US equity futures traded flat near all-time highs in a muted session as traders prepared for the Fed’s annual Jackson Hole symposium with little action across markets. The dollar was steady, while Treasurys and bitcoin fell and oil reversed losses. Contracts on the Nasdaq 100 and S&P 500 were fractionally lower after trading in the green for much of the session. Their underlying indexes closed at a record as strong corporate earnings and a rally in commodity prices outweighed lingering concerns about the threat of Covid-19 to the global economy.

“There is a sense of stabilization in the markets, as investors are already looking forward toward the Jackson Hole meeting,” said Dariusz Kowalczyk, a senior strategist at Credit Agricole CIB. “With uncertainty regarding Fed Chair Jerome Powell’s message, markets are likely to not take new major positions until there is more clarity on the Fed’s outlook.”

In premarket trading, Locust Walk Acquisition soared after its shareholders approved its SPAC deal with Effector Therapeutics. Cassava Sciences plunged 22% after a lawyer asked the FDA to halt the company’s clinical trials of an experimental drug, citing concerns about the quality of past studies of the medicine.. Meanwhile, the meme frenzy which staged an abrupt return late on Tuesday continued: AMC Entertainment (AMC), Express Inc. (EXPR) and Koss Corp. (KOSS), all of which were caught up in the meme stock frenzy earlier in the year, are climbing in U.S. premarket trading. AMC gains 4% and Express rises 7.6%, while Koss advances 2.1%.

Overnight, Chinese tech stocks struggled to extend their rally into a third day as bargain hunters retreated amid lingering concerns about how far Beijing may push its clampdown on private enterprise. Tensions return after SEC chair Gary Gensler pledged to enforce a three-year deadline for U.S.-listed Chinese firms to permit inspections of their financial audits or face delisting. Traders are also anticipating the Federal Reserve’s Jackson Hole policy symposium later this week which focuses on J-Powell’s 10am Friday speech.

Company earnings, expanding vaccinations and support from monetary policy have partially repaired sentiment after a bout of jitters over economic prospects caused by the delta strain as well as a hammering across Chinese tech giants. The next key read on the central-bank outlook is due later this week when Fed Chairman Jerome Powell speaks at the virtual Jackson Hole get-together on Friday.

Europe’s Stoxx Europe 600 Index erased earlier gains and turned negative around 730am ET, as travel stocks outperformed while banking and retail shares also rose. German stocks edged lower on Wednesday after weaker economic sentiment data, even as the broader European market clung near record highs ahead of a Federal Reserve speech on Friday.

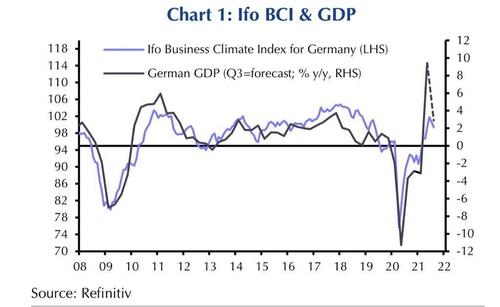

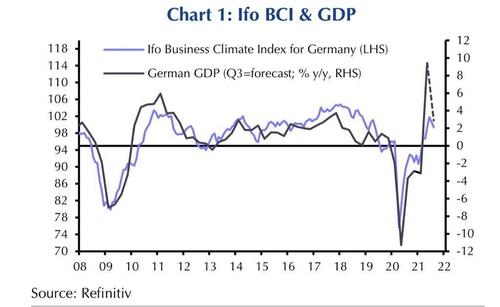

Germany’s ifo business climate index weakened to 99.4 in August, below consensus expectations, and confirming that Europe’s recovery is losing steam fast. This decline was primarily driven by a sharp fall in the assessment of business expectations, while current conditions rose slightly in August. Across sectors, trade saw the steepest decrease followed by another fall in services and manufacturing, while the construction sector remained resilient. According to the press release, the softer ifo print reflects supply bottlenecks in manufacturing consistent with the German flash PMI and the drag of delta variant concerns on expectations, in particular in the hospitality and tourism sectors.

Adding insult to injury, German exports to China declined for the first time in nearly a year in July, easing by 3.9% year-on-year to 8.4 billion euros ($9.9 billion), the statistics office said on Wednesday. That was the first decline in exports to China, Germany’s second biggest sales market outside the European Union, since August 2020, and it was the biggest slump since May 2020, when the world was gripped in the first wave of the coronavirus pandemic.

