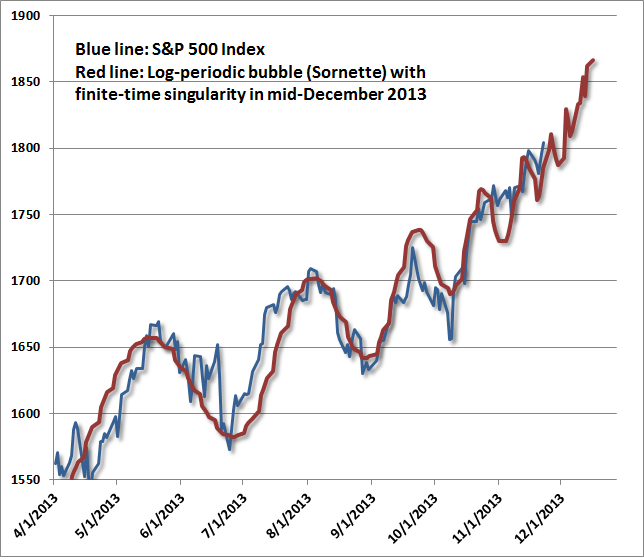

As the S&P 500 continues to make higher highs, Citi's FX Technicals group attempts to identify important levels to watch. As they have highlighted before, while they respect the price action and the fact that the markets are making higher highs, there is an underlying degree of skepticism surrounding the sustainability of this uptrend from a more medium term perspective. Important levels/targets on the S&P 500 converge between 1,806 and 1,833. A convincing rally through this range (weekly close above) may open the way for a test of the 1,990 area (coincidentally the Fed balance-sheet-implied levels for end-2014); however, at this stage they are watching closely over the coming weeks as we approach the New Year.

Via Citi's FX Technicals group:

As regular readers are aware, the chart of consumer confidence is among our favourite Techamental charts. Confidence is a key underlying factor to any economy/market and in this case the similarities in the way it trends and behaves in each cycle is quite telling.

In each of the three cycles, consumer confidence rose for exactly 4 years and 4 months and then turned down.

The recent prints have taken out what were support levels at 72.00-73.10 which further suggests lower levels will be seen.

As the overlay clearly shows, there is a serious disconnect between where confidence lies (and other factors

such as small business confidence and economic performance) and where the S&P 500 trades. The lower the confidence index, the less comfortable we are and would be with the sustainability of the stock market rally, even though we must respect the near term price action.

A closer look at the chart reveals some difference between the previous two major highs in 2000 and 2007 and may shed some light on which time period we should be more focused on in terms of price action on the S&P 500…

– 2000: The Consumer confidence index peaked in the month of January and again at the same level in May (i.e. double top at 144.70). The S&P 500 peaked in March. However the real move down in the S&P 500 was not seen until October so equities traded sideways for more than 6 months before turning lower.

– 2007: Consumer confidence peaked in July and the S&P 500 made a higher high in October. On this occasion we saw a quicker turn off the highs in both the consumer confidence and the S&P 500 as the reality set in that the credit crisis was worse than expected, especially by the time we got into early 2008 (Bear Sterns, inversion of yield curves, coordinated emergency rate cuts among major central banks etc)

– 2011: So far this year the consumer confidence number peaked in June and the equity market has continued to move higher. This makes is less similar to 2007 because under than comparison, we should have seen a stock market high in and around September but that did not happen. Could the pattern still be similar to 2000? The charts below make some comparisons.

Within the uptrend that took the S&P 500 to the 2000 high, there was a significant correction down of 22% in 1998 which was reversed by a bullish monthly reversal.

From that 1998 low at 923, the S&P 500 rallied 68.1% to 1,552.

Within the recent uptrend that started in 2009, we got a serious correction down in 2011 of 22% which ended with a bullish monthly reversal.

If we were to replicate the 1998-2000 rally in magnitude from the 2011 low, we would have peaked at 1,806 (and the high has been 1,808 so far as we have rallied 68.3%).

The parallel line on the log scale chart above comes in at 1,821.

In 2000, the high on the S&P 500 was 13.4% above the 12 month moving average. The same now would put the S&P 500 at 1,833.

Overall, when making a comparison with the 1998 – 2000 price action and how the market trades relative to the 12 month moving average, we would expect the S&P 500 to test and potentially peak between 1,806-1,833.

There are other measures that put further important on this price range…

In 2000, the S&P 500 high was 13.8% above the 55 week moving average

If replicated here we would trade at 1,824 (i.e. within the price targets set out in the previous chart when using the 12 month moving average)

A closer look at this chart reveals another level which converges here…

The channel top comes in at 1,822 while the channel base converges with the 55 week moving average at 1,594-1,603

From a medium term perspective, a break of the 55 week moving average would open the way for the 200 week which is at 1,364 (though it could be quite a while before we need to pay more attention to that)

This chart however is a warning sign that the uptrend may still have further to run.

In 2000, the S&P 500 peaked at 47% above the 200 week moving average.

If replicated again here, we could be talking about the S&P 500 trading around 1,990 before peaking. That is still 10% above current levels

In summary –

We believe the uptrend in the S&P 500 is stretched relative to the underlying economy and consumer confidence

The consumer confidence indicator is a leading one, especially given the similarities with previous cycles

As a consequence we remain sceptical in the medium-long term about the sustainability of the uptrend in the S&P 500 though have to respect that at least for now the trend is still up.

As we make higher highs, important levels that converge between 1,806 and 1,833 are now being tested.

A clear break of that region may open the way for a stretch to 1,990 though for now there is need for some caution at and around current levels.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/2UdW6RrEBQM/story01.htm Tyler Durden