The Battle Royale: Stocks Versus Bonds (Which Is Right?)

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

The S&P 500 is at valuations higher than those in 1929 and rival those of 1999. Despite a recession, the index is 25% above where it was trading before the pandemic. The equity stampede is undoubtedly bullish about corporate earnings prospects and, by default, economic growth.

As the stock bulls party, bond investors are glum about future economic prospects. Bond yields are below where they were before the pandemic started. Current yields warn of paltry economic growth and little inflation in the future.

Who has it right? (My colleague Lance Roberts touched on this issue in this past weekend’s newsletter.)

Flipping Valuations

Traditional equity valuation analysis frequently involves the comparison of a fundamental metric to share price. The result is often interpreted as quantifying the richness or cheapness of the numerator in the ratio. In the case of the more popular metrics like P/E or P/BV, that is price.

By assuming the price is fair, we can reverse traditional logic and calculate what the market implies for the denominator.

For example, assume the P/E ratio on XYZ stock jumps to 20 after lingering around 10 for decades. With this knowledge, we can make one of two assumptions.

-

The price of XYZ is twice as high as it should be

-

XYZ’s earnings are going to grow at twice the historical rate in the future.

The first bullet point assumes XYZ’s price must decline to bring its valuation to fair value. The second bullet point assumes XYZ’s earnings must increase to get its valuation to fair value.

The Peak Concept

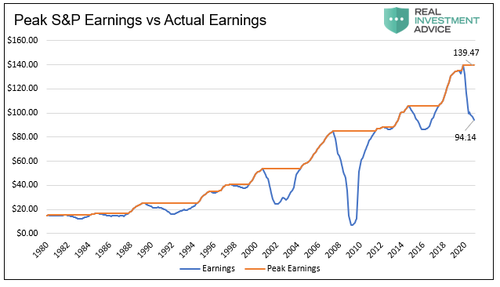

Before diving in, it’s important to note we use peak earnings and peak GDP throughout this analysis. Peak means we use the highest level of earnings or GDP at each point in time. This method helps eliminate anomalies and better focus on more durable trends. For example, the current peak earnings per share of the S&P 500 is $139.47/share, the highwater mark from 2019. The current level is $94.14. The peak P/E is only 26.50, as compared to the actual P/E of 39.

The graph below compares peak S&P 500 earnings per share to actual earnings per share. As shown, peak earnings reduce volatility and better focus on the trend.

S&P Earnings Expectations

To calculate the implied growth rates of future earnings and economic activity, let’s look at the peak P/E of the S&P 500 and assume its price S&P 500 is fairly valued.

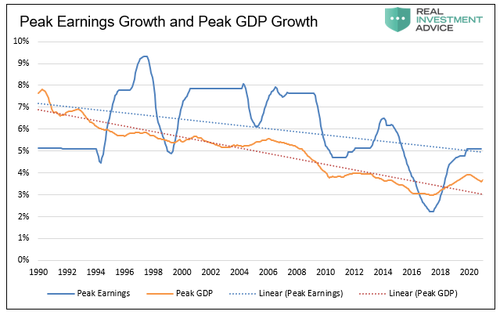

The following graph compares the secular peak earnings growth rate (blue) to the secular peak GDP growth rate. There are two important takeaways.

-

Earnings and GDP are well correlated

-

Both have been trending lower for the past 40 years

So, with an understanding of economic and earnings growth trends, we have context for comparison to market expectations.

Based on the current peak P/E versus the 20-year average and assuming the price is fair, the market implies earnings growth for the next ten years of 7.17%. By looking at the graph above, we can see it is more than 2% above the trend.

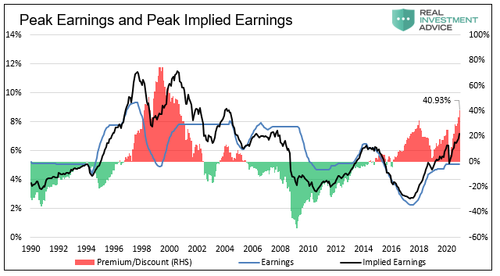

The following graph compares implied earnings growth (black) to the trend earnings growth shown(blue). The current and historical difference is highlighted in red and green.

Stock investors are betting that earnings growth (blue) will accelerate markedly and reverse the multiple decade-long trends. Such implies that GDP growth rates will also turn up.

It is worth highlighting the cyclicality of earnings forecasting errors, as shown in red and green. Periods in which forecasts were higher than actual earnings are often followed by periods where the market underestimates earnings.

We remind you: “Periods in which equities are overpriced with high valuations are followed by periods with lower returns. Conversely, periods when stocks are cheap, are often followed by periods of strong returns.” From our article: Are You Playing Roulette With Your Retirment?

