Stocks in Europe gained along with U.S. futures while Asian stocks were muted as investors saw potential for legislative deadlock to force London to delay its departure from the EU following the heavy parliamentary defeat for British Prime Minister Theresa May’s Brexit deal. The pound fluctuated and gilts fell before a no-confidence vote in Prime Minister Theresa May’s government…

… while S&P futures rose initially then faded some of their gains.

The MSCI world equity index, which tracks shares in 47 countries, was flat, while MSCI’s main European Index gained 0.3 percent. Europe’s Stoxx 600 Index was modestly in the green, led by banks and insurers following China’s plans to boost fiscal stimulus, cut taxes and shore up growth and President Mario Draghi’s comments that stimulus is still needed in the euro area. The U.K.’s FTSE 100 declined as investors contemplated May’s Brexit defeat and the pound squeeze higher continued.

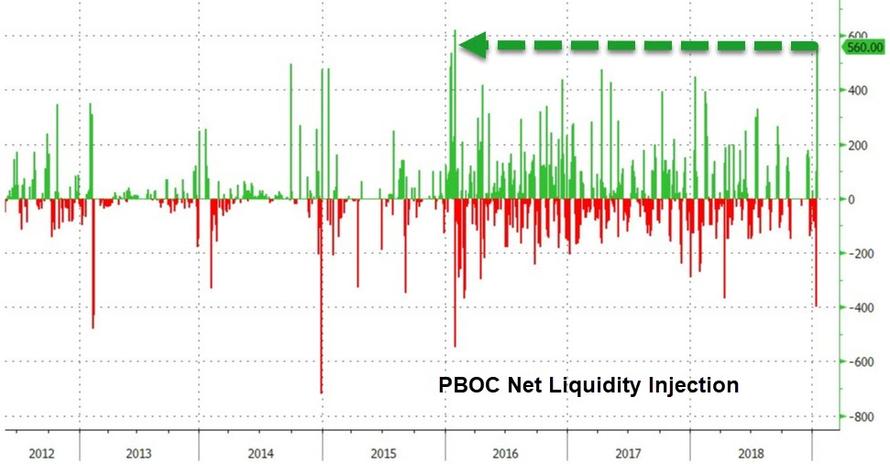

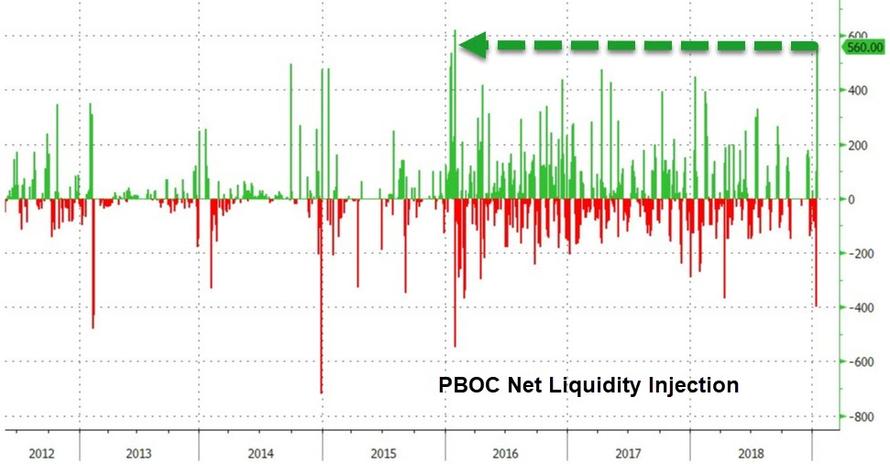

Earlier in the day MSCI’s broadest index of Asia-Pacific shares outside Japan ticked up 0.2 percent, with South Korea’s Kospi and Hong Long’s Hang Seng both scaling six-week highs. Asian shares responded well to China’s central bank injecting a record amount of money into the country’s financial system. That underscored Chinese officials’ commitment to signal more measures to stabilize a slowing economy.

Global markets have drawn succor from the resumption of Sino-U.S. trade talks, though scepticism over the absence of detailed progress was underlined overnight as the U.S. trade representative that he did not see any progress made on structural issues during U.S. talks with China last week.

