This Is Where The World Is On The “Corona Curve” At This Moment: An Update

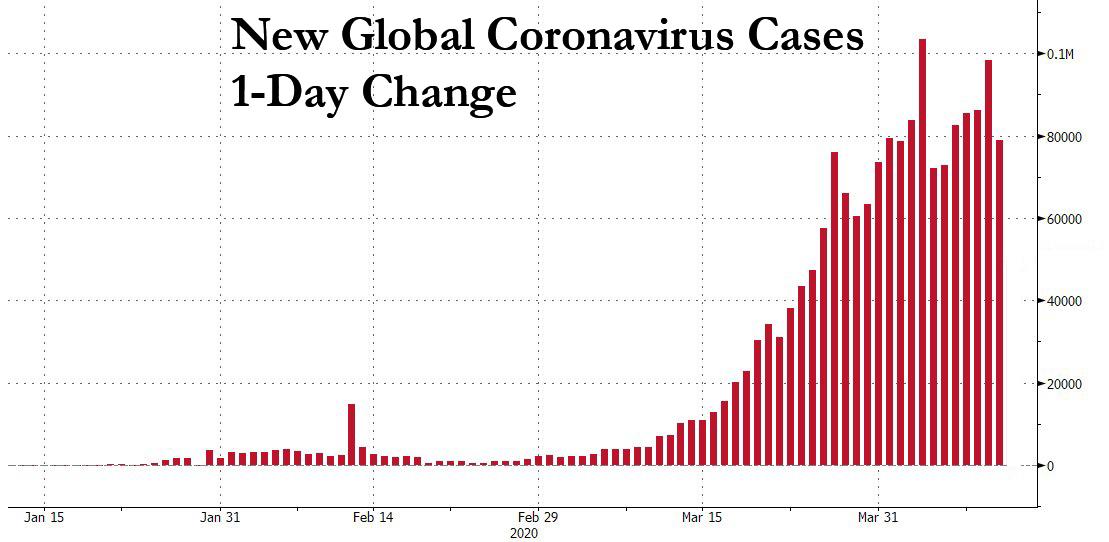

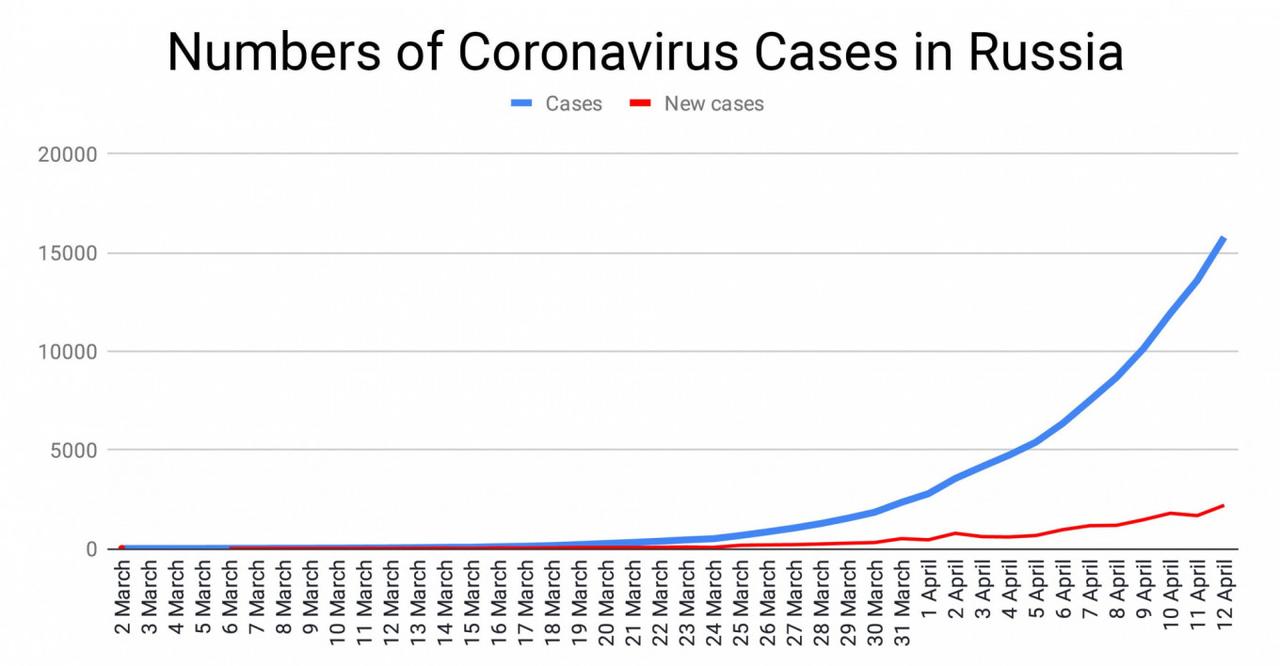

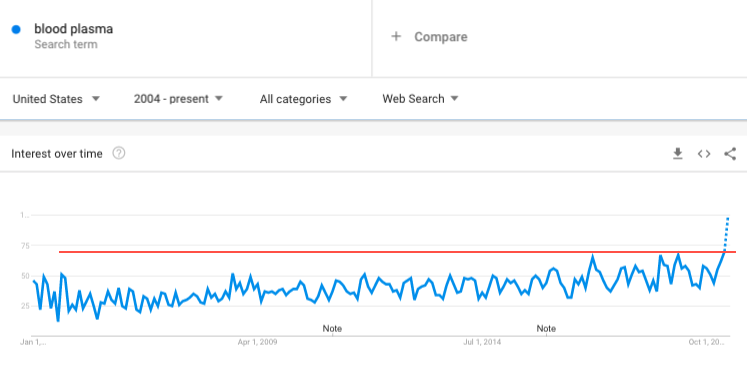

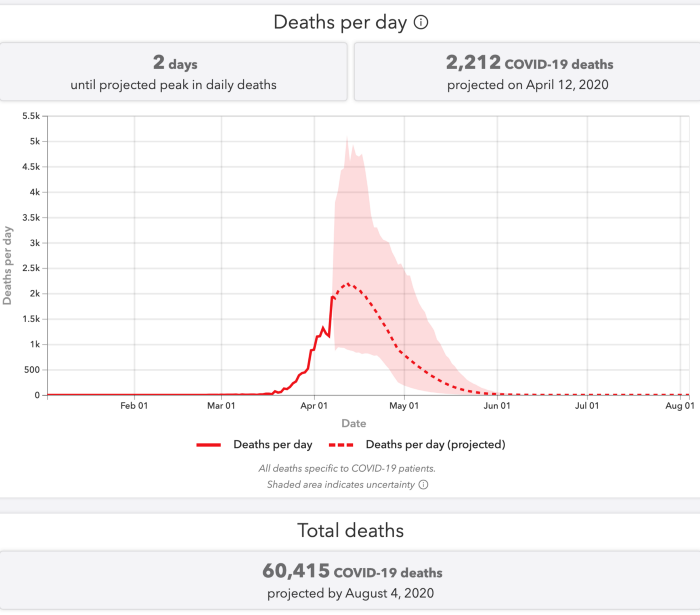

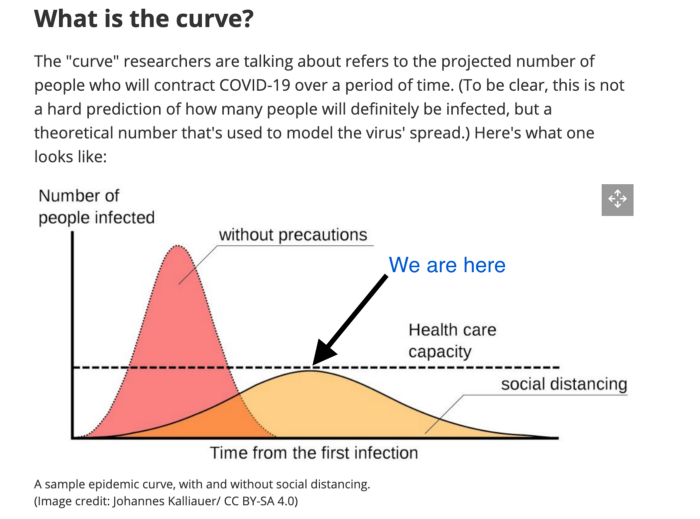

Last week, when we looked at the latest shape of the Coronavirus curve, we said that even as US cases continue to soar, “the