The Three D’s Of Recession Severity

Via Economic Cycle Research Institute (ECRI),

This may already feel like a brutal recession. But in one respect it may not be as bad as many think.

To understand why, you need to understand how a recession’s severity is measured. We have to look at the Three D’s: depth, diffusion and duration.

In terms of depth, this recession is extraordinarily deep. Already, 26.5 million people have filed for jobless claims, compared with a total of 8.7 million jobs lost during the Great Recession. And it’s not over.

Of course, a recession is really a vicious cycle, with declines in output triggering job losses, declining incomes and falling sales, which feeds back into a further drop in output.

This is integral to the diffusion of weakness across the economy – how it spreads like wildfire, cascading from industry to industry, and region to region in the country. In terms of diffusion, this recession is certainly severe, affecting a wide range of industries.

But on the third “D,” duration, this recession could be among the shortest on record. Here’s why.

With economic activity plunging so deeply, even a slow, partial opening up of the economy would lift activity off those extreme lows.

This is where good leading indexes are critical.

Full ECRI interview with @seemacnbc on @TradingNation here: https://t.co/JMFWQhRLg6

— Lakshman Achuthan (@businesscycle) April 23, 2020

Such leading indexes will reveal if the recessionary vicious cycle will flip to a virtuous cycle of a self-feeding recovery.

In that case, the recession could end by summertime. If so, this would be among the shortest recessions on record, closer to half a year, compared with a year and a half for the Great Recession.

And while that sounds downright optimistic, the end of recession is only the start of a recovery, probably with double-digit unemployment rates, which are unlikely to plunge in short order. So, things won’t get back to “normal” anytime soon.

In the second week of March on Trading Nation we took a look at the growth in ECRI’s Industrial Price Index for commodities –both those that are speculative and traded on exchanges, and other key industrial inputs that aren’t exchange-traded, and are therefore non-speculative but based on hard data on supply chain dynamics in the real economy.

Back then, I said that, if non-speculative commodity price growth held up, it would indicate that the coronavirus was not sparking a recession, but that the situation needed to be very closely monitored.

Soon after that hit, non-speculative commodity price inflation did start to plunge, and it’s still sliding, with the latest reading at its lowest point since late 2015.

As of today, it’s not yet signaling a near-term recovery, but we’re keeping a close eye on this and our other high-frequency leading indexes.

The recession’s all about the three D’s: depth, diffusion and duration. Read @StephLandsman‘s article and watch today’s interview with @seemacnbc here: https://t.co/KTjrTWe7Kz

— Lakshman Achuthan (@businesscycle) April 23, 2020

* * *

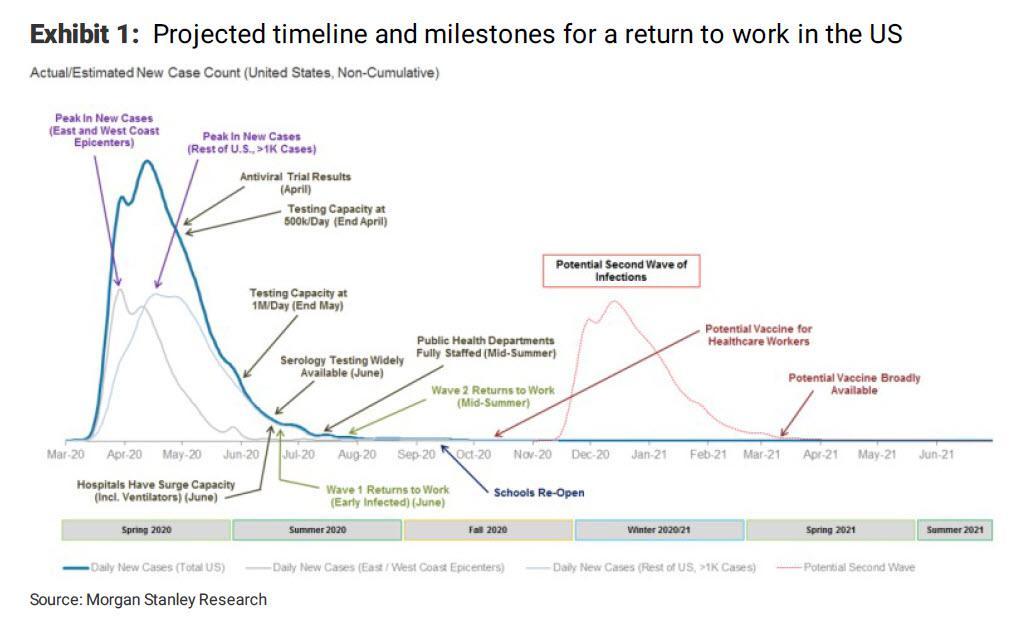

[ZH: However, as we have detailed recently, if – as expected, a second wave of the virus is seen, forget the hopes of a V-shaped recovery but more of a U-shaped or even L-shaped.]

Better hope a second wave can be thwarted, if not, a double-dip depression could be in the cards.

Tyler Durden

Sat, 04/25/2020 – 13:50

via ZeroHedge News https://ift.tt/2W2fars Tyler Durden