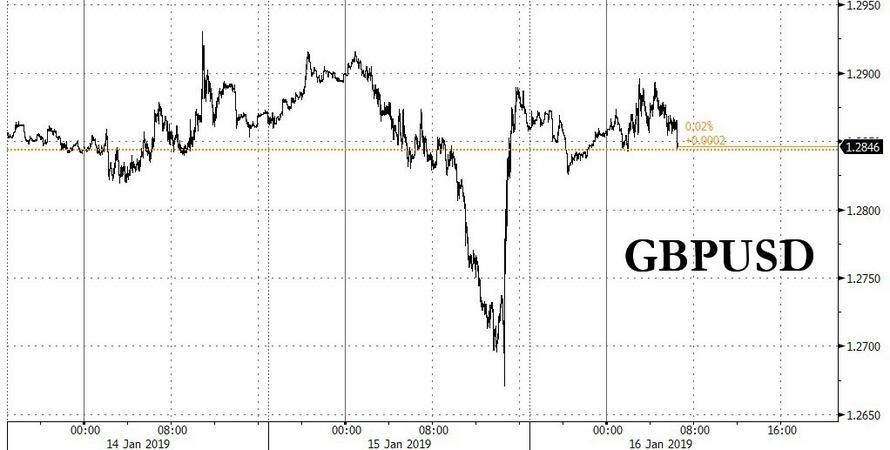

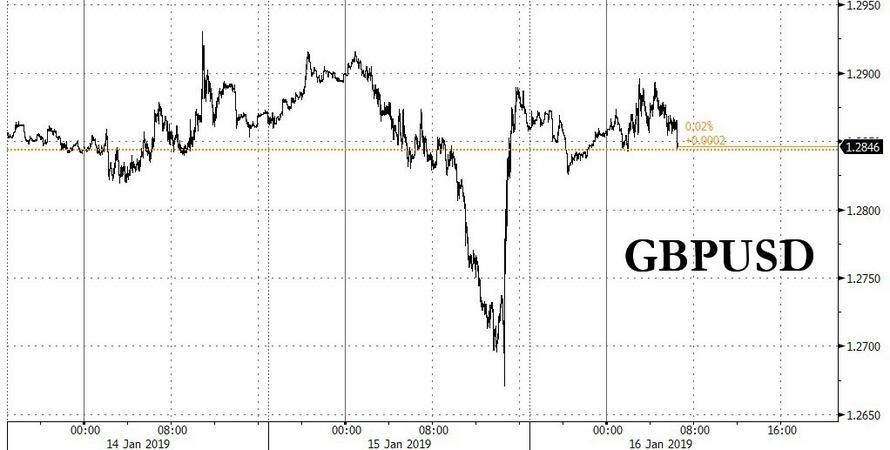

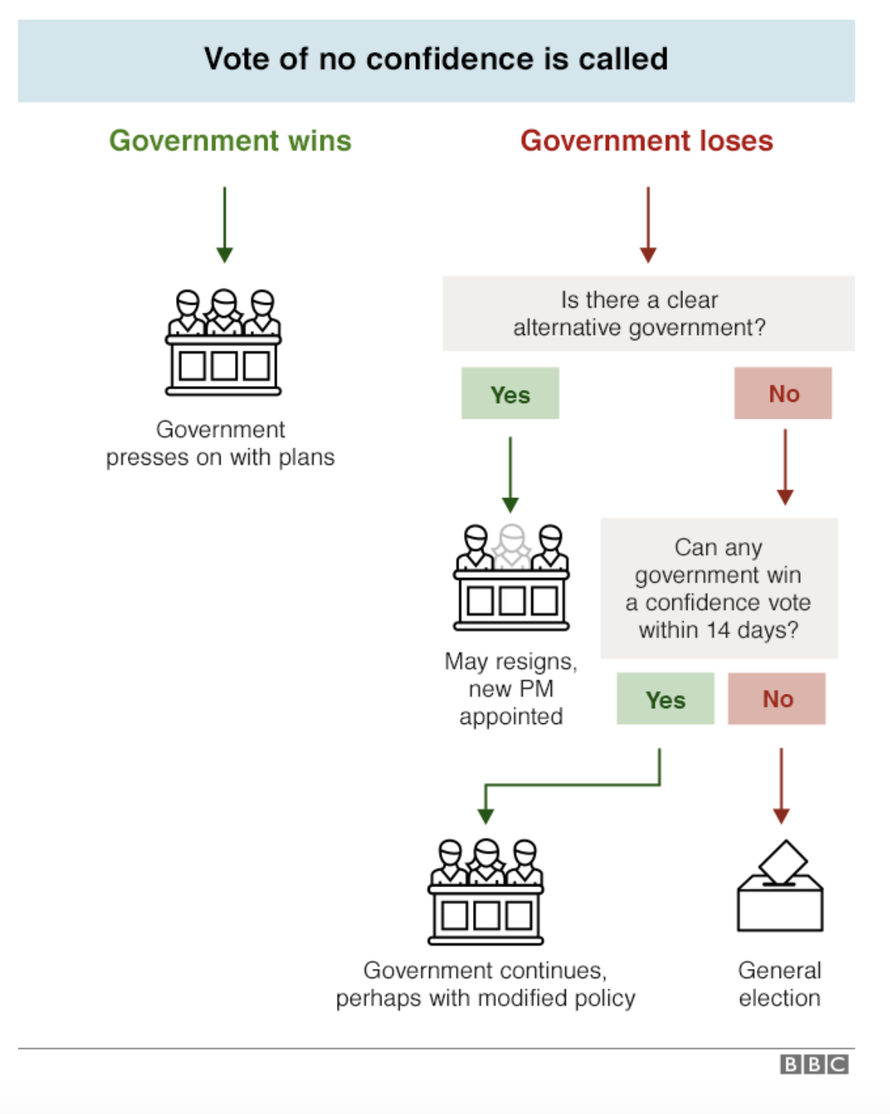

May’s government faces a no confidence vote on Wednesday after the shattering rejection left Britain’s exit from the European Union in disarray. May is expected to survive the vote but investors see little sign of breakthrough on the Brexit impasse. As a result, they are increasing betting on Britain being forced to postpone its planned March 29 exit, though few have any clarity on what that would mean for the country in the longer run.

Markets had largely priced in the overnight defeat, and in early trade major European bourses mirrored overall resilience in Asian markets. There, stocks were also lifted by signs that China will take more steps to bolster its slowing economy and the U.S. Federal Reserve may pause its run of interest rate rises.

“The evidence yesterday is that there is a quorum of (British) MPs who will do what’s required to avoid a no-deal Brexit,” said Chris Scicluna, head of economic research at Daiwa Capital Markets in London. “So there’s a strong probability of an extension of Article 50 and that means there’s an increased probability of a softer Brexit or no Brexit at all.”

With some expecting a delay to raise chances of a softer Brexit, for example based on the opposition Labour party’s idea of membership of a permanent customs union, sterling was flat against the dollar at $1.2860. “We do think it is unlikely that sterling will fall to fresh lows unless the current government falls, and that unlikely although the risk is not zero,” said Alvin Tan, an FX strategist at Societe Generale in London. “Volatility is expected to remain high, but we do think that there is upside for sterling. Sterling is very cheap on the long-term basis, partly because of the probability of the no-deal Brexit.”

