Futures Flat Ahead Of Powell, Biden Doubleheader

For the third day in a row, US equity futures were broadly flat, with the emini trading virtually unchanged from where it was this time on Monday and Tuesday as traders hunkered down ahead of today’s main event: the FOMC announcement at 2pm where Fed Chair Jerome Powell is expected to reaffirm that easy monetary policy will remain in place for a prolonged period and dismiss any suggestions of tapering bond purchases.

S&P 500 e-mini stock futures rose 0.09%. or 5 points, while Dow Jones futures were down 31 points ot 0.09% and the Nasdaq was down 7.75 or -0.06% as investors digested a mixed bag of earnings from Tesla, 3M, Microsoft and Google overnight, with tech heavyweights Apple, Facebook and Amazon due to report in the next 48 hours.

“We expect the Fed’s tone on the economy to be more positive than at the March FOMC meeting, reflecting the ongoing pickup in the data, but we don’t expect any substantive new signal yet on tapering,” TD Securities analysts wrote. “While we do not expect much price action due to the Fed decision, Biden’s remarks could continue to suggest more incoming supply, bear steepening the (Treasury yield) curve.”

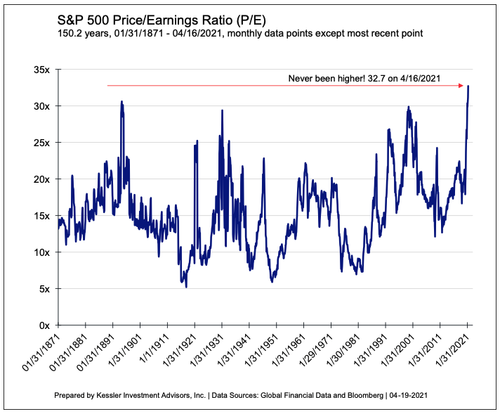

Joe Biden will also address a joint session of Congress, where he will make additional comments about infrastructure and stimulus spending. These developments would normally be a positive for stocks, but analysts say so much economic optimism is already priced into the equity market that it is difficult to buy stocks further from current levels.

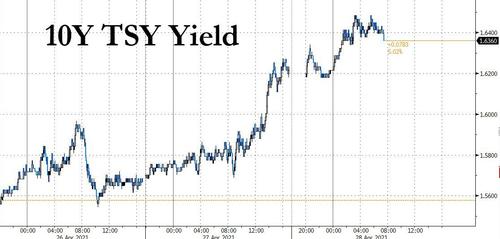

Indeed, the reflation trade reappeared as longer-dated Treasury yields extended their advance and the dollar strengthened as investors awaited clues on the timing of stimulus tapering by the Federal Reserve. U.S. stock-index futures were mixed as Americans braced for President Joe Biden’s tax plans. Breakeven rates on 10-year Treasury Inflation-Protected Securities , a measure of expected annual inflation for the coming decade, rose to 2.41%, the highest since 2013. Yields on benchmark 10-year Treasuries stood at 1.6217%, close to a one-week high.

European shares gave up opening gains on Wednesday, as caution crept in ahead of the U.S. Federal Reserve’s policy decision, but strong results from Deutsche Bank and Lloyds Banking Group boosted earnings optimism. The pan-European STOXX 600 index was up 0.06% at 440.11, with travel and leisure stocks easing from all-time highs, and miners retreating after a recent rally. The region’s banking sector was up 0.3% and insurers rose 0.6%. Deutsche Bank jumped 6.5% to the top of STOXX 600, as strength at its investment bank helped the German bank post a better-than-expected first-quarter net profit. Topping London’s FTSE 100, Lloyds Banking Group rose 3.3% after reporting a better-than-expected profit. Sweden’s SEB and Spain’s Santander inched lower after their quarterly results. The world’s biggest advertising company WPP rose 2.9% on returning to underlying growth in the first quarter, as clients launched new products and brands. German food delivery company Delivery Hero jumped 5.9%, as it expects revenues to more than double in 2021. Here are some of the biggest movers today:

- Deutsche Bank shares rise as much as 9.3% and record their biggest intraday gain since the reflation trade emerged last November, as analysts highlight the lender’s best quarter in years with broad-based strength and an upbeat outlook.

- Wickes Group gains as much as 15% from an opening price of 250p as the home-improvement business that was spun off from Travis Perkins starts trading on the London Stock Exchange. Travis Perkins rises as much as 8.7% to touch its highest level since Feb. 2020.

