The Coming De-Urbanization Of America

Authored by Jim Geraghty via NationalReview.com,

Moving Out & Not Coming Back

Yesterday on my work Facebook page, a reader asked, “Why is it that the places Covid-19 show up the most are in Democrat controlled areas?” As much as I’d like to believe that all the troubles in the world can eventually be traced back to Bill de Blasio, I responded, “Probably because ‘the places it shows up the most’ are large densely-packed cities with a lot of international and domestic air travel and high use of mass transit, where Democrats have been winning elections more than Republicans for at least a generation and in many cases several generations.”

You can split red and blue America in a lot of ways — race, age, religiosity — but arguably the strongest factor is geography. The “Big Sort” that Bill Bishop described has been at work for two decades. Sure, there are conservatives and Republicans who live in big cities and inner-ring suburbs, just rarely in the numbers that could make a difference. And there are progressives and Democrats who live in rural areas and exurbs, but again, rarely in the numbers that could make a difference in elections.

Kevin Williamson has noted that conservatives often don’t even try to persuade city-dwellers of the value of their ideas, and lapse into a casual to overt contempt of life in the big city.

Meanwhile, it is not hard to find examples of urban progressives looking at rural America with a combination of contempt, disdain, pity, smug superiority… heck, it’s not hard to find urban progressives who see suburbanites as somehow inferior and worthy of scorn, never mind residents of small-town America.

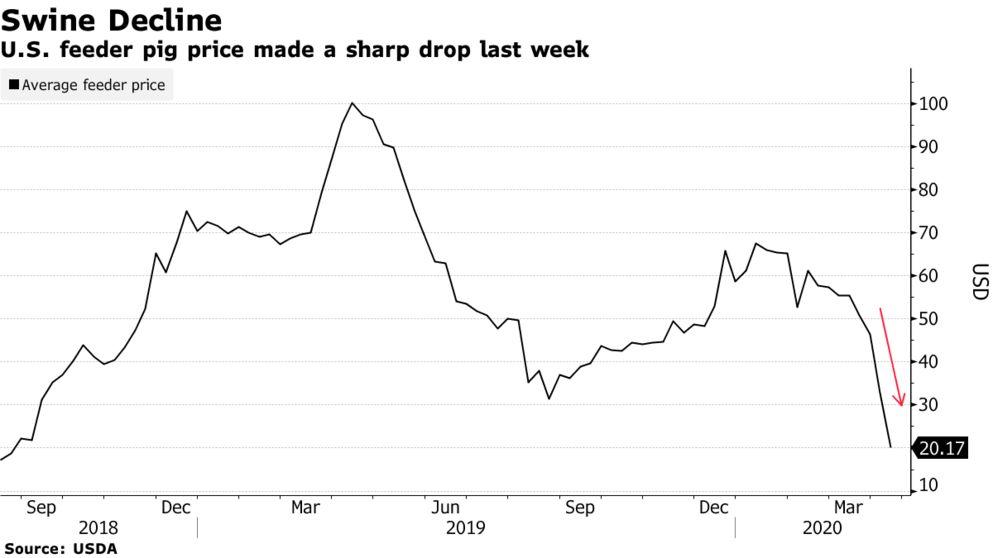

At some point the coronavirus crisis will end, but one of the extraordinarily difficult lessons of this ordeal is that the catastrophic scenarios that sound like something out of science fiction can happen in real life, and that the vast majority of us are at the mercy of fate in these scenarios. As mentioned last week, whichever way SARS-CoV-2 jumped into humans — a lab accident, wet markets, exotic-animal trader, a farmer using bat guano for fertilizer — it can happen again with another virus. Right now, as you are reading this, all around the world, scientists are working on dangerous viruses and pathogens in biosafety-level four, three, and two labs. Almost all wet markets are still open in China; all around Asia, the often-illegal trade in exotic species continues with minimal impediments; and farmers all around the world continue to use guano as fertilizer, prompting human beings to go into caves, and risk exposure to viruses that no human being has ever encountered before. Those viruses will probably be less deadly and contagious than SARS-CoV-2. But someday, humanity could encounter one that is even worse.