Ahead of today’s May confidence vote, Sky Deputy Political Editor said up to 100 Labour MPs will pivot towards a second referendum this morning. Meanwhile, the UK Government minister told business leaders that there is a backbench motion being prepared to delay Article 50, also says no confidence motion will fail. Elsewhere, BBC’s Political Correspondent tweets “Boris Johnson tells me May should ditch backstop, withhold at least half money till free trade deal done, accelerate no deal preparations. Says a new agreement can be reached before March 29.” At the same time, Talk Radio’s Kempsell tweets, Shadow Chancellor John McDonnell tells me he is not ruling out repeated motions of no confidence contrary to suggestions earlier.

Investors are also betting that the U.S. Federal Reserve will slow its interest rate hikes. On Tuesday U.S. policymakers agreed the Federal Reserve should pause further rate hikes until it is clear how much the U.S. economy will be held back by larger risks like slowing growth in China. Investors “are mainly focused on the outcome of the U.S.-China trade negotiations, but it may take more than a month before it will become clear,” said Ayako Sera, market strategist at Sumitomo Mitsui Trust Bank in Tokyo.

Treasury yields slipped amid large-size selling of call spreads on 5-, 10-year notes and the 10Y yield rose to 2.738% up from 2.71%, while the dollar recovered as the London session progressed, trading in tight ranges. British government bonds underperformed versus their German peers in early trade, with March gilt futures opening 30 ticks lower at 122.90, underperforming German Bund futures by around 10 ticks.

The mood in markets remains fairly buoyant after China pledged to step up efforts to support growth and Draghi said the euro area will avoid a recession even though recent data signaled softening momentum. Still, there are plenty of worries to give investors pause before taking this month’s rally in equities further. The political impasse in Washington continues to leave swathes of the federal U.S. government shuttered, and the U.K.’s Brexit drama threatens to impair business confidence in the second-largest European economy.

Oil prices firmed after climbing about 3 percent in the previous session as expectations that OPEC-led supply cuts will tighten markets despite signs of a global economic slowdown. Brent crude oil futures were at $61.17 per barrel at 0904 GMT, 0.1 percent above their last close.

