1 In 3 Americans Ordered To Stay Inside As Global COVID-19 Infections Pass 350K: Live Updates

Summary:

- Japan PM Abe says world “not ready” to hold Olympics

- Australia and Canada pull athletes from the games

- Spain reports 26% jump in deaths on Sunday

- Largest 2-day jump in global cases reported over the weekend

- Spain follows Italy by extending quarantine

- 1 in 3 Americans begin Monday under lockdown

- India shutters domestic transit even as ‘official’ cases remain low

- Trump sends National Guard troops to New York, California & Washington

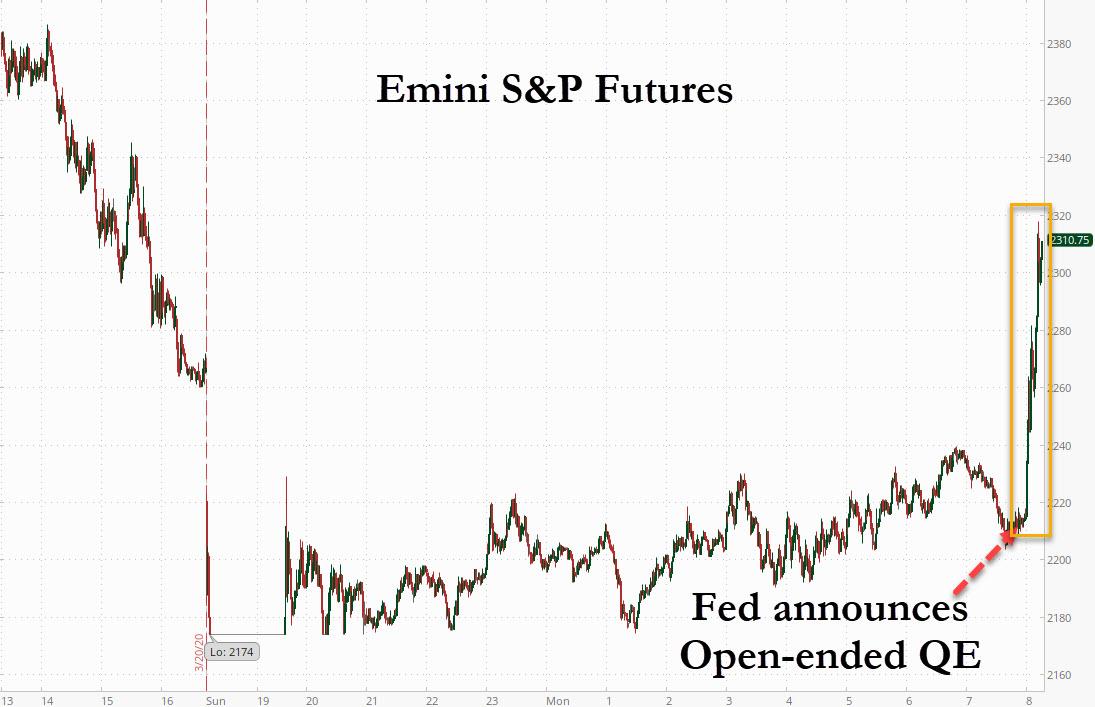

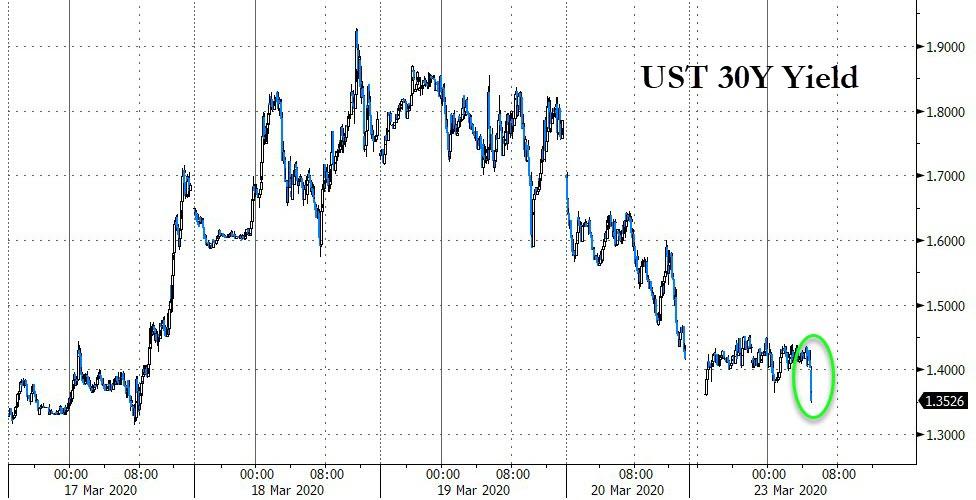

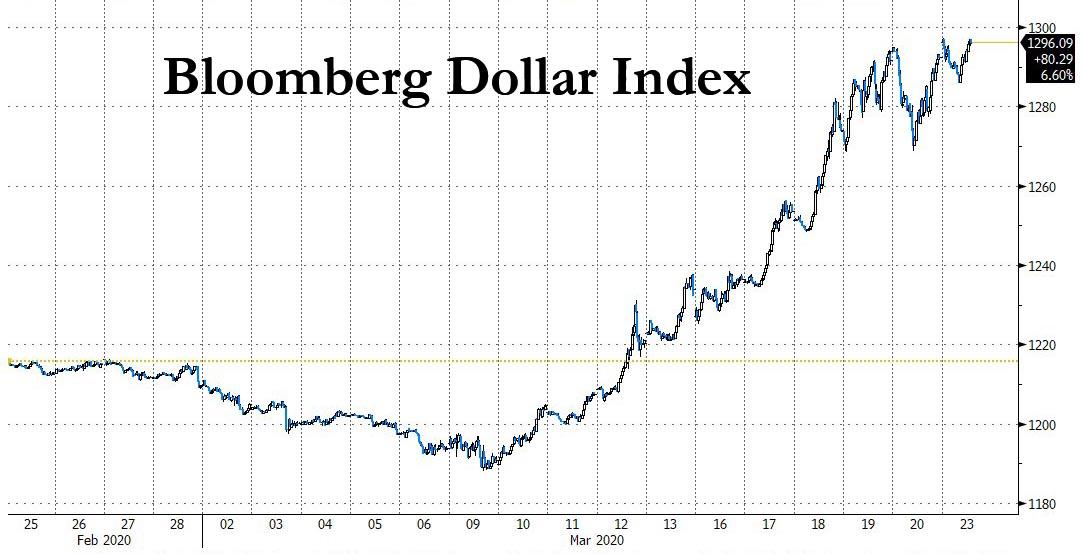

- Fed delivers latest bazooka blast with another massive monetary stimulus

- Senate holds second stimulus vote

- Amazon doubles workers overtime pay

* * *

For millions of Americans, the full weight of the novel coronavirus outbreak, and its ensuing crisis, finally became apparent over the weekend as governors from New York, to Ohio, to Delaware warned that all “non-essential” employees will soon be required to shelter in place.

