“This Is The Final Leg”: Hugh Hendry Takes A Break From Retirement To Reveal His Latest Market Thoughts

In September 2017, Hugh Hendry stunned the world when, out of the blue one of the best investors of his generation shut down his hedge fund Eclectica (his farewell letter can be found is here) disgusted with how broken and impossible to navigate capital markets had become as a result of central bank intervention and retired to the warm embrace of St Barts, even though it was clear he still had much left to say about the investing process.

And so, after keeping a low profile for nearly three years, overnight the contrarian investor penned a lengthy tweetstorm from his his brand new twitter account, touching on all the latest market development and laying out some of his latest investing ideas. Below, we have aggregated his thoughts for the benefit of all those curious what the Scotsman thinks about when he is not pursuing his retirement interests which according to this twitter profile include “luxury real-estate, mentoring, and paddle-surfing.”

Never one to disappoint, Hendry reverts to his macro roots, discussing the fate of gold and the dollar in the helicopter money regime, what it would take for the S&P to hit 10,000, whether the entire VIX regime is now inverted due to central bank backstops, and asks the “two key questions”: are we transcending from a bull market in fear to a bull market in WTF!? And will QE infinity differ from its previous vintages by driving risk asset volatility levels higher??

Hendry also touches on an old favorite topic, namely hyperinflation, a thesis which he thinks “needs stock prices to fall further and vol to rise in the conventional manner.” But his most topical observation is what are the core criteria that will allow MMT – i.e., that fusion of the Fed and Treasury known as “helicopter money”…

you can print as many dollars as you damn well please, as long as the yield curve doesn’t steepen and the dollar doesn’t rally precipitously…you’re good to go and MMT is dope.

… as the alternative is game over. As usual, his stream of consciousness answers, right or wrong, are fascinating.

The full stream is reproduced below:

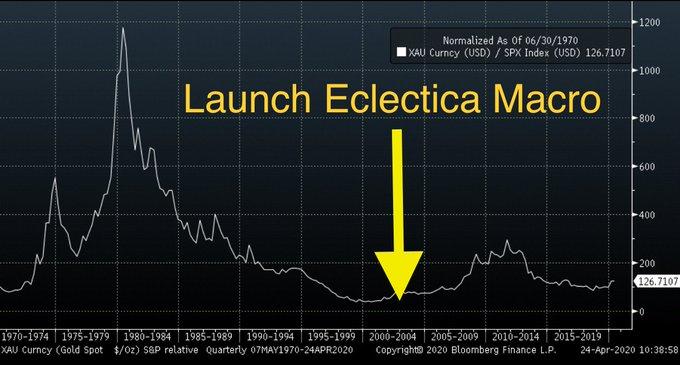

I have spent last few weeks reminiscing about the launch of The Eclectica Fund way back in 2002. Our principal objective back then was to secure the flexibility of a macro mandate to capture the emerging bull market in gold. The chart is not vol. adjusted but provides context.

It’s remarkable how little time i allocated to the trade. We did make 50pc in the first calendar year, 2003, but then retreated as it traded flat vs the total return from the SPX 2004/6. But I do kick myself at missing the final explosive moves to the all time high 2009/12.

I’ve had a long sabbatical. If you remember my mantra from 2005 became, “if you fear inflation, buy bonds!” The reasoning being that gold would lack an explosive pulse higher without first an economic calamnity. 2008 proved our thesis and our bond-like positioning hit jackpot.

Today however, “if you fear inflation then you should buy more gold”. It is simple. The Fed is trying to debase the $ to help the economy. Will it help? Maybe. Will it help the stock market? Probably. Will it help gold? Definitely. This is the final leg that i envisaged in 2002.

So gold’s got your back. My only grumble is that it reverts to a short volatility asset at the most inopportune moments like October 2008. Many good men, myself included, then missed the real action. So don’t underestimate the emotional energy you’re gonna need to hold onto this.

I say this because unusual things are happening and I’m saying “what if the bull market in fear has peaked and we find ourselves in a bull market of WTF!?” I traded at start of April a long Aug / Short Oct Vix. I’m small offside. But a 12pc equity rally and vol is up! WTF!?

I’m fomenting the idea that negative interest rates beget negative oil prices beget negative volatility. The causation is of course totally false but its a cute thing to say nevertheless. Let’s see if i can do better?

The probabilities are high that gold proves rewarding as long as you can carry it for the duration of the journey. If you are willing to accept lower, much lower probabilities, then maybe there are even better trades that are insanely convex and have no counterparty risk.

What I want to say is that 2 universal truths might be in the process of changing or flipping around. First, that option skew might change – deep OTM equity puts are typically 2x more expensive than their call equivalents; always have been but not ordained to stay that way. I think today’s policy response could create the opposite dynamic. Difficult trade to structure selling deep OTM SPX puts to buy 2x more calls without risking bankruptcy. Sure trade at cash SPX 1700 but naked and have to experience the nightmare of every point below 1700…no way

I traded this in Japan in 2013 Sold deep OTM Nikkei put, bought an even deeper OTM put, sold an ATM call spread and bought 15pc OTM call. Or at least I think i did. But the older vintages of QE encouraged volatility to fall, not rise, and we never burst through the inertia.

