Authored by Alasdair Macleod via GoldMoney.com,

The few economists who recognise classical human subjectivity see the dangers of a looming currency collapse. It can easily be avoided by halting currency expansion and cutting government spending so that their budgets balance. No democratic government nor any of its agencies have the required mandate or conviction to act, so fiat currencies face ruin.

These are some waypoints to look for on the road to their destruction:

-

Monetary policy will be challenged by rising prices and stalling economies. Central banks will almost certainly err towards accelerating inflationism in a bid to support economic growth.

-

The inevitability of rising bond yields and falling equity markets that follows can only be alleviated by increasing QE, not tapering it. Look for official support for financial markets by increased QE.

-

Central banks will then have to choose between crashing their economies and protecting their currencies or letting their currencies slide. The currency is likely to be deemed less important, until it is too late.

-

Realising that it is currency going down rather than prices rising, the public reject the currency entirely and it rapidly becomes valueless. Once the process starts there is no hope for the currency.

But before we consider these events, we must address the broader point about what the alternative safety to a fiat collapse is to be: cryptocurrencies led by bitcoin, or metallic money to which people have always returned when state fiat money has failed in the past.

Introduction

When expected events begin to unfold, they can be marked by waypoints. These include predictable government responses, and the confused statements of analysts who are unfamiliar with the circumstances. We see this today in the early stages of an inflation that threatens to become a terminal cancer for fiat currencies.

Harder to judge is the human element, the pace at which realisation dawns and the public’s consequential response to the discovery that their currency is being debauched and their wealth being transferred stealthily to the state. But history can provide some guidance.

If we consider the evidence from Austria before the First World War, we see that the economic prophets who truly understood economics became thoroughly despondent long before the First World War and the currency collapse of the early 1920s. Carl Menger, the father of subjectivity in marginal price theory became depressed by what he foresaw. As von Mises in his Memoirs wrote of Menger’s discouragement and premature silence, “His keen intellect had recognized in which direction Austria, Europe, and the world were pointed; he saw this greatest and highest of all civilizations rushing toward the abyss”. Mises then recorded a conversation his great-uncle had had with Menger’s brother, which referred to comments made by Menger at about the turn of the century, when he reportedly said,

“The policies being pursued by the European powers will lead to a terrible war ending with gruesome revolutions, the extinction of European culture and destruction of prosperity for people of all nations. In anticipation of these inevitable events, all that can be recommended are investments in gold hoards and the securities of the two Scandinavian countries” [presumably being on the periphery of European events].

The few economists who have studied American and European monetary and economic policies dispassionately and how they have evolved since the Nixon shock will resonate with Menger’s concerns. Mises also noted that this “pessimism consumed all sharp-sighted Austrians”. Menger’s pupil and friend, Crown Prince Rudolf, successor to the Austro-Hungarian throne took his own life and that of his lover in 1889 because of his despair over the future of his empire and that of European civilisation, and not because of his love affair.

As with all historical comparisons, today’s decline in American hegemony is only a most generalised repetition of the process by which an empire dies. But from this distance of over a century from events in Vienna it is easy to forget how important the Hapsburgs were and that before Napoleon the Austro-Hungarian empire had been the largest and most important of the European empires. But putting aside the obvious differences between then and now, today we see little or no evidence of cutting-edge economists sharing the despair of the early Austrians.

There is a good reason why this despair is absent today. Instead of economists independent from the state, universities, and professorial sponsorship, the entire economic profession is paid for by governments and their departments to promote statist intervention in the economic affairs of humanity. Feeding off statistics, mathematics is every policy-makers and investor’s religion. But economics is not a natural science governed by mathematics, like physics or chemistry, but a social science governed by markets; markets being forums where humans interact to satisfy their needs and wants, to exchange their production for consumption, and to manage their savings and capital.

As Hayek said of his friend Keynes, Keynes was a mathematician and not an economist. Today we can confidently state that students are taught mathematics and not economics. Economists are no longer economists, but statisticians and mathematicians devoid of the a priori reasoning that was central to the science before Keynes.

With the entire profession taught to believe in statist intervention, perhaps we should not be surprised that economists are not ringing the alarm bells warning of the consequences of decades of state manipulation of markets and of the catastrophe that evolves from denying there is any difference between money and currency, that is gold or silver, and infinitely expandable promissory notes and credit. Even many modern “Austrians” seem oblivious to the danger of a fiat money collapse, let alone the dire economic consequences. Among them there is even an antipathy against metallic money, which suggests they have not fully absorbed the theories of money and credit so lucidly explained by their earlier mentors.

