Authored by Economic Prism’s MN Gordon, annotated by Acting-Man’s Pater Tenebrarum,

Son of the Imperial City

What are the chances of Federal Reserve Chairman Jerome Powell being wrong? The chances he’ll be wrong on the economy’s growth prospects, the direction of the federal funds rate, and inflation itself? Our guess is his chances of being wrong are quite high.

The new central planner-in-chief. Central banks are facing a special case of the socialist calculation problem pertaining to the financial system. Like the comrades in the former Eastern Bloc, who tried to adjust their plans based on prices they were able to observe in the capitalist West, their best bet is to simply follow market rates. Unfortunately market rates – especially at the short end of the yield curve – are subject to an observer-participant feedback loop with the Fed, so the dilemma cannot be entirely avoided. The ritual pouring over reams of “data” may feel like a sensible activity, but ultimately it cannot solve the problem either. [PT]

What you see, unfolding before your very eyes, is a great exercise in futility. To this endeavor, the Federal Reserve has claimed central authority of the command center. The federal funds rate, the Fed’s balance sheet, economic stagnation, massive asset bubbles, and the limits of central planners are the topics of focus. Where to begin?

Powell got into the central banking business through uncommon means. To his credit, he’s not an economist. This is a great improvement over former Fed Chair, and intellectual ditherer, Janet Yellen. Like President Trump, we didn’t have the patience for her egghead PhD economist act.

Powell, on the other hand, is a lawyer turned investment banker. He didn’t spend his formative college years being indoctrinated at the church of Keynes. But that doesn’t mean his brain hasn’t been equally softened over. For Powell received an indoctrination of another sort – one that began the moment he inhaled his first breath.

You see, Powell is a son of the Washington D.C. Imperial City. He was born and raised in D.C. and has lived nearly his entire life there. He knows how the nation’s capital works. Namely, that ever expanding debt levels are needed to keep the banks of the Potomac River firm enough to support its giant command and control money suck operation.

Money sucking operation on the banks of the Potomac [PT]

Singleness of Purpose

Several years ago, as visiting scholar at the Bipartisan Policy Center, a D.C. think tank, Powell tirelessly worked for an annual salary of $1. Behind the scenes, he labored with a singleness of purpose to persuade members of Congress – one-by-one – to raise the debt ceiling.

President Obama rewarded Powell with a nomination to the Federal Reserve Board of Governors. President Trump, an ardent proponent of debt without limits, took a quick liking to Powell. He cut Yellen loose the first chance he got.

Powell is the perfect Fed Chairman at the imperfect time. Not since Alan Greenspan has there been a Fed Chairman that truly understands the purpose of their job. Ben Bernanke and Yellen, in the interim, were true believers in the power of monetary policy. They actually believed their policies were improving the world. Clearly, they missed the point altogether.

Powell, on the other hand, like Greenspan, understands that Fed policy serves one primary and one secondary purpose. The primary purpose is to keep the gravy train flowing to the Fed’s member banks. The secondary purpose is to keep the gravy train flowing to Washington. The Fed attains both of these ends through similar means: by extracting maximum tribute from dollar holders across the planet.

Plain and simple, central bank fiat money creation, multiplied by commercial banks through fractional-reserve banking, propagates financial and economic chaos. Long periods of money supply expansion and debt over-extension punctuated by abrupt, episodic contractions, has the effect of whipsawing the efforts of both the dollar savers and debtors to get ahead.

A mountain of money – has it made us richer? Only some of us. Money printing cannot create an iota of real wealth, but among other pernicious effects, it certainly leads to a redistribution of existing wealth from later to earlier receivers. [PT]

What Fed Chair Powell Forgot to Mention

Presently, Fed policy is transition from the long money supply expansion period to the abrupt, rug-yank period of contraction. This is when those who levered up their lifestyle – from jumbo mortgage home buyers, faux-wealth pretenders, and retail zombies – are bankrupted. Shortly after, the ultra-wealthy swoop in to scoop up the wreckage at a discount, which further concentrates wealth during the subsequent money expansion period.

To this end, Powell was on point at his first press conference as Fed Chairman on Wednesday. Following the two-day FOMC meeting, he announced the Fed will raise the federal funds rate 25 basis points – 0.25 percent – to a range of 1.5 to 1.75 percent. Then, following several utterances on inflation, unemployment, and the economy, Powell concluded his press conference opening remarks with the following words:

“Finally, I’ll note that our program for reducing our balance sheet, which began in October, is proceeding smoothly. Barring a very significant and unexpected weakening in the outlook, we do not intend to alter this program. As we’ve said, changing the target range for the federal funds rate is our primary means of adjusting the stance of monetary policy. As always, the Committee would be prepared to use its full range of tools if future economic conditions were to warrant a more accommodative monetary policy than can be achieved solely by reducing the federal funds rate.”

Say what? Powell manages to confuse the punters into selling. [PT]

What Powell forgot to mention, yet is acutely aware of, is that the Fed’s quantitative tightening balance sheet reduction efforts will be flooding the bond market with massive amounts of government debt. Who’s going to buy this debt? And, on top of that, who’s going to fund the Treasury’s $1 trillion deficit?

Obviously, someone will buy U.S. Treasuries. But at what price, and what yield?We suspect this massive influx of government debt for sale will be bought at a much lower price and a much higher yield. We also suspect these mechanics will mount as the year progresses and will, eventually, prick the many cheap credit asset bubbles that distort today’s economy.

Then, when the economy begins shrinking or the market crashes, whichever comes first, Powell and the Fed, as buyers of last resort, will flood the financial system with an abundance of cheap credit, and transmit greater and greater economic disparities.

Quite frankly, this is getting old.

via RSS https://ift.tt/2GdnyeT Tyler Durden

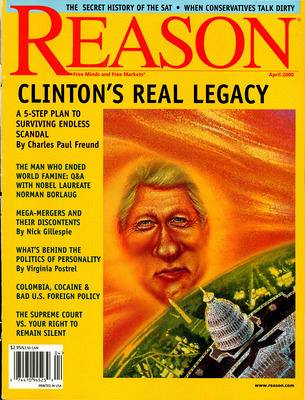

When the history of Donald Trump’s presidency is written, one major theme will be how much he got away with. You can imagine him tweeting about it: Worst president ever? I didn’t do anything @billclinton & JFK didn’t do, but I did it bigly and openly. Sad!

When the history of Donald Trump’s presidency is written, one major theme will be how much he got away with. You can imagine him tweeting about it: Worst president ever? I didn’t do anything @billclinton & JFK didn’t do, but I did it bigly and openly. Sad!