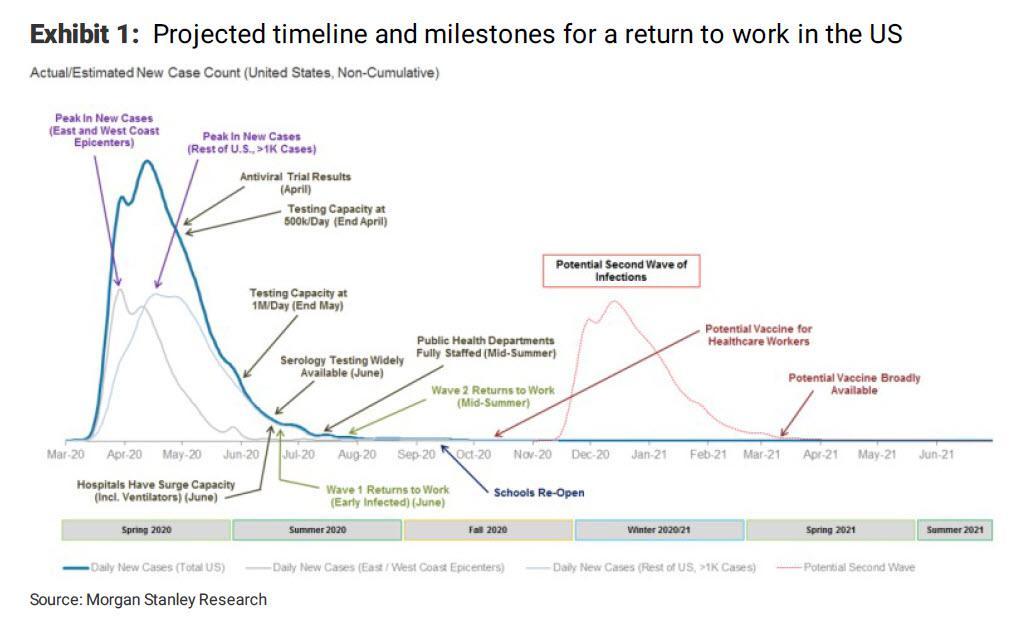

We will get through this crisis in a year or two. But we have no guarantee that additional pandemics aren’t waiting for us further along in this decade, or the next one, or the one after that. Maybe we’ll be lucky and the fudging-the-numbers-slightly meme declaring that we face a terrible plague once a century, in years ending in ’20, will turn out to be right.

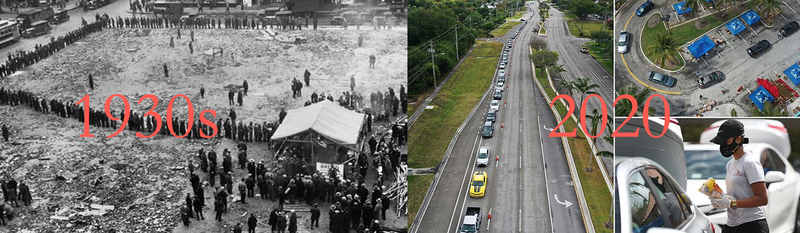

We in the United States never suffered another terror attack on the scale of 9/11, but that didn’t mean that the threat of terrorism did not shape our thinking for at least a decade afterwards, and probably even to today. We will be thinking about the risk of global pandemics and how to mitigate them for a long time to come. And that will start to influence Americans’ decisions about where they want to live.

Today in the Wall Street Journal, Anne Kadet writes about the New York City residents who are moving out, and not coming back:

They’re hardly the only family spurred by the pandemic to make a fast move, said Alison Bernstein, founder and president of Suburban Jungle, a company that specializes in matching city clients with their ideal suburban town, and helped the Usherenkos find their new home. “This whole thing is catastrophic and petrifying for families in urban areas,” she said. “People want out of the city and now.”