Hopefully, the decline of America and its dollar hegemony we will not result in military conflict, let alone one on the scale of the 1914-18 European catastrophe. But that might be a vain hope. In today’s America we see a hegemon struggling to get to terms with its decline and the reality that the rise of Asia cannot be stopped. But what concerns us here is the more obvious and immediate problem of its currency, dollars backed by nothing more than the faith and credit of the declining US Government.

It is not too late to avoid a complete collapse of the dollar-led global currency regime, but there is no sign that the measures to avoid it will be taken. And with the exclusive dominance of mathematical economists: neo-Keynesians, monetarists, and modern monetary theorists alike, there is hardly anyone, like Menger, Mises, and the other Austrian economists who, before the First World War foresaw the economic and monetary consequences of unfettered statism and inflationary financing.

Bitcoin — the canary in the currency mine

We find ourselves not being warned of potential inflationary dangers by the state-educated pseudo-economists but by a motley crowd of geeks and speculators instead, who have grasped the relative price effect from different rates of currency issuance. Bitcoin’s quantity is capped while those of fiat currencies are not. All you need to exploit this simple fact is believe and convince yourself and others that bitcoin is the replacement currency of tomorrow for the comparison between bitcoin and state fiat to appear valid.

This was certainly the story being promoted by crypto enthusiasts from shortly after bitcoin’s first trade until the end of last year. But they have become increasingly convinced that the future for bitcoin is not so much as a currency (after all, while its price in dollars is rising it is in no one’s interest to use it as a medium for exchanging goods), but simply that, like a stock index on steroids, it is the inflation hedge par excellence. And for fear of missing out, even investing institutions run by custodians of other peoples’ money are now piling in.

But an index based on equities has the fundamental prop under it of being comprised of stocks the objective of which is to earn money for shareholders by selling goods and services for profit. With bitcoin there are no underlying earnings and nothing which is inflation-linked. In that sense it is a chimera.

An argument has therefore developed, with investors and speculators buying bitcoin only because the relative rate of issue relative to fiat currencies is capped, which is expected to drive the price still higher as governments continue to print their currencies. The underlying rationale, that bitcoin is a replacement currency for state fiat currencies has been disproved and I have little more to add in this respect. It cannot be used for economic calculation, because for a borrower there is uncertainty of repayment value.

Nor does bitcoin as a rival to state currencies hold water because no central bank will permit it to act as such. This is one reason why they are heading private cryptocurrencies off at the pass by developing their own, state-issued, and state-controlled digital currencies which can be used for economic calculation. Not only has the argument for ever rising bitcoin prices become its sole support, but the underlying rationale, that cryptocurrencies such as bitcoin qualify as a medium for transactions and will be permitted to replace state-issued fiat currencies cannot apply.

By identifying relative rates of currency issue as a valuation factor the tech-savvy millennial generation has understood a partial truism. The other part of which they appear not to be fully aware is that the effect of monetary inflation is to undermine a currency’s purchasing power. It is a separate argument from one based solely on relative rates of currency issue. However, having half the story understood at least is an advance from not comprehending any of it, and when further rises in prices for goods become widely expected, as they appear to be beginning to today, crypto fans are likely to learn the consequences of monetary inflation earlier than their non-tech predecessors, and perhaps even before state-educated economists as well.

For now, investors are being enticed by nothing other than the promise of riches to buy bitcoin as an inflation hedge, being disappointed by gold’s non-performance. In a recent quote in the UK’s Daily Telegraph a Morgan Stanley analyst stated just that: “We believe the perception of bitcoin as a better inflation hedge than gold is the main reason for the current upswing… triggering a shift away from gold [funds] into bitcoin funds since September”. But without the prop of being a credible form of replacement money the only reason to buy bitcoin is that circular argument: it should be bought because it is being bought.

Furthermore, buying bitcoin funds dissipates potential bitcoin demand, because for a bitcoin fund to qualify as a regulated investment, obtaining regulatory permission is easiest when a fund deals mostly or wholly in contracts on a regulated futures exchange instead of the underlying unregulated bitcoin. In other words, much of the demand for bitcoin is being side-lined into paper versions rather than for bitcoin itself.