Here are some of the biggest European movers today:

- Stadler Rail shares gain as much as 5.8% after its 1H update, which ZKB said shows that the recovery for the train manufacturer continues with its order backlog at a record level.

- ASR Nederland shares rise as much as 5.2% following its 1H results, with KBC upgrading its rating on the insurer and saying the numbers look “very strong.”

- Mowi shares climb as much as 4% with DNB saying the dividend from the Norwegian seafood company was a positive surprise in its 2Q update. Peer Bakkafrost up as much as 4.5%.

- Grafton shares up as much as 3.5% with Peel Hunt saying its 1H results were strong as expected, with the builders’ merchant continuing to benefit from a strong U.K. and Ireland market.

- Elekta shares drop as much as 8% after the Swedish medical-equipment firm’s 1Q profit fell and it flagged cost headwinds, which Bernstein said are likely to linger.

- Aroundtown shares decline as much as 4.8% after the German property firm’s 1H results, with Morgan Stanley saying the numbers contained no surprises and that it sees better value elsewhere.

Earlier in the session, Asian equities gave back their intraday gains, with the Hang Seng Index closing 0.1% down after rising as much as 3.5% during the day. Asian markets swung between gains and losses, as investors paused for breath following the best two-day rally since early November. The MSCI Asia Pacific Index added 0.3%, having swung between a gain of 0.5% and loss of 0.1%. Financials were the biggest drag on the regional benchmark, while technology stocks gave the most support to the gauge, which gained 3.5% over the previous two sessions. Chinese tech shares listed in Hong Kong fluctuated after a two-day jump on bargain hunting. A number of observers have said the selloff sparked by Beijing’s multipronged crackdown went far enough, although uncertainty will likely remain until Chinese authorities provide more clarity on the regulatory campaign.

“Some global investors wonder if the Nasdaq Golden Dragon Index’s 30% plunge and Hang Seng Tech Index’s 25% drop since early July now mostly price in upcoming regulatory curbs,” Bloomberg Intelligence analyst Francis Chan wrote in a note. “A definite set of rules could actually help stabilize equity prices for Chinese tech and other sectors.” The Hang Seng Index fell while South Korea’s Kospi rose after both seesawed earlier in the day. Japan’s Topix eked out a small gain. The Philippine benchmark jumped more than 2%, while Taiwan’s Taiex gained more than 1%.

In rates, Treasuries were slightly cheaper across intermediates, although yields broadly remained within a basis point of Tuesday’s close. 10-year yields were around 1.305%, outperforming bunds and gilts by around 2bp each; on the charts, the 50- and 200-DMA’s are threatening to cross, something which has not happened since November 2020. According to Bloomberg, futures activity continues to be dominated by rolls, while cash volumes in the Asia session improved from Tuesday in two-way price action. U.S. auctions resume with $61BN 5-year note sale at 1pm ET, ahead of Thursday’s 7-year sale; it follows Tuesday’s strong 2-year which traded 1.1bp through the WI level

In FX, the Bloomberg Dollar Spot Index advanced modestly though moves were largely confined to tight ranges. The New Zealand dollar and Australian dollar rose slightly against the greenback, while the Japanese yen and Canadian dollar fall among G-10 peers. The pound traded in tight ranges against a broadly stronger dollar. The euro was steady versus the dollar even as a businesses confidence gauge by the Munich-based Ifo Institute fell to 99.4 in August from 100.7 in July, more than economists predicted in a Bloomberg survey. An index measuring expectations also fell, while current conditions were judged more favorably. The yen continued to be tamped down by generally positive risk sentiment.

In commodities, oil was steady after the biggest two-day gain since November with Covid-19 still shadowing assessments of the demand outlook. Base metals complex is rising. LME lead and nickel are top the bill, followed by LME aluminum, and LME copper. Iron ore futures extended a rebound from last week’s rout on optimism that China won’t allow steel demand to collapse while its economic prospects remain uncertain. Gold fell below $1,800 an ounce as traders geared up for the annual Jackson Hole symposium that’s expected to provide more clues on the Federal Reserve’s tapering outlook.

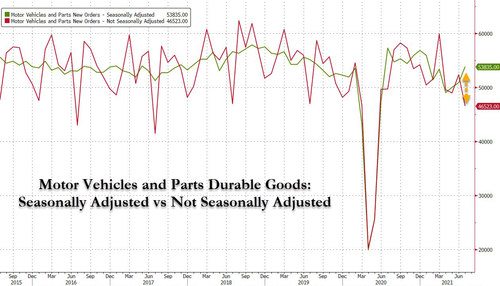

Looking at the day ahead, we get the latest durable goods orders and core capital goods orders. From central banks, ECB Vice President de Guindos will be speaking, and earnings releases include Salesforce, Autodesk and Royal Bank of Canada.

