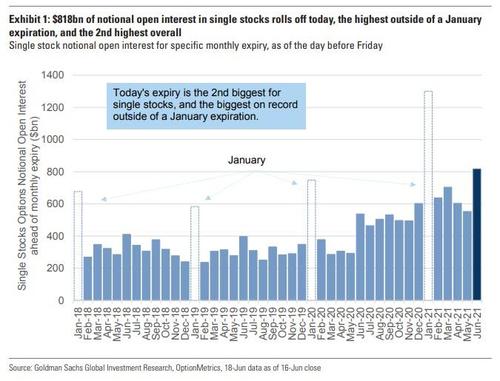

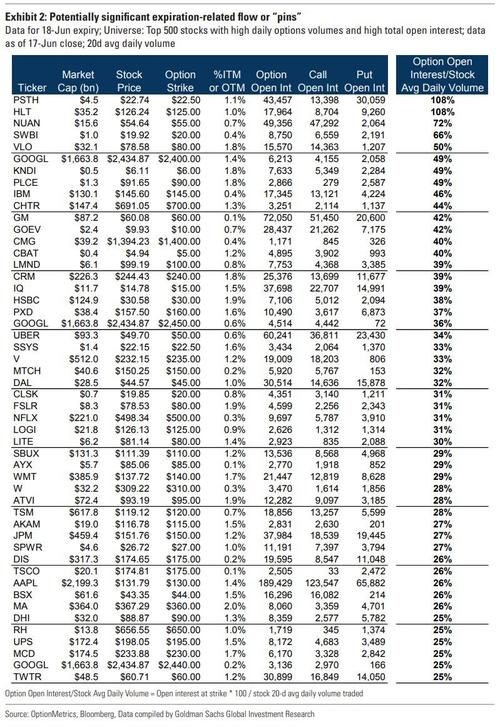

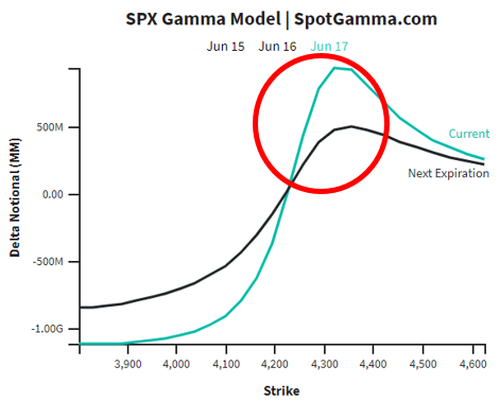

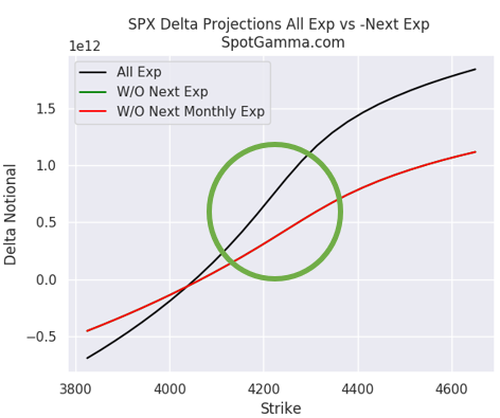

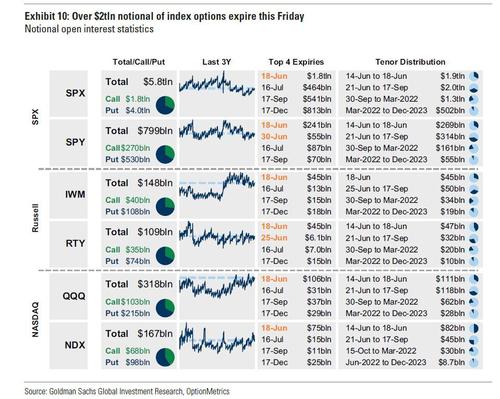

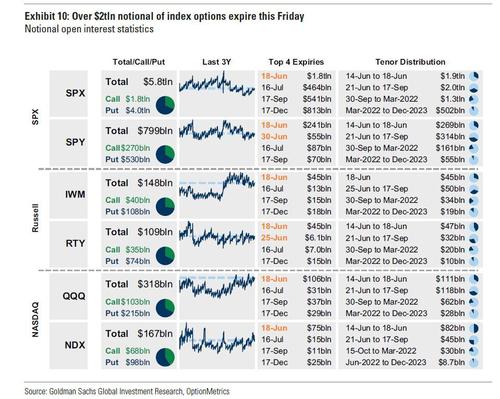

With traders on edge ahead of today’ massive quad (or triple for the anal purists) witching opex, in which over $2.2 trillion in index option gamma is set to expire potentially unleashing a burst of volatility across risk assets…

… worlds stocks were stuck just below record highs on Friday, with investors left looking for direction after digesting the U.S. Federal Reserve’s more hawkish stance (which has since been re-evaluated as bullish), while S&P futures are deathly calm with the emini trading unchanged following Thursday’ turbulent session, which saw the unwind of reflation trades resulting in a huge divergence between soaring growth (QQQ) and sliding value (IWM) stocks as markets repriced inflation expectations and as yields tumbled following Wednesday’ hawkish shock.

A plunge in yields resulting from sharply lower commodity prices and an easing in reflation trades, pushed tech stocks sharply higher on Thursday, lifting the Nasdaq Composite up 0.87%. But worries about inflation and higher rates weighed on the broader market, with the S&P 500 edging down 0.04%. The Dow Jones Industrial Average fell 0.62%.

The MSCI world equity index was off 0.13% at 713.97 points after hitting a record high of 722.32 on Tuesday. Treasury yields resumed sliding with the 10Y dropping as low as 1.47% as traders pulled back longer-term inflation expectations. The stark reversal in sentiment took place as popular trades linked to hotter inflation retreated after the Fed signaled it was preparing for earlier interest-rate increases, helping to rein in speculation that price pressures could get out of hand. In short the narrative changed from taper is bad to taper is good… just as we expected it would.