- Delivery Hero jumps as much as 9.3%, the biggest intraday gain since Dec. 28, after the food-delivery firm reported first- quarter results and said that it sees no impairment from the acquisition of South Korean peer Woowa. Rival Deliveroo climbs as much as 3.3%.

- Equiniti rises as much 8.7%, hitting the highest since April 2020, after the U.K. share-registration firm said it would be “minded to recommend” a bid on the new terms proposed by Siris.

- WPP gains as much as 4% to their highest in more than a year after first-quarter results. Goldman Sachs says organic growth was “well ahead” of expectations, noting that the ad firm reiterated its full-year outlook.

“At a market level, Europe has performed strongly year-to-date and it’s clear that there has been an anticipation that the recovery will be quite sharp and strong,” said Tom Dorner, investment director for European equities at Aberdeen Standard Investments. “You’re still seeing a rotation in the market in favour of the more cyclical names like banks and autos.”

Earnings at European companies in the first quarter of 2021 are expected to surge 71.3% from a year earlier, according to Refinitiv IBES data, up from last week’s forecast of a 61.2% jump. Investors, however, stayed away from making big bets ahead of the U.S. central bank’s policy announcement due at 2pm ET. Policymakers are widely expected to reaffirm their stance to keep monetary policy loose until enough economic progress has been made.

Earlier in the session, MSCI’s broadest index of Asia-Pacific shares outside Japan declined 0.23%. Australian stocks rose 0.55%, but shares in China slipped 0.44% while Tokyo markets edged 0.16% higher. Asian stocks moved in a narrow range before a policy decision by the Federal Reserve, while a rebound in U.S. yields hurt technology shares. The MSCI Asia Pacific Index fell as much as 0.3% before erasing losses and closing almost unchanged. Taiwan Semiconductor Manufacturing, Xiaomi and Samsung Electronics were among the heaviest drags on the index’s technology gauge. South Korean benchmarks led declines in Asia with chip makers contributing most to the drop. SK Hynix slid 3.7% to its lowest in more than two weeks on the view that its solid first-quarter earnings were already priced in. “Today’s mixed price action reflects pre-FOMC caution and a reshuffling of positions and risk exposure ahead of it,” Jeffrey Halley, a senior market analyst with Oanda, wrote in a note. “I expect that tone to dominate the session and early European trading where the data calendar is light today.” Elsewhere, the virus situation remained a dominant factor in markets including the Philippines and India, whose benchmarks were among the day’s lead gainers, supporting the broader market. Philippine stocks rose amid optimism the government will ease mobility curbs in Manila and four neighboring provinces, which are under the second-strictest quarantine level until end April. India stocks advanced for a third consecutive day as global support continued to pour in to boost efforts to curb the spread of new coronavirus cases and speed up vaccination. China’s CSI 300 Index also closed higher for a second day, boosted by gains in vaccine makers as infections in India continued to surge.

In FX the greenback advanced broadly and was steady to higher against almost all of its Group-of-10 peers although trading was subdued until Powell speaks after the Fed meeting. The euro fell but remained within a recent range. Sweden’s krona pared an earlier loss after retail sales came in much stronger than forecast; Norway’s krone and New Zealand’s dollar edged higher. The Australian dollar slipped and the nation’s bonds rebound after weaker-than- expected inflation data reinforced the view that monetary policy normalization will lag behind the Fed. The yen dropped to its lowest level in two weeks. Japan’s government bonds held losses after the Bank of Japan said it plans to maintain the size of its bond purchases in May.

In the cryptocurrency market, Ether rose to an all-time high above $2,700 after Bloomberg reported that the European Investment Bank plans to sell a two-year digital bond worth 100 million euros ($120.80 million) on the ethereum blockchain network. Rival cryptocurrency Bitcoin edged up to $55,618.

In commodities, Brent crude futures fell 0.09% to $66.36 a barrel while U.S. West Texas Intermediate crude lost 0.05% to $62.91 per barrel due to worries about energy demand. Benchmark copper continued its assent toward a record above $10,000 a tonne. The metal is used so widely in manufacturing and heavy industry across the globe that it is considered a barometer of economic health. However, gold , which is often seen as a hedge against inflation, fell 0.49% to $1,768.00 in cautious trade ahead of the Fed meeting.