Market Snapshot

- S&P 500 futures little changed at 4,486.25

- STOXX Europe 600 up 0.1% to 472.46

- MXAP up 0.2% to 198.21

- MXAPJ up 0.4% to 651.40

- Nikkei little changed at 27,724.80

- Topix little changed at 1,935.66

- Hang Seng Index down 0.1% to 25,693.95

- Shanghai Composite up 0.7% to 3,540.38

- Sensex up 0.2% to 56,059.39

- Australia S&P/ASX 200 up 0.4% to 7,531.87

- Kospi up 0.3% to 3,146.81

- German 10Y yield little changed at -0.458%

- Euro little changed at $1.1753

- Brent futures down 0.4% to $70.78/bbl

- Gold spot down 0.5% to $1,794.03

- U.S. Dollar Index little changed at 92.92

Top Overnight News from Bloomberg

- The Meishan terminal at China’s second-busiest port reopened Wednesday following a two-week shutdown that further snarled already stressed shipping routes in Asia

- Vice President Kamala Harris urged countries in the region to apply more pressure on China in a meeting with Vietnam’s president, stepping up her criticism of Beijing on a visit to Asia

- Japan’s economic recovery will be delayed more than previously expected as the delta variant pushes up infections to record levels, according to a Bank of Japan board member.

- Britain’s construction, manufacturing and food preparation industries are pushing wages higher across the economy due to a shortage of workers to fill available jobs

- A contingent of Wall Street veterans and high-level Chinese government officials are seeking to open up talks again, as business leaders work outside of the Biden administration for greater access to the world’s most populous country

- The Hong Kong dollar is gaining attention due to China’s regulatory crackdown and bets on higher U.S. rates; the currency has fallen 0.2% in August, poised for its biggest monthly loss since March

- Two months after Goldman Sachs Group Inc. led Wall Street’s return to the office, it’s taking pages from the pandemic playbooks of its more cautious rivals, requiring employees to don masks and prove they’ve been vaccinated against Covid-19 to enter the firm’s U.S. workplaces

- The lowest rank of European junk bonds, those rated CCC and below, are handing investors annualized returns of 16.3%, outstripping last year’s 11.7%. It puts them among the best performing asset classes in 2021, according to Bank of America Corp. analysts

- Famed investor Michael Burry is betting long-term Treasuries will sink. Someone has just placed a contrasting bet that any declines will be limited by selling 10,000 of $110 puts expiring in January 2023 on the iShares 20+ Year Treasury Bond ETF, with open interest at 3,800, according to data compiled by Bloomberg

Quick look at global markets courtesy of Newsquawk

Asian stocks traded somewhat mixed and failed to fully sustain the early momentum from the US where the S&P 500 and Nasdaq extended on record highs amid notable strength in cyclicals, with upside limited as participants continued to await taper clues from Friday’s Jackson Hole Symposium. ASX 200 (+0.4%) was kept afloat amid outperformance in tech and mining names and with earnings releases also driving the biggest moving stocks including WiseTech Global which rallied around 30% after its FY net profit doubled, while Nine Entertainment and Seven Group were at the other end of the spectrum despite posting improved results, with the latter’s Chairman and billionaire Kerry Stokes to step down in November. Nikkei 225 (-0.1%) was indecisive amid a mixed currency and as Japan seeks to extend its state of emergency to include an additional 8 prefectures, with comments from BoJ board member Nakamura also not providing much to excite markets as he stuck to the BoJ’s all too familiar script. Hang Seng (-0.1%) and Shanghai Comp. (+0.7%) traded tentatively despite the PBoC increasing its liquidity efforts to meet month-end demand, as participants also digested the latest varied US-China related headlines. These include the US approval of Huawei license applications to buy auto chips valued at hundreds of millions of dollars although it was separately reported that the SEC are to demand all Chinese firms to disclose more regarding investor risks including firms already trading in the US. Furthermore, insiders noted that China and the US should strengthen cooperation on cross-border regulation but stressed that China won’t back down on bottom-line issues such as key data utilized by some Chinese companies related to national security, while there were more comments from US VP Harris who maintained a hawkish tone on China. Finally, 10yr JGBs were flat amid the indecisive mood in the region and following the lacklustre picture in T-notes despite a strong US 2yr auction and disappointing Richmond Fed survey, with the BoJ presence in the market for nearly JPY 1tln of JGBs also doing little to spur prices.