“The reflation trade as driven by higher commodity prices and partially a cyclical rebound has unwound a bit,” according to Sebastien Galy, senior macro strategist at Nordea Asset Management. “There is rising evidence that different parts of the commodity space are correcting as the overshoot in prices in various sectors of the economy are settling down.”

Of course, we expect the narrative to reverse quickly should today’s opex unwind yesterday’s reversal but until then, the pan-European STOXX index eased 0.19% to 458.50 points, barely below Monday’s record high of 460.51. Stocks in London fell 0.4% after data showed British retail sales fell unexpectedly last month as a lifting of lockdown restrictions encouraged spending in restaurants rather than shops, with Tesco down 1.8%. Britain’s biggest retailer reported a sharp slowdown in underlying UK sales growth in its first quarter, reflecting a tough comparison with the same quarter last year when consumers stocked up in the country’s first COVID-19 lockdown.

“I would not expect too much of a change,” Michael Hewson, chief market analyst at CMC Markets, said of the market. “What has the Fed said that is particularly upsetting in terms of the outlook for interest rates and monetary policy? We are still talking 18 months’ time. It suggests the economy is improving and that is a good thing,” Hewson said, echoing what we said yesterday.

Earlier in the session, the MSCI index of Asia-Pacific shares ex-Japan was flat after falling for four sessions. Chinese blue-chip A shares were also little changed, along with Japan’s Nikkei. China’s economic planning agency and the market watchdog once again vowed to closely monitor prices of coal and other commodities, and firmly crack down on hoarding and price speculation, according to an NDRC statement, in which it said that this year’s surge in the price of coal and other commodities has had a “negative impact” on the real economy.

