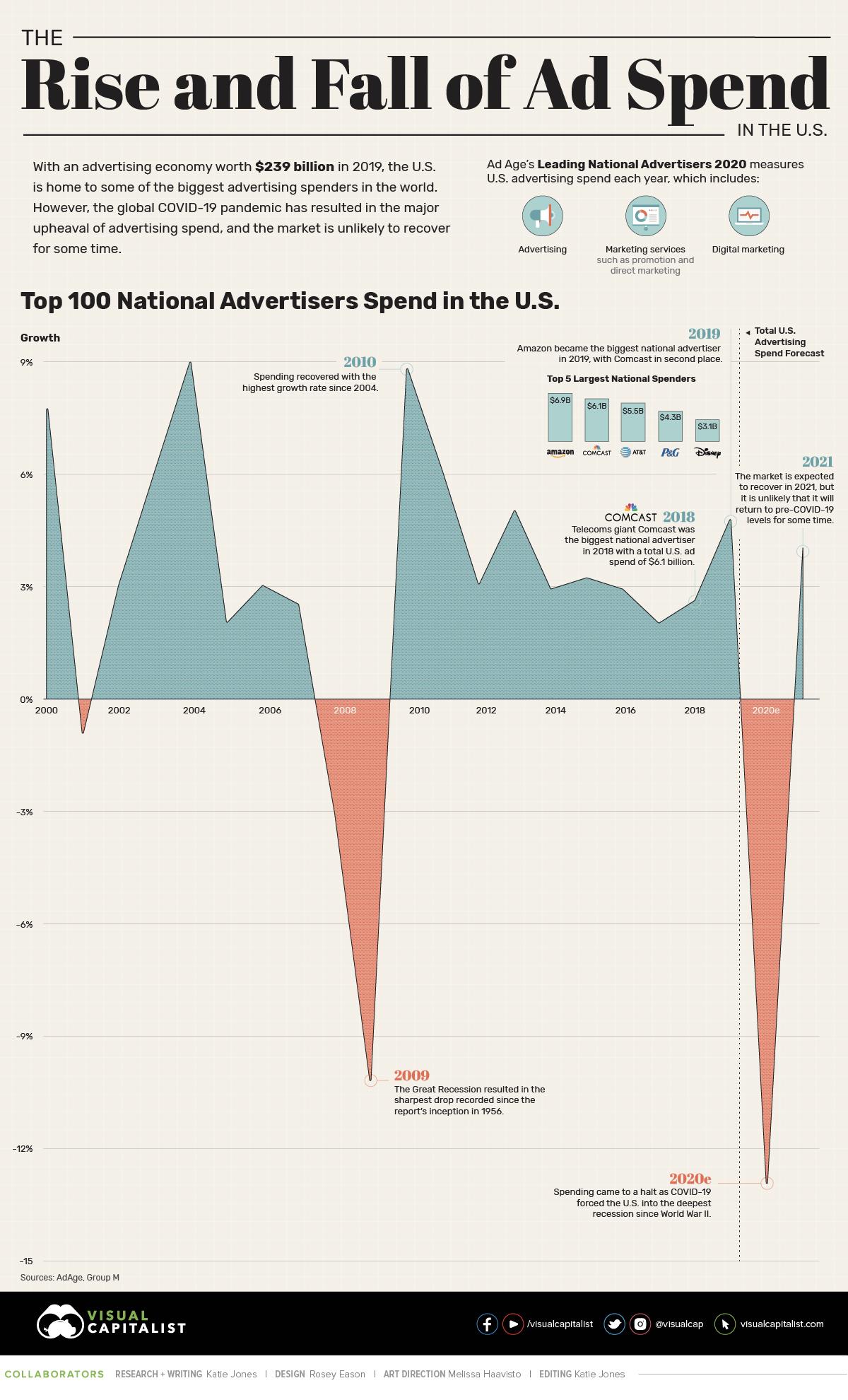

How Total Spend by U.S. Advertisers Has Changed, Over 20 Years

Tyler Durden

Thu, 10/22/2020 – 20:00

With an advertising economy worth $239 billion in 2019, it’s safe to say that the U.S. is home to some of the biggest advertising spenders on the planet.