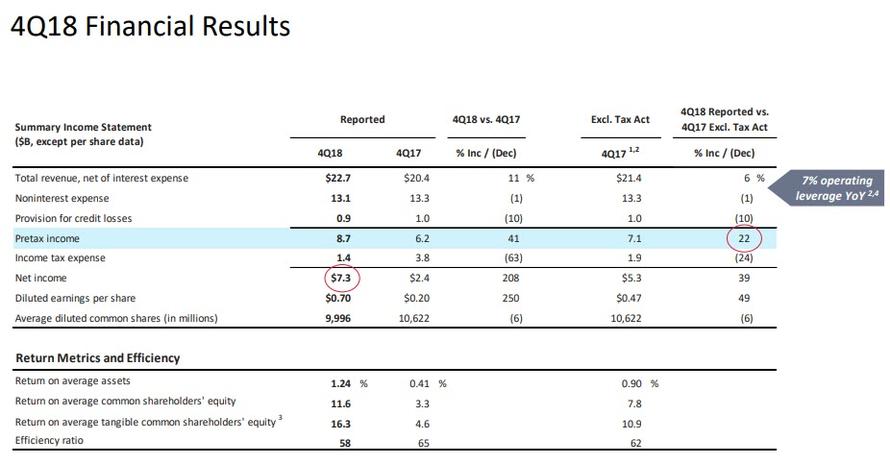

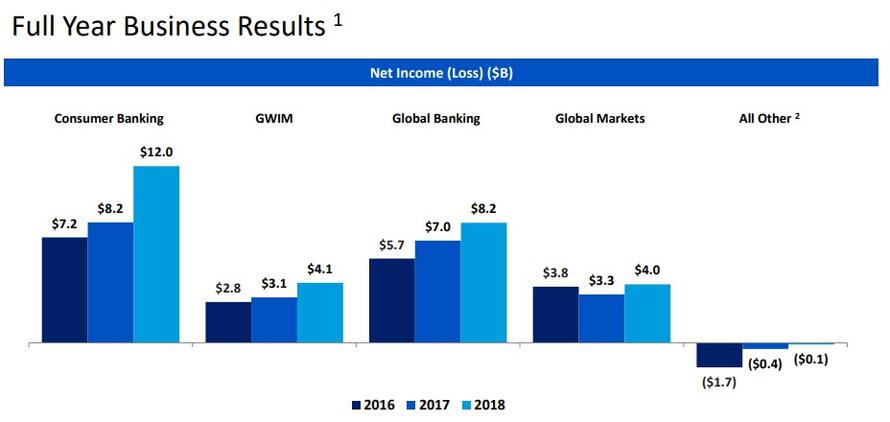

Expected data include mortgage applications. Bank of America, BlackRock, Schwab, and Goldman Sachs are among companies reporting earnings

Market Snapshot

- S&P 500 futures up 0.2% to 2,610.25

- STOXX Europe 600 up 0.07% to 348.96

- MXAP down 0.05% to 152.37

- MXAPJ up 0.2% to 494.28

- Nikkei down 0.6% to 20,442.75

- Topix down 0.3% to 1,537.77

- Hang Seng Index up 0.3% to 26,902.10

- Shanghai Composite unchanged at 2,570.42

- Sensex up 0.08% to 36,348.11

- Australia S&P/ASX 200 up 0.4% to 5,835.16

- Kospi up 0.4% to 2,106.10

- German 10Y yield rose 2.2 bps to 0.228%

- Euro up 0.06% to $1.1420

- Italian 10Y yield rose 3.0 bps to 2.513%

- Spanish 10Y yield fell 0.9 bps to 1.381%

- Brent futures little changed at $60.64/bbl

- Gold spot little changed at $1,289.58

- U.S. Dollar Index little changed at 95.96

Top Overnight News

- The Trump administration has ordered thousands of furloughed federal employees back to work without pay to inspect planes, issue tax refunds, monitor food safety and facilitate the sale of offshore oil drilling rights

- The EU is refusing to remove the Irish-border element that U.K. lawmakers most oppose

- The European Union said it was horrified by the massive scale of the U.K. Parliament defeat of the Brexit deal agreed with PM May but said there was no option to renegotiate. Brexit pushes Britain to brink as government fights for survival

- On an hour- long conference call following Parliament’s overwhelming rejection of the government’s deal to leave the EU, Chancellor of the Exchequer Philip Hammond floated the possibility of delaying the departure beyond the March 29 deadline, according to four people with knowledge of the call

- China’s central bank injected a net 560b yuan ($83b) into the financial system through open-market operations, the biggest one-day addition on record

- BOE Governor Mark Carney told lawmakers in London that the rebound in the pound after Prime minister May’s Brexit vote defeat would appear to reflect some expectation that the process of resolution would be extended and that the prospect of no deal may have been diminished; said the BOE is in discussions with the U.K. Treasury about the powers it needs to smooth any financial ructions if the country leaves the EU without a deal

- The German government is planning to extend the contract of Bundesbank President Jens Weidmann by another eight years when it expires at the end of April, according to people familiar with the matter

- The euro-area economy isn’t headed for a recession, even though softening momentum underscores the need for ECB stimulus, according to President Mario Draghi

- China’s central bank boosted injections via open-market operations to the most on record to meet seasonal demand for cash due to tax payments and major holidays

- Federal Reserve Bank of Kansas City President Esther George, who has been one of the most hawkish members of the central bank’s policy group, urged her peers to be patient and pause before considering additional rate increases.