In FX, the dollar was heading for its best week in nearly nine months as investors priced in a sooner-than-expected ending to extraordinary U.S. monetary stimulus. The Bloomberg Dollar Spot Index was little changed Friday. Among Group-of-10 currencies the yen led gains as the Bank of Japan maintained its policy rate and said it would extend its Covid support program.

No major data is expected and corporate news was thin, leaving investors to continue pondering what the Fed’s comments will mean for the assets they hold in coming months.

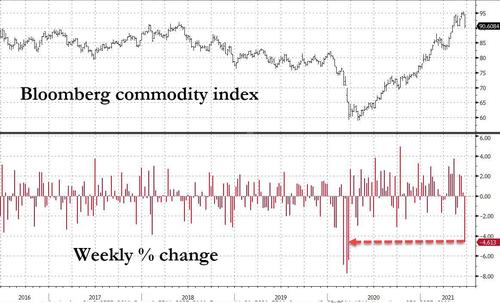

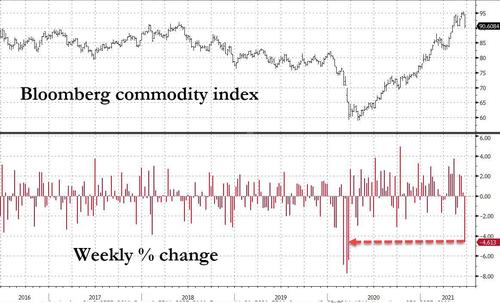

Markets that are clearly benefiting from the reopening are seeing a pullback, with copper heading for its worst week in more than a year. The Bloomberg Commodity Index is on course for its steepest weekly slump since March 2020.

Elsewhere in commodities, gold prices, which plunged following the Fed comments, edged higher but were still set for their worst week since March 2020. Spot gold was last up 1% at $1,790 per ounce. Oil fell for a second day, with Brent crude slipping from this week’s 2018 high. Strength in the greenback pushed oil lower for a second straight session, while spot gold remained down around 5% for the week after the Fed dented the yellow metal’s safe haven appeal. Global benchmark Brent crude was down 0.68% at $72.63 a barrel after settling at its highest price since April 2019 on Wednesday. U.S. West Texas Intermediate crude, which touched its highest level since October 2018 on Wednesday, shed 0.42% to $70.74.

In terms of the day ahead there isn’t much on the calendar, but data releases include German PPI and UK retail sales for May. Otherwise, a presidential election is taking place in Iran.

Market Snapshot

- S&P 500 futures little changed at 4,222.25

- STOXX Europe 600 down 0.1% to 458.64

- MXAP down 0.2% to 207.77

- MXAPJ little changed at 696.85

- Nikkei down 0.2% to 28,964.08

- Topix down 0.9% to 1,946.56

- Hang Seng Index up 0.8% to 28,801.27

- Shanghai Composite little changed at 3,525.10

- Sensex down 0.3% to 52,167.66

- Australia S&P/ASX 200 up 0.1% to 7,368.85

- Kospi little changed at 3,267.93

- Brent Futures down 0.5% to $72.68/bbl

- Gold spot up 1.0% to $1,791.51

- U.S. Dollar Index little changed at 91.89

- German 10Y yield fell 0.4 bps to -0.199%

- Euro little changed at $1.1917

Top Overnight News from Bloomberg

Quick look at global markets courtesy of newssquawk

Asian equity markets were sluggish following the mixed lead from Wall Street where the mood was indecisive amid an unwinding of inflation hedges, looming quadruple witching and following weaker than expected US data, although tech outperformed and the NDX posted a fresh record high helped by a pullback in yields. ASX 200 (+0.3%) was led higher by tech as the sector found inspiration from US peers although upside in the broader market was limited by commodity-related losses with energy names dragged after WTI crude briefly dipped beneath USD 70/bbl. Nikkei 225 (Unch.) lacked conviction amid an unsurprising BoJ policy conclusion in which the BoJ maintained policy settings as expected and extended pandemic relief measures by six months beyond the September deadline as was flagged by source reports, although Eisai was the biggest gainer due to a global strategic collaboration with Bristol Myers Squib in which Eisai will receive USD 650mln and also be entitled to as much as USD 2.45bln in milestones. Hang Seng (+0.7%) and Shanghai Comp. (-0.5%) were varied with the mainland bourse weakened by lingering tensions with the West, while outperformance in Hong Kong was driven by tech and retailers as JD.com celebrated its birthday with the 6.18 shopping festival and with Anta Sports also lifted after forecasts of a minimum 110% jump in H1 net.

