Submitted by Jeffrey Snider via Alhambra Investment Partners,

With the BLS’s release of Q4 productivity figures, we get to check the BLS’s estimates just in time for today’s increasingly irrelevant payroll report. That much has become thoroughly apparent especially since the middle of last year as the Establishment Survey and unemployment rate only diverge with the overall breadth of economic indications. With GDP no longer corroborative, the labor reports have been in a world all their own. Far too many economists still rely upon them as their sole window for economic interpretation and these productivity numbers show further why they should not.

You have to understand what productivity means as both an economic concept and the statistic as it is constructed and presented. No economy will grow with low or even zero productivity; it’s plain common sense. Yet, the BLS’s numbers say that productivity growth has been zero or near it for five years. It has puzzled economists only because they take the calculations at face value. The fact that productivity is and remains so confusing already suggests that further investigation on all those accounts within the figure is warranted, and even demanded.

Any way you want to present the productivity estimates, clearly “something” is amiss starting around the beginning of 2011, flowing into and out of the 2012 slowdown. It has persisted at an alarmingly low state for years now, meaning that this is not simple statistical variation that will converge on its own to the mean. I have chosen to focus on the latter two years because that encompasses the “best jobs market in decades”, which serves really to highlight the major discrepancy here. In terms of economic common sense, why would businesses be hiring so robustly and getting so little out of their employees overall?

In the statistical sense, the BLS tells us that productivity since the start of 2011 is just slightly positive; during the “best jobs market in decades” it is even less so – essentially zero.

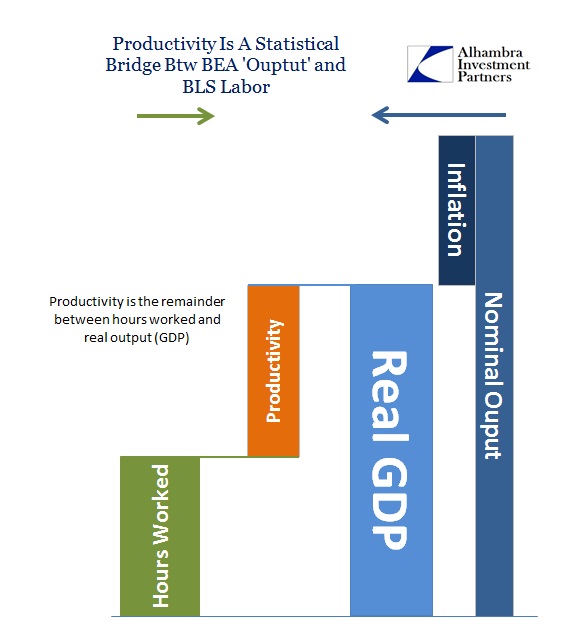

The statistical measure of productivity is essentially a check between the BLS’s version of the economy in labor against the BEA’s version of the economy in GDP. We start on the right side (below) where overall nominal GDP is reduced by some calculation of price changes and then further sliced into what the BLS uses as “private output.” On the left side, the BEA inputs its related CES figure for total hours worked, which goes hand in hand with the payroll and employment estimates. Productivity is simply the difference or plug in between output and hours.

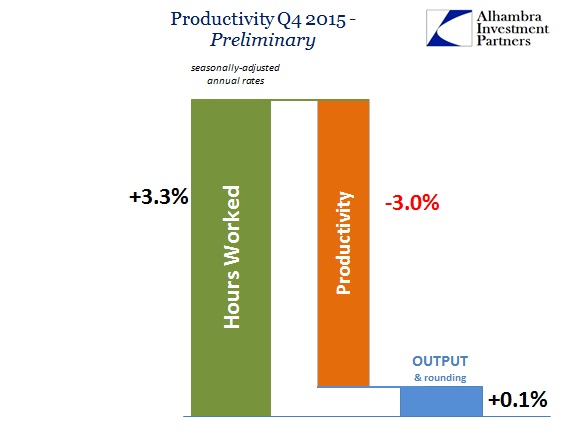

While not derived as anything more than a remainder between other terms, it does again give us an opportunity to at least sync up the BEA’s version of the economy and the BLS’s; labor market vs. GDP. With GDP less than 1% in Q4 2015 and the Establishment Survey wholly unbothered by anything, you can guess without much trouble that there would be an issue in this kind of reconciliation through statistical productivity. Sure enough, the BLS reported today that productivity was supposedly -3.0%.

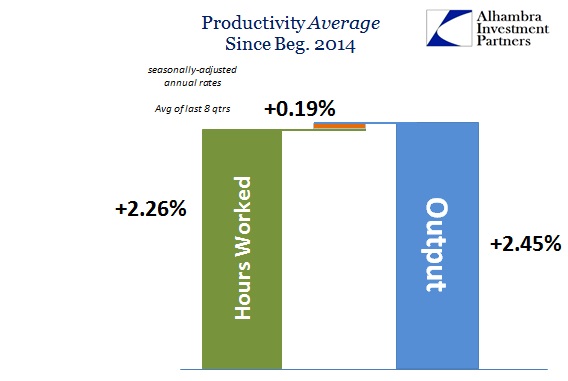

Private output being barely positive, the relatively large increase in BLS’s version of hours worked left productivity to be so highly negative. In other words, the BLS-skewed picture of the economy was nothing like the BEA’s account, with highly negative productivity just that kind of signal. One quarter of difference is not all that rare, though the size of the discrepancy is already suggestive, but this divergence has lasted again for years. Using just the averages of the past eight quarters, we can see the problem clearly.

