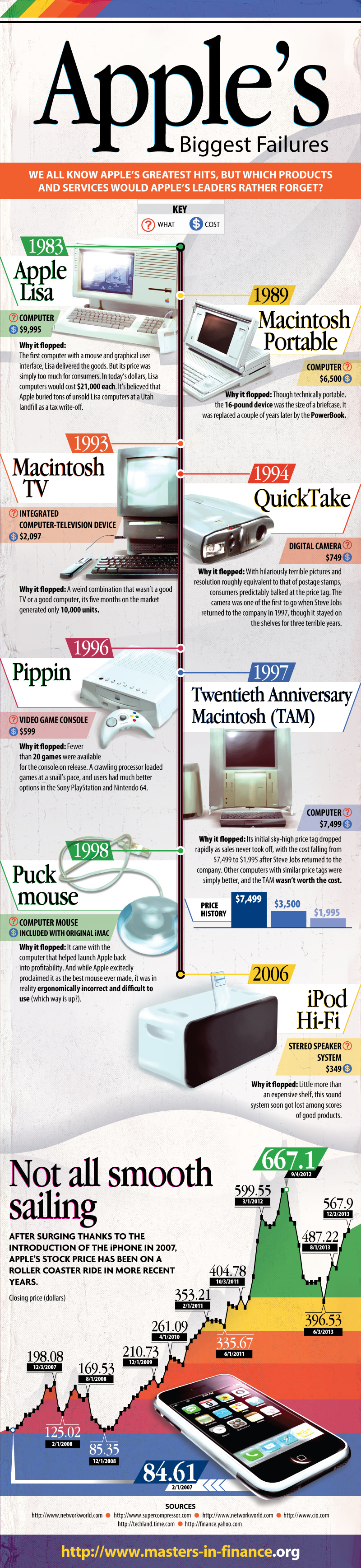

We all know Apple’s greatest hits, but which products and services would Apple’s leaders rather forget?

Source: Masters-in-Finance.org

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/NzgJlqT0oRU/story01.htm Tyler Durden

another site

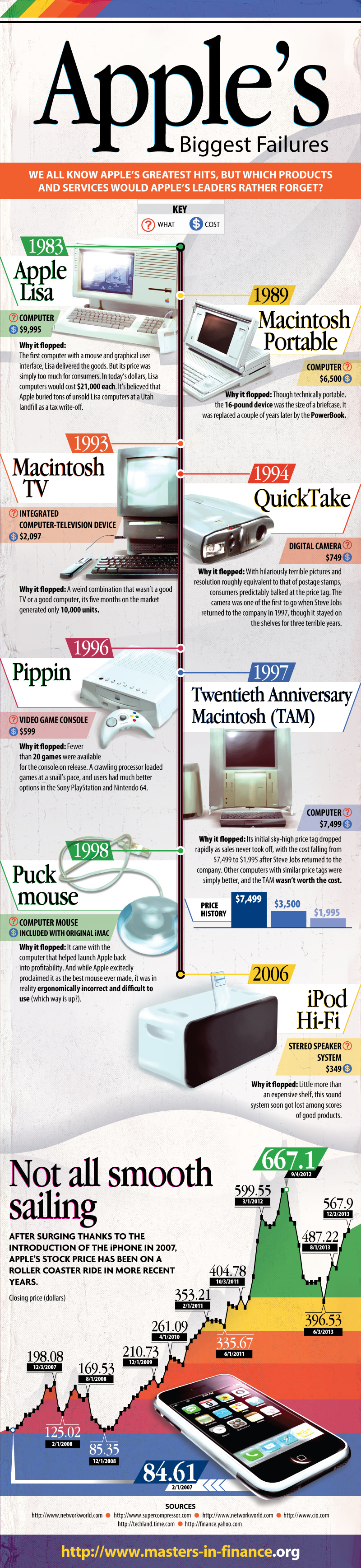

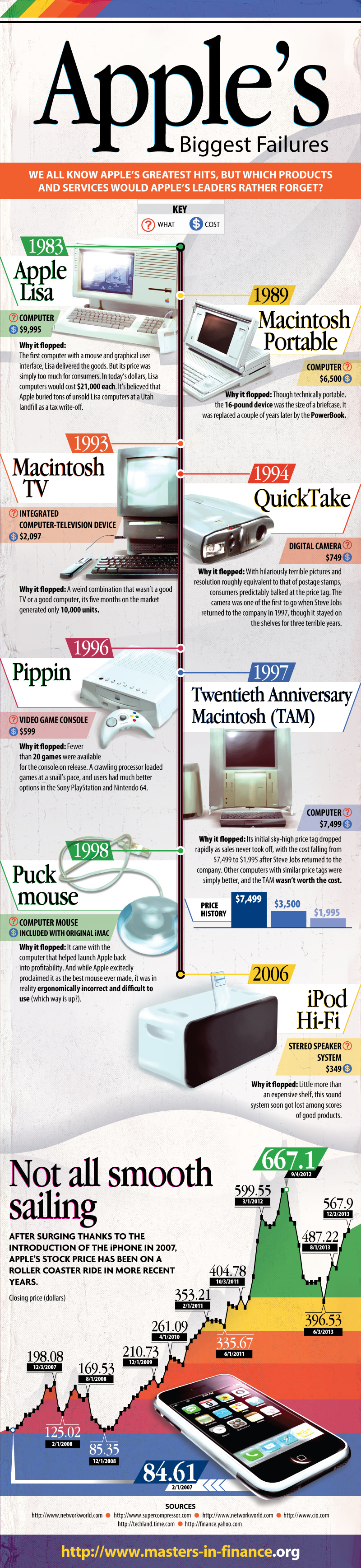

We all know Apple’s greatest hits, but which products and services would Apple’s leaders rather forget?