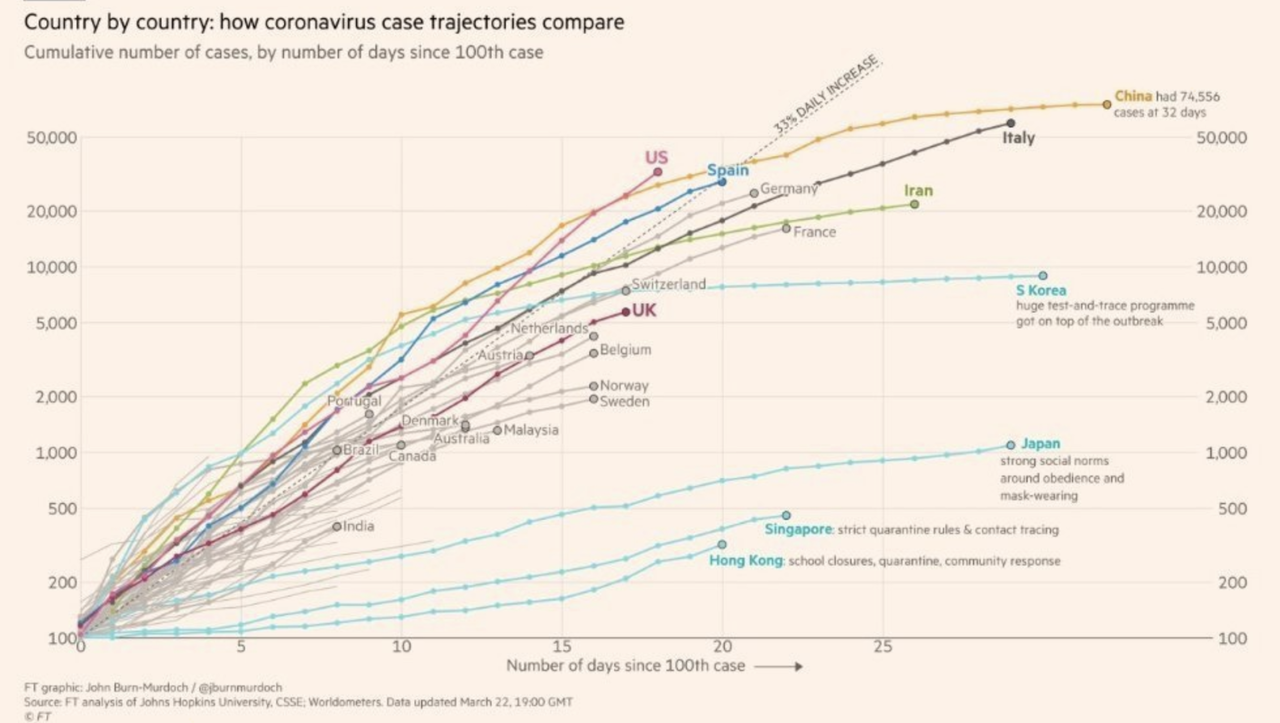

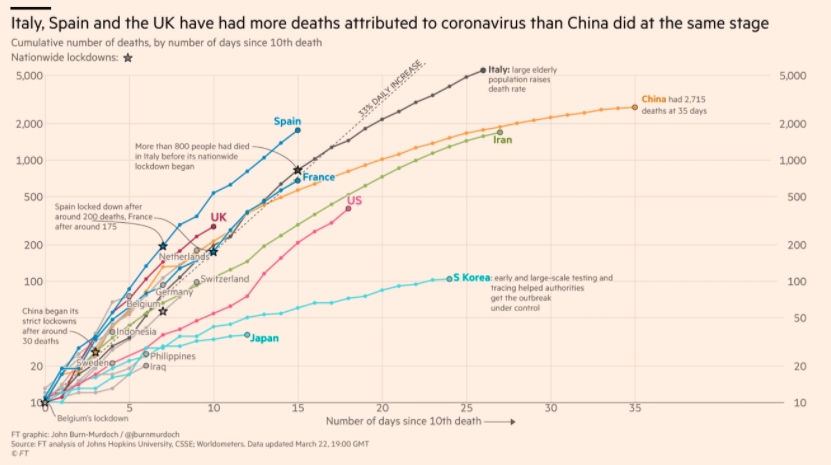

Additionally, though hundreds of thousands of cases around the world likely remain undiagnosed, global health authorities revealed on Monday that the acceleration in new cases over the last 48 hours was the fastest on record, according to the FT’s calculations: According to the paper, the total number of confirmed cases around the world increased by a record magnitude this weekend as the situation worsened, particularly in the US.

Health authorities reported an additional 61,872 cases over the 48-hour period, while the number of fatalities increased by 3,260 to 14,748, the largest two-day jump in new cases on record.