- Sweden’s Social Democratic leader Stefan Lofven is poised for another four years in power after convincing the Left Party to support his new centrist government, shutting out the nationalists from influence

Asian equity markets traded mixed as the region struggled for firm direction after the tech-led gains on Wall St. and PM May’s Brexit deal defeat in parliament. ASX 200 (+0.4%) finished positive as gains in tech and financials eventually outweighed the weakness across the commodity-related sectors, while Nikkei 225 (-0.6%) suffered the fallout from a firmer currency. Hang Seng (+0.3%) and Shanghai Comp. (Unch.) conformed to the indecisive tone but with the mainland kept afloat for most the session after stronger than expected Loans and Aggregate Financing data, while the PBoC also conducted its largest ever daily net liquidity injection heading into next month’s Chinese New Year celebrations in which it cited rapidly falling liquidity due to tax payments. Finally, 10yr JGBs eked only minimal gains despite the underperformance of riskier assets in Japan and firmer results in the latest 5yr JGB auction.

Top Asian News

- BOJ Is Said to Cut Inflation Forecast on Cheaper Oil

- Another Xiaomi Stock Sale Adds Grease to $32 Billion Rout

- World’s Most Valuable Startup Takes a Hit From China’s Slowdown

- China Injects Record Funds to Counter Tax, Holiday Cash Demand

- Top China Fund Sees Bonds Trouncing Stocks Again This Year

Major European equities are mixed after trimming opening gains [Euro Stoxx 50 -0.1%] with outperformance seen in the FTSE MIB (+0.5%) where banking names are up, in particular UniCredit (+2.6%) at the top of the index following the Co. stating they consider their NPE coverage to be fully adequate. Sectors are largely in the green, with financial names outperforming; in particular the Stoxx 600 Banking sector is up by over 1% as some are interpreting the governments Brexit defeat as reducing the likelihood of Britain crashing out of the EU. Other notable movers include Hammerson (+1.7%) after being upgraded at Deutsche Bank and Ryanair (+2.1%) who are up in sympathy following United Continental Holdings posting a beat on their top and bottom line overnight; were subsequently up 6% after-market. Elsewhere, Deutsche Bank (+1.7%) and Commerzbank (+1.5%) are up following reports that German officials have spoken to watchdogs regarding a potential deal between the two.

Top European News

- Reckitt CEO Kapoor to Leave After 8 Years Capped by Setbacks

- BASF Is Said to Weigh Pigments Unit Sale as Rival Also Exits

- Denmark’s DSV Bids $4 Billion for Swiss Freight Rival Panalpina

- Banks Are Said to Seek Exemptions in Looming Romania ‘Greed Tax’

- Cineworld Slips; CFO Notes Cost of ‘80s’ U.S. Cinemas Refurbs

In FX, the DXY was little changed following last night’s advances in which the index attempted, but failed to breach 96.000 to the upside, while it creeps closer to the top of a 95.850-96.080 range. Impetus for the buck was initially provided following yesterday’s comments from US Senator Grassley who cited USTR Lighthizer as US-China talks showed little progress in key issues. The dollar then came off highs as Fed hawk (and voter) George noted that it might be a good time to pause on rate hikes. Subsequently DXY fell to around 95.850 amid the Fed member’s shift in stance before recouping losses. In terms of technical DXY eyes its 100 DMA at 96.03 to the upside, though looking ahead, US retail sales have been postponed amid the ongoing US government shutdown.

- GBP – The calm after the storm as PM May’s deal was defeated by a historical 230 votes shortly before Labour leader Corbyn tabled a motion of no confidence (as expected), scheduled for 1900GMT today. The move higher came amid hopes that Article 50 will be extended past March 29th as PM May will attempt to conjure up a revised deal with the EU or face a hard-Brexit which is unfavoured by most UK MPs. However, the EU made it clear that renegotiations will not be open, while Commons leader Leadsom mentioned that the UK Government is not looking to postpone the Brexit date ahead of tonight’s vote of no confidence. The Pound was largely unreactive to Corbyn’s no confidence motion as the Conservative party and the DUP (alongside some Labour MPs) are likely to support the Government rather than amplify the chaos in Parliament. Moving on, on the data front, Sterling side-line the release of inflation figures which largely printed in-line with expectations. Cable currently resides just below 1.2900, just above its 100 HMA at 1.2857 after having tested the big figure to the upside on multiple occasions.

- EUR, JPY- Meanwhile, the EUR is relatively flat against the buck as a lack of fresh catalysts (and all eyes on Brexit) largely shelved the single currency as it moves in tandem to the greenback. EUR/USD further extends losses below 1.1450 and fluctuates on either side of the 1.1400 level ahead of its 50 DMA at 1.1380. Of note, 950mln in options expiries are seen at strike 1.1380-1.1400. Similarly, with the Yen overnight safe-haven driven gains were largely neutralised by the strengthening dollar as USD/JPY rises to the top of a 108.38-73 range with almost 1.7bln in option expiries scattered between 108.75-109.00.