Source: Masters-in-Finance.org

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/NzgJlqT0oRU/story01.htm Tyler Durden

We all know Apple’s greatest hits, but which products and services would Apple’s leaders rather forget?

Source: Masters-in-Finance.org

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/NzgJlqT0oRU/story01.htm Tyler Durden

Overview

US: The broad characteristics of the investment climate are unlikely to change very much in the first part of next year. The largest policy change is the beginning of the long awaited slowing of the Federal Reserve’s long-term asset purchases. The process will likely be gradual and may take the better part of 2014 to come to a complete stop. The drag from fiscal policy will likely lessen. The roughly 1.7% annual growth in employment since 2009 is set to continue and underpin a continued expansion of the world’s largest economy.

EUROZONE: The ordo-liberalism as articulated by Germany, embodied in treaty agreements, and enshrined by the European Central Bank condemns the euro area, and by implication, many of the countries that move in its orbit, to a protracted period of slow growth and low inflation. The institutional evolution in Europe continues and the pieces of an imperfect banking union are being established. The ECB is likely to respond to the adverse monetary developments, but unless the perceived threat of deflation increases, it is likely to refrain from extreme measures, such as a negative deposit rate or outright purchase of bonds.

CHINA: The Chinese economy may slow modestly in the coming quarters, though officials will likely respond to evidence that growth is falling below 7.0%. The focus has shifted toward the implementation of reforms announced by the Third Plenum. These entail financial and governing reforms. The special economic zone in Shanghai will be viewed as a test case of the ability of the reformers to implement their program over the obstacles posed by inertia, corruption, and outright opposition.

JAPAN: The first year of Abenomics has seen growth strengthen, deflation pressures ease, the yen weaken and Japanese equities advance smartly. The early turbulence of Japanese government bonds has eased and nominal yields remain low (real rates negative). The second year is bound to be more challenging, as the economy has lost momentum in the second half of 2013.

There may be some increased consumption ahead of the April 1 hike in the retail sales tax from 5% to 8%, but this is likely to be borrowed from subsequent quarters. This may not occur until closer to the middle of the year, when the Bank of Japan decides to provide more financial support for the expansion in addition to extra insurance around its 2% inflation goal (excluding fresh food and the retail sales tax).

FOCUS ON THE FED AND US GOVERNMENT

Investors have come around to the Federal Reserve’s admonishments that tapering is not tightening. Unlike in Operation Twist, under which the Fed sold short-term Treasury securities and bought long-term, the current guidance is that the Fed does not want to see short-term rates rise. It is more willing to accept curve steepening.

The Fed’s structure is characterized by a strong core of 7 governors and 12 regional presidents, whose majority is diluted by a rotating voting system that empowers only five to vote on the FOMC decisions. Under-appreciated by many participants, the Board of Governors is likely to change significantly. This is not just a function of Bernanke stepping down. There are already two vacancies on the Board of Governors. In addition, there may be another two or three governors that step down, suggesting that 4-5 people may be new next year (assuming Governor Powell is reappointed for another term).

The $10 billion of tapering, divided equally between Treasuries and mortgage-backed securities, announced December 18, speaks to the Federal Reserve’s gradualism. The forward guidance suggests a rate hike is highly unlikely in 2014. Although the probable expiration of emergency jobless benefits at the start of the year will likely push the unemployment rate down through a further reduction in the participation rate, the Federal Reserve has signaled that the unemployment rate is likely to fall below the 6.5% threshold it has identified.

We had expected the tapering move and greater forward guidance to be delivered by the new Federal Reserve chair. We had argued that the Fed’s forward guidance would be more credible if the chairman that will implement it, issued it. Due in part to our concern that after an inventory-fueled 3.6% SAAR Q3 GDP, the US economy is going to slow back to what now seems to be its growth trend of around 2.25%-2.50%. In addition, we are concerned about downside risks to the core PCE deflator in the coming months. Finally, with Republicans seeking more spending cuts in exchange for lifting the debt ceiling, which President Obama refuses to negotiate, another fiscal impasse cannot be ruled out.

The November 2014 congressional elections may produce substantial changes to the composition of the legislative branch. The entire lower chamber, the House of Representatives and one third of the upper chamber (Senate) face voters. There is a very low support rating for both parties, but the power of incumbency in the US political system should not be under-estimated.

There may be important signals from the primary contests. The partial closure of the Federal government highlighted the internecine struggle for the reins of the Republican Party, largely between the northern and southern wings (identify more with the Tea Party movement). Although the business community is mostly supporting the north, the passions, energy and populist appeal may favor the southern wing. Its anti-Washington rhetoric has found a responsive chord.

The primaries will test whether the southern wing can wrest control of the entire party by beating some key northern Republicans. Such a victor though may prove to be pyrrhic, in the general election and, arguably more importantly, in the 2016 presidential contest. Indeed, with the November election, the 2016 presidential campaign begins and President Obama becomes increasingly a lame duck, with diminishing influence.

EURO ZONE: SUCCESS WILL PROVE CHALLENGING

After being hobbled by existential doubts over the sustainability of monetary union, credit degradation, financial fragmentation, the euro area is now challenged by its successes. The return of the funds borrowed under the long-term repo agreement has been the principle drain of the excess liquidity that kept EONIA (key index of overnight rates) nearer the zero deposit rate than the repo rate (which is at 25 bp, following the ECB’s surprise November rate cut).