The trade was therefore before its time but I am probably one of the few risk managers anywhere with the experience of running a big options/futures book that was seeking higher equity prices and higher volatility – just ask all the Japanese vol traders that I enriched…

Second, I think the futures curve for VIX is going to trade in backwardation; that the carry from short selling future volatility versus spot to a gullible public that was only too willing to pay almost anything to protect themselves against the next deflationary event has gone.

The key questions: are we transcending from a bull market in fear to a bull market in WTF!? And will QE infinity differ from its previous vintages by driving risk asset volatility levels higher??

The key is the dollar. It is to the Fed what the punitive gold reparations of the 1920 Paris Peace Accord were to the German Reichsbank and German stock prices. Which is to say that the Fed are going to have to issue many more trillions of dollars to stop the USD moving higher.

We were wrong. All of us. It was never going to be about soulless creditors rolling over and simply enriching debtors via paying them higher and higher wages like Henry Ford. No; changes, BIG changes, in major price regimes always begin with currency debasements.

And, remember that the dollar short is ALWAYS the largest short position. Foreign mismatching of dollar asset/liabilities is always the imperative justification to devalue the dollar to bail-out the rest-of-the-world and it always sets the stage for risk asset prices to recover.

It’s just that a 35% fall from the highs of the greatest bull market ever has precipitated c. $8trillion in global fiscal response and probably 5x that in its monetary equivalent if we consider swap lines etc with not a day passing where that figure seems like an understatement. And then you look at the charts and to quote Raoul Pal, who else cause he seems omnipresent, but the blinking dollar hasn’t blinked; not an inch, its barely sold off at all…that’s downright frightening.

And so here is where it gets really cookie for I believe you can’t forecast a risk recovery that witnesses the SPX reclaim its all time high. No. If that’s your mindset you have to imagine 2x or why not 3x? The SPX at 10,000 now that is a WTF idea!?

And I’m tiring now but I just don’t see that outcome materialising unless we see another profound, I want to say debilitating, decline in the SPX below 1700. That’s why I don’t like the gold trade on its own without some kind of long vol trade to cushion if not enrich the journey.

So maybe sell dollar cross or treasury vol as these are the naval plimsoll lines of MMT: you can print as many dollars as you damn well please, as long as the yield curve doesn’t steepen and the dollar doesn’t rally precipitously…you’re good to go and MMT is dope.

So we know the critical lines, the levels that absolutely must not be crossed, they, the authorities, and us, we all know it. The Fed has to, and will do, everything in its powers to flatten the yield curve and prevent the dollar appreciating from here.

And the consequences of their actions will be to becalm volatility in these assets making them a good source to fund, in the first instance, equity volatility, as I think the hyperinflation thesis needs stock prices to fall further and vol to rise in the conventional manner.

But should this happen I would want to buy those incredibly cheap Dec 21 3000 calls and forget about funding via selling OTM puts; but I’m getting way to far ahead of myself…you see what confinement does?

Hendry concludes with some “regional” observations, including what Hendry’s “macro volatility trade at World’s End for years” has been, and which nonetheless are just as interesting:

Where are all the customers’ yachts? I got to tell you that they seem to be en-route to St Barts. No cases of the virus in over a month on the island and from my vantage point, over-looking the sea, there isn’t a day that passes without another mega yacht sailing past my house.

The island is hard, almost impossible, to reach, unless you can charter a boat or your very own private jet. But where else would you rather stay if money is no option? The island is on the same time zone as NYC and it has the holy trinity of no debt, no taxes and no crime,

And you can still finance the purchase of properties here with 20 year €uro loans fixed for less than 2%! That’s not going to last forever…St Barts has been my macro volatility trade at World’s End for years

Like my German industrialist forefathers – I have no German ancestry ! although my name is derived from the German word hug meaning heart, mind and spirit – but markets, bankers and investors are always slow to recognise a transition to higher prices caused by currency debasement/

When i was younger i read all those stories of international investors – the smart ones – hoovering up hard, cash producing German assets, funded by bankers who severely underestimated the potential for increases in interest rates that would make their loan books worthless…

Yet here we are 100 years later and my friend, who works in a restaurant, just secured 1.35PC fixed for 20 years! These loans are sure to become worthless as the pendulum finally swings from the creditor to the debtor community. Maybe we’re all bank robbers now…WTF!!

Still want more? Then listen to the following 12 minute podcast Hendry recorded last week, and where every sentence seems to seep with nostalgia for the Scott’s glory investing days.

Who knows, maybe if the market remains volatile enough, Hugh will come emergy from retirement for another try?

Tyler Durden

Sat, 04/25/2020 – 13:25

via ZeroHedge News https://ift.tt/3cEMT10 Tyler Durden