-

TRY – The Turkish Central Bank left rates unchanged at with their main rate at 24.00% while largely reiterating its tight stance, stating that the CB are to further monetary policy tightening will be delivered if needed. As such USD/TRY fell from 5.4134 to an intraday low of 5.3800 before pairing back a third of the move.

In commodities, Brent (-0.1%) and WTI (-0.5%) are drifting further into negative territory, with WTI losing the USD 52.00/bbl handle. As the positive market sentiment following yesterday’s 0.560mln draw in API crude inventories begins to fade; despite a 3% rally in the previous session on the back of this. Elsewhere, ARA region crude inventories rose 2.4mln/bbl to 51.3mln/bbl for the week ending January 11th. Markets will be looking ahead to today’s weekly EIA release, where crude stocks are expected to post a draw of 1.5mln. Gold (-0.1%) is relatively flat, but towards the bottom of it’s slim USD 4/oz range; as the dollar remains relatively uneventful and FX market reaction to the Brexit vote defeat is largely positive as the prospect of a no-deal has lessened. Separately, the US Senate has voted to advance a resolution which criticises sanctions on companies tied to Oleg Deripaska, which includes Rusal.

US Event Calendar

- 7am: MBA Mortgage Applications, prior 23.5%

- 8:30am: Retail sales data postponed by govt shutdown

- 8:30am: Import Price Index MoM, est. -1.3%, prior -1.6%; 8:30am: Import Price Index YoY, est. -0.8%, prior 0.7%

- 10am: Business inventories data postponed by govt shutdown

- 10am: NAHB Housing Market Index, est. 56, prior 56

- 2pm: U.S. Federal Reserve Releases Beige Book

- 4pm: TIC Flows data postponed by govt shutdown

DB’s Jim Reid concludes the overnight wrap

I got back late last night from Brussels and I suspect that many more U.K. politicians and Brexit negotiators will be making the opposite journey in the days and weeks ahead. To cut to the chase the DB house view is that in spite of the biggest defeat for a U.K. government (432-202) on record in the big Brexit vote, last night’s news flow was very positive for the pound and very supportive of a soft Brexit.

We’ll come to why it was so positive but first the detail. Some 118 Tory MPs broke ranks to vote against the deal as did all 10 DUP members. PM May slightly outflanked the opposition and offered them the chance to hold a no-confidence vote today, which stole Mr Corbyn thunder a bit, but he promptly demanded one. This will likely be a non-event and actually gives the Government a chance to get a confidence-restoring win with the DUP and the hard Brexit ERG Conservative group almost immediately saying they’ll back the Government. Amusingly, the 6 hour debate and 7pm vote was scheduled to follow a short lunchtime bill today that asks for low letter boxes to be banned to save postmen’s backs and to stop them being attacked by cats and dogs. Hopefully this bill survives as it will be good to see that Parliament can still get other business done in the midst of such political turmoil.

The reason DB feels this was a positive night for Sterling was that PM May surprised by immediately agreeing to cross-party talks to determine a way forward on Brexit. The exact quote from May was “… if the House confirms its confidence in this government I will then hold meetings with my colleagues, our confidence and supply partner the DUP and senior parliamentarians from across the House to identify what would be required to secure the backing of the House. The government will approach these meetings in a constructive spirit, but given the urgent need to make progress, we must focus on ideas that are genuinely negotiable and have sufficient support in this House… if these meetings yield such ideas, the government will then explore them with the European Union”.

On the positive side, since there is a large parliamentary majority in favour of a soft Brexit outcome, possibly in the form of membership of the customs union, the odds of a market-friendly outcome have risen sharply. If you were looking for doubts though then you might say a) Mrs May comments were slightly vague in who she would have cross party talks with. Is senior Parliamentarians wide enough? Will it include Jeremy Corbyn?, b) is there a consensus for anything in Parliament that the EU would accept?, c) previously the Labour Party’s executive have said that if they can’t get a general election (they likely won’t after their first attempt tomorrow) they will move policy towards a second referendum. If such an outcome materialises it might confuse the issue. It would also result in a more binary outcome and increase the risk of leaving with no deal. It could be very positive or negative, and d) how will the Conservative Brexiters react to a softer Brexit? Do they have any power? So these and many more questions remain unresolved but on balance last night opened the way to much more benign Brexit.

On c) above, Sky News reported overnight that up to 100 Labour members will shift to calling for a second referendum today, in an apparent effort to pressure Corbyn into supporting one after the confidence vote likely fails. This might complicate cross-party talks as PM May made it quite clear when extending an olive branch that the U.K. is definitely leaving the EU, so we could reach an impasse very quickly if Labour adopts this strategy. Plus, May’s spokesman said that she remains committed to an independent trade policy, which would preclude a compromise deal that includes membership in the customs union. So it remains to be seen what sort of compromise could emerge from any cross-party negotiations.