Bubbles based on pure speculation always fail. That is not to say that speculative flows won’t drive bitcoin’s price higher still; as a possibility it seems highly likely. But that is for speculators, not those who seek protection from evolving economic and monetary events. Attention should be paid to Menger’s reported words 120 years ago, quoted above, that “In anticipation of these inevitable events, all that can be recommended are investments in gold hoards and the securities of the two Scandinavian countries” — except the securities of the two Scandinavian countries offer no escape today.

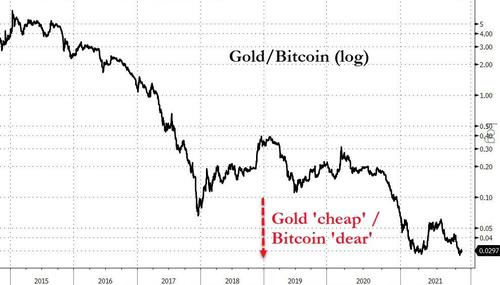

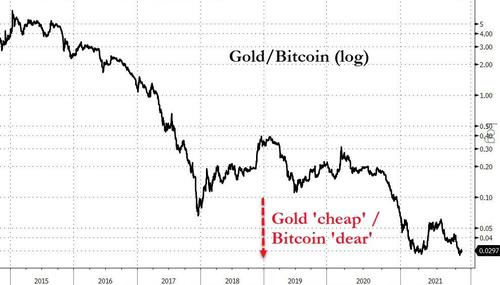

That being the case, the price of gold measured in bitcoin would appear to present a remarkable opportunity for lucky holders of bitcoin and similar private-sector cryptocurrencies. This is shown in Figure 1 below.

Since April 2015, the ratio of gold to bitcoin prices has fallen from over 5 to 0.03, a decline of over 99%. We have established why bitcoin has advanced: it is now due solely to the madness of an investing crowd, given that it is apparent that it will have no monetary role in the future. Market participants have either forgotten about or turned their backs against the metallic monies of millennia which have always returned as circulating media when state-issued fiat currencies fail.

Why gold is under-owned and unappreciated

Bitcoin is just part of this story: the other is the central banks’ resistance to rivalry to their fiat currencies from sound money. When US citizens were banned from owning gold coin, gold bullion, and gold certificates by executive order in 1933, the US Government’s desire to escape the discipline of gold as money became public. The resetting of international currency arrangements at Bretton Woods replaced gold with the dollar as the reserve currency with convertibility into gold limited to central banks and certain post-war supranational organisations. Even that failed, leading to the Bretton Woods agreement being suspended by President Nixon in 1971.

Led by the US Fed, ever since the Nixon shock central banks have run a propaganda campaign to convince their private sectors that gold’s historic role as the money “of last resort” had been made redundant through the magic of monetary progress. That propaganda campaign is now fifty years old and encompasses the entire working lives of employees in all financial sectors. The dollar myth as the ultimate form of money is now fully institutionalised.

In parallel with statist propaganda there has been a fundamental reform of the financial system to permit the development of various forms of derivatives. While derivatives previously existed in limited quantities, their massive expansion since the mid-eighties big-bang and the repeal of the Glass-Steagall Act created the means to absorb speculative demand for all commodities, including metallic money. According to the Bank for International Settlements, outstanding notional amounts of gold OTC derivatives at the end of last year stood at $834bn, to which must be added derivatives on regulated markets totalling a further $100bn. Together they are the equivalent together of over 15,000 tonnes of gold.

There is little doubt that, like bank credit, the financial system’s ability to create paper gold out of thin air has had a profound effect on the price. Backing this inflation of derivative paper has been the expansion of bank and shadow bank credit. That is now coming to an end, with the implementation of the latest phase of Basel 3 banking regulations.

Basel 3 and the net stable funding ratio

If you Google it, you find that Basel 3 is an internationally agreed set of measures developed by the Basel Committee on Banking Supervision in response to the financial crisis of 2007-09.

It was a crisis centred on derivatives, which highlighted the inadequacies of minimum capital requirements, banking supervision and market discipline, the three pillars of banking regulation. Basel 3 is gradually being introduced, but the regulations which concern gold and silver derivatives are what specifically concern us. Curbing balance sheet risk from inappropriate funding of precious metal derivative positions has already been introduced in Europe, Switzerland, and the US with the introduction of the net stable funding ratio. The last major financial jurisdiction to be affected is the UK, which introduces appropriate regulations from the first trading day of 1922 — in only nine weeks’ time.