At essentially zero productivity, that would suggest that output is gained only through increasing labor – which is not the way a truly productive system operates. Past productivity calculations bear that out conclusively. From 2004 through 2007, productivity averaged 1.66% (which is being charitable by comparison of only later in that cycle, since productivity from 2002 through 2007 averaged 2.53%) which means that if productivity in the current period was at least as positive as then there would have been only about a third of the increase in total hours.

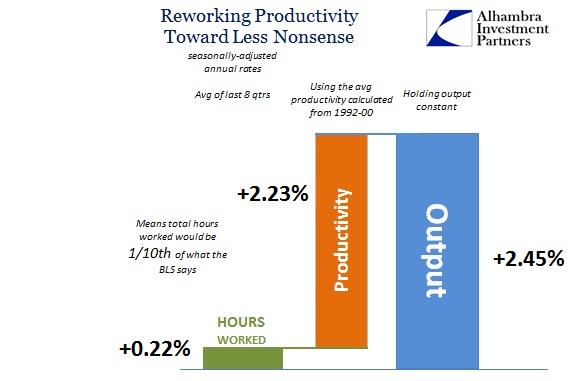

The recovery from the dot-com recession during the housing bubble mania was not in any way especially robust. By further comparison, the average productivity rate in the 1990’s (from 1992 through the end of 2000) was 2.23%. Using that in our current status would have meant virtually no labor gains whatsoever, as the “best jobs market in decades” simply disappears almost entirely.

While that may sound unduly harsh, it actually more closely replicates our economic experience outside of these payroll accounts. In other words, as noted earlier today, factory orders have contracted for fourteen consecutive months through December 2015, a direct relationship with consumers and consumer spending. That would appear far more like what we see of a more positive productivity figure rather than a highly positive labor figure. That is also true of retail and wholesale sales, as well as the fact of Chinese production and global trade and economy that was and remains highly dependent on those same US consumers.

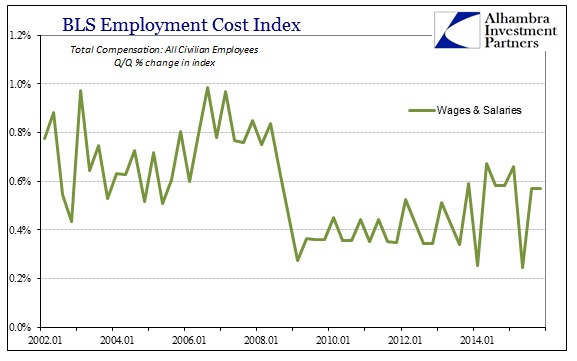

The front side of the labor statistics shows nothing but terrific gains, but the rest of them including this multi-agency economic check disagrees – vehemently. The numbers just don’t add up to the “best jobs market in decades”, far from it. Further, the BLS’s own inflation metrics also argue in favor of productivity rather than robust employment. The Employment Cost Index endures at a highly subdued rate where the unemployment rate heading for and reaching “full employment”, as Janet Yellen claims, should be creating highly visible inflation pressures through wages.

That is the whole point of the rate increase exercise, as it indicates that the FOMC believes the mainstream BLS statistics suggest “slack” is gone and that overheating through wage gains is the primary concern. The ECI and its components continue to instead show nothing of the sort; agreeing fully with the productivity check that I describe above.

Economists have been saying for over a year that the unemployment rate is and was meaningful; more meaningful, in fact, than market prices in funding and credit that increasingly doubted the full narrative. Those markets have been proven increasingly correct as the labor statistics fall further and further toward irrelevance. How likely is it that they have been accurate and the economy just falls apart while businesses are hiring and expanding labor utilization at a rate not seen since Bill Clinton’s last term? Occam’s Razor alone would suggest the productivity interpretation, that the BLS has simply been overstating labor gains for years. That would actually fit quite well within both the decrepit recovery picture, the one that has caused Main Street to near political revolt, and the onrushing recession.

The only other statistical possibility is that the BEA has been understating GDP, a question that is increasingly settled by further and broader contraction throughout the economy. If anything has been overstated it is by far the belief in the “best jobs market in decades”; it simply cannot be found in even the BLS’s own more removed numbers. That it will not reconcile with the BEA’s output figures nor the increasingly negative world we see around is leaves so very little doubt in that respect. The jobs market just wasn’t there; how could it have been? It never made sense and a closer inspection easily reveals it never added up, either.

That explains why economists were so wrong about 2015 because they were depending on phantom jobs in order to forestall very real market-driven and market-suggested danger. There is no productivity mystery, only a distinct and illegitimate lack of curiosity on the part of economists to simply take the Establishment Survey as gospel regardless of how little it fit the rest of the world. It also calls into question the legitimacy of the FOMC and monetary policy that was certainly subject to, and predicated upon, the same quackery. No matter how little the payroll reports described the economy as it was, including the relation to GDP, they held on to nothing else to instead deny everything. And some continue to.

via Zero Hedge http://ift.tt/1PoCWSN Tyler Durden