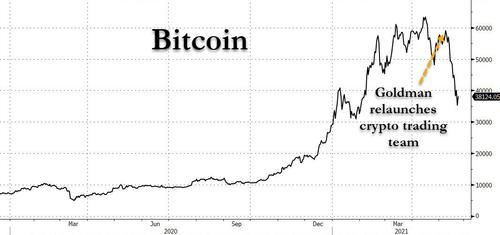

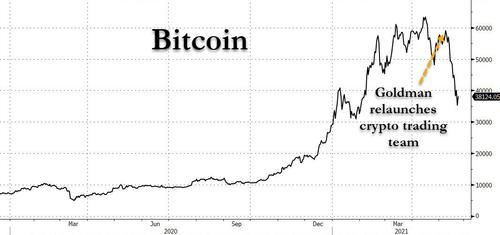

When Goldman officially announced two weeks ago that it was re-launching a previously rumored cryptocurrency trading team on May 6…

… some joked that this was the top-tick for the crypto space: after all, the last time Goldman launched a bitcoin trading desk, the sector imploded and just a few months later Goldman killed its expansion plans, sending cryptos tumbling even more, and starting the infamous crypto winter which lasted over two years.

In retrospect, such cynicism wasn’t too far off, because bitcoin did plunge more than 40% since the day Goldman decided to relaunch its trading effort.

However, poor recent price action notwithstanding, we doubt that Goldman would let it go 2 out of 2 on catastrophic crypto crashes as soon as it officially gets involved.

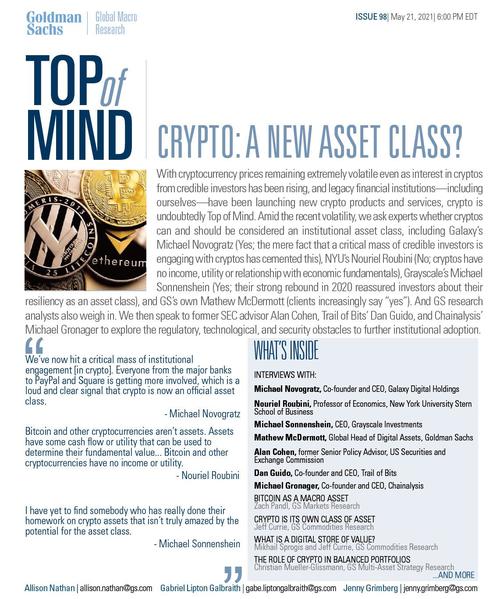

Confirming this is an aggregate report published by Goldman late on Friday which is as close to an initiation by Goldman on the asset class as one can hope (last month Goldman already revealed its favorite “crypto-exposed” stocks), and which includes not only a handful of both “pro” crypto interviews (with Mike Novogratz leading the cheerleaders) as well as “anti” (Nouriel Roubini not surprisingly is the lead hater), but more importantly Goldman reveals its own thoughts on:

- Bitcoin as a macro assets

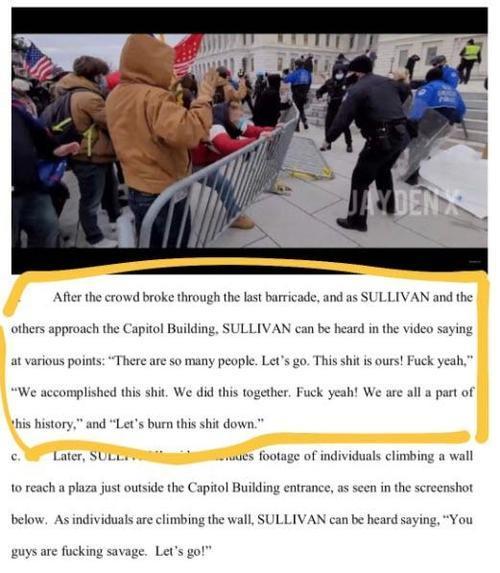

- Crypto as its own asset class

- What is a digital store of value, and

- The role of crypto in balanced portfolios

While the full report can be found in the usual place (for pro subscribers)…

… we wanted to highlight the one thing we found notable in the 40 page report, is the bank’s preference for ethereum (an entirely new technological platform) over bitcoin (a store of value and an alternative payment system) which is not really surprising: as Mike Novogratz points out, “the three biggest moves in the crypto ecosystem—payments, DeFi, and NFTs—are mostly being built on Ethereum, so it’s going to get priced like a network. The more people that use it, the more stuff that gets built on it, and the higher the price will ultimately go.” And since for the past five years much of the world has largely associated crypto with bitcoin, it will take some time for conventional wisdom to realize that there is much more to crypto than just bitcoin.