The US was the hardest hit on Sunday, adding 9,339 cases, nearly 4,000 more than the 5,560 new cases that Italy added. For the first time in nearly 2 weeks, Italy saw a slowdown over the weekend. In Spain, meanwhile, the situation has been the opposite: 450 people have died in Spain over the past 24 hours after contracting the coronavirus, while there has been a surge in intensive care patients.

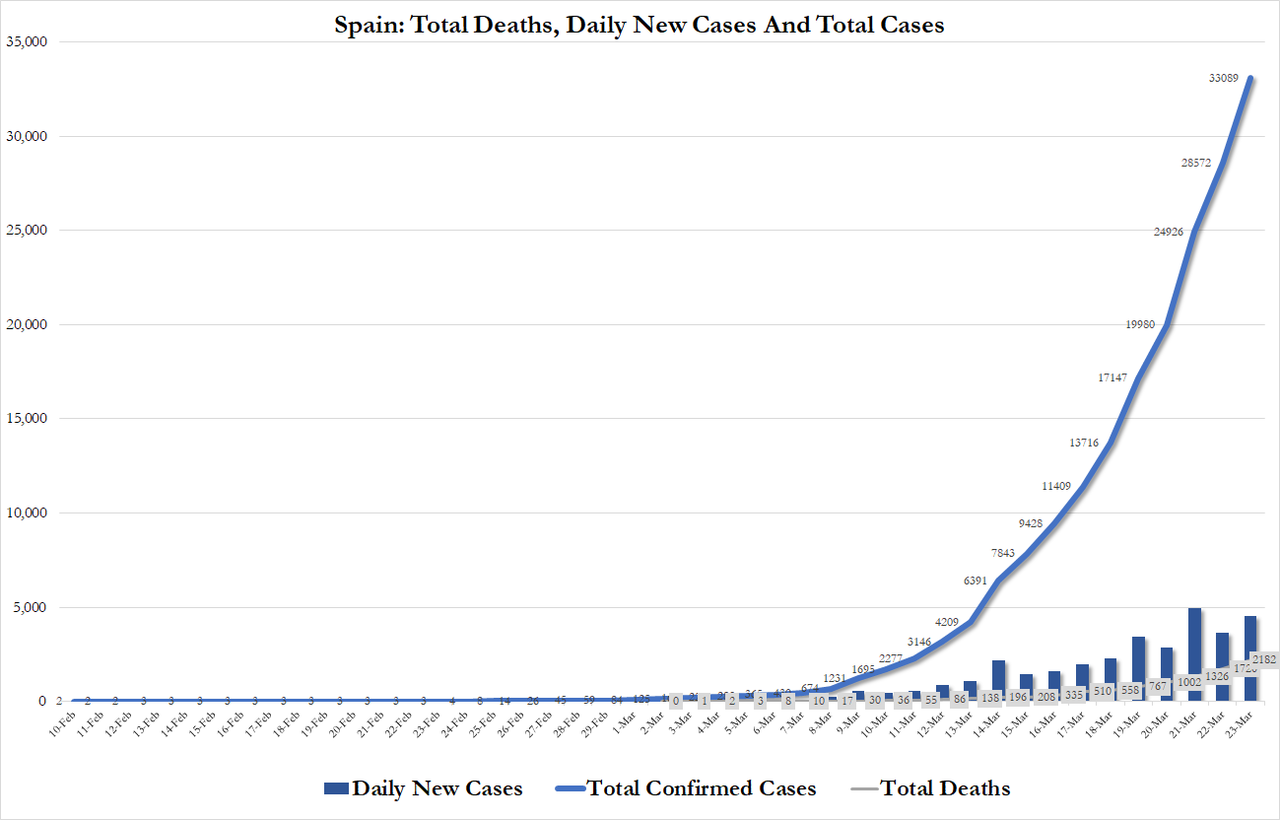

The ministry of health in Madrid said on Monday that 2,172 have died, a 26% increase on Sunday’s total of 1,720. Spain, with more than 33,000 infected, is the worst-hit European country after Italy.