Ms. Bernstein said demand for her firm’s services is up 40% from the same period last year. Some are prompted by safety concerns. Others worry the shelter-in-place edict will drag on, confining them to small city apartments.

Carlo Siracusa, president of Residential Sales for N.J.-based Weichert Realtors said while inventory is low due to sellers pulling homes off the market, demand remains high because of a new wave of city dwellers shopping in the suburbs.

“They’ve been confined to a small space the last 45 days and want out,” he said. “There’s a sense of urgency.”

Are cities still worth it? Many will conclude they are. The opportunities are unparalleled, lots of jobs are there, the arts scenes are thriving, the professional sports teams are there. Nearby international airports allow you to get anywhere in the world fairly easily. Cities have more people closer together than towns and suburbs, so they just have more things going on — fascinating museums, festivals, marathons, concerts, pedestrian-only streets lined with quirky shops, distinct ethnic neighborhoods, small businesses, unique non-chain restaurants, skyscrapers and observation decks, broad boulevards, huge libraries, inviting public squares. Even the train stations can be beautiful. People who appreciate all the joys of a city — and who can still afford the cost of living — won’t easily give up all of that. Our cities will not empty out.

But they may shrink, and this outbreak is likely to accelerate the trend of seeing urban life as a luxury for the wealthy and young and a necessity for the poor and old.

Whatever you want to call the trend in urban planning over the past two or three decades — I’d characterize it as Richard-Florida-ization — it has reoriented American big cities’ offerings, enhancing their appeal to certain groups of people, often at the cost of other groups of people. Florida now gets mocked as “the Patron Saint of Avocado Toast,” but I think the demographic numbers don’t lie. Cities are terrific and exciting places for young people, particularly college students and recent college graduates, and double-income, no-kids couples — and probably retirees as well. But once a couple has a child, urban life becomes a lot more difficult and less appealing. A small apartment can become unbearable with a new baby. The public schools are hit-and-miss at best. Bigger kids want a yard to play in, or maybe a swing set. The cost of living starts to be prohibitive.

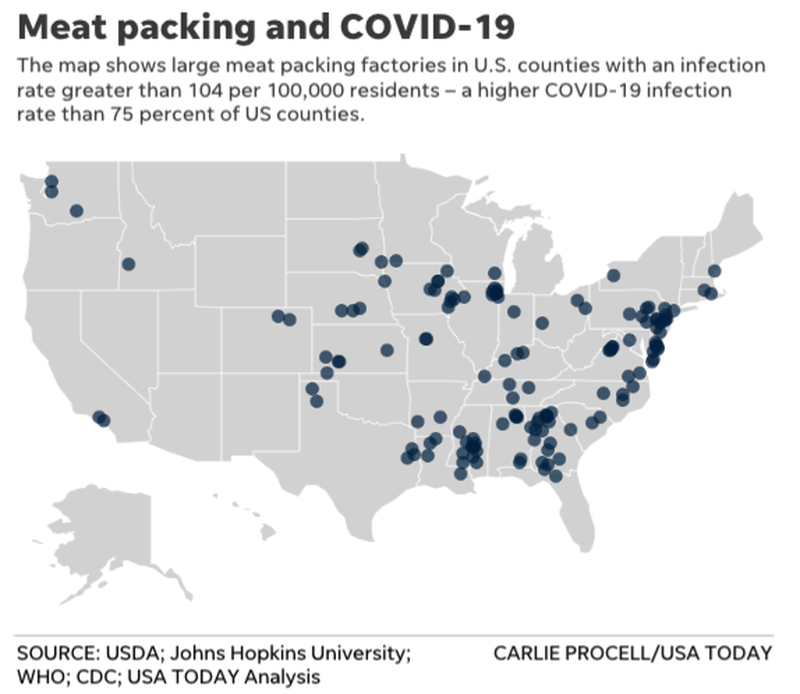

And now we are learning, once again, that densely packed cities are particularly dangerous places to be during a disease outbreak.