Which incidentally brings up the question, of just what is crypto, and conveniently none other than the head of commodities at Goldman, Jeff Currie, has dedicated an entire section discussing this, which also reveals how Goldman is approaching the various constituents of the crypto space: Currie argues that cryptos are a new class of asset that derive their value from the information being verified and the size and growth of their networks. Here are the details:

The term “cryptocurrencies”—which most people take to mean that crypto assets act as a digital medium of exchange, like fiat currency—is fundamentally misleading when it comes to assessing the value of these assets. Indeed, the blockchain that underlies bitcoin was not designed to replace a fiat currency—it is a trusted peer-to-peer payments network. As a cryptographic algorithm generates the proof that the payment was correctly executed, no third party is needed to verify the transaction. The blockchain and its native coin were therefore designed to replace the banking system and others like insurance that require a trusted intermediary today, not the Dollar. In that sense, the blockchain is differentiated from other “digital” transactional mechanisms such as PayPal, which is dependent upon the banking system to prevent fraud like double-spending.

In order to be trustworthy, the system needed to create an asset that had no liabilities or contingent claims, which can only be a real asset just like a commodity. And to achieve that, blockchain technologies used scarcity in natural resources—oil, gas, coal, uranium and hydro—through ever-increasing computational-power consumption to “mine” a bit version of a natural resource.

From this perspective, the intrinsic value of the network is the trustworthy information that the blockchain produces through its mining process, and the coins native to the network are required to unlock this trusted information, and make it tradeable and fungible. It’s therefore impossible to say that the network has value and a role in society without saying that the coin does too. And the value of the coin is dependent upon the value and growth of the network.

That said, because the network is decentralized and anonymous, legal challenges facing future growth for crypto assets loom large. Coins trying to displace the Dollar run headlong into anti-money laundering laws (AML), as exemplified by the recent ransoms demanded in bitcoin from the Colonial Pipeline operator and the Irish Health service. Regulators can impede the use of crypto assets as a substitute for the Dollar or other currencies simply by making them non-convertible. An asset only has value if it can either be used or sold. And Chinese and Indian authorities have already challenged crypto uses in payments.

As a result, the market share of coins used for other purposes beyond currencies like “smart contracts” and “information tokens” will likely continue to rise. However, even these non-currency uses will need to be recognized by courts of law to be accepted in commercial transactions—a question we leave to the lawyers.

The network creates the value, unlike other commodities

Unlike other commodities, coins derive their entire value from the network. A bitcoin has no value outside of its network as it is native to the Bitcoin blockchain. The value of oil is also largely derived from the transportation network that it fuels, but at least oil can be burned to create heat outside of this network. At the other extreme, gold doesn’t require a network at all.

Derived demand leaves the holder of the commodity exposed to the risk of the network becoming obsolete—a lesson that holders of oil reserves are now learning with decarbonization accelerating the decline of the transportation network, and, in turn damaging oil demand. Likewise, bitcoin owners face accelerated network decay risk from a competing network, backed by a new cryptocurrency.

As the demand for gold is not dependent on a network, it will ultimately outlive oil and bitcoin—gold entropy lies at the unit, not the network, level. Indeed, most stores of value that are used as defensive assets—like gold, diamonds and collectibles—don’t have derived demand and therefore only face unit-level entropy risk. This is what makes them defensive. The world can fall apart around them and they preserve their value. And while they don’t have derived demand, they do have other uses that establish their value, i.e. gold is used for jewelry and as a store of value.