However, as Visual Capitalist’s Katie Jones notes, the COVID-19 pandemic has resulted in the major upheaval of advertising spend, and it is unlikely to recover for some time.

The graphic below uses data from Ad Age’s Leading National Advertisers 2020 which measures U.S. advertising spend each year, and ranks 100 national advertisers by their total spend in 2019.

Let’s take a look at the brands with the biggest budgets.

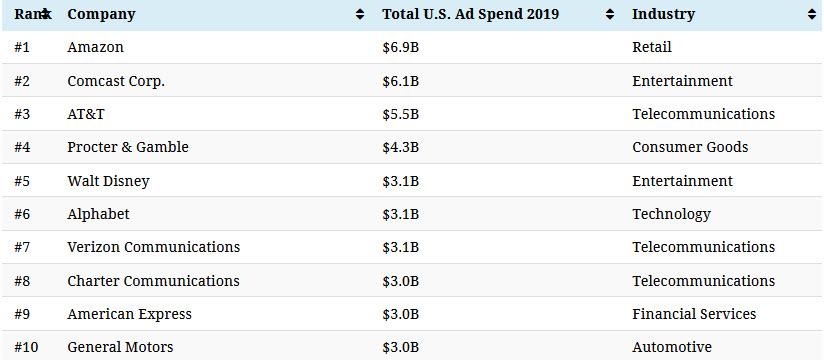

2019’s Biggest Advertising Spenders

Much of the top 10 biggest advertising spenders are in the telecommunications industry, but it is retail giant Amazon that tops the list with an advertising spend of almost $7 billion.

In fact, Amazon spent an eye-watering $21,000 per minute on advertising and promotion in 2019, making them undeniably the largest advertising spender in America.

Explore the 10 biggest advertisers in 2019 below:

The report offers several ways of looking at this data—for example, when looking at highest spend by medium, Procter & Gamble comes out on top for traditional media spend like broadcast and cable TV.

On the digital front, Expedia Group is the biggest spender on desktop search, while Amazon tops the list for internet display ads.

The Rise and Fall of Advertising Spend

Interestingly, changes in advertising spend tend to fall closely in step with broader economic growth. In fact, for every 1% increase in U.S. GDP, there is a 4.4% rise of advertising that occurs in tandem.

The same phenomenon can be seen among the biggest advertising spenders in the country. Since 2000, spend has seen both promising growth, and drastic declines. Unsurprisingly, the Great Recession resulted in the largest drop in spend ever recorded, and now it looks as though history may be repeating itself.

Total advertising spend in the U.S. is estimated this year to see a brutal decline of almost 13% and is unlikely to return to previous levels for a number of years.

The COVID-19 Gut Punch

To say that the global COVID-19 pandemic has impacted consumer behavior would be an understatement, and perhaps the most notable change is how they now consume content.

With more people staying safe indoors, there is less need for traditional media formats such as out-of-home advertising. As a result, online media is taking its place, as an increase in spend for this format shows.

But despite marketers trying to optimize their media strategy or stripping back their budget entirely, many governments across the world are ramping up their spend on advertising to promote public health messages—or in the case of the U.S., to canvass.

The Saving Grace?

Even though advertising spend is expected to nosedive by almost 13% in 2020, this figure excludes political advertising. When taking that into account, the decline becomes a slightly more manageable 7.6%

Moreover, according to industry research firm Kantar, advertising spend for the 2020 U.S. election is estimated to reach $7 billion—the same as Amazon’s 2019 spend—making it the most expensive election of all time.

Can political advertising be the key to the advertising industry bouncing back again?

via ZeroHedge News https://ift.tt/2IP2C3M Tyler Durden