At the same time, the only path of adjustment for the uncompetitive periphery members is internal devaluation, which means a relative decline in domestic prices has produced a disinflationary environment on the general level. This coupled with the compression of domestic demand, has improved external accounts, while the infamous Target2 imbalances decline. Yet, core countries, especially Germany, have refused to offset the austerity in the periphery with sufficiently strong enough stimulus. This has served to protect the German external surplus, while creating low inflationary conditions.

On top of the growing EMU current account surplus, foreign investors have returned to Europe. Several large institutional investors and wealthy individuals have been acquiring property and other distressed assets in Europe. A few hedge funds made the news with moves into Greece. Through early December, the Athens Stock Exchange was up 30%, the most in the region.

Greek banks and corporate bonds w

ere among the most distressed assets and, arguably, offered the best returns in turn-around situation. Many global investors were under-weight on European stocks and bonds, and then in mid-2013 the surveys suggested that an economic recovery was at hand, causing many investors to move back in. Spanish and Italian stocks and bonds seemed to have been favored. US money market funds increased their exposures to European paper.

European banks continue to de-leverage and sell non-core assets, often in other countries. With a banking union gradually being built, some investors will look more favorably toward European bank shares. Before the ECB assumes regulatory authority over the systemically important European banks, it will review the quality of the assets, ensure the proper uniformed classifications are employed, and stress test the banks. While not ideal due to reliance on national resources, a resolution mechanism has been agreed upon.

The crisis and the policy reaction in Europe have weakened the political center. Rather than the cuts in social programs and high unemployment fueling a move to the left, it is the populism on the right that has emerged in Europe. This is not simply a phenomenon in countries in the periphery, like Greece; rather it is evident in the stronger countries, like Austria and Finland. It is perhaps most evident in France, where recent polls put (Marine) Le Pen’s National Front at the top.

This disenchantment will likely be felt in the EU Parliamentary elections and local elections in May 2014. National political elites may feel besieged. While the crisis forged a tighter union, despite expectations in some quarters of the dissolution of EMU, the recovery may see rearguard action, to recapture some of the sovereignty surrendered.

In addition to these forces, when considering the outlook for the euro-dollar exchange rate, the two-year interest rate differential continues to provide useful insight. Investors now accept that reducing the amount of long-term assets purchased by the Fed and a rate hike are two completely separate events, which allows the U.S. 2-year yield to remain anchored. At the same time, the prospects of more liquidity provisions by the ECB, slow growth and low inflation points to a low 2-year German yield.

The US 2-year yield peaked in early September, ahead of when many, though not us, had expected the Fed to taper, at almost 55 bp. By late November, it had fallen to almost 25 bp. Given the risk of a Fed rate hike by late 2015, such a yield on the two-year note seems too low. As yields return toward fair value (37-50 bp), the dollar’s descent may slow. However, a significant rally may require even higher yields.

German 2-year yields fell to 5bp in early November amid speculation that the ECB could adopt a negative deposit rate. As an aside, the lower yields German has enjoyed as a result of the crisis, has saved the German government more money than it has actually paid to aid peripheral countries. In any event, the yields rose sharply, back up above the 100 day average (~17 bp) and near 25 bp in early December was closer to the year’s high (~38 bp). As yields return to fair value, the euro’s appreciation will likely be corrected.

CONTINUING CHANGES IN JAPAN

While the euro-dollar exchange rate seems particularly sensitive to the movement of short-term rates, the dollar-yen rate often seems more sensitive to long-term interest rate developments. The prospects of Fed tapering have seen long-term US interest rates move back toward the upper end of the 2013 range. However, as the whiff of disinflation remains, and Q3 growth of 3.6% is a one-quarter wonder (inflated by inventories that will be worked off at the cost of future output), we expect the rise in US 10-year yields to be contained.

Japanese bond yields, on the other hand, may rise in 2014, but not because the BOJ stops its buying program. Rather the low rates of return will push institutional investors, including the Government Pension Investment Fund, into equities. New government-sponsored investment schemes are designed to encourage equity investment, though given the risk-averse nature of Japanese households, relatively high dividend stocks will likely be preferred.

In a deflationary environment, low nominal Japanese Government Bond (JGB) yields still translated to positive real rates, and sometimes, relatively high ones at that. However, with the rise in inflation, real yields have turned negative. This may further squeeze households out of fixed income. At the same time, the disinflation in North America and Europe has seen real interest rates there rise and Japanese foreign bond purchases may continue to attract Japanese investors into 2014.

Japanese households are not only being squeezed by the negative real return on their savings, but also by the reluctance of businesses to share their strong profits growth with their employees in the form of higher wages. On top of that, retail sales tax will further erode the purchasing power of Japanese households.

Although officials generally expect the JPY5.5bln supplemental budget (to be financed by higher tax revenues generated by the economic recovery and using previously allocated but unspent funds) to offset the economic impact of the sales tax increase. We are less sanguine and expect the erosion of household finances will erode support for the Abe government and prompt additional fiscal support, as well as re-energize the debate of the second leg of the retail sales tax hike (from 8% to 10% in 2015).

Whereas many observers had expected the yen to trend lower throughout 2013, we had anticipated a broad trading range to begin shortly after the much anticipated quantitative easing by the new BOJ Governor Kuroda began. We now see pressure from interest rates and capital flows to help fuel another leg down for the yen, against the dollar and euro. It may meet increasing resistance from officials at the multilateral meetings in the first part of 2014, where critics see unfair advantage stemming from a policy aimed at currency devaluation. Indeed, the drive to double the money base within two years has achieved where overt (and apparently covert) intervention failed.

We see scope for around a 5-7% depreciation of the yen as the dollar moves into a new trading range against it, while the dollar stays range-bound against the euro. Later in the year, we expect the dollar-yen pair to find a new trading range as the dollar trends higher against the euro.