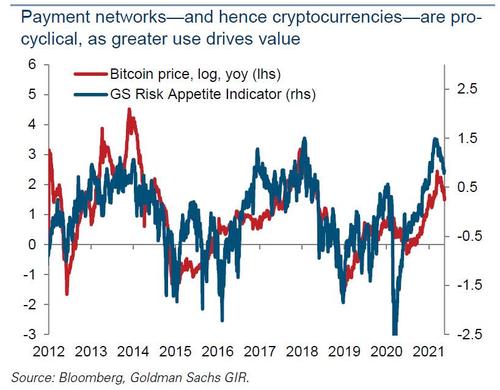

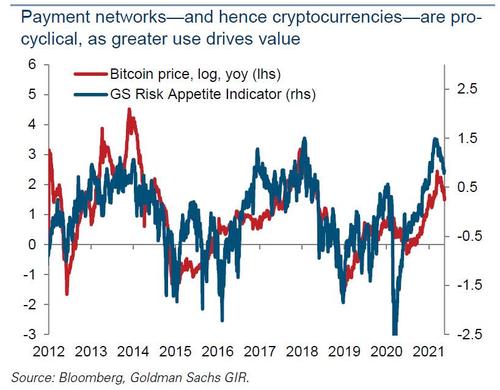

Transactions drive value, creating a risk-on asset

Crypto doesn’t trade like gold and nor should it. Using any standard valuation method, transactions or expected transactions on the network are the key determinant of network value. The more transactions the blockchain can verify, the greater the network value. Transaction volumes and the demand for commodified information are roughly correlated with the business cycle; thus, crypto assets should trade as pro-cyclical risk-on assets as they have for the past decade. Gold and bitcoin are therefore not competing assets as is commonly misunderstood, and can instead co-exist. Because the value of the network and hence the coin is derived from the volume of transactions, hoarding coins as stores of value reduces the coins available for transactions, which reduces the value of the network. Because gold doesn’t have this property, it is the only commodity that institutional investors hold in physical inventory. Nearly all other commodities are held in paper inventory in the form of futures to avoid disrupting the network. This suggests that, like oil, crypto investments will need to be held in the form of futures contracts, not physically, if they are to serve as stores of value.

Crypto assets aren’t digital oil, either, as they are not non-durable consumables and can therefore be used again. This durability makes them a store of value, provided this demand doesn’t disrupt network flows. The crypto assets that have the greatest utility are also likely to be the dominant stores of value—the high utility reduces the carry costs.

So what is crypto? A powerful networking effect

The network provides crypto an extremely powerful networking externality that no other commodity possesses. The operators—miners, exchanges and developers—are all paid in the native coin, making them fully vested in its success. Similarly, users—merchants, investors and speculators—are also fully vested. This gives bitcoin holders an incentive to accommodate purchases of their own products in bitcoin, which in turn, creates more demand for the coins they already own. Similarly, ether holders have an incentive to build apps and other products on the Ethereum network to increase the value of their coins.

Because the coin holders have a stake in the network, speculation spurs adoption; even during bust periods, coin holders are motivated to work to create the next new boom. After the dot-com bust, the shareholders had no commodity to promote. In crypto assets, even when prices collapse, the coin holders have a commodity to promote. They will always live for another boom, like an oil wildcatter.

It’s all about information

As the value of the coin is dependent on the value of the trustworthy information, blockchain technology has gravitated toward those industries where trust is most essential—finance, law and medicine. For the Bitcoin blockchain, this information is the record of every balance sheet in the network, and the transactions between them—originally the role of banks. In the case of a smart contract—a piece of code that executes according to a pre-set rule—on Ethereum, both the terms of that contract (the code) and the state of the contract (executed or not) are the information validated on the Ethereum blockchain. As a result, the counterparty in the contract cannot claim a transfer of funds without the network forming a consensus that the contract was indeed executed. In our view the most valuable crypto assets will be those that help verify the most critical information in the economy.

Over time, the decentralized nature of the network will diminish concerns about storing personal data on the blockchain. One’s digital profile could contain personal data including asset ownership, medical history and even IP rights. Since this information is immutable—it cannot be changed without consensus—the trusted information can then be tokenized and traded. A blockchain platform like Ethereum could potentially become a large market for vendors of trusted information, like Amazon is for consumer goods today.