light at the end of the tunnel is now visible” and indeed as JPMorgan’s MW Kim writes in his latest Covid-19 update note published late last week, the global infection growth is showing early signs of slowing (53% W/W vs. 95% W/W two weeks ago), according to Johns Hopkins data, according to which the number of global confirmed cases is set to surpass 2 million in the coming days.

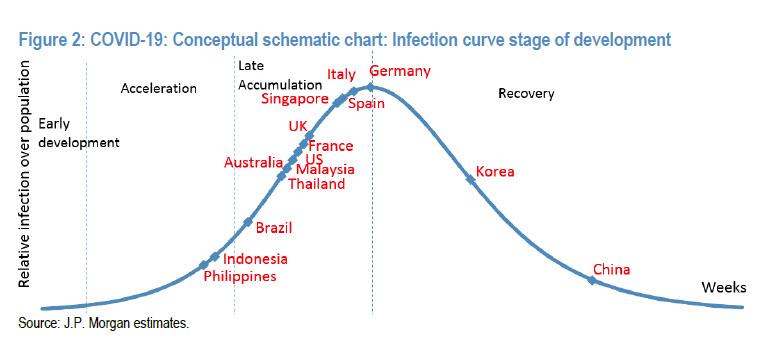

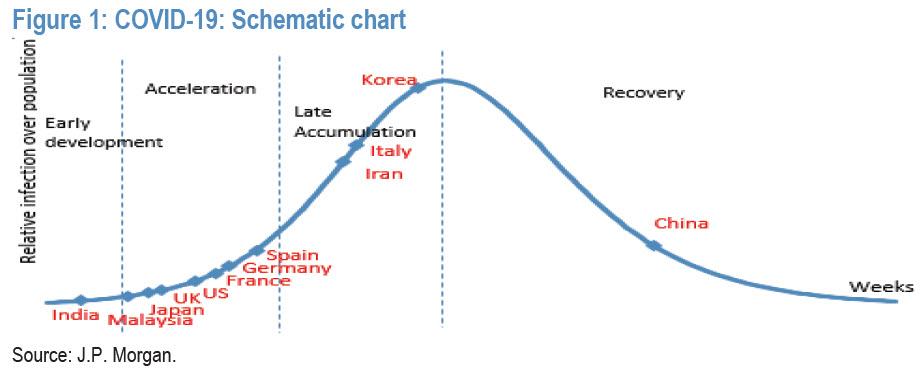

This reduction in new cases is the result of a sharp drop in the number of susceptible targets (i.e., cutting new contacts), which means that curve control is working with both China and Korea now well into the recovery stage, while Germany, Spain and Italy are at or near the curve peak, with US, France, the UK and several other nations close behind.

