Earlier today, Brits were greeted with some good news: London house prices rose to a record in November, “as strengthening demand pushed values higher in all regions of England and Wales” according to Acadametrics. Bloomberg reported that values increased 0.6 percent from October to an average 238,839 pounds ($390,900), and that prices reached an all-time high in London, soaring 9.2% in the quarter, and parts of the southeast as average values climbed 4.9 percent from a year ago. “The trajectory is clearly upward,” said David Brown, commercial director of LSL Property Services. “Competition is strong as a result of rising demand and supply of new instructions not growing, a factor that will continue to prop up prices in the long term.” As usual, much was left unsaid, such as where demand is coming from. The answer, as is the case virtually everywhere else in the world, is simple: China.

According to another Bloomberg report citing Jones Lang LaSalle, Chinese investment in London between 2010 and Q3 of this year has risen by a “ludicrous speed” comparable 1,500%, or from a frugal GBP54 million to over GBP 1 billion! And boy do the Chinese love London – according to the same report, over 50% of European property investment by Chinese buyers is now in London. As a result, China is now the third-largest overseas purchaser in U.K. behind Germany and U.S., which invested GBP 1.2 billion and GBP 1.1 billion respectively. “We expect the pool of investors from China targeting London to grow significantly in the coming years. They will consider everything from urban regeneration sites through to trophy assets,” Damian Corbett, JLL’s head of Central London office investment, said in statement.

In other words, as London real estate becomes ever more unaffordable to orinary UK citizens, who instead are forced to rent out shipping containers, Chinese buyers will buy pretty much anything in the UK, with no regard for cost, since ever more of that ~$200 billion in monthly credit created by the government, which as we showed before blows both the Fed and BOJ money creation out of the water, is parked outside of China, which is aggressively trying to stop its own domestic housing bubble, and in the process blowing housing bubbles everywhere else around the world.

Which brings us to point number two: the latest target of the Chinese hot money colonization is none other than bankrupt Detroit.

Detroit, broke with almost no prospects for recovery, is the fourth most popular U.S. destination for Chinese real estate investors. In fact, it was bad news—the city’s July 18 bankruptcy filing—that triggered renewed interest. “While the bankruptcy is viewed as a bad thing elsewhere, it raised the exposure level of Detroit’s real estate market in China,” says Evonne Xu, a Michigan attorney catering to Chinese purchasers. Middle Kingdom, meet Motown.

Chinese shoppers can’t resist a bargain. Where else can you buy a two-story home in the U.S. for $39? China Central Television, the state broadcaster, in March reported that two houses in Detroit cost the same as a pair of leather shoes. No wonder a poster on Sina Weibo, the Twitter-like service, asked, “Seven-hundred thousand people, quiet, clean air, no pollution, democracy—what are you waiting for?”

Who says the Chinese are waiting? Dongdu International Group of Shanghai bought, sight unseen, two downtown icons, the David Stott building for $4.2 million and the Detroit Free Press building for $9.4 million, both at auction this September.

Moreover, Chinese purchasers are making bulk purchases of “inexpensive properties”—those selling for $25,000 or less—in the rings surrounding the city center. “They’re banking on the downtown resurgence spiraling out into those rings,” explains Kelly Sweeney of Coldwell Banker Weir Manuel. Mainland parties often buy at tax and foreclosure sales, hold their property, and patiently wait for appreciation.

…

The Chinese are coming, but what are they doing? Dongdu International will make a big contribution to downtown by redeveloping the Detroit Free Press building, turning it into a retail and residential complex, but that ambitious plan appears to be the exception. China’s rich are investing in the Motor City like they invest in their own country, where they buy multiple units at a time. In China, like here, they often keep their acquisitions vacant, treating new properties like stores of value.

