Attorney and legal analyst Jonathan Turley has weighed in on Paul Manafort’s fate, as the first of two trials against the former Trump campaign aide gets underway in Virginia on Monday. Turley suggests that Manafort is “in the worst possible legal position” of having to “run the tables” – beating all 18 counts in his Virginia trial, as well as seven counts in his D.C. trial, while trying Mueller’s team will probably point out that he’s a multimillionaire Washington lobbyist that a jury is unlikely to identify with.

That said, there are many considerations to take into account which Turley describes – including the possibility of a presidential pardon, however if you want to know precisely how screwed Manafort is, read on:

Authored by Jonathan Turley via The Hill

Paul Manafort gambles against all odds at trial

Hunter Thompson once decried the fleeting fortunes of gamblers as “tomorrow’s blinking toads, dumb beasts with no hope.” Paul Manafort is about to discover if he is one of those “blinking toads.” The trial of the former Trump presidential campaign chairman in Virginia, on more than a dozen criminal counts of tax fraud, bank fraud and reporting violations, is about to begin. Rather than take a plea, Manafort has taken the gamble of a trial and the lingering chance of a pardon.

Manafort is in the worst possible legal position of having to “run the tables” by not only beating 18 counts in Virginia but then beating seven counts in a separate trial in Washington. He needs a sweep or nothing. That is quite a gamble and, frankly, Manafort is a bad bet. While he needs to beat all the charges, special counsel Robert Mueller needs only one conviction on one count to put Manafort away for as much as a decade.

That is what it means to “play the house.” The house usually wins. Right now, Las Vegas would give Manafort about the same odds of acquittal as it would give the Baltimore Orioles to win the World Series. Indeed, the one thing the Orioles, ranked worst in the MLB, have going for them is that people actually want them to win. That is not the case with Manafort, and that lack of empathy is likely to grow considerably in coming weeks with the expected witnesses at his trial.

The first challenge for the defense is that Manafort can be easily painted as someone who made millions off some of the world’s most disreputable characters. The more that jurors learn of Manafort, the less likely they are to find him relatable or likable. To the contrary, his lifestyle will place a wide social and economic chasm between him and the jury. That is by design, as prosecutors know his lifestyle could leave jurors less inclined to give him the benefit of any doubt.

For that reason, they intend to call a myriad of minor witnesses, from a ticket vendor for the New York Yankees to a high-end tailor to a Mercedes Benz salesman. Jurors will hear about his six homes, $2 million worth of antiques, a $500,000 landscaping bill, the two silk rugs costing $160,000, and almost $1.5 million in clothes for himself. All of this is part of a lifestyle that seemed to be collapsing under its own weight, necessitating the alleged fraudulent efforts to secure nearly $25 million in bank loans.

This type of evidence invites class resentment and an unconscious desire to see an elitist fall. The legal chasm may be equally challenging. Jurors will be buried in a mountain of transactional and bank documents from numerous countries. Manafort is accused of hiding $30 million to evade U.S. taxes by using accounts in the United Kingdom, Cyprus and the Caribbean island nation of Saint Vincent and the Grenadines. Prosecutors claim he may have made more than $60 million in working for Ukrainian interests.

With multiple counts and such a daunting record, a jury often inclines to rely on prosecution witnesses. In this case, the witnesses will include Manafort’s former aide and confidant, Rick Gates. The combination of a less than sympathetic defendant, a tower of financial documents and a flipped former associate makes conviction on at least some of these counts a high likelihood. So why hasn’t Manafort sought a deal with Mueller? Well, several possible reasons exist.

First, Mueller might be a bit short on mercy. He is unlikely to cut a deal with Manafort that did not involve pleading guilty to at least one count. Mueller would have to clear counts in both Washington, D.C., and Virginia, and that could not be done easily with a walk-away plea. Any plea likely would put Manafort behind bars for years. At age 69, a 10-year sentence could be the same as life in prison. Moreover, most of these counts would run concurrently so, while even one conviction is enough to hold him for much of his remaining years, Manafort may not find a deal as attractive.

Second, unlike former Trump attorney Michael Cohen, Manafort still has hope for a pardon. If President Trump were to go nuclear in shutting down the investigation, he likely would issue a slew of pardons. At this point, he is more likely to pardon Hillary Clinton than Cohen, but Manafort has remained loyal and silent.

Finally, just as Mueller might not be able to give Manafort what he needs, Manafort might not have enough to offer Mueller. The problem with being the matinee defendant for the special counsel investigation is that a plea bargain is more costly to secure. Manafort would need deliverables on Trump, and he may not have them. Short of a quid pro quo understanding with the Russians, or confirmation of the president’s knowledge of the Trump Tower meeting with Russians that implicates Donald Trump Jr. and others, Manafort may not have a deliverable.

