Schiff: People Are Still Too Focused On The ‘Pin’ & Not The ‘Bubble’

There seems to be some optimism in the markets that the end of the coronavirus shutdown is getting closer. There is also this resistant myth that the economy will just fire back up at the snap of a finger. Peter Schiff recently appeared on RT Boom Bust along with Christy Ai to talk about the markets and the pandemic.

He said people are still far too focused on the pin and not the bubble that it popped.

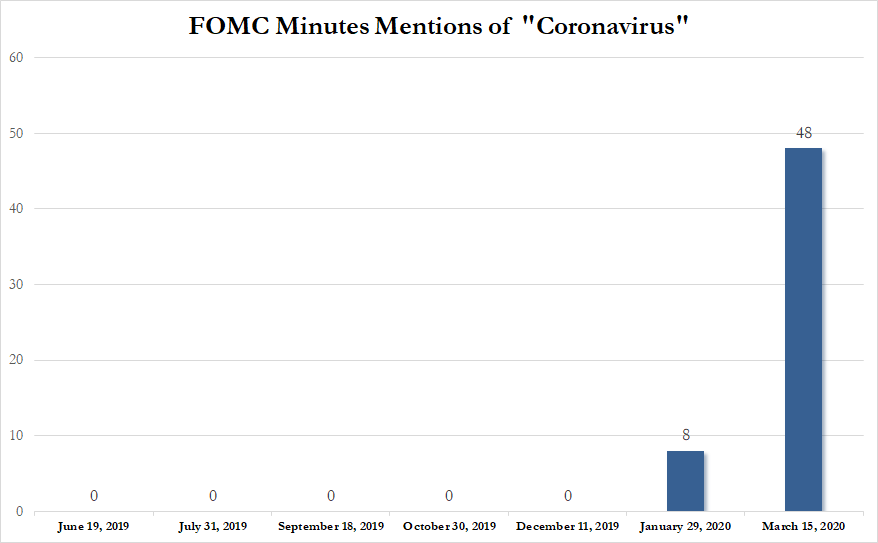

The US stock market has had some strong rally days recently with this growing optimism that we could be nearing the coronavirus peak. So, has the stock market found its bottom? Peter doesn’t think so.

Too many people are focused on the pin and are ignoring the bubble that the pin pricked. You know, before the COVID-19 shutdown, the economy was long overdue for a severe recession, and the US stock market was long overdue for a bear market. So, I think the COVID virus simply accelerated the onset of both…

So I would not get excited about this rally. I think we still have a long way to go on the downside. And the economy, I think, is going to be even worse.”

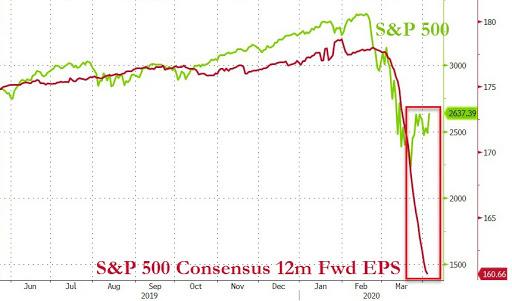

Christy agreed with Peter saying this is not the real bounce and we still have a long way drop. She pointed out that earnings still have a long way to fall and there is a massive unemployment tail from the pandemic.

Peter was asked about the response to the government stimulus package signed by President Trump.

As you would expect, a lot of people are trying to line up for whatever free money the government is handing out. But it’s not free. There’s going to be a heavy price to be paid in terms of the loss of purchasing power of the US dollar as prices respond to all the new money being created.”

Peter said the programs are also doing far more harm than good.

What they are doing is exacerbating the downturn and they are going to push the recovery off even further into the future because the government is basically encouraging businesses that should be downsizing and kind of adjusting their cost structure to the new reality — instead, the government is encouraging them to hold on to employees that they would be better off letting go and freeing up to do something else.

Instead, they are going to keep some employees entrenched in companies that are probably going to end up failing because they refuse to lay off people. And so instead, they are going to have to lay off even more people later.

And I think a lot of these loans are never going to be repaid because even the people that don’t fire their workers, a lot of these businesses are going to go out of business because they didn’t fire their workers and then everybody’s going to be out of a job. And the government is not going to get any money back because the loans have no security and there’s no personal guarantee.”