Top Asian News

- China Reopens Terminal at World’s Third-Busiest Port

- China Marks First Arrest in Sex-Assault Case That Rocked Nation

- China Boosts Liquidity Injection After Funding Costs Climb

- BOJ Sees Delta Variant Delaying Recovery More Than Expected

Major bourses in Europe have conformed to a mixed picture (Stoxx 600 +0.2%) as the modest optimism seen around the cash open waned. Fresh fundamental newsflow has been light, whilst immediate price action was limited upon the release of an overall cautious German Ifo survey – with businesses citing supply chain concerns alongside rising COVID infections, whilst half the companies in manufacturing and retail also want increased prices to cover rising costs. US equity futures meanwhile remain stable in early European trade as eyes, for now, turn to the Fed’s Jackson Hole Symposium ahead of next week’s crucial US labour market report. Back in Europe, the breadth of the price action among the majors are narrow, with no standout underperformer/outperformer. Sectors are also mixed with no real theme. Travel & Leisure is however the standout outperformer – although likely on the back of the Leisure side with Evolution Gaming and Flutter Entertainment among the top gainers in Europe. Banks follow a close second amid the more favourable yield environment. Chip names meanwhile have not seen a clear reaction to source reports that contract manufacturer TSMC (+2.7% pre-market) is hiking prices by 10-20%. Some large-cap customers of TSMC include the likes of Apple, NVIDIA, Intel and AMD. On the other end of the spectrum, autos continue to be hit by the chip crunch prompting further halting of production, while Oil & Gas and Basic Resources also see mild losses. Interesting individual movers remain somewhat scarce but Deliveroo (-2.0%) shares slumped over 10% at the cash open but pared back losses within five minutes – with no clear catalysts behind the move. Note, US President Biden is today expected to host a cybersecurity summit with executives from major tech, bank and energy firms – with the focus reportedly on national security threats. Some companies reportedly attending include Apple, Amazon, Microsoft, Alphabet, JP Morgan, Bank of America, ConocoPhillips, PG&E, and Duke Energy.

Top European News

- Nord Stream 2 Loses Case to Have EU Pipeline Rules Waived

- U.K. Construction and Manufacturing Boost Wage Inflation

- German Business Confidence Slips Amid Persistent Supply Squeeze

- Switzerland’s Economic Recovery Seen Coming to a Sudden Halt

In FX, no major change in risk appetite or the general market tone, but the Greenback has gleaned enough traction to stall selling pressure that was slowly building on Tuesday to the point where the DXY looked prone to losing sight of 93.000 altogether and the Buck was on the verge of collapse through key levels against major and EM peers. However, the index appears to have found a base, albeit tentative, just above yesterday’s low (92.804) and is attempting to consolidate between 92.872-93.057 parameters ahead of US durable goods and a speech from Fed’s Daly that is due alongside results of the 5 year T-note auction.

- JPY/CAD/CHF – If there was any doubt surrounding the close correlation between UST/JGB yield differentials and the Yen, then the latest price action in Usd/Jpy should remove lingering uncertainty as the headline pair bounces further from sub-109.50 lows amidst renewed or ongoing Treasury curve steepening in wake of a stellar 2 year sale. Moreover, decent option expiry interest from 109.85-90 (1.24 bn) may well be compelling around the NY cut in similar vein to Tuesday when roughly the same size lower down acted like a magnet irrespective of broad Buck weakness. Elsewhere, the Loonie’s increasingly tight link to oil prices is also evident given a fade in WTI and the rebound in Usd/Cad to 1.2600+, while the Franc has pared gains from close to 0.9100 and even nearer 1.0700 vs the Euro in wake of a sharp deterioration in Swiss investor sentiment.

- NZD/GBP/AUD/EUR – The Kiwi has lost some altitude and momentum following NZ trade data showing a swing from surplus to deficit, but remains elevated around 0.6950 on divergent RBNZ/FOMC near term policy outlooks, while the Pound is still rangebound on the 1.3700 handle and just over 0.8550 in Eur/Gbp cross terms. Back down under, the Aussie is relatively resilient and pivoting 0.7250 even though construction work down during Q2 fell some way short of expectations. Conversely, the Euro is retesting resistance circa 1.1750 with some assistance from ECB’s de Guindos flagging imminent upgrades to macroeconomic projections rather than two misses out of three Ifo metrics, including a particularly big undershoot in expectations.