Trump was not known to be close to Manafort, though they had interactions going back years. In other words, Manafort may not have a “get out of jail” card to use against Trump or key figures. For any of these reasons, Manafort may simply view a deal as offering too little and risking too much. Conversely, a pardon could mean no jail time and a clean slate.

If Mueller convicts Manafort, it is likely to be celebrated as proof of the legitimacy of the special counsel investigation. In truth, it is not. Manafort’s charges have nothing to do with Mueller’s original mandate involving Russian collusion, obstruction, or any of the allegations directed against the president. That does not make Manafort innocent, but this was not the game Mueller was supposed to be playing.

Manafort still has a defense to present, so it is too early to declare him a loser. However, he is taking a gamble in not taking a plea. In playing against the house, his odds at trial are long and, if he ever comes up for sentencing, his credit is short.

Jonathan Turley is the Shapiro Professor of Public Interest Law at George Washington University. You can follow him on Twitter @JonathanTurley.

via RSS https://ift.tt/2LWps9S Tyler Durden

Accusations of sexual misconduct and nepotism have come out against former Federal Emergency Management Agency (FEMA) personnel chief Corey Coleman just weeks after Coleman resigned in June.

Accusations of sexual misconduct and nepotism have come out against former Federal Emergency Management Agency (FEMA) personnel chief Corey Coleman just weeks after Coleman resigned in June.

More than 450 Floridians have been ordered to surrender their firearms since the state’s “red flag” law took effect in March, according to a new report.

More than 450 Floridians have been ordered to surrender their firearms since the state’s “red flag” law took effect in March, according to a new report.

Venezuelan President Nicola Maduro took to television last week to announce his solution to the country’s monetary woes: eliminating five zeros on all new Venezuelan bolivar bills.

Venezuelan President Nicola Maduro took to television last week to announce his solution to the country’s monetary woes: eliminating five zeros on all new Venezuelan bolivar bills. The death penalty is surfacing as a key issue in Louisiana’s upcoming gubernatorial election, in 2019. With execution drugs unavailable, the state’s top prosecutor is proposing the use of new drugs, nitrogen-induced suffocation, or “hanging, firing squad, or electrocution,” if necessary.

The death penalty is surfacing as a key issue in Louisiana’s upcoming gubernatorial election, in 2019. With execution drugs unavailable, the state’s top prosecutor is proposing the use of new drugs, nitrogen-induced suffocation, or “hanging, firing squad, or electrocution,” if necessary. But Louisiana Attorney General Jeff Landry (R) is not convinced that the problem is legitimate, nor that a solution is really out of reach for Edwards. In a late July

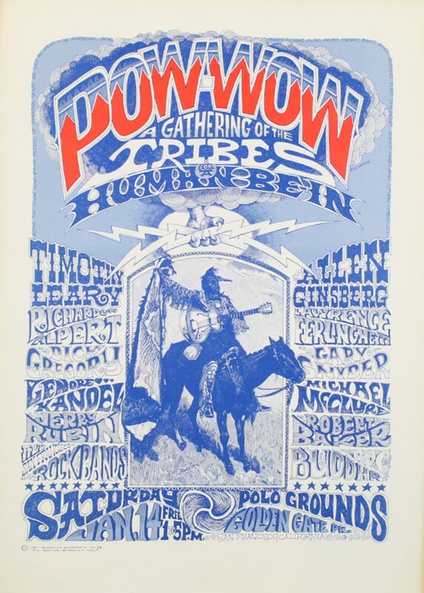

But Louisiana Attorney General Jeff Landry (R) is not convinced that the problem is legitimate, nor that a solution is really out of reach for Edwards. In a late July  Back in San Francisco in 1967, there was an event that helped catalyze the “Summer of Love” and was variously billed as

Back in San Francisco in 1967, there was an event that helped catalyze the “Summer of Love” and was variously billed as  The Koch’s sins are that they disagree with Trump on many issues, including criminal-justice reform, trade, and immigration. They want more of it than the president and his supporters, who have managed in just a few years to utterly transform the GOP into the party of protectionists and xenophobes. It wasn’t always this way, as anyone who remembers Ronald Reagan and George H.W. Bush

The Koch’s sins are that they disagree with Trump on many issues, including criminal-justice reform, trade, and immigration. They want more of it than the president and his supporters, who have managed in just a few years to utterly transform the GOP into the party of protectionists and xenophobes. It wasn’t always this way, as anyone who remembers Ronald Reagan and George H.W. Bush