Put briefly, a bank will no longer be able to run unrestricted derivative assets and liabilities without them being tied together. In other words, if a bank has a derivative as an asset on its balance sheet, it must relate specifically to and match a liability for netting purposes and be otherwise unencumbered if a balance sheet funding penalty is to be avoided. If a bank owns unencumbered physical gold as an asset, it can match that against a customer’s unallocated account without a funding penalty, if it has successfully sought and obtained regulatory permission to do so.

Two consequences follow. The first is that a bullion bank can only run an uneven book if it is prepared to accept a funding penalty through the application of the net stable funding ratio.[iii]Therefore, liquidity will almost certainly be withdrawn from futures and forwards markets, at least because banks want to appear fully compliant with the regulations. And the second is that most of the BIS gold derivative number of $834bn referred to above reflects bullion banks liabilities to their gold deposit accounts. By the year-end bullion banks will want to remove them, and the only way this can be achieved is by paying off customer gold accounts in fiat currency.

There could be thousands of tonnes equivalent of paper gold to reconcile in this way, leaving gold account depositors to either abandon their gold exposure entirely or to buy physical replacements in the market. And while the gaff is being blown on gold forwards and futures, reconciling central bank swaps and leases could also emerge as a problem.

In short, the factors that have suppressed the gold price since the early 1970s are not only coming to an end but are being reversed. The liquidation of paper gold threatens a gold liquidity crisis, which in the past would have been resolved by making bullion available through central bank gold swaps. But with central banks already owed bullion by the commercial banks and increasingly concerned about monetary inflation, this facility may be restricted.

For the leading central banks, the introduction of Basel 3’s net stable funding ratio therefore comes at a difficult time. They are already fighting to convince their markets that inflation is only a transient price effect and are beginning to reluctantly admit it is more intractable than they thought. The last thing they need is for the gold price to be forced higher by their own regulations, adding to fears of yet higher inflation to come.

But for individuals seeking to escape a fiat money catastrophe it appears that the ratio of gold to bitcoin is at an extreme of overvaluation for bitcoin and an extreme undervaluation for gold.

The next waypoints in understanding inflation

Because bitcoin has introduced the concept of relative rates of issue for currencies, the masses of the millennial generations will be alerted to the debasement of fiat currencies sooner than they would otherwise have been. We are less interested in how this is reflected in cryptocurrency prices than how this knowledge changes relations between consumers and state currencies.

Statist economists and monetary policy makers at the major central banks insist that higher prices for consumer goods are being driven by a combination of increased spending, which was stored up during covid lockdowns, and logistics disruption. To this can be added labour problems, with acute shortages in certain industry sectors and absenteeism due to continuing covid infections. Furthermore, energy and other input costs for businesses have been rising rapidly.

Monetary policy makers are aware that a wider consumer panic over rising prices must be avoided. They understand that continuing reports of product shortages will risk encouraging consumer stockpiling, driving consumer prices even higher. They will fear that interest rates would have to be increased significantly to bring price inflation back under control. But growth in the major economies appears to be stalling, which in the Keynesian playbook calls for lower interest rates and monetary stimulation instead. This leads us to…

Waypoint 1. Commentary in the main-stream media has yet to address this dilemma. It is to be expected at any time.

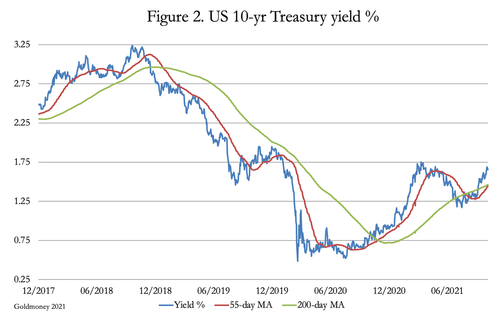

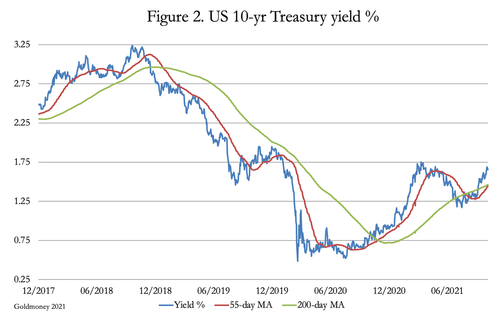

Following our first waypoint, we can assume that interest rates will be forced to rise by markets beginning to discount further losses of currency purchasing power for which interest compensation is demanded. That will inevitably terminate the bull market in equities because it undermines bond prices, pushing up yields and disrupting relative valuations. Figure 2 shows that this process has probably started, though markets are not yet discounting a rise in bond yields beyond a minor amount.