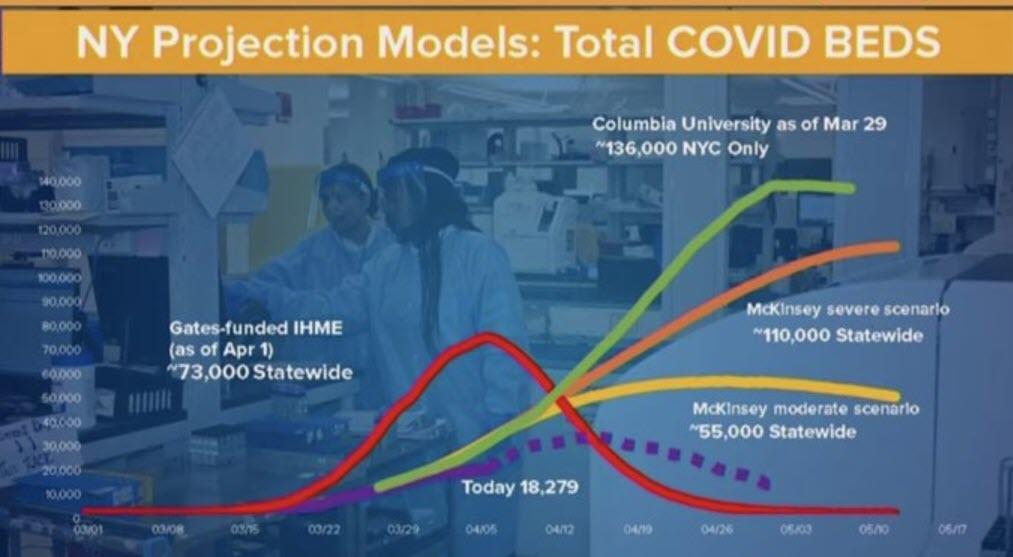

This is certainly impressive considering what the curve looked like just two weeks ago:

In other words, the first wave of coronavirus infections appears to be plateauing as a result of a sharp, forced reduction in secondary infection rates, or R-0. This has been achieved in three ways:

- Reducing susceptibles: an accurate vaccine targeting COVID-19 could reduce the initial susceptible (or S0) with smaller/slower infection development similar to seasonal flu.

- Shortening the infection period: certain therapies for COVID-19 could shorten the period of recovery (or duration of infection). As a result, this could lower the secondary infection rate (or Ro) compared to the initial infection curve experience without the treatment.

- Lowering the transmission rate: The transmission rate (or beat) can be reduced by encouraging a higher level of hygiene adoption including wearing masks. Given the transmission rate is the combination of (1) average contact rate between susceptible and infectious and (2) the probability of transmission, wearing a mask could lower the probability of transmission.

With that in mind, JPMorgan looked at some new development in the coronavirus therapeutic approach (or possible way to reduce the recovery period) and updates its thoughts on the wearing of masks (or possible ways to lower the probability of transmission).

- Control of Cytokine storm as a therapeutic approach. Cytokine storm, an overproduction of immune cells and their activating compounds (cytokines), is believed to be responsible for acute respiratory distress syndrome (ARDS) and multiple organ failure in severe COVID-19 patients. Therefore, some companies intend to develop drugs targeting the production of cytokine in COVID-19; including Siltuximab, an FDA and EMA-approved interleukin (IL)-6 mAB developed by EUSA Pharma with encouraging preliminary efficacy; Kevzara (IL-6 mAB) by Regeneron and Sanofi (currently in Phase II/III); TJM2 (anti GM-CSF) by Chinese biotech I-MAB (received IND clearance from the FDA); and Jakafi by Incyte (in collaboration with Novartis), a JAK-1/2 inhibitor approved for polycythemia vera (PV) and graft-versus-host disease (GVHD) (recently initiated Phase III trial in COVID-19).

- Masks or no masks in public places during COVID-19? JPM’s opinion is that reducing the number of people exposed to those infected should be the primary strategy for curve control. Wearing a mask as a supplementary measure to reduce the transmission rate is also topical. In countries like China and Korea, wearing masks is recommended in public places to reduce the risk of infection, while public health agencies in the West have generally recommended wearing masks only for healthcare workers and the sick. The US CDC recently revised its stance and recommends people to wear face coverings in public places. We believe wearing a mask properly (which doesn’t require special skills and only takes education) will lower the risk of infection, given the transmission might occur via droplets, which can be controlled by preventing touching one’s face with one’s hands.

