Why Illinois Is Broke: 109,881 Public Employees With $100,000+ Paychecks Cost Taxpayers $14B

Submitted by Adam Andrzejewski, originally published in Forbes,

Illinois could soon be the first state in history to have its bonds rated as “junk.” Last month, both Moody’s MCO and Standard & Poor’s downgraded Illinois debt to just one notch above junk status.

Last week, the Illinois State Senate President Don Harmon (D-Chicago) wrote a letter to Congress requesting a $41.6 billion bailout. Critics balked.

In many ways, Illinois may have already crossed the Rubicon.

Our analysis at OpenTheBooks.com shows that an Illinois family of four now owes more in unfunded pension liabilities ($76,000) than they earn in household income ($63,585). In a state of 13 million residents, every man, woman, and child owes $19,000 — on an estimated $251 billion pension liability.

Our auditors discovered 110,000 public employees and retirees who earned more than $100,000 last year.

We found tree trimmers in Chicago making $106,663; nurses at state corrections earning up to $277,100; junior college presidents making $491,095; university doctors earning up to $2 million; and 111 small town managers who out-earned every governor of the 50 states ($202,000).

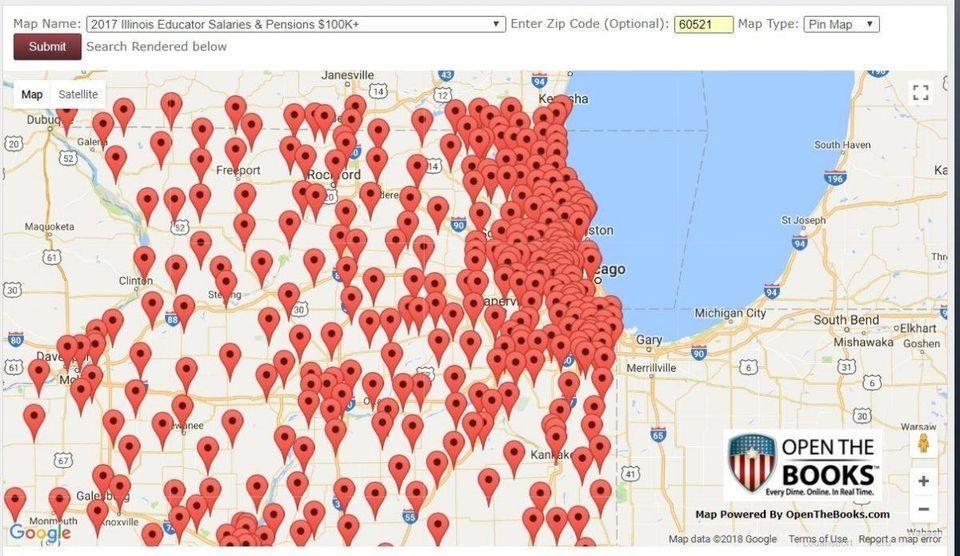

Our interactive mapping tool allows users to quickly review the 110,000 public employees and retirees across Illinois making more than $100,000 (by ZIP code). Just click a pin and scroll down to see the results in your neighborhood rendered in the chart beneath the map.

Auditing Illinois’ large pay and pension systems

Here’s a system by system break down with the head counts of employees and retirees who made more than $100,000 per year:

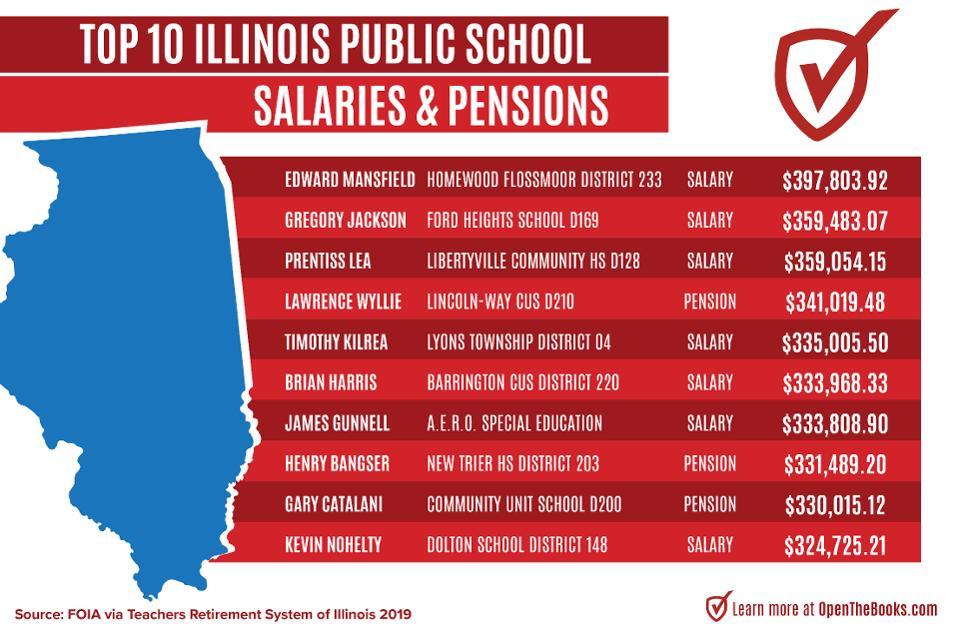

Public schools (35,000) – Last year, nearly 22,000 educators earned a six-figure salary while more than 13,500 retirees received six-figure pensions. Six retired superintendents pocketed $300,000+ pensions, including Lawrence Wyllie (Lincoln-Way CHSD 210 – $341,019); Henry Bangser (New Trier Township HSD 203 – $331,489); Gary Catalani (Wheaton-Warrenville Unit SD 200 – $330,015); Laura Murray (Homewood-Flossmoor CHSD 233 – $324,677); and Mary Curley (Hinsdale CCSD 181 – $315,336).