Top Asian News

- BOJ Flags Novel Step to Aid Post-Covid Climate Change Efforts

- China Mulls Full Abandonment of Birth Restrictions by 2025: DJ

- Thailand to Ease Covid-19 Curbs, Approves Phuket Reopening

- China EV Stocks Rise on Optimism Over Tax, Sales, Chip Drive

In FX, the DXY was flat overnight but held on to most of its post-FOMC gains having tested the 92.00 level to the upside, with the greenback unfazed despite the recent pullback in yields and disappointing US data in which Philly Fed Business Index missed forecasts and Jobless Claimants numbers were higher than expected. EUR/USD suffered from the USD strength and briefly gave up the 1.1900 status, while the latest central bank commentary had little bearing on the single currency, in which ECB’s Weidmann called for the PEPP to end soon and ECB’s Visco noted the path of the global recovery is still uncertain and that large supply and demand issues caused by the pandemic, coupled with the pickup in commodity prices, will complicate the assessment of the inflationary outlook. GBP/USD was pressured and eyes 1.39 to the downside amid the weight of a firmer USD and with the currency not helped by Chancellor Sunak’s refusal to provide help for businesses hit by extended COVID restrictions. USD/JPY and JPY-crosses were subdued after the prior day’s slump and following an uneventful BoJ policy decision where the central bank maintained policy settings and extended its pandemic-relief programme as expected, while antipodeans drifted lower ahead of the European entrance to market following the recent downturn across the commodities complex.