Crypto beyond this boom and bust cycle

By many measures—Metcalfe’s Law or Network Value to Transactions (NVT) ratio —crypto assets are in bubble territory. But does the demand for “commodified information” create enough economic value at a low enough cost to be scaled up in the long run? If the legal system accommodates these assets, we believe so. While many overvalued networks exist, a few will likely emerge as long-term winners in the next stage of the digital economy, just as the tech titans of today emerged from the dot-com boom and bust. This transformation is happening now—there are already an estimated 21.2 million owners of cryptocurrencies in the US alone. However, technological, environmental and legal challenges still loom large.

Ethereum 2.0 is expected to ramp up capacity to 3,000 transactions per second (tps), while sharding—which will scale Ethereum 2.0’s Proof of Stake (PoS) system through parallel verification of transactions—has the potential to raise capacity to as much as 100,000 tps. For context, Visa has the capacity to process up to 65,000 tps but typically executes around 2,000 tps. PoS intends to have validators stake the now scarce and valuable coins to incentivize good behavior instead of having miners expend energy to mine new blocks into existence, as under Proof of Work, making crypto assets more ESG friendly. PoS also can significantly boost computational time in terms of transactions per second, which will further incentivize technological adoption. Ironically, this is likely where the value of and demand for bitcoin will come from—being used as the scarce resource to make the PoS system work instead of natural resources.

While overcoming the economic challenges will likely be manageable, the legal challenges are the largest for many crypto assets. And this past week was challenging for crypto assets with confirmation that the 75 bitcoin ransom over the Colonial Pipeline was actually paid. This is a reminder that cryptocurrencies still facilitate criminal activities that have large social costs.

For Ethereum, new companies which aim to disrupt finance, law or medicine by integrating information stored on the platform into their algorithms are likely to run into problems with being legally recognized. If crypto assets are to survive and grow to their fullest potential, they need to define some concept of “sufficiently decentralized” that will satisfy regulators; otherwise, the technologies will soon run out of uses.

In short: bitcoin is good, and “ironically” will be used as the “scarce resource” to make PoS systems work “instead of natural resources”, but while bitcoin may end up being a one-trick pony (if quite valuable) it is the new blockchain platforms – like Ethereum – that will serve as the basis for a marketplace of trusted information, as Goldman puts it “like Amazon is for consumer goods today.”

