Authored by Mark Jeftovic via OutOfTheCave.io,

Four years ago, after the unthinkable happened and the ‘wrong guy’ won the US election of 2016, I wrote an article about how I had feared a type of “cultural purge” from within the corporate media, Big Tech and cancel culture spheres.

Like everybody else, I didn’t expect Trump to win (like most other Libertarians, I was holding my nose and pulling for Gary Johnson, whose running mate, Bill Weld, endorsed Hillary Clinton during the election campaign).

What I expected then, after Trump would have unceremoniously lost the 2016 election, was a type of cultural purge against anybody and everybody who enabled his run or supported him. What surprised me was that after he won the cultural purge proceeded anyway. In retrospect it seems obvious, at the time it blindsided me.

For the next four years we watched any (remaining) semblance of objectivity and impartiality wither away from the mainstream media. Even more troubling, was that it was also happening within Big Tech. Everything polarized and all judgement calls became characteristically asymmetrical. As I noted on occasion, that compared to the post 9/11 era when the Neocons controlled the narrative and the word “liberal” was a slur, everything flipped. Now it was the word “conservative” that was unusable and being a single micron to the right of centre was equated with being “literally Hitler”.

I could list the countless examples of deplatformings, cancellations, character assassinations and careers destroyed in the intervening time. It became so ridiculous, so devoid of any attempt at a claim to due process or fairness that an entire counter-culture has formed around criticizing or ridiculing it. I wrote a book about defending from deplatform attacks, which I started giving away for free in April when Big Tech started deplatforming deviant reporting on the COVID-19 crisis. Babylon Bee sprang into existence and quickly rivalled The Onion, riffing on cancel culture and hitting headwinds on multiple occasions when their scathing satire was indistinguishable from the reality they were lampooning.

TL,DR: Cancel culture is a right-wing conspiracy promulgated by Qanon Incels

More than once I thought “This is it, this has to be Peak Outrage”, and then somebody else’s career or business would be destroyed, sometimes for imagined transgressions that may or may not have taken place years ago or even before the target even started a position they’d just been canceled from having (David Collum’s section on cancel culture, featuring his own cancelation, lays many of these out in his famous Year In Review series, the 2020 issue).

Once the 2020 election was finally in the rear-view mirror and it appeared likely the administration had changed I thought, once again, that the worst was over. The world was mired in lockdown fatigue, we’re not even dealing with the economic fallout of COVID yet, and “ding dong the witch is dead”. Surely cancel culture and social justice extremism would taper off, if only out of exhaustion.

Boy am I wrong, again.

The ignominy with which TheDonald has chosen to close out his term, the lack of humility, of which is he likely congenitally incapable of, will instead reignite the flames of the culture wars and propel them to new heights.

I don’t even want to get into the gory details of the events of Jan 6, the storming of the capital, the riots, other than to say that when we talk about the twilight of the nation state and the rise of the Network State in our #AxisOfEasy podcasts, these are the sort of disorderly episodes we fear punctuating or worse, defining, this oncoming societal shift.

We certainly seem to be into The Fourth Turning now, a book I have been rereading and was just finishing up listening to the day of the DC riots. Their prescience is creepy, especially as they outlined the “climax” phase of the Crisis period, which, by their reckoning started around… 2020 and would last another 6 to 10 years:

One or both of today’s dominant parties could go the way of the Whigs…History warns that when a crisis catalyzes, a previously dominant political party or regime can find itself perceived or blamed for direct mistakes that led to the national emergency.

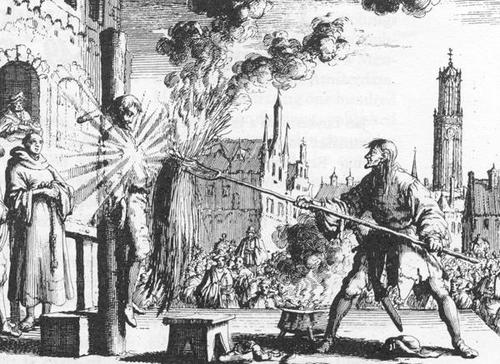

Whoever holds power when the Fourth Turning arrives could find themselves joining the ranks of the 14th century Lancastrians, circa 15th century Catholics, circa 1680 Stewarts, circa 1770 Tories, circa 1860 Democrats, and circa 1929 Republicans. That party could find itself out of power for a generation.

Key persons associated with it could find themselves defamed, stigmatized, harassed, economically ruined, or even personally punished”

Since that day, Big Tech and corporate media moved at a new speed that I found dizzying. Twitter pile-ons are ugly enough spectacles and that’s just watching end-users gang up on the sacrificial deviant of the day. But watching Shopify of all companies, pile on to Facebook and Twitter’s deplatforming of a sitting president (which at this moment he is, like it or not), Simon and Schuster canceling their contract to publish Sen Josh Hawley’s book on Big Tech censorship (which I wanted to read) and I’m sure the list will go on after I’m done writing, this is just fucking crazy.

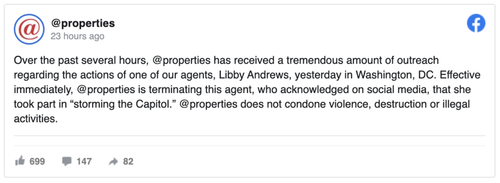

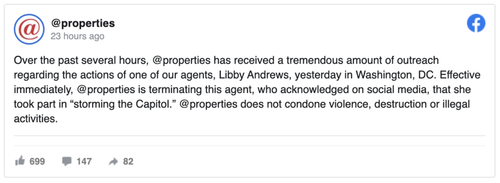

(I paused writing this to take a meeting, an hour later I come back to finishing it off and a friend, who fled Chicago this past summer because of the complete breakdown of civil order there, among other US cities at that time, sent me this story. It outlines numerous other firings and cancelations of Chicagoans who attended the DC rally (but not necessarily involved in the violence), and businesses who even commented in social media about it.)

Translation: a social media mob demanded we cancel one of our employees with zero due process or time to consider, so we did. Who do you want us to fire next?

Think it through people.

Do you want to live in a society where Facebook and Twitter decide not what is permissible to say but even which narratives can be explored and which ones can’t?

Yes I know, “private companies, their own AUP, blah blah blah” – I’m a libertarian and a tech company CEO, so I know all this. I’ll preempt these objections with what I said in my book, which is that when tech companies base platform/deplatform decisions on something that is happening outside of their platforms, they are in effect, exercising jurisprudence and adjudicating international law. All any company can competently assess is what is happening on within their respective platforms, how their employees are fulfilling their roles and serving the businesses customers and nothing else.

Would you be ok with your employer firing you if enough strangers who don’t know you, don’t do business with your company and have no first hand knowledge of events or what your circumstances are scream at your boss to cut you loose?

Do you want contracts to be subject to negation by public sentiment of events 2 or 3 or more degrees separated from the contracted parties?

Do you want to have every aspect of your life scrutinized by somebody else’s measure of moral and ideological purity before you can say anything online? How about before you can book a hotel room? Fill up your car with gas? Go shopping? Get on a plane?

After all, we have big data and AI now, so this is all doable.

Do you really want to live within the constraints of a type of societal social credit system where your every action, your very thoughts are bounded by external and ever shifting, subjective and revisionist social mores? Many of them defined by the most oversensitive, self-absorbed hysterics on social media?

Be very careful if you think this is a good thing, because sooner or later, you’re going to be on the wrong side of it. By then it’ll be too late.