HIGH INCOME COUNTRIES ROUND UP

To round out this overview, let’s turn our attention away from the US, Japan and euro area and look at a few other high income countries.

UNITED KINDGOM: The strength of the UK economy was a pleasant surprise in 2013 and the momentum looks to carry over into 2014. Although price pressures are stubborn, barring a significant data surprise, we do not expect the BOE to hike rates in the New Year, though we see some risk that rates will be hiked before the next general election in May 2015. After the May EU parliament and local elections, Scotland’s referendum (Sept 18) will move more into the spotlight. While there may be some apprehension beforehand, lasting market impact may be minimal.

AUSTRALIA: We are not convinced that the Reserve Bank of Australia’s monetary policy cycle is complete. Barring a dramatic decline in the Australian dollar, we think that late Q1 or

early Q2 may offer a window of opportunity for the RBA to move. Poor economic data, including easier price pressures, and/or an appreciation of the Australian dollar, would raise our confidence of another rate cut.

CANADA: Canadian monetary policy is more likely to be on hold through 2014 and the Canadian economy is likely to under-perform the US. We look for further depreciation of the Canadian dollar. Our forecast anticipates the US dollar to move toward CAD1.10 by mid-year.

SWEDEN: In the face of disappointing economic activity and the risks of deflation, the Riksbank cut the repo rate to 75 bp and implied scope for another 25 bp rate cut in the first half of 2014. Household debt levels remain a concern to officials, but interest rate policy is not the most efficient way to address it. Look for macro-prudential efforts to be stepped up in the coming months.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/bLHm4ejaNHU/story01.htm Marc To Market

2003

2003

marked the tenth anniversary of the death of Bryan Clements. His

obituary in the Arizona Daily Sun attributed his passing

to “complications following brain surgery,” though the reality of

his end was rather weirder and more interesting than that suggests.

So was his life. Bryan was a part-time mountain man, and a model

for some of the attributes of Rollo, a main character in the novel,

High Desert Barbecue. He mattered not just because he made

the world a stranger and better place, writes J.D. Tuccille, but

also because the room for his existence is an underappreciated

feature of what can be an all-too stifling and rule-bound

world.

from Hit & Run http://reason.com/blog/2013/12/24/jd-tuccille-says-leave-room-for-the-moun

via IFTTT

While I don’t believe a word the professional criminals at the Federal Reserve say about anything, this is nonetheless an interesting clip from CNBC earlier today. The guest was Jeffrey Lacker, the President of the Federal Reserve Bank of Richmond.

Of course, I do note that after Lacker says his statement about the lack of imminent Fed intervention, he does mumble “at this point” under his breath.

The first thirty seconds is all that’s worth watching.

Jeffrey Lacker: “Fed Has No Interest in Stopping Bitcoin” originally appeared on A Lightning War for Liberty on December 24, 2013.

from A Lightning War for Liberty http://libertyblitzkrieg.com/2013/12/24/jeffrey-lacker-fed-had-no-interest-in-stopping-bitcoin/

via IFTTT

Not satisfied with paying less taxes than his secretary, it seems Warren Buffett has decided that his employees should also pay more for their healthcare. His latest acquisition, Heinz, has recently announced a very significant cut in retiree health benefits. Of course, as the Pittsburgh Post-Gazette reports, Heinz is not admitting this is due to Obamacare but the company is not alone with 60% of employers considering changes through 2013. In an effort to cope with the uncertainty of ongoing health payments, companies have chosen (potentially smaller) lump-sum benefits, leaving the employee to fund the rest. As one reitree noted, “I feel that they should stand behind the moral obligation of the preceding owners of this company and maintain the program,” but, keeping promises does not seem to be the norm these days.

Add Arnold Waldo of Carrick to the list of people disappointed with recent changes being made at the H.J. Heinz Co.

Mr. Waldo, 82, who retired from the Pittsburgh food company in 1985, received a letter in late November notifying him that Heinz was reducing its contribution to a retiree reimbursement account used to cover certain medical expenses, such as co-pays for doctor visits and health insurance premiums.

“Beginning in 2014, Heinz will contribute $1,093 per year, per household to your RRA,” the letter dated Nov. 21 said.

The cut, not the first to the retiree benefit, takes the level that Heinz is contributing to the account down from $3,500 per year, Mr Waldo said.

The company confirmed that it has made changes recently, although it did not say how many people were affected.

…

“Heinz recently announced a reimbursement adjustment for a certain group of retirees in order to provide a more consistent contribution level across the vast majority of our Medicare-eligible retirees,”

…

In 2010, he said, Heinz stopped providing health insurance and created the retiree reimbursement account instead. The company started with a $7,000 contribution the first year to help with the transition and then moved to the $3,500 level.

Nor is Heinz the only company to reduce retiree health benefits. Research from Towers Watson/ISCEBS released two years ago found 60 percent of employers that offered retiree medical plans were considering changes for 2012 or 2013.

…

…the use of such programs has helped businesses avoid coping with swings in health insurance costs. Workers get a lump sum and then choose how to best spend it.

Waldo, who worked at the Heinz operation on the North Side for 28 years, notes, “I feel that they should stand behind the moral obligation of the preceding owners of this company and maintain the program.”