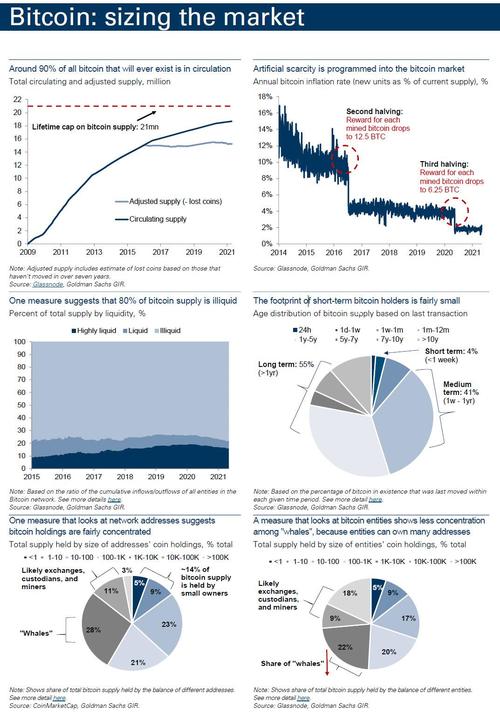

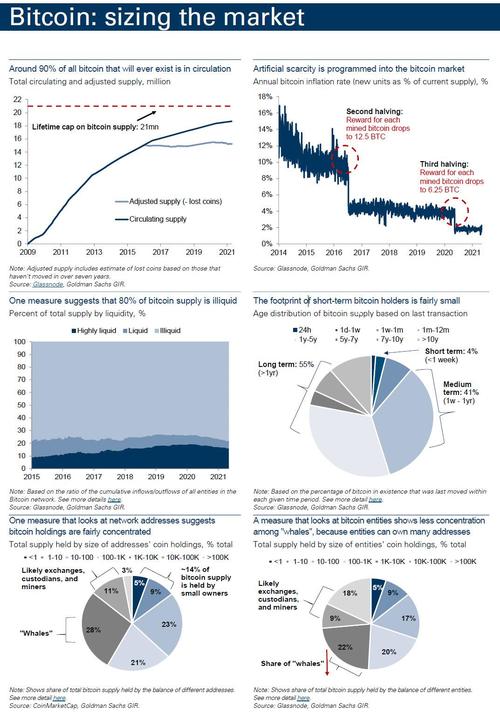

Since this is a Goldman report, it was naturally chock-full of charts and images, and below we reproduce the main ones, first, focusing on bitcoin…

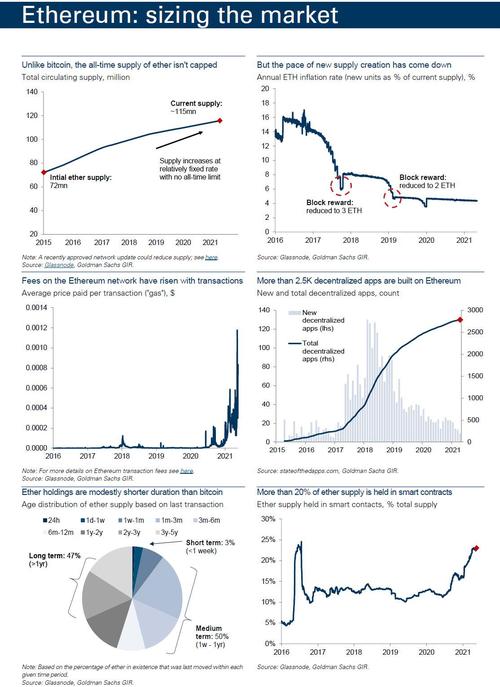

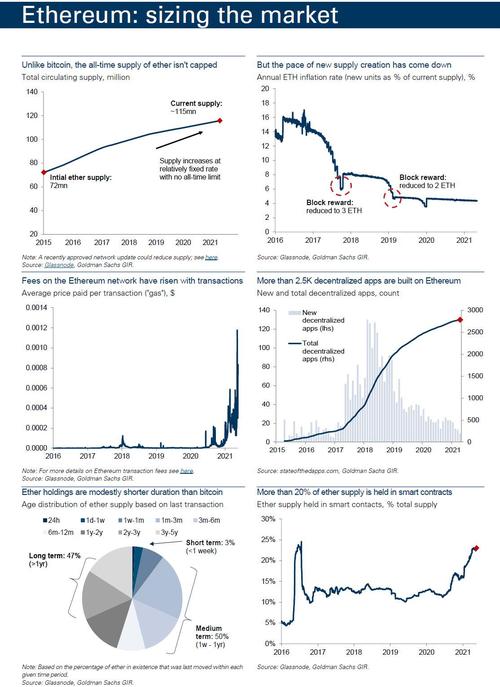

… then ethereum…

And with that background in place, here is why Goldman believes that “ether has high chance of overtaking bitcoin as the dominant digital store of value.” Here is Goldman explaining what is a digital store of value:

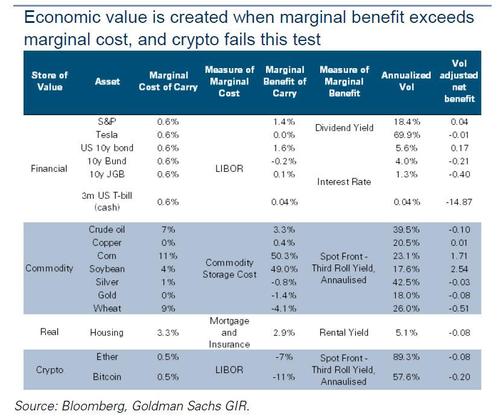

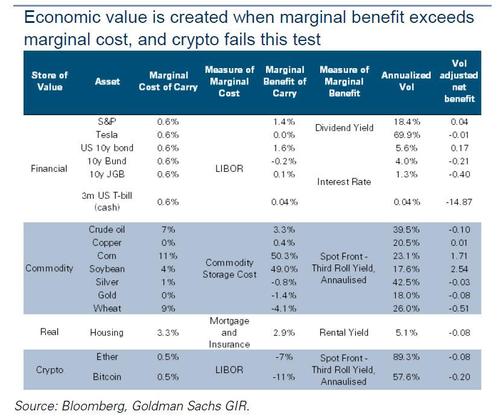

Based on emerging blockchain technology that has the power to disrupt global finance, yet with limited clear use today, bitcoin has been labeled a solution looking for a problem. Many investors now view bitcoin as a digital store of value, comparable to gold, housing, or fine wine. But all true stores of value in history have provided either income or utility, and bitcoin currently provides no income and only very modest utility.

However, unlike bitcoin, several other crypto assets have clear economic rationales behind their creation. Bitcoin’s first-mover advantage is also fragile; crypto remains a nascent field with shifting technology and consumer preferences, and networks that fail to adjust quickly could lose their leadership. We therefore see a high likelihood that bitcoin will eventually lose its crown as the dominant digital store of value to another cryptocurrency with greater practical use and technological agility. Ether looks like the most likely candidate today to overtake bitcoin, but that outcome is far from certain.

What is a store of value?

A store of value is anything that preserves its value over time. While financial stores of value like equities and bonds hold their value because they produce a given cash flow, yield is not a prerequisite for value. Art, wine, gold, and non-yielding currencies are widely used as stores of value too. Yet all of these non-yielding assets have a clear material use besides being stores of value. This usefulness generates a “convenience yield”—the incentive for people to own them—that reflects both the utility a consumer derives from using these assets and the relative scarcity of that utility—a fact captured by Adam Smith’s famous Diamond-Water paradox.

We place assets on a continuum across time by their store of value properties. We identify stores of future value, like financial assets that offer the owner the right to future yields or the promise of growing value over time, stores of present value, like consumable commodities such as oil and grains for which the utility of driving and eating today imparts a convenience yield, and stores of past value, like gold, art or even housing in which the assets store value generated in the past because of their duration.

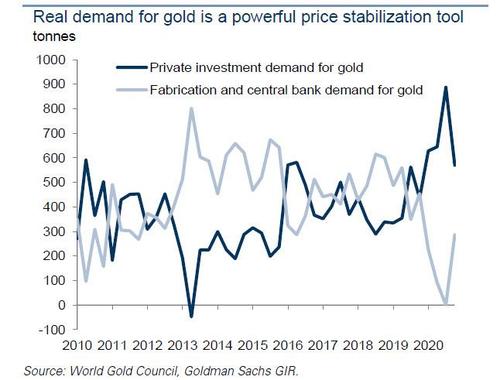

Value always stems from use

The key to stores of past value like gold and houses is that someone demanded these assets in the past and placed value in them by exchanging something of value, usually currency, for them. Indeed, all important non-yielding stores of value developed real uses before becoming investment assets. For instance, gold was first used as jewelry to signal permanence, commitment or immortality. The economic problem was a need to signal permanence, and gold’s durable and inert elemental properties solved that problem. Given the state of technology at the time, gold was the only solution for this problem, which explains why so many societies adopted it for this use.

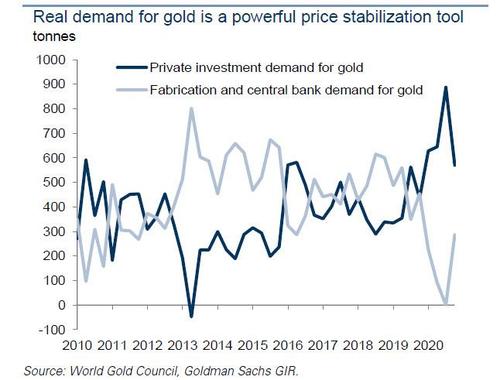

And when societies began to conquer each other and needed a means to standardize international trade, gold was the natural choice to solve this economic problem as most societies already owned gold and it was divisible. Real use is important for stores of value because consumption demand tends to be price-sensitive and therefore provides some offset to fluctuations in investment demand, tempering price volatility. For example, jewelry demand is the swing factor in the gold market, falling when investment demand for gold pushes prices higher, and vice versa.