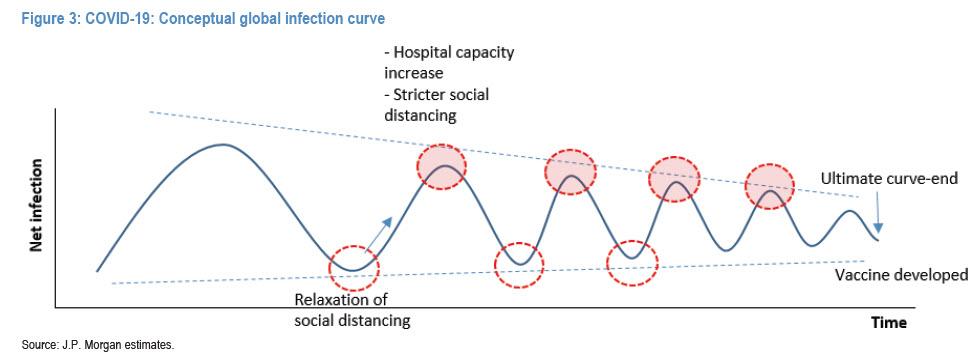

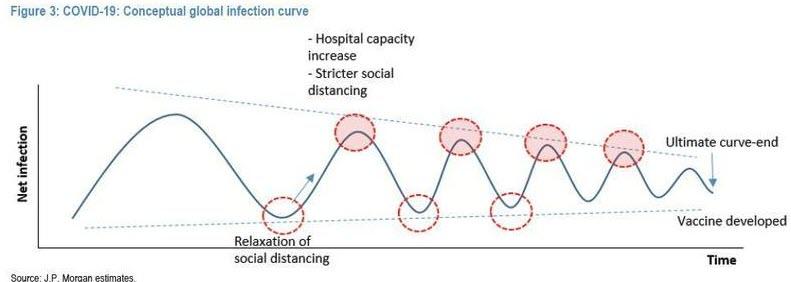

JPM’s conclusion is that reducing the susceptible (i.e., cutting new contacts) should remain the prime strategy. Herd immunity might be considered an option once a vaccine becomes available. However, there are concerns about a possible series of infection waves following relaxation of social distancing rules. Hence, based on the bank’s epidemiology modelling framework, shortening the infection period (i.e., therapies: production of cytokine in COVID-19) and lowering the transmission rate (i.e., wearing masks) could be extra mitigating factors.

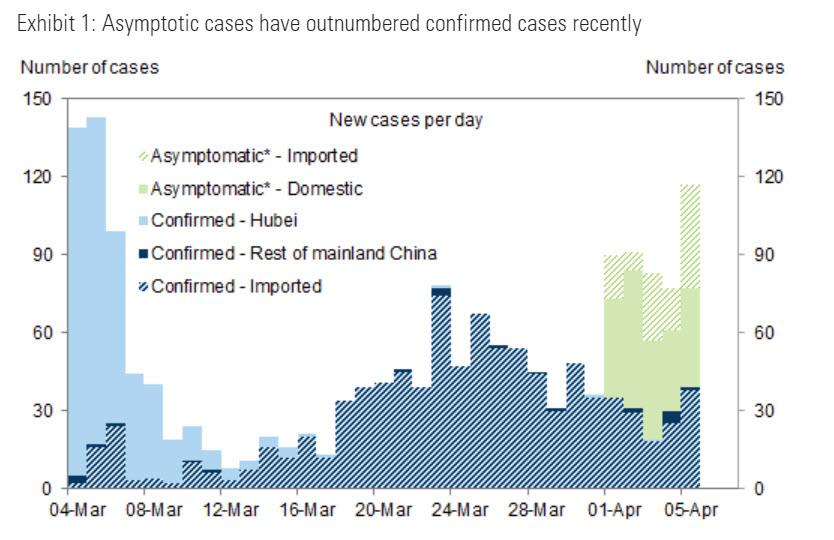

And speaking of the second wave of infections, there are some not so good news: China appears to be experiencing a rebound in new cases and the onset of the dreaded second wave, although it is still early to determine if there is a sufficiently high number of new cases for Beijing to seek a renewed shuttering of the economy (it is unlikely China will pursue this option until it is again too late and the real number of cases has soared). In any case this dynamic has to be watched closely.

