industry body has warned that many companies that continue operating will shut this month due to the currency shortage.

-

The city authority in Harare has scaled back refuse removal and other services because it can’t access diesel for its trucks.

-

Doctors staged a six-week strike to demand improved working conditions and that their salaries be paid in cash. While the labor action was called off on Jan. 10, it could take months to clear operation backlogs.

-

Teachers and other state workers have warned that they’ll down tools unless the government pays them in cash.

No yellow vests? Maybe they can’t afford them?

via RSS http://bit.ly/2stImcQ Tyler Durden

Burgers and a side of memes. It’s a classic conundrum: You’ve invited the championship-winning college football team over for dinner, but your kitchen staff has all been furloughed because of your temper tantrum about a giant wall. What to do? Why, order some good old-fashioned American Food, obviously.

Burgers and a side of memes. It’s a classic conundrum: You’ve invited the championship-winning college football team over for dinner, but your kitchen staff has all been furloughed because of your temper tantrum about a giant wall. What to do? Why, order some good old-fashioned American Food, obviously.