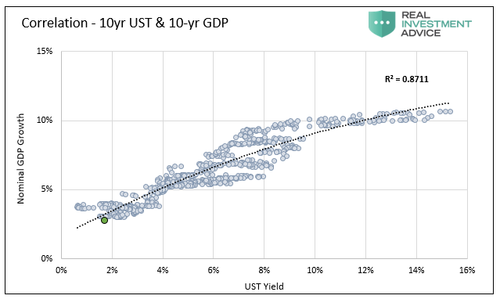

Bonds

Bond yields, like corporate earnings, track nominal GDP exceptionally well. Assessing what bond yields tell us about implied future growth is straightforward as we directly compare yields to peak GDP growth rates. The graph below shows the significant statistical correlation between 10-year bond yields and 10-year nominal GDP growth.

As represented by the green dot, the current ten-year yield is 1.72%, and the ten-year nominal GDP growth rate is 3.71%.

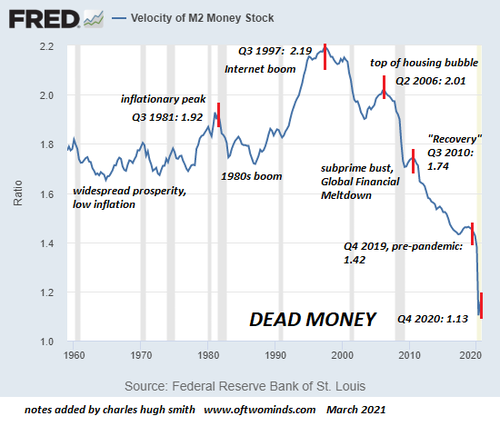

The bond market currently implies sub 2% GDP growth, well below the current trend. Bond yields expect the decades-long trend lower in GDP growth to continue. By default, bond investors forecast earnings growth will continue to trend downward.

Place Your Bets – Bonds

Bond yields argue for longer-term economic trends continuing. Stock prices imply earnings and economic growth will accelerate meaningfully, reversing long-term trends.

Supporting the bond market’s view are the macroeconomic headwinds we frequently discuss. For economic growth rates to rise, we need to see productivity and or demographic trends reverse.

Barring a significant reversal of immigration policy, demographics will continue to contribute less to economic growth. In fact, the Census Bureau just announced the U.S. population grew at its slowest rate since the 1930s, and prior to that, the late 1700s. They attribute the decline to low rates of immigration and births.

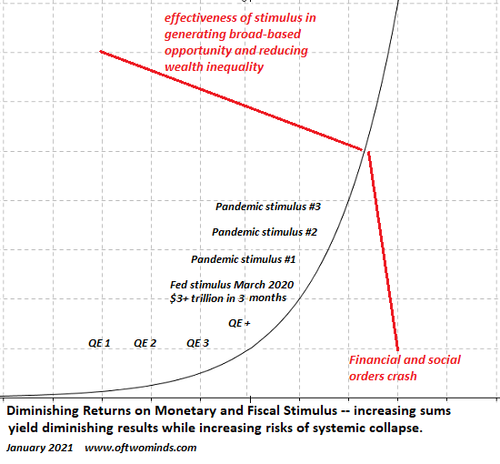

Productivity growth depends on capital expenditures, education, employee training, and new technologies. There are few signs spending in these areas is occurring at any greater rate than it has in the past decade. Worse, COVID-related stimulus and related spending point to a surge in non-productive debt and consumption. The additional non-productive debt burden will further hamper productivity growth.

Unfortunately, the recent surge in the amount of debt is likely to do little for future growth. As Lance Roberts discussed, “Debt Doesn’t Create Growth.”

“More debt doesn’t lead to more robust economic growth rates or prosperity. Since 1980, the overall increase in debt has surged to levels that currently usurp the entirety of economic growth. With economic growth rates now at the lowest levels on record, the change in debt continues to divert more tax dollars away from productive investments into the service of debt and social welfare.”

Place Your Bets Stocks

While the equity bulls must contend with well-established trends, they do have a couple of cards up their sleeve. For starters, the nation runs a $4 trillion annual deficit which is significantly boosting economic activity. While more debt will impede longer-term growth, fiscal stimulus will flow through to corporate earnings for the time being. Further, it’s not unreasonable to think that massive deficits will continue well beyond the end of the pandemic.

Second, the Fed seems intent on generating inflation. If they do, earnings will be boosted artificially by inflation. However, valuations tend to shrink in inflationary periods, which may not be so bullish for stock prices.

Summary

Our bet is with the bond investors. Earnings will recover as spurts of temporary inflation and massive fiscal spending ripple through corporate income statements. However, the fiscal and monetary pandemic response only strengthens our resolve that economic growth rates will continue to trend lower.

The only difference between the response to the 2008 financial crisis is the government and Fed did more of it this time. The economic growth rate following the financial crisis was weaker than the prior expansion. Given the same stimulus playbook is being used, albeit to a more considerable degree, we can only assume the results will be similar.

Tyler Durden

Wed, 04/28/2021 – 11:27

via ZeroHedge News https://ift.tt/32VJd8d Tyler Durden