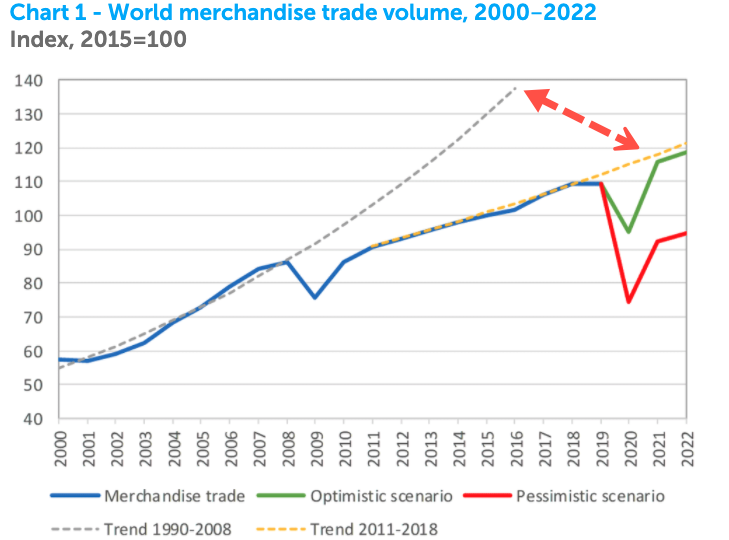

Christy reiterated that the tail of the coronavirus is very long and will be very long-lasting. It won’t be a V-shaped recovery as many seem to expect. We have both a severe supply shock that is morphing into a demand shock.

On the day of the show, both gold and stocks were in the midst of strong rallies. Peter was asked why gold was up when it seemed to be a “risk-on” day.

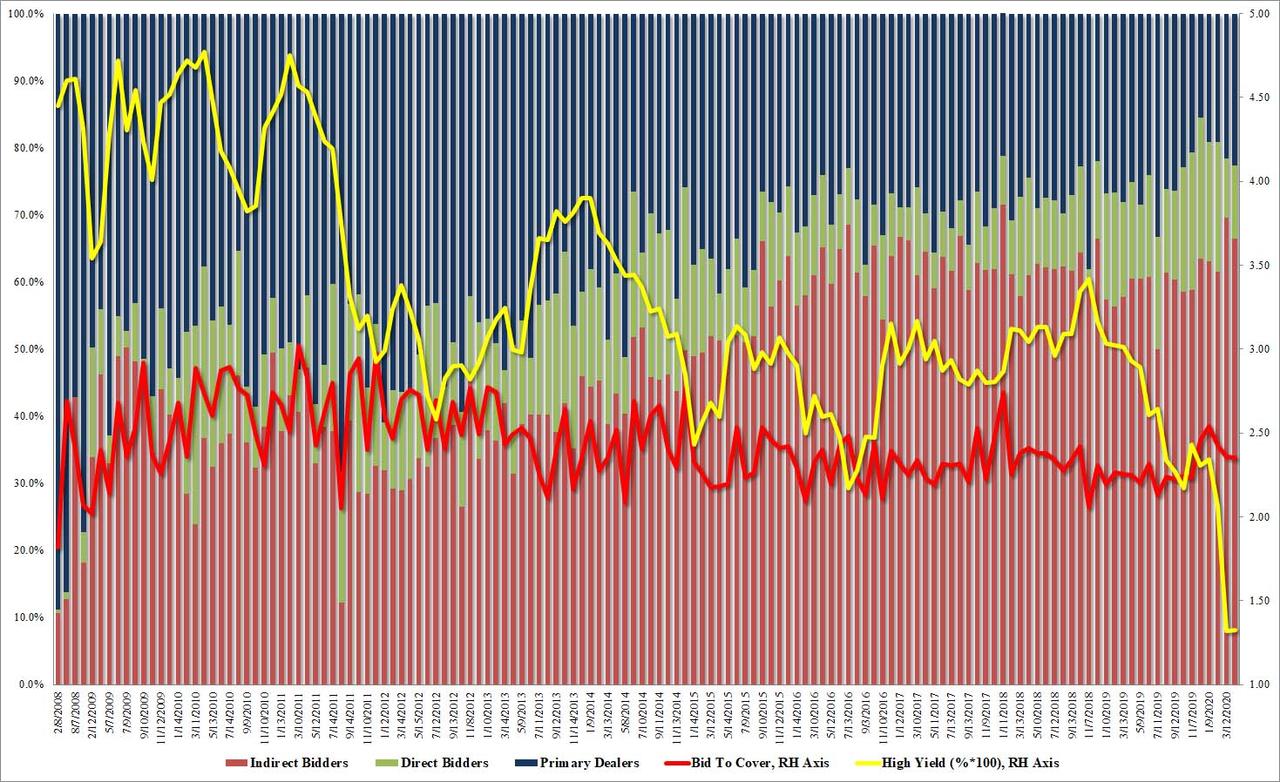

I think the risk is inflation. The only thing that’s propping up the stock market is the Fed and other central banks printing money, which is creating inflation. So, you don’t have earnings going for the stock market. All you have is all the cheap money that’s being created. And inflation is much better for gold than it is for the stock market. And so, that’s why both stocks and gold are going up.

But I think eventually, gold is going to be going up much more than the stock market and I think gold is going to be going up even as the stock market rolls over and goes down. So, I think in terms of gold, stock prices are going to continue to fall. In fact, they’re going to fall precipitously regardless of what happens to nominal stock prices because of the massive inflation being unleashed by the Fed and other central banks.”

Tyler Durden

Wed, 04/08/2020 – 14:20

via ZeroHedge News https://ift.tt/2XkdJHh Tyler Durden