If you’re living in New York City right now, the good news is that you’re living amongst some of the best doctors and medical personnel in the world. But you probably live in an apartment. Leaving that apartment requires using an elevator (use a glove to touch the buttons) or the stairs (don’t touch the railings or doorknobs with your bare hands). Once you get on the street, you can try to keep space between yourself and everyone else, but there are just lots of people around. Advocates for public transportation insist the connection between the subway system and the virus is ‘tenuous,” but . . . how many other places are you forced into relatively close contact with lots of strangers with circulated air for a significant stretch of time? How many people use those stairway railings each day? How many people touch the turnstiles and subway poles?

Life in a small town or the suburbs is no guarantee of protection from the coronavirus. Tiny Cynthiana, Ky., population around 6,300, had a cluster of cases, fourteen in the town and surrounding county. My stretch of suburbia, Fairfax County, has 2,306 cases. But we’ve got 1.1 million people spread out over 406 square miles — roughly the size of Los Angeles. At least we can walk around our neighborhoods and the trails in the woods with minimal fear of exposure.*

The world has been forced to embrace telework and experiment with working from home like never before. The need for white-collar workers to all be in one central location – and paying some considerable rent for that office space – is shrinking before our eyes.

When authorities require or recommend you stay inside your home, your home becomes exponentially more important — not just a place to sleep and store your stuff. Kitchens matter when you’re cooking almost every meal at home. A yard, patio, deck, porch, or gazebo gives you the ability to enjoy fresh air within your own space.

Who knows if the coming year or two will have on-and-off social distancing and stay-at-home orders? All of those glorious amenities of the city aren’t that appealing if they’re closed.

Some reacted to the previous trend of the urbanization of America with satisfaction. After “White Flight” and “Brain Drain” and so many bad trends in American cities in the 1970s and 1980s, many urban areas were finally enjoying a renaissance. A handful became “innovation hubs for the knowledge economy” — New York City, Seattle, Austin, Boston, Silicon Valley — enjoying an explosion of jobs — with a much slower increase in the amount of available housing. Rents and the cost of real estate skyrocketed, creating glittering cities with much of the rest of America on the outside looking in.

And now some people in the cities may not want to live in them anymore.

“Blue America” might be moving to the suburbs or right into “Red America” – and maybe we would be better off if we saw each other as neighbors, instead of rivals in a never-ending culture war.

* * *

ADDENDUM: It will probably not surprise you to learn I think Senator Tom Cotton has the assessment of the likelihood of SARS-CoV-2 arising from an accidental exposure of a naturally occurring virus just about right:

While the Chinese government denies the possibility of a lab leak, its actions tell a different story. The Chinese military posted its top epidemiologist to the Institute of Virology in January. In February Chairman Xi Jinping urged swift implementation of new biosafety rules to govern pathogens in laboratory settings. Academic papers about the virus’s origins are now subject to prior restraint by the government.

In early January, enforcers threatened doctors who warned their colleagues about the virus. Among them was Li Wenliang, who died of Covid-19 in February. Laboratories working to sequence the virus’s genetic code were ordered to destroy their samples. The laboratory that first published the virus’s genome was shut down, Hong Kong’s South China Morning Post reported in February.

This evidence is circumstantial, to be sure, but it all points toward the Wuhan labs. Thanks to the Chinese coverup, we may never have direct, conclusive evidence—intelligence rarely works that way—but Americans justifiably can use common sense to follow the inherent logic of events to their likely conclusion.

Tyler Durden

Sat, 04/25/2020 – 14:40

via ZeroHedge News https://ift.tt/2KzmJ3I Tyler Durden