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/iuI2rJwdGwQ/story01.htm Tyler Durden

Via Russ Certo of Brean Capital,

From the first headline to the last, the following brief month-by-month summary of the year shows just how far markets and global happenings have come…

January 2013: Risk seen in mortgage bonds, Swiss National Bank currency losses, fresh budget fights brewing, Egyptian Pound Extends Slide, more Asians going for gold in vault, SNB loses USD 16.5 billion, next comes the US downgrade, U.S. needs further deficit cuts to avoid downgrade-Moody’s, Gross says government financing schemes such as QE to end badly, dealers take biggest year-end gamble since 2006, Brian Sach to resign as Senior Advisor-Fed, Yellen hopes Fed able to ‘exit’ easy monetary policy, bond market investors about to get crushed-Goldman, banks win 4 year delay as regulators loosen Basel Liquidity Rule; AAPL paid 1/40 of all U.S. federal corporate taxes in 2012, Muni tax cap threatens $150 billion bond calls-Citi, Blackstone rushes $2.5 billion purchase as homes rise, QE unwind signal may end in ‘huge’ rate rise-Former Fed official, Abe aids Fed as Japan seen buying $558 billion foreign debt, Ambrose: Bundesbank to pull gold from New York and Paris, Bernanke seen buying $1.14 trillion in 2014.

February 2013: Margin debt only 13% from previous peak, Asian astrologers warn of stormy Year of Snake, Gold volatility squeeze means rise to $1,900, carried interest back in crosshairs, Bridgewater bets world stocks get lift as cash moves into market, EU tax would cover secondary-market government bond transactions, Fed party is over, invest overseas-Marc Faber, Moody’s-States outlook negative 6th straight year, biggest buyers stamped from junk bonds on loss, FT-Fed exit fears increasing, gas prices risen for 32 days straight, Simpson and Bowles to offer up deficit fix, Spain to impose yield ceiling on bond sales by regions, BOE plans to sign Yuan currency swap deal with China, Fed dealer borrowing hits 1 year high.

March 2013: Swaps now clearing on exchanges, Cover the 2% 10 year shorts, expect U.S. home prices to increase 8%-BofA, Fed may be miscounting money supply.

April 2013: Ellington joins race to buy rental homes, Abe warns over Japan inflation target, shadow inventory, Asia souring wages hit factories stoking inflation, Eurodollars-FRA/OIS may need to add premium amid libor changes, number is uglier under the surface-labor participation rate, banks would need 15% capital in Brown-Vitter proposal, Fed braces for 4th summer slump, hedge funds cut bets most since 2008, VIX bets climb to three year high, housing prices are on a tear, bond funds might shift strategies, Der Spiegel-the Bitcoin boom and its many risks, drop in UST demand may indicate more risk taking, State Street’s Junk ETF reports second-biggest daily withdrawal, Hilsenrath, BOJ bazooka, Obama mulls sail of TVA in budget plan, TVA bonds drop after Obama proposal, using of 401ks as an ATM soars by 28%, large explosion reported, Catalonia mulls taxing banks, Wall Street jobs at record low as profits rise, Germany auctions 30-year bonds at record-low yield of 2.16%, Treasury cuts bill auctions by $9 billion, Rwanda debut $400 million Eurobond, market’s $20 trillion yielding below 20%.

May 2013: Apollo’s Black ‘selling everything’, Posen predicts Geithner would be successor to Bernanke, MBI may be seized by regulators, dividend stocks being new bonds, copper leads metals higher, SEC zeroing in on ‘prime’ funds as viewed as most vulnerable, WSJ interview with Mel Watt, T-bill rates turn negative, ‘modifying to prosperity’ may hurt housing recovery-TD, Blackrock creates new alternative to money funds, Moody’s downgrades Bermuda, record cash sent to balance funds, U.S. 2 year $35 billion auction attracts fewest bids.

June 2013: Treasury futures volume record, Fannie/Freddie plunge bond wipeout speeds shift to short-term shelter, Hindenburg Omen, PMI rumor, Finra-Brokers who fail to warn clients of risks of bond investing, tender for EUR 2.9 Greece government bonds, carry traders fall victim to Bernanke tapering wager; plan to abolish FNMA/FHLMC, “off the run ites”, Fed tapering of QE is ‘appropriate next step’ for policy, home loan rates approaching 4%, MBS-immediate backstop bid may be hard to find, mortgage derivatives volume jumps to highest in almost year, Brazils outlook revised to negative, Vanguard tips fund outflows, Nikkei, SPDR gold holdings fall below 1,000 tons, futures traders raise bests on 2014 rate boost, five banks must raise $21 billion in fresh capital, Bonds tumble with stocks as gold falls in global rout, PBOC said to add cash after China money rates jump, BOJ taps Fed FX sap line, U.S. said to consider doubling leverage standard for big banks, ETF losses were far beyond what the most sophisticated risk models could have, U.S. govt. Treasury funds see 5th week of redemptions, Hilsy-market may be misreading the Fed’s messages, Freddie to sell first structured agency credit risk transaction, 5yr auction direct award lowest since Nov. 2009, China suspends PMI details.

July 2013: 30 year swaps turn positive for the first time since 2008, part-time jobs surge to all time high, FT-Carney to extend QE, margin calls rise to 3 month high, Larry Summers circles as Fed opening looms, U.S. Treasury sued over Fannie/Freddie dividend, Egypt sells $1 billion bonds to Qatar as reserves decline, FT-banks warn against spread of clearing houses, Japanese sold record amount of foreign bonds in June, Treasury futures surge as Bernanke sees ‘accommodative’ policy, Rupee FX controls, banks dodge bullet with deal on swaps, European auto sales fall to two-decade low, German ZEW unexpectedly drops, CME to address bond contract duration shift, China Treasury holding hit record, Goldman rejects case for dollar gains seeing 6% drop, Bernanke seeks to divorce QE tapering from interest rate outlook, Ally said to weigh raising up to $1 billion; Finra increases MBS transparency, SEC warns prepare for repo defaults, Will the ECB embark on negative rates, Boehner-White House spoiling for a Government shutdown, Fed Chair ping pong.