To the day ahead now, and the main highlight will be the aforementioned Federal Reserve decision and Chair Powell’s press conference as well as Biden’s first address to Congress. Otherwise, we’ll also hear from ECB President Lagarde, as well as the ECB’s Schnabel, Centeno and Rehn. In addition, President Biden’s address to Congress will be a major highlight, along with earnings releases including Apple, Facebook, Qualcomm, Boeing, GlaxoSmithKline and Ford. Finally, data releases include Germany’s GfK consumer confidence reading for May, France’s consumer confidence reading for April, and the preliminary March reading for US wholesale inventories.

Market Snapshot

- S&P 500 futures little changed at 4,180.50

- STOXX Europe 600 little changed at 439.50

- MXAP little changed at 208.42

- MXAPJ little changed at 703.11

- Nikkei up 0.2% to 29,053.97

- Topix up 0.3% to 1,909.06

- Hang Seng Index up 0.4% to 29,071.34

- Shanghai Composite up 0.4% to 3,457.07

- Sensex up 1.6% to 49,744.87

- Australia S&P/ASX 200 up 0.4% to 7,064.67

- Kospi down 1.1% to 3,181.47

- German 10Y yield rose 3.3 bps to -0.216%

- Euro down 0.1% to $1.2076

- Brent Futures down 0.09% to $66.48/bbl

- Gold spot down 0.4% to $1,769.61

- U.S. Dollar Index up 0.1% to 91.002

Top Overnight News from Bloomberg

- EU lawmakers gave their approval to the post-Brexit trade accord with the U.K., marking the final step in the ratification process and the end of four years of political brinkmanship

- The EU is looking to strengthen its hand against the growing economic threat posed by China, with new powers targeted at foreign state-owned companies

- The last barrier to a stronger Taiwan dollar may have just given way, paving the way for the currency to rise to a level last seen over two decades ago

- One large option bet built up over the past week is aiming for a surprise at the Federal Reserve Bank of Kansas City’s annual symposium in Jackson Hole. Ahead of this year’s meeting, a large wager has been placed on a faster-than-expected pace of rate hikes before Sept. 2024, though with an expiry of this coming September

- The market’s reflationistas are getting a second wind, as a string of solid economic numbers and the prospect of more stimulus raise the chances of a revival in trades linked to rebounding growth and prices

- An American warship fired warning shots when vessels of Iran’s paramilitary Revolutionary Guard came too close to a patrol in the Persian Gulf, the U.S. Navy said Wednesday

Quick look at global markets courtesy of Newsquawk

Asian equity markets traded tentatively following the flat performance of US peers as caution lingered ahead of the FOMC and amid a deluge of earnings. ASX 200 (+0.4%) and Nikkei 225 (+0.2%) were kept afloat owing to their softer currencies although the upside was contained by weakness in Australia’s miners following a pullback in commodity prices and with the tech sector hindered after weakness in US peers, as well as the mixed fortunes of industry heavyweights post-earnings in which Microsoft declined and Google shares surged after-hours despite both beating on top and bottom lines. Meanwhile, stronger than expected Japanese retail sales and earnings releases have supported the risk appetite in Tokyo with Fuji Electric and Osaka Gas among the biggest gainers after both reported a jump in FY net. Hang Seng (+0.5%) and Shanghai Comp. (+0.4%) were choppy as focus also centred on corporate results with Chinese participants bracing for an influx of releases that involve over a thousand earnings updates set for today. Finally, 10yr JGBs were lower on spillover selling from USTs which were pressured after a mixed 7-year auction and due to corporate supply in US, while firmer results at the 2yr JGB auction also failed to spur prices and Australian 10yr yields were choppy with early gains wiped out following soft inflation data.