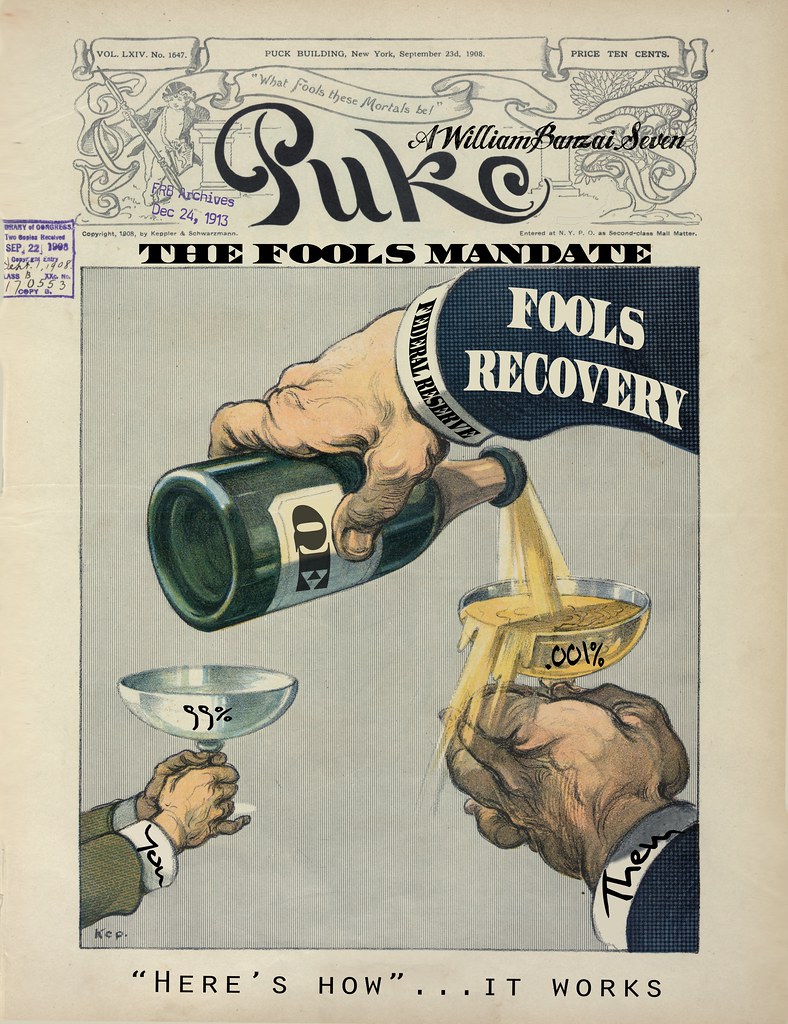

As we have been repeating for the past three years, all China’s intrepid real estate investors are doing, is parking China’s record hot money – one of the three pillars of the so-called US housing recovery – abroad. In this case, in a broke city.

The Chinese buy-and-hold tactics in Detroit suggest patience, but that’s not the whole story. The bigger story is that the parking of wealth offshore indicates capital flight. The Chinese have only 13% of their wealth outside China, according to Oliver Williams of WealthInsight, while the global average is 20% to 30%, so some of transfers of wealth abroad are normal for a developing society.

There may be more, however, and as China prepares to liberalize its financial and social policies, the wealthiest part of the population may be considering outright getting the hell out of dodge, and taking trillions with it.

But it’s not just money that is fleeing. A study conducted by Bank of China and Hurun found that more than half of China’s millionaires have taken steps to emigrate or are considering doing so. This statistic tells us the transfers of cash out of China are not just normal diversification.

There is substantial disagreement as to how much Chinese individuals have already stashed offshore. Boston Consulting Group estimates they hold $450 billion in assets outside their country, and WealthInsight believes the number to be $658 billion.

Yet everyone agrees that the figure, whatever it is, will go up fast. Boston Consulting, for instance, predicts offshore assets will double in three years. CNBC late last month called the movement of Chinese capital “one of the largest and most rapid wealth migrations of our time: hundreds of billions of dollars, and waves of millionaires flowing out of China to overseas destinations.”

Forbes’ conclusion is accurate: Detroit is not an investment destination as much as it is a safe(r) place to park cash which may or may not have been procured by legal means, but which thanks to the epic cash creation tsunami emanating from the Middle Kingdom will be sure to continue for the foreseeable future: “So the Chinese buying up Detroit says less about the prospects of Motown than what they think of their own country. It’s not like the Motor City is a good place to invest. It has what is surely the worst housing market in the U.S. “I’ve been in the Detroit area for 35 years,” says Chen, the broker from Troy. “Thirty-five years ago downtown Detroit was like this, and it’s not getting better.” But that doesn’t matter – there is money to be parked outside of China, and any place will do. After all, in a globalized monetary system, money is instantly fungible to any corner of the globe, especially when facilitated by such “dumbest banks of 2013” who defy all money-laundering regulations, as RBS.

The conclusion:

As grim as the future is for Motown, it is evidently better than China’s, at least according to many Chinese. They are pouring their cash into Detroit.

So yes: the colonization of the world’s premier, and not so premier, metropolitan centers by China will continue, until the liquidity spigot is finally turned off. In the meantime recall that this is nothing new: after all Japan experienced an identical liquidity-driven colonization of the developed world in the 1980s, when it seemed Japan would buy up Manhattan. That didn’t work out too well for them. With China, this time won’t be any different either.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/jLDblZTCvlo/story01.htm Tyler Durden