August 2013: MBS applications plunging at fastest rate in 4 years, record equity inflows, Jackson Hole agenda leak, investors euphoric as US margin debt reaches ‘danger’ levels, Janus funds posts highest withdrawals in three years, Russ vacation 🙂

September 2013: Fed may use reverse repos for macro goals, Treasury shortage squeezes, worst losses since 1999 defy history’s rally signal-Munis, bank exits sovereign debt markets due to low returns, MMFS expected to embrace Fed reverse repos, bond outflows $9 billion on week, 10 year bunds hit 2%, Obama seen delaying Fed nomination until Syria issue resolved, repo market may shrink $500 billion amid new capital ratios, Spain considers coming with 50 year bond, blutarsky bills, Hussmann on rates, White House-prepare for shutdown, Fed funds futures price first 25 bp rate hike at May 2015, everything you need to know about how a government shutdown works, ESM may issue debt in dollars, other currencies, Lombard, the case for cash, JPM settlement reaches $20 billion, U.S. may file charges against ICAP employees, countdown to shutdown, Wal-Mart cutting orders as unsold merchandise piles up, ECB says private sector loans fell most on record in August, Labor say California caught up with backlog of new claims, T-bill surrounding debt ceiling.

October 2013: Taper, Sequester, Selfie, biggest foreign creditors show concern for default, long volatility, biggest pension fund at risk holding 60% in JGBs, 1 month bills 30 bps cheaper on the day, GC rate jumps, consumer confidence plummets firs

t week of govt. shutdown, Fidelity sells off short-term US government debt, Hong Kong lifts margin discount on Treasuries, Canadian T-bills, liquidity, FT-US debt crises sees $10 billion cash flood into BNY Mellon, Caroline Baum-This is no way to run a country, S&P-shutdown has taken $24 billion out of economy, Blackstone funding largest U.S. single family rentals, London house prices surge, central bank drops tapering talk, platinum shortages extend as car sales quicken, Hollande says 75% tax will apply to everyone, FT-BOE admits limits on forward guidance, 5yr butterfly spread at four month low.

November 2013: RBS to isolate $61 billion in toxic loans, Revise terms of overnight fixed rate reverse repo, liquidity draught, home prices climb 88% of U.S. cities, squeezed middle class looks to Dollar stores, confessions of a quantitative easer, default wave of $1.6 trillion looming for JUNK-Fridson, Venezuela bonds plunge, PBOC to end Yuan intervention, Census ‘faked’ 2012 election jobs report, Janet BernYellenKE, Americans recovering equity in homes at record pace, ECB ready to fight deflation, Senate filibuster rule change, Oil breaks on Iran deal, Labor- holiday weeks ‘challenging’ to seasonally adjust, FHLB system accounts for 75% of lending.

December 2013: Russ gets metacarpal syndrome from typing, the Fed now owns one third of the entire US bond market, Canadian dollar touches lowest in two years, record crowds but spending declines, investor survey largest net shorts, largest open interest, Congress trying to avoid another shutdown, deluge of Muni debt on tap, wealthy go frugal this holiday, 10 year notes -2.25% in repo, G-fee increase, Manhattan apartment rents drop as vacancies rise to 2006 levels, Fischer buzz, only 11% of managers see taper this week, TAPER, lumber up-limit, Yen weakening, 5yrs cheap on the curve, 5yrs CHEAPER on the curve, 5 point futures print overnight, year-end tidings.

It has been a long year but society at large (always) has a lot to be thankful for.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/rCfWDCuaodg/story01.htm Tyler Durden

By EconMatters

Super Bowl of MMA

In looking back at investment decisions for 2013, one of the most glaring business mistakes was made by the UFC in failing to pull off a once in a lifetime marketing bonanza with the Mega Super Fight between Anderson Silva and Georges St-Pierre. This event could have been the Super Bowl of MMA bringing in more revenue, and roping in even casual soccer moms into event viewing parties that are an advertiser`s wet dream.

Super Fight Risk Realized

Unfortunately, for the UFC Anderson Silva lost his belt to Chris Weidman earlier this year, and Georges St-Pierre got beat up pretty bad against Johny Hendricks and went into semi-retirement causing much of the hype and luster to fall off of that Goliath versus Goliath matchup to once and for all determine the pound for pound best fighter in the Universe of Mixed Martial Arts.

Penny Wise & Pound Foolish

This is where the UFC, being penny wise and pound foolish really came back to bite them in the profit category as an organization. I give the organization a lot of credit for risking everything at one point, really putting it all on the line, which most businesses these days just don`t have the guts to do, to make MMA into an actual mainstream sport. So before I am rather harsh with this present criticism, I want to give kudos to that incredible business accomplishment.

Once in a Generation

However, with all the UFC has been through this makes this failing to pull off the Mega Super Fight in 2013 an even more glaring business blunder. Dana White grew up around the boxing world, he understands the promotion game.

It isn`t whether fighters really are invincible, it is the perception of greatness and invincibility that sells tickets for such a marquee matchup. These types of matchups don`t come around very often, maybe once a decade if promoters are lucky.

These are the Sugar Ray Leonard versus Thomas Hearns, Gerry Cooney versus Larry Holmes, Muhammad Ali versus George Foreman Super-Fights that promoters have to cash in on for the bigger picture growth opportunities for marketing the sport to a wider audience.

Everybody has a Price

Both fighters had an aura of invincibility around them earlier this year, the UFC needed to sit these two guys in a room and make this fight happen. Eventually every fighter is going to lose this aura of invincibility if they fight long enough. A good promoter never lets this happen, when both fighters are at their peak you make the fight happen, and this means by whatever means necessary.