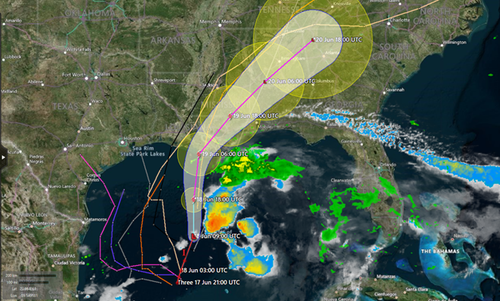

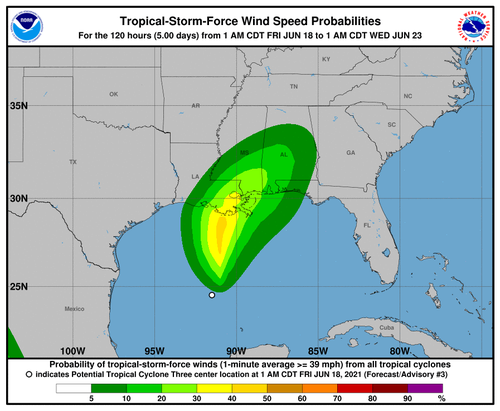

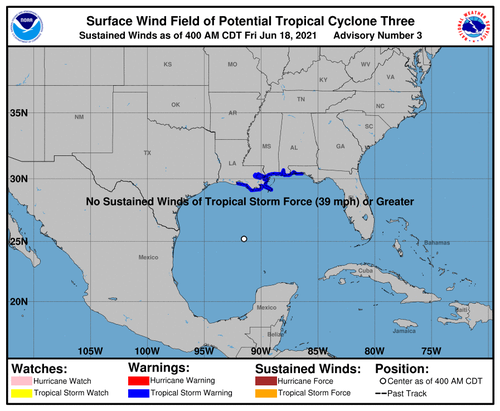

Commodities were mixed overnight with WTI crude futures despondent following the prior day’s heavy selling pressure alongside a broad slump across the commodities complex as the greenback extended on gains and amid suggestions from the US that progress was achieved in Iran talks although challenges remain. There were also updates overnight from the NHC which announced a tropical storm warning will likely be required for a portion of the northern Gulf of Mexico, while Chevron (CVX) withdrew staff from offshore facilities in the area due to the potential tropical storm and Occidental Petroleum was also implementing storm procedures. Gold nursed some losses overnight although the recovery was insignificant compared to the circa USD 90/oz drop suffered since the FOMC and copper’s attempts to recoup losses were also limited by the tentative mood across risk assets.

US Event Calendar

DB’ Jim Reid concludes the overnight wrap

The oldest international football fixture in the world takes place today at the Euros. 149 years after it was first played England vs Scotland will divide us here in the U.K.. My father’s ancestry was a mix of Scottish and Dutch and until I was about 9 I supported Scotland. However at that age I started to realise I’d never been to Scotland, had a load of friends who supported England and started to disagree with most things my Dad said. So I changed my allegiances. Not quite Zola Budd but still. I would say that the 1982 Scotland World Cup song “We had a dream” (look it up on YouTube) is one of the best football songs and was one of the first records I bought. Luckily as I changed, England songs occasionally got even better with “World in motion” and “Three Lions”.

After the inflationists again placed one in the back of the net following the hawkish shift from the Federal Reserve on Wednesday, the disinflationists made an immediate and stunning comeback last night and hit a screamer into the top corner. US Treasuries had a incredible day in the circumstance as investors grew in confidence that the Fed had removed some of the tail risk of a much higher-inflation outcome in the future. So although the data still points to building price pressures, and the market continues to price in an earlier hike than the Fed is currently implying (by end-2022 rather than in 2023), the moves in various assets yesterday marked another vote of confidence that the Fed would prove able to keep those pressures contained. Or on a more sinister interpretation that they are making a hawkish policy error. Not my thoughts but the market pricing certainly demands attention.

By the close of trade, yields on 10yr Treasuries were down -7.1bps to 1.504% (1.470% at the lows), mostly reversing the +8.3bps move the previous day.Inflation breakevens declined -2.8bps, which in turn took them to a 3-month low of 2.29%. Indeed, the 10yr breakeven now stands over -30bps lower compared to its intraday high of 2.594% we saw after the release of the bumper April CPI report back in May. 30 year Treasuries rallied -11.5bps to 2.09% (2.05 at one point) the lowest level in 4 months, with the 5yr-30yr yield curve flattening the most over 2 days since late February. So the back end thinks less of the ability for the Fed to honour AIT than they did before the FOMC.

Furthermore, in a sign of how investors are recalibrating the risks, the traditional inflation hedge of gold (-2.10%) moved sharply lower for a second day running, which brings its losses over the last 2-days to -4.60%, thus marking its worst 2-day performance this calendar year.

These aftershocks from the Fed continued to be felt elsewhere yesterday, with the US dollar index (+0.83%) reaching a 2-month high, having risen in 4 of the last 5 sessions. However, yet more data pointed to inflationary outcomes in the future, with the Philadelphia Fed’s manufacturing business outlook survey seeing the prices paid diffusion index rise to 80.7, which is its highest since 1979, while the current prices received index was up to 49.7, which is the highest since 1980. So the big question for markets now is whether two hikes in 2023 will prove enough to keep inflation at target, or whether the Fed will be forced to move by end-2022 as investors are currently pricing in or even earlier.