Chicago (22,000) – We calculated that the city paid out $521.2 million in extra pay (overtime, vacation, supplemental, fitness, etc.) above base salaries. Four deputy fire chiefs made between $314,983 and $351,715. Police officers made up to $272,672 and EMT’s up to $270,851. The Chicago Transit Authority (CTA) paid line workers up to $300,135, telephone line workers up to $282,123, and escalator mechanics up to $203,855.

Colleges & universities (16,000) – Bradley Underwood made $2.9 million as the basketball coach at the University of Illinois. Junior college power couple Dale Chapman ($491,095) and Linda Terrill Chapman ($242,070) combined for a $733,000 income at Lewis and Clark Community College. Fady Toufic Charbel ($2 million); Mark Gonzalez ($1.1 million); and Konstantin Slavin ($1 million) are million-dollar doctors at University of Illinois at Chicago (UIC). A UIC pension paying out $524,865 goes to a retired doctor, Tapas Das Gupta.

State of Illinois (15,000) – Six-figure salaries and pension payouts amounted to $1.8 billion last year. Five barbers at Corrections made over $100,000 while eight nurses at Veterans, Human Services and Corrections made between $200,000 and $277,100. Eight troopers and police officers at the Tollway Authority made between $200,000 and $277,000. A court-ordered monitor, Dr. Stewart Pablo, cost taxpayers $327,600 to report on the lack of mental healthcare availability within the prison system — $1 million in total during the past three years.

Cities & villages (8,000) – Small town managers rake in the pay, perks, and pension benefits. These administrators include Michael Ellis (Village of Grayslake – $296,654); Richard Nahrstadt (Village of Northbrook – $290,603); Dane Bragg (Village of Buffalo Grove — $280,000); Patrick Nagle (Village of Rosemont — $279,523); Michael Cassady (Village of Mount Prospect — $278,282); and Reid Ottesen (Village of Palatine – $274,067). The Wheaton Park District conferred a $273,243 pension on retired administrator Elizabeth Kutska.

Private associations, nonprofits, and retired lawmakers

Consider the many ways that private associations, nonprofits, and retired lawmakers have exploited the legal loopholes.

- Retired Chicago Mayor Richard M. Daley (D) double dipped the pension system for nearly $232,000. Daley made $149,009 per year in state lawmaker pension payouts after a short eight-year career as a state senator plus another $83,784 per year in city pension payouts for his 22 years as the mayor of Chicago.

- Three of the highest earners within the municipal pension system work for private associations – not government. Peter Murphy, executive director of Illinois Association of Park Districts, made $359,287, while Brett Davis, executive director of the Park District Risk Management Agency, brought in $331,817. Brad Cole of the Illinois Municipal League pulled down $313,997. These private nonprofits muscled their way into the government system.

- Former Illinois Governor Jim Edgar (R) double dipped pension systems: General Assembly pension ($175,951 per year) and University Retirement System pension ($85,140). After “retiring” from the University of Illinois, he was hired back part time for another $62,769. Last year, Edgar’s total payout from all sources was $323,860.

We estimate that Edgar earned $2.4 million in compensation from the University of Illinois (2000-2013) and another $2 million in pension payments already paid-out from his 20-year career as legislator, secretary of state and governor.

Highly compensated locals

DuPage County employees have a history of hefty salaries and pensions. Anthony Charlton, director of Stormwater Management, made $253,420. Five more county administrators made over $202,000 last year. Dewey Hartman, a chief deputy police officer, received $324,431 – a $159,574 bump in his final year. Hartman now receives a $176,872 pension.

Local park district administrators outearned the state director of parks ($116,500). These included James Pilmer ($212,794) at Fox Valley; Raymond McGury ($209,443) at Naperville; and Michael Bernard ($206,819) at Wheaton. However, the top two pensions exceeded the highest salaries: Elizabeth Kutska ($273,242) from Wheaton; and Steven Messerli ($215,484) from Fox Valley.

Library, forest preserve and even water district employees tapped into the largess. Brian Dorn pulled down $247,071 at North Shore Water Reclamation while Edward Stevenson made $214,856 at the Forest Preserve of DuPage County. Gayle Mountcastle made $190,318 at the small Park Ridge Public Library and out-earned Brian Bannon, CEO of the Chicago Public Library ($167,004).

Possible solutions to the Illinois crisis

Illinois Governor J.B. Pritzker wants to hike the income tax during a recession. The proposal would change the state constitution to allow for a progressive income tax. Currently, the Illinois income tax is a flat rate tax.

Last week, Illinois State Senate President Don Harmon wrote a letter to Congress asking for a $40 billion bailout. $10 billion in bailout would be used for pension plan solvency.

This week, U.S. Senate Leader Mitch McConnell suggested another path, “I would certainly be in favor of allowing states to use the bankruptcy route.” McConnell specifically mentioned Illinois along with Connecticut, California, and New York.

Tyler Durden

Tue, 04/28/2020 – 18:05

via ZeroHedge News https://ift.tt/35kDb1h Tyler Durden