In commodities, WTI and Brent front month futures have remained choppy with a downside bias within recent ranges ahead of the Jackson Hole Symposium, but perhaps more importantly next week’s decision-making OPEC+ meeting. It will be interesting to see whether the producers continue with the 400k BPD/month output increase in the face of peak growth, persisting Delta threats and pressure from the US to bring down prices. Further, the German Ifo metric only added to economic slowdown woes, whereby COVID was cited as a factor behind the pullback in morale. Elsewhere, prices were little moved by the weekly private inventories yesterday which printed a smaller-than-expected – with traders now looking ahead to the weekly EIA figure. Until then, price action will likely be dictated by the overall market mood in the absence of any fresh catalysts. WTI Oct’ resides just above USD 67/bbl (vs USD 67.66 high) whilst its Brent counterpart dipped back below USD 71/bbl (vs high 71.20/bbl). Elsewhere, spot gold has remained under pressure sub-1,800/oz amid as yield and Dollar dynamics result in a net-net negative for the yellow metal ahead of Fed speak starting tomorrow. LME copper prices have firmed since the European open despite the indecisive risk tone, but potentially as the Buck waned off best levels. Overnight reports meanwhile suggested Chilean state-owned miner Codelco, the world’s largest copper producer, reached an agreement on a new contract with supervisors at the Andina mine – which accounted for some 10% of Codelco’s output. Meanwhile, iron ore futures saw a choppy overnight session as prices pulled back from recent highs, with traders citing fragile near-term fundamentals and the indecisive tone across the market.

US Event Calendar

- 8:30am: July Cap Goods Ship Nondef Ex Air, est. 0.7%, prior 0.6%

- 8:30am: July Cap Goods Orders Nondef Ex Air, est. 0.5%, prior 0.7%

- 8:30am: July – Less Transportation, est. 0.5%, prior 0.5%

- 8:30am: July Durable Goods Orders, est. -0.3%, prior 0.9%

DB’s Jim Reid concludes the overnight wrap

Risk assets had another strong performance yesterday, and the S&P 500 climbed to yet another all-time high as markets continued their reversal after last week’s delta-related selloff. Further positive Covid developments have been part of the story, with investors taking solace in the plateauing number of cases at the global level. But in addition to that, we’ve also had some interesting developments on the policy front over the last 24 hours, with hopes for further fiscal spending bolstered by progress in the US House of Representatives on the Democrats’ economic agenda. And that in turn follows the PBoC’s statement we reported on yesterday that they’re going to improve credit support for the real economy, which has added to this theme of continuing policy support.

We’ll have to wait and see whether Chair Powell’s speech on Friday is part of that trend, but in the meantime US equities continued to advance, with the S&P 500 (+0.15%) at a fresh record thanks to a 4th consecutive advance for the index. Cyclical industries and small caps outperformed, with the Russell 2000 rising +1.02%, reflecting the increase in risk appetite among investors. This was surpassed by an even bigger gain from megacap tech stocks however, as the FANG+ index rose a further +1.31%. Over in Europe meanwhile, the STOXX 600 (-0.01%) had a more subdued day, but that balance between advancing cyclicals and retreating defensives was also present there too, and the German DAX outperformed with a +0.33% gain.

Another place where the improvement in the demand outlook was evident was in commodity prices. By the end of last week, both WTI and Brent crude oil prices had just posted their worst weekly performances of 2021 so far. But in the last 2 days alone they’ve posted massive gains of +8.38% and +9.01% respectively. In fact more broadly, the Bloomberg Commodity Spot Index (+1.34% yesterday) has now had its strongest 2-day performance in over a year, having also been aided by strength among metals and agricultural prices, which shows that this isn’t just an energy story either.

As mentioned at the top, over the last 24 hours the US House of Representatives moved to adopt the $3.5 trillion budget resolution while also starting the process of a floor debate on the bipartisan infrastructure bill. This doesn’t mean that the $3.5 trillion budget plan will go through yet, but it allows Democrats to now debate the finer points of the deal. The motion was approved in a 220-212 vote after the House Democratic leadership came to a compromise with some of their moderate members, who’d been refusing to vote for the reconciliation bill unless the infrastructure package were passed. Under the compromise, Speaker Pelosi committed to passing the infrastructure bill by September 27, and committed to rallying support among House Democrats for it to pass. While the process has been protracted, yesterday showed that the fiscal-stimulus-train remains on track for the US economy for the time being, and we should have a better idea of exactly how large the final package will be in a matter of weeks.

