Biden To Propose $80 Billion For IRS, More Power To Chase Down High-Income Tax Evasion

The Biden administration is expected to propose giving the IRS $80 billion and granting the agency more power to track down tax evasion by high-income individuals and corporations, according to the New York Times, citing ‘two people familiar with the plan.’ The proposed funding would be an increase of two-thirds over the agency’s entire budget for for past decade.

The 10-year proposal would also include new disclosure requirements for small business owners not organized as corporations, as well as other wealthy people who could be hiding income from the IRS. Those using so-called pass-through corporations (such as the one the Bidens used to funnel $13 million through tax loopholes), as well as people holding wealth in ‘opaque structures,’ would be subject to new reporting requirements.

The additional money and enforcement power will accompany new disclosure requirements for people who own businesses that are not organized as corporations and for other wealthy people who could be hiding income from the government.

The Biden administration will portray those efforts — coupled with new taxes it is proposing on corporations and the rich — as a way to level the tax playing field between typical American workers and very high-earners who employ sophisticated efforts to minimize or avoid taxation. –New York Times

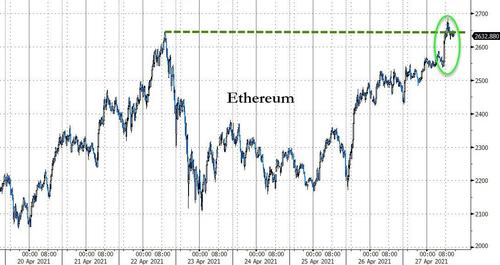

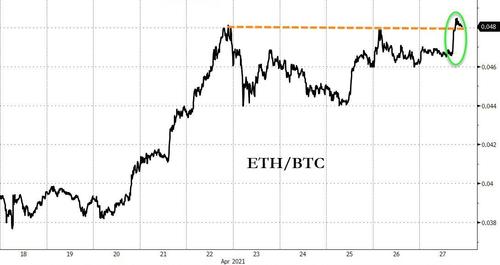

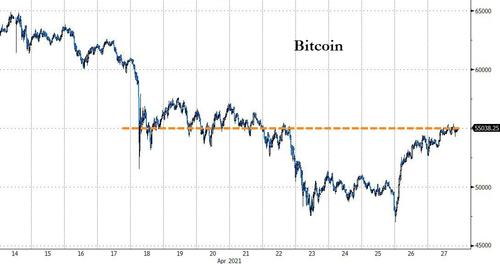

According to the report, some $700 billion in tax revenues recovered over 10 years by the beefed-up IRS will help pay for Biden’s next stimulus injection – dubbed the “American Families Plan” – which is expected to cost at least $1.5 trillion. It will follow Biden’s $2.3 trillion infrastructure package, which follows some $5.3 trillion already passed for pandemic relief (Ethereum hit all-time highs today, coincidentally).

The new plan would include universal prekindergrten, a paid federal leave program, and childcare affordability measures – as well as free community college for all.

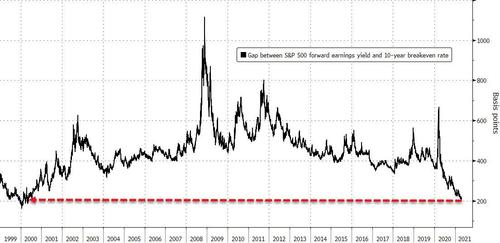

Biden also plans to pay for his printing bonanza by raising the top marginal income tax rate for wealthy Americans to 39.6% from 37%, and wants to raise capital gains tax rates for those earning over $1 million per year – including income received through stock dividends.

The Biden administration is likely to portray the $780 billion recovered over 10-years as a conservative estimates – as it only includes money directly collected through enhanced tax audits and additional reporting requirements – and doesn’t count people or businesses who choose to pay more taxes after previously avoiding them.

Previous administrations have long talked about trying to close the so-called tax gap — the amount of money that taxpayers owe but that is not collected each year. This month, the head of the I.R.S., Charles Rettig, told a Senate committee that the agency lacked the resources to catch tax cheats, costing the government as much as $1 trillion a year. The agency’s funding has failed to keep pace with inflation in recent years, amid budget tightening efforts, and its audits of rich taxpayers have declined.

Mr. Biden aims to change that. His economic team includes a University of Pennsylvania economist, Natasha Sarin, whose research with the Harvard University economist Lawrence H. Summers suggests that the United States could raise as much as $1.1 trillion over a decade via increased tax enforcement.

Mr. Summers praised Mr. Biden’s expected plan in an email late Monday. “This is the broadly right approach,” he said. “Deterioration in I.R.S. enforcement effort and information gathering is scandalous. The Biden plan would make the American tax system fairer, more efficient and, I’m confident, raise more revenue than official scorekeepers now forecast — likely a trillion over 10 years.” –New York Times

The Biden admin’s $80 billion plan would also provide the IRS with a dedicated funding stream, allowing the agency to ‘steadily ramp up their enforcement practices without fear of budget cuts, and to signal to potential tax evaders that the agency’s efforts will not be soon diminished.”

Former IRS commissioner under President George H.W. Bush, Fred T. Goldberg Jr., called the new plan “transformative” for integrating several approaches.

“Information reporting, coupled with restoring enforcement efforts, is key to improve in compliance,” Goldberg told the Times in an email. “Audits alone will never do the trick.”

“None of this happens overnight. A decade of stable funding is necessary to recruit and train talent and build on the necessary technology — not only for compliance purposes but to meet the quality of services that the vast majority complaint taxpayers expect and deserve.”

Tyler Durden

Tue, 04/27/2021 – 17:40

via ZeroHedge News https://ift.tt/2S81Tzw Tyler Durden