Ether beats bitcoin as a store of value

Given the importance of real uses in determining store of value, ether has high chance of overtaking bitcoin as the dominant digital store of value. The Ethereum ecosystem supports smart contracts and provides developers a way to create new applications on its platform. Most decentralized finance (DeFi) applications are being built on the Ethereum network, and most non-fungible tokens (NFTs) issued today are purchased using ether. The greater number of transactions in ether versus bitcoin reflects this dominance. As cryptocurrency use in DeFi and NFTs becomes more widespread, ether will build its own first-mover advantage in applied crypto technology.

Ethereum can also be used to store almost any information securely and privately on a decentralized ledger. And this information can be tokenized and traded. This means that the Ethereum platform has the potential to become a large market for trusted information. We are seeing glimpses of that today with the sale of digital art and collectibles online through the use of NFTs. But this is a tiny peek at its actual practical uses. For example, individuals can store and sell their medical data through Ethereum to pharma research companies. A digital profile on Ethereum could contain personal data including asset ownership, medical history and even IP rights. Ethereum also has the benefit of running on a decentralized global server base rather than a centralized one like Amazon or Microsoft, possibly providing a solution to concerns about sharing personal data.

A major argument in favor of bitcoin as a store of value is its limited supply. But demand, not scarcity, drives the success of stores of value. No other store of value has a fixed supply. Gold supply has grown nearly ~2% pa for centuries, and it has remained an accepted store of value. Plenty of scarce elements like osmium are not stores of value. In fact, a fixed and limited supply risks driving up price volatility by incentivizing hoarding and forcing new buyers to outbid existing holders, potentially creating financial bubbles. More important than having a limited supply to preserve value is having a low risk of dramatic and unpredictable increases in new supply. And ether, for which the total supply is not capped, but annual supply growth is, meets this criterion.

Fast-moving technologies break first-mover advantage

The most common argument in favor of bitcoin maintaining its dominance over other cryptocurrencies is its first-mover advantage and large user base. But history has shown that in an industry with fast-changing technology and growing demand, a first-mover advantage is difficult to maintain. If an incumbent fails to adjust to shifting consumer preferences or competitors’ technological advances, they may lose their dominant position. Think of Myspace and Facebook, Netscape and Internet Explorer or Yahoo and Google.

For crypto networks themselves, active user numbers have been very volatile. During 2017/18, Ethereum was able to gain an active user base that was 80% the size of Bitcoin’s within one year. Ethereum’s governance structure, with a central developer team driving new proposals, may be best suited for today’s dynamic environment in which crypto technology is changing rapidly and systems that fail to upgrade quickly can become obsolete.

Indeed, Ethereum is undergoing much more rapid upgrades to its protocol than Bitcoin. Namely, Ethereum is currently transitioning from a Proof of Work (PoW) to a Proof of Stake (PoS) verification method. Proof of Stake has the advantage of dramatically increasing the energy efficiency of the system as it rewards miners based on the amount of ether holdings they choose to stake rather than their processing capacity, which will end the electricity-burning race for miner rewards. Bitcoin’s energy consumption is already the size of the Netherlands and could double if bitcoin prices rise to $100,000. This makes bitcoin investment challenging from an ESG perspective.

While PoS protocols raise security concerns due to the need for trusted supervisors in the verification process, Bitcoin is also not 100% secure. Four large Chinese mining pools control almost 60% of bitcoin supply and could in theory collude to verify a fake transaction. Ethereum too faces many risks and its ascendance to dominance is by no means guaranteed. For instance, if the Ethereum 2.0 upgrade is delayed, developers may choose to move to competing platforms. Equally, Bitcoin’s usability can potentially be improved with the introduction of the Lightning Network, a change of protocol to support smart contracts and a shift to PoS. All cryptocurrencies remain in early days with fast-changing technology and volatile user bases.