Top Asian News

- Hitachi Agrees to Sell Metal Unit to Bain Group for $3.5 Billion

- Samsung Heirs to Pay $11 Billion, Donate Art to Settle Tax Bill

- Huawei Quarterly Sales Slump as Sanctions Hit Phone Business

- Ant-Backed Startup Zomato Files for $1.1 Billion Mumbai IPO

European cash bourses trade mixed (Euro Stoxx 50 +0.4%) as most of the region gave up the modest gains seen at the cash open, albeit the breadth of price action remains narrow. Fresh fundamental catalysts have been light once again in the run-up to the FOMC policy announcement later today and President Biden’s speech to Congress, until then earnings are poised to hold the spotlight barring any major headlines. US equity futures are also lacklustre with the NQ initially the laggard as the US 10yr yield briefly eclipsed 1.65%, although, at the time of writing, the downside in the ES is slightly less pronounced vs the YM, NQ and RTY. Back to Europe, some of the cash majors manage to hold narrow gains with the FTSE 100 (+0.2%), DAX 30 (+0.2%), and CAC 40 (+0.2%) experiencing some earnings-related impetus, with the Lloyds (+3.3%), Delivery Hero (+9.4%), Deutsche Bank (+9.0%) and Sanofi (+1.8%) all leading in their respective indices. Sectors are mixed but it’s difficult to discern a particular risk tone or theme amid earnings. The banking sector remains a top performer in light of Deutsche Bank and Lloyds earnings and against the backdrop of a higher yield environment, in turn lifting some regional peers with BNP (+1.7%), SocGen (+1.6%), and Barclays (+1.6%) among the main beneficiaries. Other earnings-related movers include Sainsbury (-2.3%), Puma (-2.5%), Danske Bank (-2.4%), Assa Abloy (-4.0%), Sanofi (+1.9%), Covestro (-0.3%), and Saipem (-9.0%). State-side, Microsoft (-2.0% pre-mkt) and Google (+5.0% pre-mkt) trade mixed pre-market post-earnings, whilst Apple (-0.3% pre-mkt) saw a sources piece overnight via Nikkei suggesting the Co. is trimming planned AirPod production by 25-30% amid intensifying competition and lower demand.

Top European News

- Santander Sees Highest Profit in a Decade as Provisions Drop

- Lloyds Beats Forecasts and Begins to Unwind Covid Provisions

- Danske May Need to Start Wider Probe of Dirty Money Flows

- Delivery Hero Sees Full-Year Revenue of Up to $8 Billion

In FX, the Dollar remains on a firm footing against the backdrop of more pronounced bear-steepening along the US Treasury curve ahead of the Fed and another keynote speech from President Biden on his American Families Plan amidst reports that he may ask Congress to foot the entire Usd 1.8 tn bill and issue an executive order to increase the minimum wage for federal contract workers to Usd 15/hour from Usd 10.95 at present. The fiscal, inflationary and funding/issuance implications are all overshadowing what was a decent 7 year note auction and dovish-leaning expectations for the upcoming FOMC. Hence, the DXY has reset after another dip below 91.000 to eclipse yesterday’s best within a 90.897-91.127 range in the run up to weekly mortgage applications, advance trade and wholesale inventories that are due for release before the Fed policy announcements, accompanying statement and post-meeting press conference from Chair Powell.

- CHF/JPY – Diverging yield differentials continue to weigh on the Franc and Yen to the extent that an improvement in Swiss investor sentiment and firmer than forecast Japanese retail sales have not prevented Usd/Chf or Usd/Jpy from rebounding further from recent lows to 0.9180+ and 109.00+ respectively. However, the former has pared back towards 0.9150 and the latter pulled up just shy of a prior April high around 109.08 vs 109.10 on the 14th.

- AUD/NZD – Mixed Aussie data overnight in the form of trade in comparison to preliminary jobs, earnings and retail sales, but softer than expected Q1 CPI alongside a retreat copper prices after a resolution to the Chilean port workers pension dispute has dragged Aud/Usd under 0.7750 to the relative benefit of the Kiwi via the Aud/Nzd cross back below 1.0750 and keeping Nzd/Usd anchored to 0.7200 awaiting NZ trade data.

- GBP/EUR – Sterling is still straddling round numbers vs the Buck and Euro at 1.3900 and 0.8700 in the absence of anything Pound specific to trade off, bar less deflationary BRC UK shop prices, while the single currency remains rangebound against the Greenback between broad 1.2100-1.2050 parameters with key declining trendline resistance above the big figure coming in circa 1.2109 today and almost aligning 100 DMA/21 WMA supports providing a cushion during bouts of selling (currently at 1.2055 and 1.2053). Moreover, Eur/Usd is barricaded in big option expiries into the NY cut, stretching from 1.2000 (2.5 bn) to 1.2140-50 (1.5 bn) and totalling 8.8 bn – see 7.32BST post on the Headline Feed for details and a breakdown of size at various strikes.