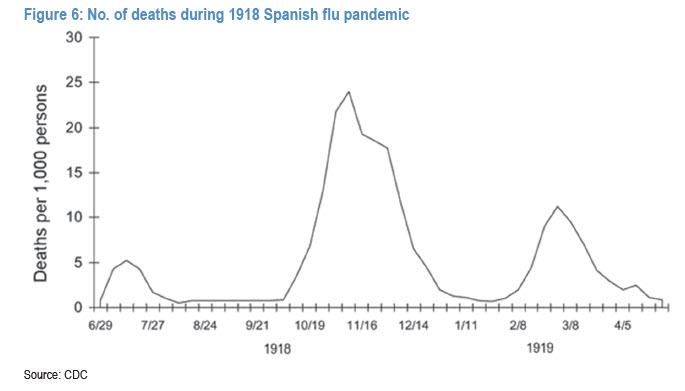

Which then brings us to the $64 trillion (not that far off from global GDP) question: is the coming “second reinfection wave” going to be smaller or bigger – similar to the Spanish Flu pandemic – where deaths in the second wave were 5x greater than those from the first?

Here JPM believes that next waves could be at a smaller amplitude with lower mortality rate potential compared to the current first wave. This is due to (1) strong risk awareness among stakeholders; (2) faster government response potential at the infection tipping point; and (3) enhanced risk manual at the containment stage. However, even a substantially reduced amplitude of wave 2 (and 3 and 4), suggest that ongoing economic shutdowns will be recurring feature of life for quarters if not years!

The amplitude could be higher, however, a la the Spanish Flu pandemic, if it turns out that the life cycle of the coronavirus is far longer than assumed. As JPM noted last week, the COVID-19 infection life cycle could last for 4-5 weeks including a 2-week incubation period.

The bottom line, and somewhat counterintuitively, the sooner the world declares victory against the Wu Flu, the faster the general population will rush back into “social un-distancing”, sparking new case clusters as the infection restarts from scratch, forcing authorities to re-establish social distancing once again, and so on, as the entire process repeats from square one.

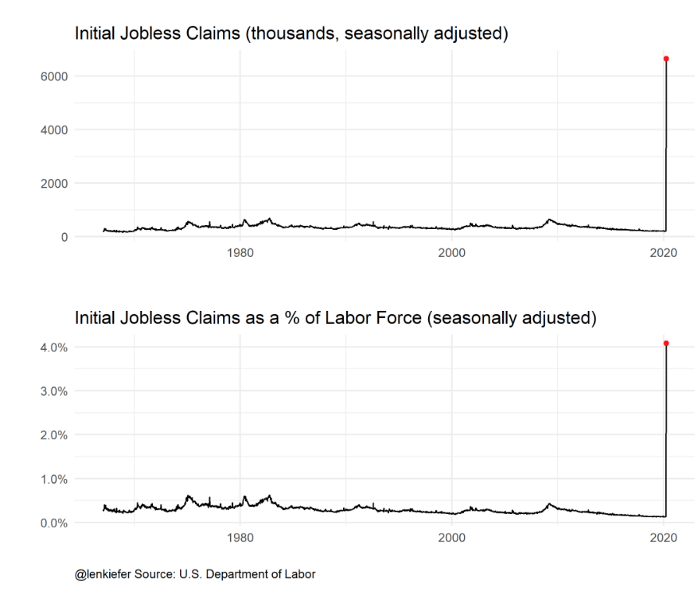

Which brings us to the latest assessment made from Minneapolis Fed chief and former Goldman and PIMCO staffer, Neel Kashkari who has somehow also emerged as a budding epidemiologist and who today warned that without an effective therapy or a vaccine for the novel coronavirus, the US economy could face 18 months of “rolling shutdowns” as the outbreak recedes and flares up again.

“We’re looking around the world. As they relax the economic controls, the virus flares back up again,” the 2020 FOMC voter Kashkari said Sunday on CBS’s “Face the Nation.” Kashkari “We could have these waves of flareups, controls, flareups and controls until we actually get a therapy or a vaccine. I think we should all be focusing on an 18-month strategy for our health care system and our economy.”

Kashkari warned that “this could be a long hard road that we have ahead of us until we get either to an effective therapy or a vaccine. It’s hard for me to see a V-shaped recovery under that scenario,” he said.