In this case it all came down to money as it usually does. Sure one of the fighter`s legacy was going to be tarnished. One of the fighters was probably going to take a reputational hit, a marketing blow, and maybe a considerable beating in the Octagon. But this is MMA that is to be expected.

I am sure that one or both of the fighters probably wasn`t ready for the fight, or the timing wasn`t perfect, it never really is right? There is always going to be some scheduling, training, or vacation timetable that could take precedence in matc

hing these two fighters. The point is that great fighters are perfectionists and they want everything to be perfect. They want things to be just right to maximize the opportunity to win every fight.

These Super Fights are never going to fall just perfectly for both fighters, and this is where compensation comes into play, to compensate both fighters for taking the risk of this fight not fitting perfectly into their fighting and life schedules.

Compensate for Risk Aversion

The business opportunity is so great that the UFC needs to pay the fighters to assume the risk of not being the perfect time for the fight. One or both of the fighters had at times issues in blocking this fight from occurring that if enough money was put on the table, to compensate one of these fighters for taking on additional risk outside of their own comfort zone, this is what means were necessary to make this fight happen.

Silva – GSP Transcends Sport

From a business perspective this fight is bigger, transcends the actual outcome of whether one of the fighters wins or loses; it is the promotion of the sport, and the huge, once in a lifetime marketing opportunity that rarely presents itself.

It all comes down to money; a good promoter sits the two fighters in the room, and keeps raising the money bar until this fight happens. There literally is no realistic figure of fighter compensation whereby the UFC ever loses money on this fight when you run the numbers and account for the extrinsic and intrinsic revenue benefits of this event.

Furthermore, when you factor in the big picture of becoming the ultimate hype destination for the entertainment and media focus one time in the year like the Super Bowl, and what that means for broadening the sport to a wider audience, and future advertising opportunities – the $20 million per fighter figure is a bargain for the UFC. I guarantee you the UFC never saw this big picture or this fight would have happened!

UFC lacked Due Diligence Analysis: Didn`t Commit Enough Money to make Fight Happen

I have watched over the years how tight the UFC is with their money, and they didn`t put enough money on the table to make this Super Fight happen. The UFC wasn`t willing to put enough money on the table to change one of the fighter`s minds to pull off this event. I don`t know the exact figures that the UFC offered both the fighters but it obviously wasn`t enough to persuade one of the fighters to overlook their reservations about taking the fight.

Therefore it wasn`t enough, whatever that figure was. I am pretty confident that it was nowhere near the $20 million figure I just cited which would have made this Super Fight a reality in my opinion. I am guessing they envisioned something in the 6 to 9 million dollar range per fighter.

UFC Should Have Comprehensively Crunched the Numbers

This is the main criticism of the UFC, they were too short-sighted in their analysis to realize that by lowballing the fighters, so that one or both of them wouldn`t commit in early 2013, that they were risking never being able to have this Super Fight because one or both of the fighters could lose and ruin the aura of invincibility. The UFC failed to adequately factor in what I call the Lost Opportunity Cost.

They figured eventually one of the fighters who were putting off the fight would come to the table at the figure the UFC wanted to make this fight happen, and it could have worked out this way in a perfect world.

But you just cannot take that risk with these once in a generation Marketing Goldmine Super Fights, the risk is too great for conditions to no longer exist that make it just an ‘interesting fight.’ This is where the UFC failed in their analysis, and they should have built this into their equations, and put more money on the table.

$200 Million Mistake Brutal for Private Ownership – Forever Lost Opportunity

Well, this is what happens when a business becomes penny wise, and pound foolish. This business failure for 2013 probably cost the UFC an additional $200 million dollars in 2013 by my conservative calculations, and much more long-tern goodwill in the advertising and marketing space.

This is something that a sport like the UFC who only recently got the attention of the broader advertising community just cannot let happen considering where they have come from, once being on the verge of bankruptcy, and shunned by mainstream advertising and product affiliation.

This is one of the classic business and marketing failures of 2013, and a future lesson to be taken to heart by any promotional and entertainment firm, don’t be shortsighted when it comes to putting money on the table to make big productions come to fruition.

© EconMatters All Rights Reserved | Facebook | Twitter | Post Alert | Kindle

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/RhW_gwSksqY/story01.htm EconMatters

By EconMatters

Super Bowl of MMA

In looking back at investment decisions for 2013, one of the most glaring business mistakes was made by the UFC in failing to pull off a once in a lifetime marketing bonanza with the Mega Super Fight between Anderson Silva and Georges St-Pierre. This event could have been the Super Bowl of MMA bringing in more revenue, and roping in even casual soccer moms into event viewing parties that are an advertiser`s wet dream.

Super Fight Risk Realized

Unfortunately, for the UFC Anderson Silva lost his belt to Chris Weidman earlier this year, and Georges St-Pierre got beat up pretty bad against Johny Hendricks and went into semi-retirement causing much of the hype and luster to fall off of that Goliath versus Goliath matchup to once and for all determine the pound for pound best fighter in the Universe of Mixed Martial Arts.

Penny Wise & Pound Foolish

This is where the UFC, being penny wise and pound foolish really came back to bite them in the profit category as an organization. I give the organization a lot of credit for risking everything at one point, really putting it all on the line, which most businesses these days just don`t have the guts to do, to make MMA into an actual mainstream sport. So before I am rather harsh with this present criticism, I want to give kudos to that incredible business accomplishment.