Equity indices put in a mixed performance in spite of the sizeable moves elsewhere. The S&P 500 finishing just below unchanged (-0.04%), as the index remained less than 1% away from its all-time closing high from Monday. In terms of the sectoral moves, tech stocks were the biggest outperformers on both sides of the Atlantic, with the NASDAQ up +0.87% to an all-time high as lower yields helped. Small-cap stocks struggled however, with the Russell 2000 (-1.18%) falling for a 4th day running. The largest tech stocks outperformed once again with the NYFANG index (+1.81%) reaching its highest close since April, however it remains over -6% lower than its mid-February highs. The drop in yields and commodity prices revived the growth-over-cyclical trade as banks (-4.26%), energy (-3.49%) and materials (-2.20%) were the worst performers in the US. Meanwhile in Europe the STOXX 600 (-0.12%) failed to sustain its run of 9 successive gains as it lost ground after reaching a succession of record highs. If yesterday had seen a 10th gain in a row (as it was very briefly on track for in the afternoon) that would have been the longest winning run since 2006.

Asian markets are also mixed this morning with the Nikkei (+0.08%) and Kospi (+0.07%) flattish while the Hang Seng (+0.59%) is up and the Shanghai Comp (-0.49%) down. The Shanghai Comp is likely being driven by yesterday’s news that the Federal Communication Commission has proposed a ban on products from Huawei and four other Chinese electronics companies, including surveillance cameras widely used by schools. Meanwhile, we have also had the BoJ policy decision this morning with the central bank maintaining its policy rate and keeping its 10y yield target unchanged. The BoJ did extend its lending measures introduced during the pandemic by six months to March 2022 though. Further, in a surprise move the central bank said that it will introduce a new funding measure to support climate change initiatives and will offer details at next month’s meeting. Elsewhere, futures on the S&P 500 are up +0.07% while the US dollar is trading largely unchanged in early trade today. In terms of overnight data releases Japan’s May CPI came in at -0.1% yoy (vs. -0.2% yoy expected) while core CPI printed at +0.1% yoy (vs. unchanged expected).

Elsewhere in markets yesterday there were a number of central bank meetings in various countries, though the decisions in Switzerland, Norway, Turkey and Indonesia all saw rates left unchanged. Back in Europe, sovereign bonds caught up with the selloff in the US the previous day, with yields on bunds (+5.5bps), OATs (+2.2bps) and BTPs (+4.1bps) all moving higher but off their tights as Treasuries reversed course. And there was also a reasonably big selloff in commodities too as referenced above, with Brent crude (-1.76%) and WTI (-1.54%) oil prices falling back from their 2-year highs, whilst copper (-4.72%), corn (-5.94%) and wheat (-3.58%) lost ground as well, in addition to gold as mentioned above. It was the biggest one day drop for copper since this past October, as the large moves in yields and the dollar weighed hard on the industrial bellwether. Overnight, commodities are recouping some of yesterday’s losses with Copper (+0.61%), DCE iron ore (+1.78%) and SHF steel rebar (+1.96%) all up. Futures on corn (+0.80%), soybeans (+1.88%) and wheat (+1.13%) are also up. Nonetheless, crude oil prices have taken another leg lower and are down a further c. -0.75%.

On the pandemic, the UK continued to be a source of concern as 11,007 cases were reported yesterday, which is the highest daily total since February 19th, whilst the numbers admitted to hospital over the last week are up +43% on the previous one. That said, there was some better news from the UK in that 80% of the adult population have now received a first vaccine dose. The vast majority of new cases in the UK are a result of the delta variant, which has not been seen in as large quantities in the US so far, however yesterday Illinois reported 64 new delta cases – its most in one day so far. In the last reading of CDC data, the delta variant made up just under 3% of total cases as the alpha variant remains the most prevalent currently.

Wrapping up with yesterday’s data, the weekly initial jobless claims from the US for the week through June 12 unexpectedly rose to 412k (vs. 360k expected), up from their post-pandemic low the previous week. That also breaks a run of 6 successive weekly declines in the measure. Separately, in the Philadelphia Fed’s manufacturing business outlook survey for June (which we mentioned above on the prices measures), the general activity index fell to 30.7 (vs. 31.0 expected).

In terms of the day ahead there isn’t much on the calendar, but data releases include German PPI and UK retail sales for May. Otherwise, a presidential election is taking place in Iran.