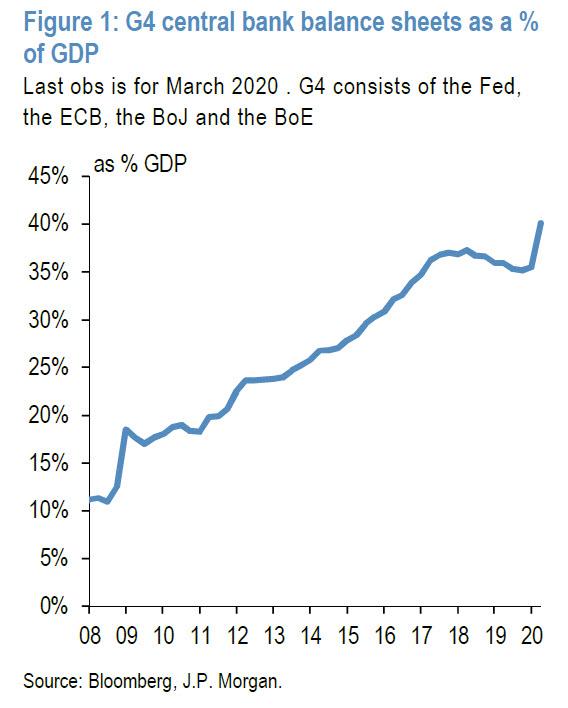

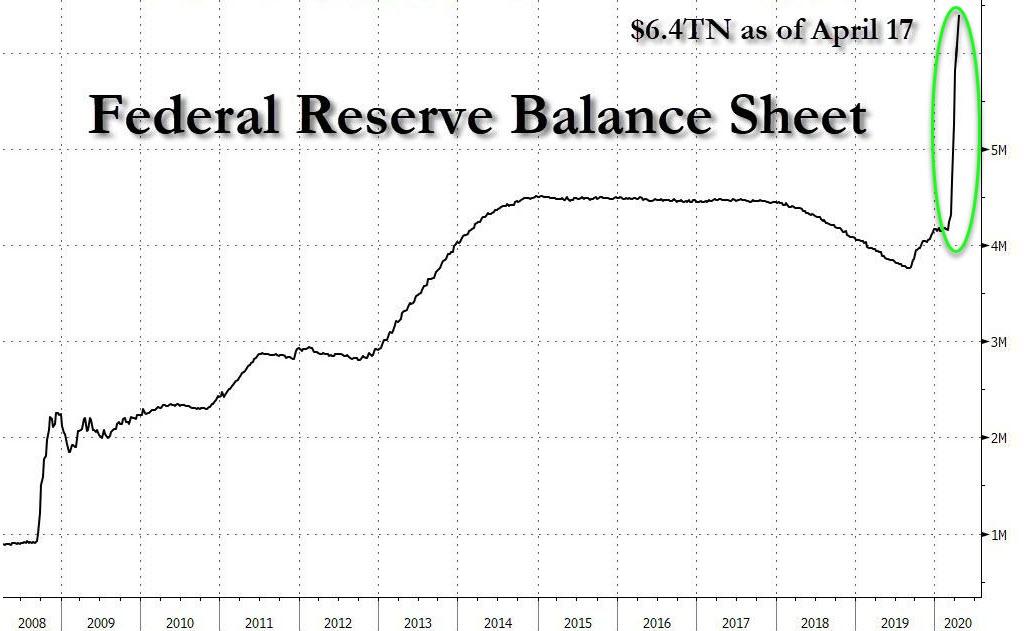

Of course, since Kashkari has been wrong about everything his entire career – most notably, in late January he asked “QE Conspiracists” to show him how the Fed is manipulating stock prices, which led to the Fed unleashing unlimited QE just two months later and demonstrating very vividly just how it is manipulating stock prices, this may be the most promising assessment of where we stand on the curve yet.

Tyler Durden

Sun, 04/12/2020 – 17:10

via ZeroHedge News https://ift.tt/2yMU5JF Tyler Durden