Authored by Ray Dalio via LinkedIn,

Politics is playing a bigger role in influencing the markets than is typical, and I (and others) am still trying to figure out where Donald Trump is taking us, especially as it regards trade and other wars. Besides prompting me to think hard and dig deep into what’s now happening, it is leading me to delve deeper into past trade and military wars to see their effects on economies and markets.

I will pass along my findings when I complete the examination. In the meantime, I will share some of my ruminations for the little that they are worth.

Since Donald Trump sounds more willing to enter into a trade war than any president since Herbert Hoover, and since starting a trade war is like throwing rocks in the gears of the world economy, his recent moves are naturally scary to the markets.

However, thus far what he has actually done is modest and appears significantly politically motivated, so what we are seeing could be a negotiation tactic and a political move that needn’t mean a trade war is likely.

Also, as expected, the Chinese response to his move was modest, so thus far we have seen a lot of threatening without much damage, which is understandable ahead of midterm elections. If this is the negotiating that I expect, the next move will be toward some trade agreements that will look like victories for Trump, so tensions will subside and the markets will like it.

That’s the most likely scenario. I would consider that scenario to be broken if there is any new worsening in trade relations with China from here.

We will find out soon enough.

At the same time, I can’t help but wonder if the trade war is part of a bigger impending conflict.

The analogy with the late 1930s continues to echo in my head – i.e., the confluence of wealth gaps and economic stress leading to moves to populism of both the left (communism) and the right (fascism), accompanied by the shifts in the world order from a dominant power coming out of the Great War to a rising power rivaling that dominant power (if you don’t know about this dynamic, read up on Thucydides’s Trap), all leading to military conflicts.

During such times, chaotic democracy and laissez-faire commerce tend to give way to more directed authoritarianism and “state capitalism” (i.e., government redirecting “business” activities into the service of the country’s interests and away from the service of the shareholders’ interests). It is notable that Donald Trump, at the same time as his tariffs were announced, changed key leaders from moderates to hardliners, who are more inclined to believe that broader conflicts are likely/warranted. One could conjecture that some of Donald Trump’s recent interventions in the economy – e.g., his executive order that prevented Broadcom from buying Qualcomm, protectionism to assure domestic production capabilities, and limiting of Chinese purchases of technology and other key resource companies – are all straws in the wind pointing in that direction.

We are certainly in a period in which the world order is transitioning from being U.S.-dominated to being multipolar (so Thucydides’s Trap is worth considering), wealth gaps are large and rising, and populism, nationalism, and militarism also appear to be rising – and these factors will likely play larger roles in affecting economies and markets (e.g., populism in Mexico as manifest in the upcoming July election could have a bigger effect on Mexico’s economy and markets than anything else).

At such times, I believe that it is especially important to keep one’s portfolio liquid (to be flexible) and diversified (to not have concentrated risks).

* * *

Dalio’s comments echo Eric Peters’ view that throughout history, great nations and empires fail when they surrender their institutions to an individual. The Chinese know this. Why’d they do it?

Is Beijing preparing for instability? Chinese banks have $40trln balance sheets (50% of global GDP, 3x Chinese GDP). US banks hold $17tlrn balance sheets (less than 1x US GDP).

Might China be preparing for internal economic instability? Or perhaps it’s that the West is in deep political disarray, fractured, fighting itself.

The unipolar American world order is crumbling, the US relinquishing leadership. Such transitions have historically produced periods of profound global risks, opportunities – Beijing knows this.

via RSS https://ift.tt/2GdTYpt Tyler Durden

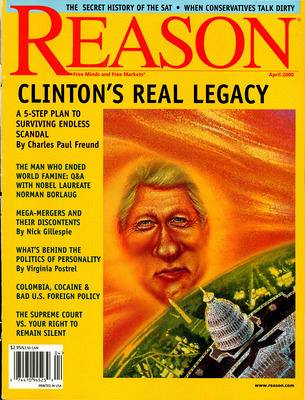

When the history of Donald Trump’s presidency is written, one major theme will be how much he got away with. You can imagine him tweeting about it: Worst president ever? I didn’t do anything @billclinton & JFK didn’t do, but I did it bigly and openly. Sad!

When the history of Donald Trump’s presidency is written, one major theme will be how much he got away with. You can imagine him tweeting about it: Worst president ever? I didn’t do anything @billclinton & JFK didn’t do, but I did it bigly and openly. Sad!