The technical message from this chart confirms that the 10-year UST yield is set to go significantly higher, affecting government borrowing adversely through rising interest costs. And when the bear market in these bonds becomes more obvious to investors and foreign holders of them alike, funding the government deficit will become much more difficult. The scale of the rise in fixed interest yields is likely to take market participants and policy planners alike by surprise.

The only way in which monetary policy planners can attempt to control rising bond yields and to stop equities sliding into a bear market is to increase the pace of currency creation, particularly through enhanced QE. But for now, the Fed’s stated intention is to taper QE, not increase it. This leads us to…

Waypoint 2. No anticipation of this dilemma in the media or independent commentary has yet been detected. Look out for it.

In the run up to the northern hemisphere winter and the Christmas shopping season, energy prices and fuel costs are set to rise further. There is no sign of product shortages being resolved. The danger is that with continuing product shortages, consumers will push their purchases of goods not immediately needed even further into the future in case they become unavailable. This will drive consumer prices even higher, creating expectations of yet higher interest rates in financial markets.

The Fed will have a straightforward choice: resist market pressures for higher interest rates to save financial markets, stave off insolvencies by over-leveraged borrowers and minimise government funding costs; or protect the dollar by raising the funds rate sufficiently to take all expectation of higher rates out of the market and ignore the financial carnage. This will be next…

Waypoint 3. No anticipation of this dilemma in the media or independent commentary has yet been detected.

There is a specific danger developing from consumer demand leading to a general stockpiling goods. When the process goes beyond a certain point the consequences of consumers disposing of their currency and credit in favour of goods become apparent. Currency no longer works as the objective value in a transaction, this role being switched to goods, because people begin to buy goods just to get rid of currency.

When that process starts in earnest, the fate of the currency is sealed. A hundred years ago this was called the crack-up boom, the final abandonment of currency.

Waypoint 4. No anticipation of the final nails in the fiat currency coffin is currently anticipated. When it is, the fate of the currency will have already been sealed.

Summary and conclusions

Those of us not under the direct management of the US monetary policies will not escape the consequences. All western central banks accept the dollar as their reserve currency and not metallic money, so events affecting the dollar affect all the other fiat currencies. Furthermore, the other major central banks led by the Bank of Japan, European Central Bank, and the Bank of England are pursuing similarly inflationary monetary policies. Central bank groupthink is concreted into global monetary policies. Without a change in their mandate the end of modern currencies is only a matter of time — and a shortening one at that.

The dying days of fiat are foreshadowed by the speculative fervour in bitcoin and other leading cryptocurrencies. A new millennial tech-savvy class of investors has got at least half the message, that fiat currency quantities are being inflated. That a significant element of the population has grasped this much about currencies early challenges the long-held wisdom that not one in a million understands money, which allows governments to oversee a limitless expansion of currency and credit for significant periods of time. Therefore, the danger to state inflationism is that significant numbers will act sooner to avoid currency depreciation by dumping it in favour of goods. It is a process that once started is impossible to stop.

While the establishment appears vaguely aware of this danger, it lacks the theoretical knowledge to deal with it. Ninety years of denying classical economics in favour of Keynesianism and other statist monetary theories are too embedded in the official mind. And in the absence of understanding the destructive forces of inflationism, prescient individuals seeking protection for their families, close friends and themselves have no option but to reduce their dependency on fiat currencies and all ephemeral financial assets tied to them. These include savings deposits and “stores of wealth”, particularly fixed-interest bonds and equities.

The fashionable alternative is distributed ledger cryptocurrencies which are beyond the interference of the state, exemplified by the rise and rise of bitcoin. But this article points out that this has now become dominated by speculation, so much so that in their ignorance of catallactics investors are discarding metallic money in favour of bitcoin.

This is a mistake. There are sound reasons why metallic money, gold and silver, have always been money used as a medium of exchange. And as Figure 1 in this article illustrates, relative to bitcoin gold is now less than 1% of its value in 2016. Bitcoin is the bubble; gold has become the anti-bubble.

The systematic suppression of gold in favour of the dollar as the world’s reserve currency is now coming to an end. The fact that westerners hardly own any bullion as part of their savings is a mistake they will rue, if, as seems inevitable, current monetary and economic policies persist.