DB’s Oliver Harvey has published a special report titled “It’s time to buy the pound,” available here . He outlines the current state of play and the main risks to the view, which are: a) May losing the confidence vote today, b) May reneging on her pledge to seek a cross-party compromise, or c) parliament’s deliberations resulting in a consensus for a second referendum. The last is probably the biggest risk, but Oli is still confident that the most likely scenario is a pivot toward a softer Brexit.

In market terms the pound had depreciated -1.31% ahead of the vote, as defeat for May looked likely, but it completely pared its losses versus the dollar after PM May’s speech and her apparent pivot toward cross-party compromise. This was helped by support announced in May’s favour in the confidence vote. Futures on the FTSE 100 traded -0.47% lower after the European close, reflecting the impact of the stronger pound. Sterling is trading largely flat (-0.06%) this morning.

In reaction from the EU to the Brexit vote, officials in Brussels ruled out the prospect of an extraordinary summit of the 27 EU leaders any time soon saying there’s little to discuss if lawmakers in the UK can’t decide what they want while most diplomats said they were stunned by the extent of the loss. Elsewhere, the EC President Jean-Claude Juncker told the UK, “Time is almost up” while, French President Emmanuel Macron said that the EU won’t offer any more concessions to the UK to solve “an internal UK politics problem” and added that ‘I will be very vigilant on that, we went as far as we could.”

Prior to last night’s main event it had for the most part already been a constructive session for risk assets, helped mostly by the China fiscal headlines from earlier in the morning. That said, there was some reasonable divergence across the main US equity markets with the NASDAQ (+1.71%) leading the way in part due to a price hike by Netflix which analysts deemed will be successful (+6.52%) while the NYSE FANG index (+2.72%) turned in its third >2% move of 2019 already. The S&P 500 finished +1.07% as banks lagged a bit (+0.78%) following JP Morgan’s results – more on that shortly – while the DOW closed up a more modest +0.65%. Earlier in the day we’d seen the STOXX 600 end +0.35% and the FTSE 100 +0.58% with the latter benefit from a weakening Pound during the European session.

Elsewhere credit markets were pretty quiet with US and European HY spreads ending -4bps and -2bps tighter respectively. Yesterday we published a short note detailing our updated spread forecasts in light of the moves in credit spreads since we published our 2019 outlook in mid-November. Our qualitative expectations of moderate spread widening by year end with a bear market rally in the first few months of the year still holds. Click here for the link to the report.

Treasuries ended up pretty much unchanged and appear to have finally found a floor for now in the 2.60% to 2.70% range. Bunds (-2.4bps) were a touch stronger although the reality is that they are still in the middle of the 12bps YTD range with ECB President Draghi doing little to shake things up – confirming that “recent economic developments have been weaker than expected and uncertainties remain prominent”. Elsewhere, BTPs (+3.1bps) actually underperformed despite reports of over €35bn of bids for Italy’s first syndicated deal this year (about 10% higher than a sale last year) and Italian bank stocks dropped -2.19% after Il Sole 24 Ore reported that the ECB is implementing new rules on non-performing loans. The banks will have seven years to fully provision for current and future potential losses. Gilts were down -3.9bps and tracked the Sterling move while the eye catching move in the commodity complex came once again from oil where WTI darted back up +2.93% following two days of declines.

Turning to Fedspeak, the most notable comments came from Kansas City Fed President George, who is a voter this year and has recently been the most hawkish member of the committee. She said that another hike “is not urgent” and that called for “patience in considering our policy actions.” So a definite shift away from the hawkish end of the spectrum and toward the center of the committee, which is consistent with no rate hikes until June. Separately, Politico reported that Liu He has formally accepted the invitation to meet with US officials in Washington on January 30-31, as expected. So the twin supports of a more dovish Fed and positive progress on the trade front continued to support markets yesterday.

This morning in Asia markets are trading mixed with the Nikkei (-0.58%) leading the decline on a strengthening yen (+0.18%) while the Hang Seng (-0.09%) and Shanghai Comp (-0.06%) are off their lows and trading flattish with the Kospi (+0.37%) up. Meanwhile, the PBoC injected CNY 560bn into the financial system on Wednesday, the biggest one-day addition on record, to meet seasonal demand for cash due to tax payments and major holidays. China’s onshore yuan is down -0.11% on the liquidity injection. In other overnight news, Bloomberg reported (citing sources) that the BoJ is almost certain to cut its inflation forecast for the fiscal year starting in April citing the sharp fall in oil prices, the government’s decision to make pre-school education free and looming cuts to mobile phone charges as the reasons. The BoJ’s next board meeting and policy decision is scheduled on January 23. Elsewhere, futures on S&P 500 are up +0.24%.