US Treasury yields moved higher against this backdrop, with the 10yr yield up +4.2bps to 1.294% thanks to higher inflation breakevens (+3.6bps) alongside a modest rise in real yields (+0.6bps). Meanwhile, Europe only saw a slight rise in yields, with those on 10yr bunds (+0.2bps), OATs (+0.4bps) and gilts (+0.3bps) just inching higher.

Overnight in Asia, risk appetite has weakened with markets trading lower for the most part, including the Nikkei (-0.06%), Hang Seng (-0.36%) and Kospi (-0.29%). That said, Chinese bourses are a bit more mixed with the CAI (-0.11%) and Shenzhen Comp (-0.07%) losing ground whereas the Shanghai Comp (+0.34%) has advanced this morning. Elsewhere, futures on the S&P 500 are down -0.08% while in foreign exchange markets, the US dollar index is up +0.13% this morning.

Over in New Zealand, which is facing its highest number of Covid cases since the very beginning of the outbreak last year, another 62 cases were reported today, up from 41 yesterday and bringing the total number of community cases to 210. And in Australia, New South Wales reported a record 919 new daily cases whilst Japanese PM Suga is set to hold a news conference at 9pm local time today to announce the extension of a state of emergency to 8 more prefectures.

Otherwise on the pandemic, the issue of booster jabs are coming increasingly to the forefront of the debate as scientists look into the question of whether vaccine efficacy is likely to wane over time. In fact in Israel, where the booster is already available to many, the eligibility age was reduced yesterday so that anyone over 30 can now receive, down from 40 previously. And separately in the UK, the Times newspaper reported that sources close to the Joint Committee on Vaccination and Immunisation would likely end up approving booster jabs in stages. Staying on the UK, Scotland’s First Minister Sturgeon didn’t rule out the prospect of bringing back Covid-19 restrictions after Scotland recorded its highest number of daily cases since the pandemic started. In the US, the number of vaccine mandates in the private sector has increased following the FDA’s full approval of the Pfizer vaccine now, and Deloitte and Goldman Sachs will be requiring proof of vaccination to enter their US offices starting this Autumn.

Turning to the situation in Afghanistan, President Biden announced that the US would stick to its August 31 deadline for evacuations from Kabul airport, which went against the calls to extend the withdrawal deadline at the G7 yesterday, where UK Prime Minister Johnson convened world leaders to discuss the ongoing situation. German Chancellor Merkel said during the G7 meeting that the deadline should get pushed out as she didn’t think it would be possible to get everyone out by the August 31 deadline, calling on allies to leave reduced troops on the ground. President Biden is also facing domestic calls to push out the deadline, with Senate Minority Leader McConnell saying “extend the deadline, get outside the perimeter, make sure that every single American who wants to leave is able to get out with our assistance and our Afghan allies.”

Staying on the political scene, we got another important election development from Germany yesterday, as a poll from Forsa showed the centre-left SPD (23%) taking an outright lead over Chancellor Merkel’s CDU/CSU (22%) bloc, which is the first time that’s happened since 2017. This continues the trend of steadily-increasing SPD support over recent weeks, and brings into play the prospects that Merkel’s party could be out of power soon for the first time since 2005. One potential coalition option this could throw into play is a so-called traffic-light coalition between the SPD, the liberal FDP and the Greens. However, as DB’s Barbara Boettcher wrote in her blog on Monday (link here), there are doubts that the liberal FDP would help the SPD or the Greens into the chancellery, particularly given they hold diametrically different stances across a range of key policy areas, including on fiscal and climate policy.

There wasn’t much at all on the data front yesterday, though the final estimate of German GDP growth in Q2 was upgraded to show a +1.6% expansion (vs. +1.5% previous estimate). Otherwise in the US, we also had July’s new home sales, which came in at an annualised rate of 708k (vs. 697k expected), and the Ricmond Fed’s manufacturing index fell by more than expected in August to 9 (vs. 24 expected).

To the day ahead now, and data releases to look out for will include the Ifo’s business climate indicator from Germany for August, as well as the preliminary July readings from the US for durable goods orders and core capital goods orders. From central banks, ECB Vice President de Guindos will be speaking, and earnings releases include Salesforce, Autodesk and Royal Bank of Canada.