- CAD – The Loonie has Canadian retail sales to look forward to and potentially offer some independent inspiration before the FOMC, as Usd/Cad rotates either side of 1.2400 eying crude prices, overall risk sentiment and yields

In commodities, WTI and Brent front-month futures trade choppy within a relatively narrow band, with the former on either side of USD 63/bbl (62.67-63.30 range) whilst the latter meanders just under USD 66/bbl (65.54-66.22 range) at the time of writing. Fundamental newsflow has been light thus far although the geopolitical landscape remains heated amid reports overnight that the US Navy fired warning shots at Iranian boats in the northern Persian Gulf, in the vicinity of the Strait of Hormuz chokepoint. Further, Russia has returned to its punchy rhetoric as per Foreign Minister Lavrov’s comments which stated that the West is delusional for thinking that Russia has retreated following the end of military exercises, and added that a war in the Donbass region is possible, but must be avoided. As a reminder, the OPEC+ meeting which was originally scheduled for today has been cancelled – the producers will stick to its quotas for now which sees some 600k BPD of oil back in the market from next month (350k BPD from OPEC+ and 250k BPD from Saudi’s unilateral cuts). On the data front, yesterday’s Private Inventory data so a larger-than-expected build (+4.3mln bbls vs exp. +0.7mln bbls), although Cushing and the products were more bullish. Participants will be eyeing the weekly DoEs as the next scheduled catalyst – with headline crude seen building 659k bbls. Elsewhere, spot gold and silver are pressured by the firmer Buck with the former sub-1,775/oz and the latter below USD 26/oz, albeit still within recent ranges. Turning to base metals, copper prices have been waning off highs following their recent run and after LME prices reached levels close to USD 10,000/t yesterday. The rise in prices has been attributed to a surge in demand from the EV front as more carmakers unveil plans to enter the market, whilst supply-side woes emanated from Chile whereby port and miners threatened strikes if the government blocked pensions bill. However, Chilean President Pinera said he will sign into law the opposition-led bill allowing the third drawdown from pensions – enabling people to make early withdrawals from their pension fund. Finally, Dalian iron ore prices retreated from peaks after rising to an all-time high with traders citing follow-through from US infrastructure plans coupled with robust China demand.

US Event Calendar

- 8:30am: March Retail Inventories MoM, est. -0.2%, prior 0%; March Wholesale Inventories MoM, est. 0.5%, prior 0.6%

- 8:30am: March Advance Goods Trade Balance, est. -$88b, prior -$86.7b, revised -$87.1b

- 2pm: April FOMC Decision

DB’s Jim Reid concludes the overnight wrap

After yesterday paddling pool story it seems apt that we have the first forecast for rain here in the South of England today for what seems like a couple of months. To be fair we had a freak and brief snow storm 2 plus weeks ago but outside that nothing. This should at least mean that this new pool will last for at least another day before it gets punctured like all the other ones!

The main market cloud yesterday was the US 7 year Treasury auction which reignited the bearish bond trade even as global equities hovered around their record highs, with investors there in a holding pattern as they awaited the outcome of today’s Fed meeting and an array of corporate earnings releases. The S&P 500 (-0.02%) and the MSCI World index (-0.14%) saw the slimmest of declines from their all-time highs on Monday, while Europe’s STOXX 600 was also down -0.08%. However the general market posture was still fairly risk-on with risk assets performing strongly elsewhere, with the industrial bellwether of copper up +1.06% to its highest level in over a decade, WTI oil prices advancing (+1.66%), and bitcoin up another +3.62% after its double-digit gain at the start of the week. It was the reverse story for safe havens however, with sovereign bonds slipping back for a second day on both sides of the Atlantic as gold (-0.27%) also lost ground.

10yr US Treasuries climbed +5.5bps to 1.622%. They edged slowly higher in the US morning session, before accelerating just ahead of the $62 billion auction of 7yr notes and then continuing even higher after. 7yr auctions have attracted weaker demand in recent months, especially this past February where yields saw an intra-day range of 22.6bps around weak demand. Perhaps the recent surge in commodities played a part as US inflation expectations were up +4.6bps to 2.41%, the highest closing level since mid-April 2013. Yields similarly moved higher in Europe, with those on 10yr bunds (+0.4bps), OATs (+0.8bps) and BTPs (+2.1ps) all up as they remained on track for a 5th successive weekly rise.

After the close last night we saw more of the megacap tech earnings releases as both Alphabet and Microsoft announced their results. Google’s parent company, Alphabet, reported Q1 earnings of $26.29/share (est. $15.64/share) on the back of better margins and sales than expected. The company also announced a $50bn share buyback, and the stock rose +4.35% in after-market trading after falling -0.67% during the session. Microsoft beat estimates by a much smaller margin, with EPS coming in at $2.03 (est. $1.78) and better cloud computing sales than expected, though they continue to cite strong competition from Google and Amazon. Microsoft shares still traded -2.74% lower in after-market trading, as investors may have been looking for more. Prior to the US open, large industrial conglomerate 3M (-2.63%) had cited higher costs for materials and transportation, which is sure to have caught the attention of inflation-seekers.