High vol is here to stay until real use drives value

The key difference between the current rally in crypto and the crypto bull market of 2017/18 is the presence of institutional investors—a sign that financial markets are starting to embrace crypto assets. But bitcoin’s volatility has remained persistently high, with prices falling 30% in one day in just this past week. Such volatility is unlikely to abate until bitcoin has an underlying real, economic use independent of price to smooth out periods of selling pressure. Indeed, more recently, institutional participation has slowed as reflected in lower inflows into crypto ETFs, while the outperformance of altcoins indicate that retail activity has once again taken center stage.

This shift from institutional adoption to increasing retail speculation is creating a market that is increasingly comparable to that of 2017/18, increasing the risk of a material correction. Only real demand that solves an economic problem will end this volatility and usher in a new mature era for crypto—one based upon economics rather than upon speculation.

Goldman’s conclusion: ethereum is the platform that solves economic problems here and now, while bitcoin is “a solution looking for a problem.” It’s also why two weeks ago, JPMorgan also laid out a bullish case for eth even as it has continued to slam bitcoin. As a reminder, JPMorgan’s quant Nick Panigirtzoglou laid out six reasons why ethereum is set to continue its ascent even if there is a crackdown on bitcoin by either China or the US:

- The European Investment Bank (EIB) used the ethereum blockchain to issue €100mn in two-year zero-coupon digital notes last week, its first ever digital bond. The transaction involved a series of bond tokens on the ethereum blockchain, where investors purchase and pay for the security tokens using traditional fiat. The EIB digital bond is surely very significant as it represents the endorsement of the ethereum blockchain by a major official institution.

- The first ethereum ETF (ETHH) was launched on April 20th by Purpose Investments in Canada and three more ethereum ETFs launches followed during the same month.

- The structural decline in ethereum supply from the pending introduction of protocol EIP1559 in the summer. EIP 1559‘s objective is to make transaction fees on the ethereum blockchain more predictable by introducing an automatically calculated base fee for all transactions depending on network activity. Once paid with ethereum, this fee would be immediately burned, implying reduced supply of ethereum in the future. Ethereum’s theoretically unlimited supply had been a concern in the past, with ethereum in circulation rising by 5% per year over the past three years. Via burning ethereum through base fees, EIP1559 could potentially reduce the annual change of ethereum in circulation to 1-2% per year.

- The greater focus by investors on ESG has shifted attention away from the energy intensive bitcoin blockchain to the ethereum blockchain, which in anticipation of Ethereum 2.0 is expected to become a lot more energy efficient by the end of 2022. Ethereum 2.0 involves a shift from an energy intensive Proof-of-Work validation mechanism to a much less intensive Proof-of-Stake validation mechanism. As a result, less computational power and energy consumption would be needed to maintain the ethereum network.

- The sharp growth of NFTs and stablecoins in recent months are increasing the usage of the ethereum which is already dominating the DeFi ecosystem.

- The rise in bond yields and the eventual normalization of monetary policy is putting downward pressure on bitcoin as a form of digital gold, the same way higher real yields have been putting downward pressure on traditional gold. With ethereum deriving its value from its applications, ranging from DeFi to gaming to NFTs and stablecoins, it appears less susceptible than bitcoin to higher real yields.

In short, while one doesn’t have to agree with Goldman or JPMorgan, these represent the institutional take. In other words, bitcoin and ethereum can co-exist and ostensibly become even more popular and eventually hit new all time highs (as a reminder FundStrat sees bitcoin hitting $100,000 and Ethereum rising to $10,500), but if the hammer hits and central banks in collaboration with local regulators decide to crackdown on crypto, what they will in fact be eliminating is the tax-evasion/money-laundering threat that bitcoin represents, while ethereum – and its various de-fi spinoffs – is left untouched. While that might mean ethereum has to find use within the demand confines of the so-called “establishment”, we doubt those who are long it will complain if Goldman is proven right and it becomes the “Amazon of trusted information”, one token trading at $20,000 or much more.