A group “allied with the White House” is allegedly putting together dossiers on hundreds of journalists who are critical of the Trump administration. Much like opposition-research files on rival political candidates, theses dossiers contain potentially scandalous tweets and other statements dug up from journalists’ pasts.

A CNN statement condemned “those working [to] threaten and retaliate against reporters as a means of suppression.”

“Four people familiar with the operation described how it works,” reports The New York Times:

The group has already released information about journalists at CNN, The Washington Post and The New York Times—three outlets that have aggressively investigated Mr. Trump—in response to reporting or commentary that the White House’s allies consider unfair to Mr. Trump and his team or harmful to his re-election prospects.

Operatives have closely examined more than a decade’s worth of public posts and statements by journalists, the people familiar with the operation said. Only a fraction of what the network claims to have uncovered has been made public, the people said, with more to be disclosed as the 2020 election heats up. The research is said to extend to members of journalists’ families who are active in politics, as well as liberal activists and other political opponents of the president.

The idea is to present authentic statements, often in out-of-context or misleading ways.

But before you freak out—or get out the popcorn—keep in mind that the whole project may be mostly bluster.

“It is not possible to independently assess the claims about the quantity or potential significance of the material the pro-Trump network has assembled,” states the Times. “Some involved in the operation have histories of bluster and exaggeration. And those willing to describe its techniques and goals may be trying to intimidate journalists or their employers.”

While Trump family friends and campaign staff have been spreading the oppo research, the White House press office “said that neither the president nor anyone in the White House was involved in or aware of the operation, and that neither the White House nor the Republican National Committee was involved in funding it,” according to the Times.

FREE MINDS

The meaning of sex comes before the U.S. Supreme Court this fall. Quartz explains:

An upcoming high court case, to be argued in October, asks whether transgender employees are protected from discrimination under a federal civil rights statute known as Title VII. The Department of Justice says no. It is siding with a funeral home owner who fired a transgender employee.

But the worker was successfully represented in the lower courts by the Equal Employment Opportunity Commission (EEOC), a federal government agency. That puts the federal government in the somewhat awkward position of fighting the person who was originally its client….

The Justice Department insists in a brief filed this month that Title VII, enacted in 1964, doesn’t cover transgender employees because “the ordinary public meaning of sex” at the time of its passage was biological sex as determined by reproductive organs. The legislation was “originally designed to eliminate employment discrimination against racial and other minorities—it was especially clear that the prohibition on discrimination because of ‘sex’ referred to unequal treatment of men and women in the workplace,” the [Justice Department] brief states.

Read the brief here.

FREE MARKETS

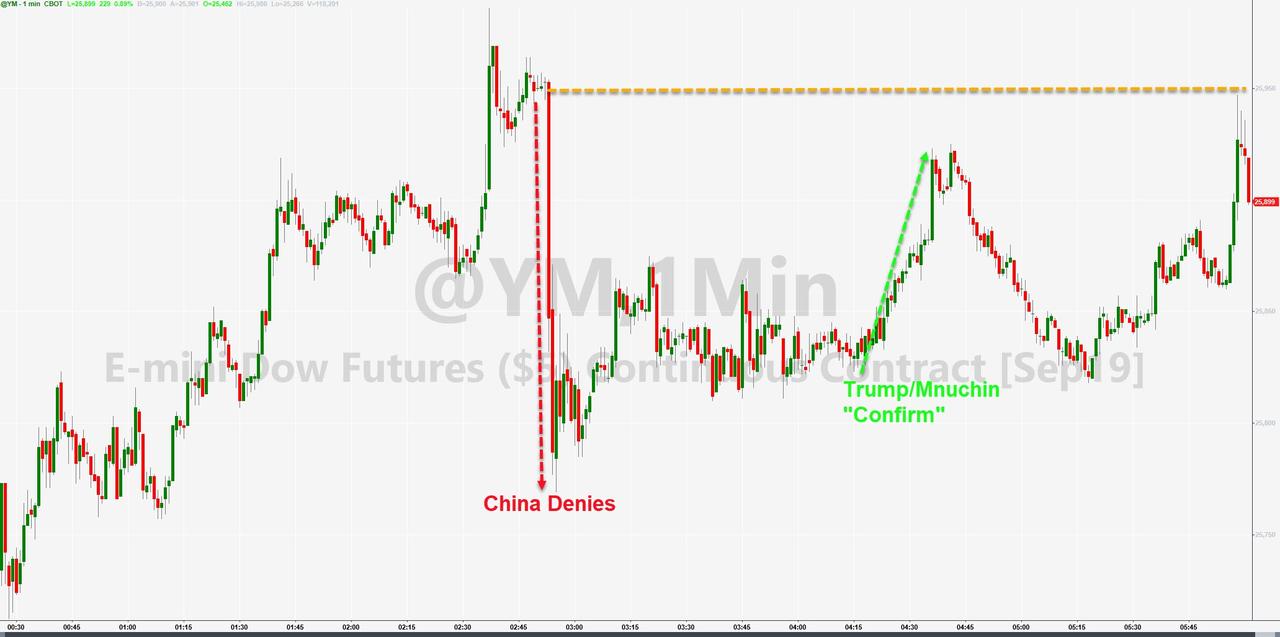

No, the White House won’t force companies out of China, say Trump aides. But the fact it needed to be denied is a bad sign.

The denial comes after President Donald Trump on Friday tweeted this:

We don’t need China and, frankly, would be far better off without them. Our great American companies are hereby ordered to immediately start looking for an alternative to China, including bringing your companies HOME.

On Sunday, Trump economic adviser Lawrence Kudlow told CNN it was merely the president making a suggestion:

What he is suggesting to American businesses [is] you ought to think about moving your operations and your supply chains away from China and secondly, we’d like you to come back home.

But Treasury Secretary Steve Mnuchin told a somewhat different story to Fox News:

I think what he was saying is he’s ordering companies to start looking. He wants to make sure to the extent that we are in an extended trade war, that companies don’t have these issues and move out of China.

More at The Wall Street Journal.

ELECTION 2020

Talk radio host Joe Walsh is officially in:

Friends, I'm in. We can't take four more years of Donald Trump. And that's why I'm running for President.

It won't be easy, but bravery is never easy. But together, we can do it. Join me… join us: go to https://t.co/d40HA9h2Kz.

Let's show the world we're ready to be brave.

— Joe Walsh (@WalshFreedom) August 25, 2019

QUICK HITS

- “Trump suggested dropping nuclear bombs into hurricanes to stop them from hitting the U.S.,” reports Axios.

- He’s baaaaack:

Joe Arpaio running for Maricopa County sheriff in 2020 https://t.co/13fStaMAHc

— Yashar Ali ???? (@yashar) August 26, 2019

- A Los Angeles sheriff’s deputy admits he faked being shot by a sniper.

- The Cherokee Nation will appoint a delegate to the U.S. House of Representatives, for the first time acting on a nearly 200-year-old guarantee from the feds that it could.

- Can Bitcoin replace central banking? A podcast debate.

- A look at which states may be next to legalize recreational marijuana use and sales.

- Axios outlines “how many steps it takes to get an abortion in each state.”

- How veggie burgers “got caught in a war over the future of meat.”

from Latest – Reason.com https://ift.tt/2ZwfLp2

via IFTTT