Coming back to yesterday and those JP Morgan earnings that we highlighted above, the bank’s share price opened -2.32% lower but rallied to close +0.73% after earnings missed. Similar to Citigroup the day prior, fixed income sales and trading revenues came in much weaker than expected and in fact down 18% yoy and the weakest Q4 revenue in a decade. This was partially offset by strong investment banking revenues, though loan provisions were larger than expected too. Wells Fargo shares fell -1.55% as revenues and expenses both disappointed and management said they expect to operate under the Federal Reserve-mandated asset cap through end-2019, rather than through June as previously expected. A reminder that today we get results from Bank of America and Goldman Sachs.

In other news, yesterday’s economic data in the US was softer than expected but didn’t appear to really phase markets. The January empire manufacturing reading printed at just +3.9 which compared to expectations for +10.0 and an upwardly revised +11.5 in December. That was actually the lowest reading since May 2017 while the expectations component (+17.8) also hit the lowest since February 2016. That also leaves the ISM-adjusted empire index at 51.9 and the lowest since January 2017. So a marked deterioration to start the year, but not a shift into contractionary or recessionary territory. It’ll be worth seeing if the Philly Fed district report conveys a similar message to this tomorrow.

In addition to that, the December PPI reading also aired on the disappointing side at both the headline (-0.2% mom vs. -0.1% expected) and core (-0.1% mom vs. +0.1% expected) levels. That said health care PPI was solid at +0.15% which therefore points to upside for the health care component of PCE inflation and therefore the broader core PCE, which our economists expect to print around 1.89% later this month (or later, depending on the US government shutdown).

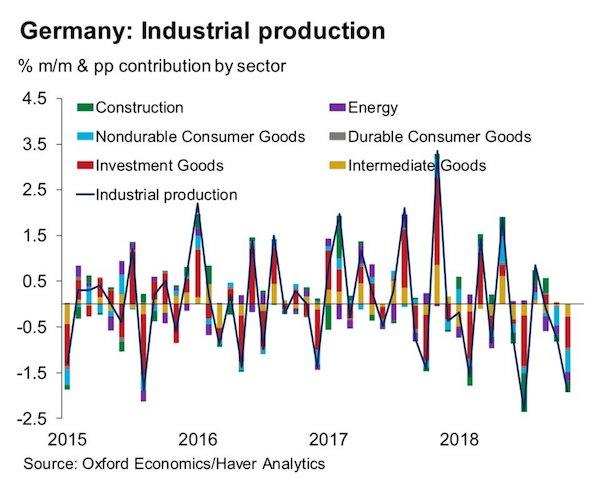

Here in Europe the main data focus was Germany’s 2018 GDP reading which hit expectations at 1.5%. Importantly, that implies only modest growth for Q4 (but at least likely positive after recent fears of a negative print) and while our economists had expected some positive payback after the WLTP shock to push growth temporarily above trend in Q1 2019, they have seen very limited evidence of this so far and as such estimate Q1 GDP at around +0.25% qoq. The result of this is a downward revision to their 2019 growth forecast in Germany to 1% from 1.3% previously. Given the recent weakness in the Euro area macroeconomic data, the ECB President Draghi said in his address to the European parliament yesterday that the Euro-area economy is not heading towards recession but to a slowdown and “it could be longer than expected.”

Other than digesting the fallout from last night’s Parliament vote in the UK today and preparing for the confidence vote, we’ll also have the December inflation data docket here in the UK to keep an eye on this morning, while there’s also the final December CPI prints due in Germany and Italy. Given the government shutdown in the US the retail sales report is to be postponed along with business inventories, leaving the December import price index and January NAHB hosing market index data as the only releases due. The Fed’s Beige Book is also due out this evening. Meanwhile the Fed’s Kashkari is due to speak late this evening while the BoE’s Carney and ECB’s Nowotny speak this morning. Earnings wise it’s the turn of Bank of America and Goldman Sachs today.

via RSS http://bit.ly/2SYTPwj Tyler Durden

Since 1996 Gallup has been asking Americans whether they support a ban on “assault weapons.” Gallup has never explained what “assault weapons” are, and there’s a good reason for that, Jacob Sullum says: The category is defined by politicians, so its meaning is arbitrary, mutable, and illogical.

Since 1996 Gallup has been asking Americans whether they support a ban on “assault weapons.” Gallup has never explained what “assault weapons” are, and there’s a good reason for that, Jacob Sullum says: The category is defined by politicians, so its meaning is arbitrary, mutable, and illogical.

This government shutdown is now longer than any in history. The media keep using the word “crisis.”

This government shutdown is now longer than any in history. The media keep using the word “crisis.”

After the Raleigh, North Carolina, city council imposed a $300-per-scooter fee and other limitations on electric scooters, Bird scooters added a $2

After the Raleigh, North Carolina, city council imposed a $300-per-scooter fee and other limitations on electric scooters, Bird scooters added a $2