Once in a Generation

However, with all the UFC has been through this makes this failing to pull off the Mega Super Fight in 2013 an even more glaring business blunder. Dana White grew up around the boxing world, he understands the promotion game.

It isn`t whether fighters really are invincible, it is the perception of greatness and invincibility that sells tickets for such a marquee matchup. These types of matchups don`t come around very often, maybe once a decade if promoters are lucky.

These are the Sugar Ray Leonard versus Thomas Hearns, Gerry Cooney versus Larry Holmes, Muhammad Ali versus George Foreman Super-Fights that promoters have to cash in on for the bigger picture growth opportunities for marketing the sport to a wider audience.

Everybody has a Price

Both fighters had an aura of invincibility around them earlier this year, the UFC needed to sit these two guys in a room and make this fight happen. Eventually every fighter is going to lose this aura of invincibility if they fight long enough. A good promoter never lets this happen, when both fighters are at their peak you make the fight happen, and this means by whatever means necessary.

In this case it all came down to money as it usually does. Sure one of the fighter`s legacy was going to be tarnished. One of the fighters was probably going to take a reputational hit, a marketing blow, and maybe a considerable beating in the Octagon. But this is MMA that is to be expected.

I am sure that one or both of the fighters probably wasn`t ready for the fight, or the timing wasn`t perfect, it never really is right? There is always going to be some scheduling, training, or vacation timetable that could take precedence in matching these two fighters. The point is that great fighters are perfectionists and they want everything to be perfect. They want things to be just right to maximize the opportunity to win every fight.

These Super Fights are never going to fall just perfectly for both fighters, and this is where compensation comes into play, to compensate both fighters for taking the risk of this fight not fitting perfectly into their fighting and life schedules.

Compensate for Risk Aversion

The business opportunity is so great that the UFC needs to pay the fighters to assume the risk of not being the perfect time for the fight. One or both of the fighters had at times issues in blocking this fight from occurring that if enough money was put on the table, to compensate one of these fighters for taking on additional risk outside of their own comfort zone, this is what means were necessary to make this fight happen.

Silva – GSP Transcends Sport

From a business perspective this fight is bigger, transcends the actual outcome of whether one of the fighters wins or loses; it is the promotion of the sport, and the huge, once in a lifetime marketing opportunity that rarely presents itself.

It all comes down to money; a good promoter sits the two fighters in the room, and keeps raising the money bar until this fight happens. There literally is no realistic figure of fighter compensation whereby the UFC ever loses money on this fight when you run the numbers and account for the extrinsic and intrinsic revenue benefits of this event.

Furthermore, when you factor in the big picture of becoming the ultimate hype destination for the entertainment and media focus one time in the year like the Super Bowl, and what that means for broadening the sport to a wider audience, and future advertising opportunities – the $20 million per fighter figure is a bargain for the UFC. I guarantee you the UFC never saw this big picture or this fight would have happened!

UFC lacked Due Diligence Analysis: Didn`t Commit Enough Money to make Fight Happen

I have watched over the years how tight the UFC is with their money, and they didn`t put enough money on the table to make this Super Fight happen. The UFC wasn`t willing to put enough money on the table to change one of the fighter`s minds to pull off this event. I don`t know the exact figures that the UFC offered both the fighters but it obviously wasn`t enough to persuade one of the fighters to overlook their reservations about taking the fight.

Therefore it wasn`t enough, whatever that figure was. I am pretty confident that it was nowhere near the $20 million figure I just cited which would have made this Super Fight a reality in my opinion. I am guessing they envisioned something in the 6 to 9 million dollar range per fighter.

UFC Should Have Comprehensively Crunched the Numbers

This is the main criticism of the UFC, they were too short-sighted in their analysis to realize that by lowballing the fighters, so that one or both of them wouldn`t commit in early 2013, that they were risking never being able to have this Super Fight because one or both of the fighters could lose and ruin the aura of invincibility. The UFC failed to adequately factor in what I call the Lost Opportunity Cost.

They figured eventually one of the fighters who were putting off the fight would come to the table at the figure the UFC wanted to make this fight happen, and it could have worked out this way in a perfect world.

But you just cannot take that risk with these once in a generation Marketing Goldmine Super Fights, the risk is too great for conditions to no longer exist that make it just an ‘interesting fight.’ This is where the UFC failed in their analysis, and they should have built this into their equations, and put more money on the table.

$200 Million Mistake Brutal for Private Ownership – Forever Lost Opportunity

Well, this is what happens when a business becomes penny wise, and pound foolish. This business failure for 2013 probably cost the UFC an additional $200 million dollars in 2013 by my conservative calculations, and much more long-tern goodwill in the advertising and marketing space.

This is something that a sport like the UFC who only recently got the attention of the broader advertising community just cannot let happen considering where they have come from, once being on the verge of bankruptcy, and shunned by mainstream advertising and product affiliation.

This is one of the classic business and marketing failures of 2013, and a future lesson to be taken to heart by any promotional and entertainment firm, don’t be shortsighted when it comes to putting money on the table to make big productions come to fruition.

© EconMatters All Rights Reserved | Facebook | Twitter | Post Alert | Kindle

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/42AlENj6CnQ/story01.htm EconMatters

This morning we showed that new home prices in America have never been higher. This is great news, right? Well not if you are an average American looking to buy a new home. Based on the median real income, home prices have never been more unaffordable at a stunning 6.7x average salary. Moreover, for those unable to see the bubble (or unsustainability), it appears Bernanke learned well from his previous planner-in-chief, having manufactured a much more aggressive ramp in prices leaving the average American even further away from the American Dream.

Still think “we” can handle higher interest rates?

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/1EQ0Fnm_gFQ/story01.htm Tyler Durden