Tech stocks actually underperformed the broader market yesterday, with the NASDAQ (-0.34%) moving lower as Tesla (-4.53%) struggled following its own earnings release the previous day. We’ll hear more on the earnings front later on today, with the main highlights today including reports from both Apple and Facebook.

Aside from the earnings announcements, the main highlight for markets today will be the Federal Reserve’s latest policy decision, along with Chair Powell’s subsequent press conference. According to US economists’ (preview link here), today should largely serve as a status check of the economic recovery relative to the substantial forecast upgrades that the FOMC unveiled at their March meeting. And in the press conference, they expect Powell will likely continue his subtle shift in tone in a more optimistic direction. However, they also think that given the remaining gaps in the labour market and the Fed’s focus on seeing actual rather than forecasted progress, April is too soon for the return of taper talk, and those discussions will heat up during the summer instead. So as with last week’s ECB meeting, today is likely to act as more of a placeholder rather than see any major headlines.

Today’s other big highlight is also in the US, with President Biden making his first address before a joint session of Congress tonight. The main pillar of that is expected to be the American Families Plan, which will include fresh investments in education and childcare, and the White House have already previewed that one of the ways they want to pay for this is by raising capital gains taxes on the richest 0.3% of Americans. However, Biden is also expected to use the speech to outline other priorities for the coming months as well, including police reform and expanding affordable healthcare. All this is on top of a pretty expansive agenda that Biden has laid out in his first 100 days, having proposed an infrastructure-based American Jobs Plan of more than $2tn over the coming decade, which would be financed via higher corporate taxes, and having already passed the $1.9tn American Rescue Plan last month.

Asian markets are trading mixed overnight with the Nikkei (+0.32%) and Hang Seng (+0.13%) up while the Kospi (-0.93%) and Shanghai Comp (-0.04%) are down. Futures on the S&P 500 are up +0.13% and European ones are also pointing to a positive open with Stoxx 50 futures up +0.20%. Yields on 10y USTs are flattish while, the US dollar index is up +0.11%. In terms of data releases, Japan’s March retail sales came in at +1.2% mom (vs. +0.6% mom expected). In other news, the Washington Post has reported that a US warship fired warning shots when vessels of Iran’s paramilitary Revolutionary Guard came too close to a patrol in the Persian Gulf.

There wasn’t a great deal of news on the pandemic yesterday, though we did get remarks from President Biden on the topic. The President said the White House intends to send vaccines, therapeutic drugs and vaccine manufacturing equipment to India, where they saw over 300,000 new cases for a sixth straight day. Biden also highlighted the new CDC guidelines that say those who are vaccinated no longer need to wear masks when gathering with friends either outdoors or indoors. Face coverings are still recommended if gathering in public places indoors and large gatherings outdoors such as concerts and sporting events.

Looking at yesterday’s data, and the US Conference Board’s consumer confidence reading rose to a post-pandemic high in April of 121.7 (vs. 113.0 expected). That means the rise over the last 2 months has been the strongest since 1974, back when the reading only came out every other month. In terms of other releases, the Richmond Fed’s manufacturing index remained at 17 in April (vs. 22 expected), and the FHFA house price index rose by +0.9% in February (vs. +1.0% expected). Separately, the S&P Case Shiller index showed US housing prices in the 20 US cities used in the benchmark rose 11.9% over the last year (vs 11.8% estimated), which was the largest jump in 15 years on the back of low mortgage rates and lesser inventory.

To the day ahead now, and the main highlight will be the aforementioned Federal Reserve decision and Chair Powell’s press conference. Otherwise, we’ll also hear from ECB President Lagarde, as well as the ECB’s Schnabel, Centeno and Rehn. In addition, President Biden’s address to Congress will be a major highlight, along with earnings releases including Apple, Facebook, Qualcomm, Boeing, GlaxoSmithKline and Ford. Finally, data releases include Germany’s GfK consumer confidence reading for May, France’s consumer confidence reading for April, and the preliminary March reading for US wholesale inventories.

Tyler Durden

Wed, 04/28/2021 – 07:45

via ZeroHedge News https://ift.tt/3dZRoH6 Tyler Durden