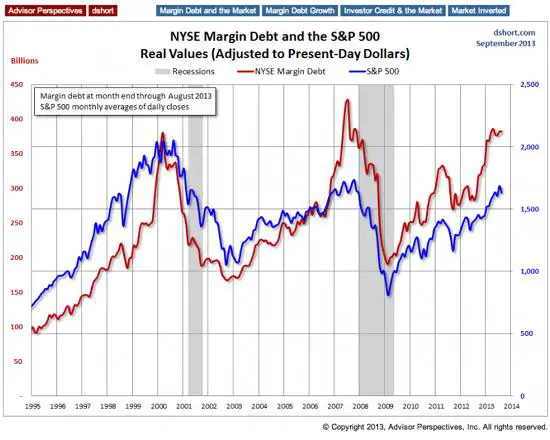

Following record UMich misses, Gallup's economic confidence collapse, the slump in the conference board's measure of confidence, and Bloomberg's index of consumer comfort signaling major concerns among rich and poor in this country (in spite of record highs in stocks), today's Consumer Confidence data from UMich continues to confirm a problem for all those 'hoping' for moar multiple expansion. Falling for the 3rd month in a row, and missing expectations for the 2nd month in a row, this is the lowest confidence print in 2013. Perhaps even more worrisome for the 'hope and change' crowd is that the 12-month economic outlook has collapsed to its lowest since Nov 2011. It would seem that all that free money flooding our 'markets' has reached peak efficacy in terms of confidence inspiration, and as Citi notes, when this cycle has played out in the past, equity market corrections are often quick to follow…

As we have noted previously – this move in confidence is key…

But, it's all about confidence… investors will not be willing to pay increasing multiples unless they are confident that the future streams of earnings are sustainable and forecastable… And simply put, the current levels of Consumer Sentiment need to almost double for the US equity market tp approach historical multiple valuation levels…

and the cycle appears to be shifting…

Via Citi,

Is consumer confidence set to turn?

Consumer Confidence is once again following a dynamic where we see it move higher for 4 years and 4 months before beginning to collapse

- Moves higher from 1996-2000 with a smaller dip halfway through in October 1998

- Moves higher from 2003-2007 with a smaller dip hallway through in October 2005

- Moves higher and so far tops out in June 2013. Also sees a small dip halfway through in October 2011.

Higher yields do not help confidence…

A sharp rise in mortgage rates has a negative feedback loop to consumer confidence. For those families and individuals that were now looking/able to enter the housing market, the recent spike in rates acts as a headwind.

In addition to the economic backdrop, there is plenty of tail risk as we head into the end of the year. Oil prices have been rising since the summer began (and in reality since the Summer of 2012), partially due to geopolitical risks which are very much “top of mind.” A bigger spike due to a supply shock would choke the economic recovery.(In our view)

In the US, the appointment of a new Fed Chairman and the upcoming budget/debt ceiling debates are likely to bring added volatility. Tapering itself can also induce concern as the “Bernanke put” is being removed from markets.

In Europe, many of the structural problems related to the single currency union have not actually been addressed and the peripheral countries could still create turmoil going forward (see Fixed Income section focusing on Italy in particular for more on this). There has also been little concern with both the German elections and the German Court decision on the constitutionality of the OMT program. A surprise in either of these could be cause for concern.

Emerging Markets are still not out of the woods yet as growth has been weak relative to expectations and countries with current account deficits are beginning to feel pressure in their FX and Bond markets. This is an issue we believe is only starting to develop which we will continue to expand on at later dates.(We have also looked at this in our EM FX section this week)

Overall, the weak economic backdrop, poor housing recovery and potential for tail risk events over the next few months suggest that we have topped out in Consumer Confidence, a warning sign for equity markets.

The relationship between Consumer Confidence is clear, and IF June did mark the high and Confidence continues to decline, then we would expect to see that translate to weakness in the equity markets. The removal of the “Bernanke put” only adds to this concern.

A major turn has taken place in equity markets on average four months after Consumer Confidence turns, which would point to a decline beginning around September-October. As we have previously expressed, we remain of the bias that a correction in equity markets on the order of 20%+ is likely this year/ into 2014 and the current dynamics support such a move.

Should we see a decline of that magnitude, it is almost certain that yields would move lower in a rush to safe assets.

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/bHOF49_vOG8/story01.htm Tyler Durden

![]()