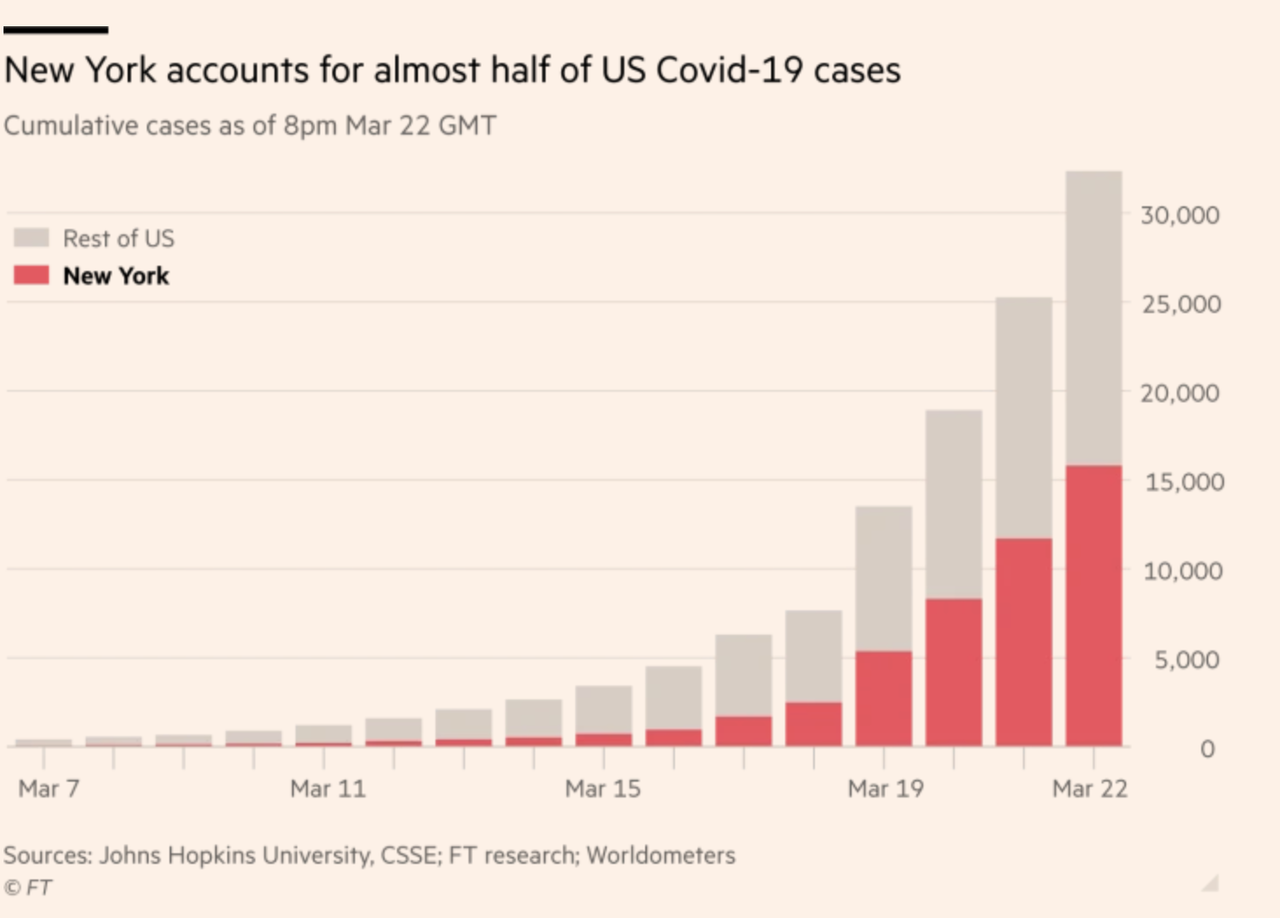

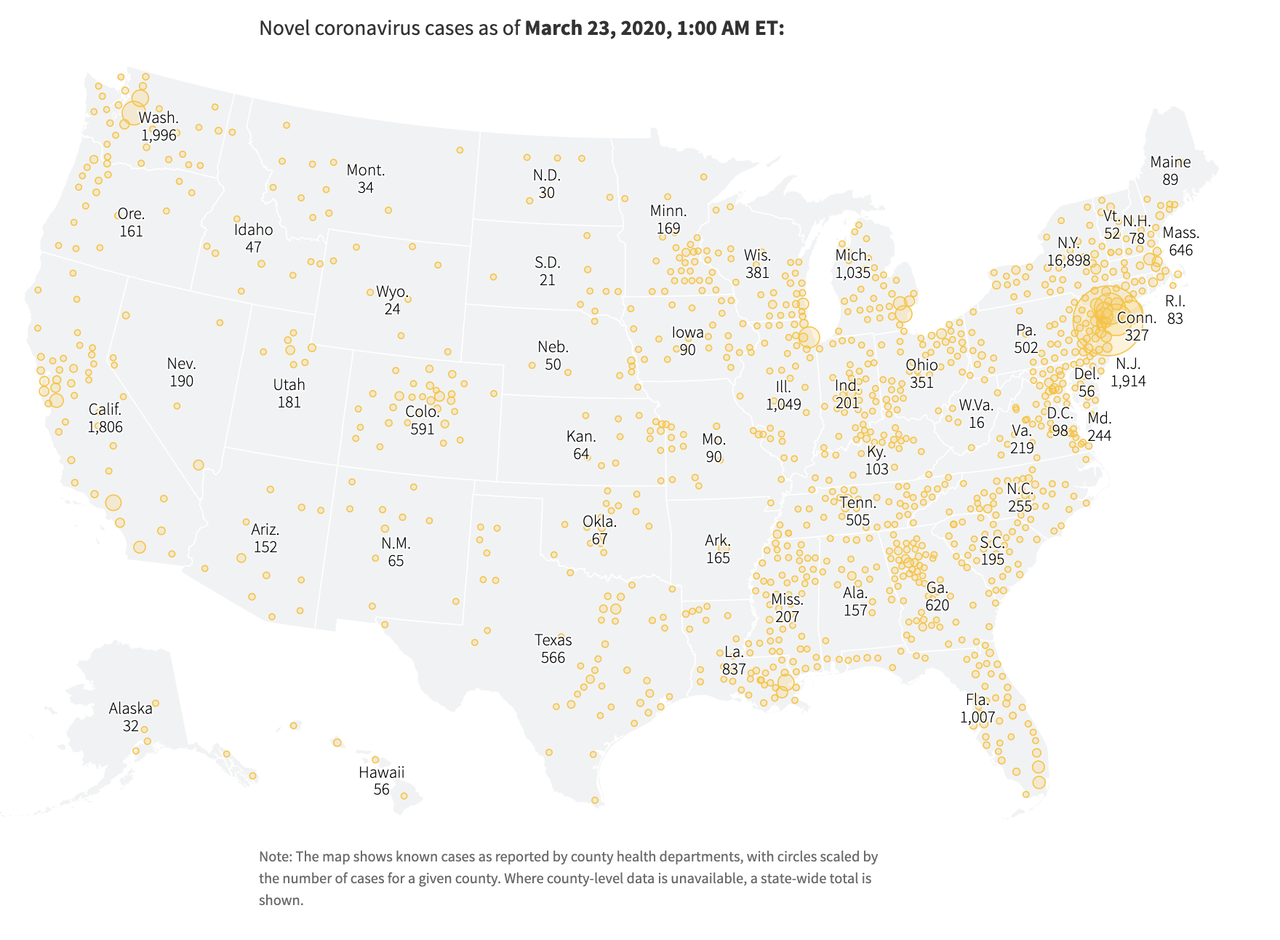

Across the US, the scale of the crisis was finally laid bare when the total number of confirmed cases surged to almost 30,000 and New York emerged as an international hotspot. As of Monday morning, the total number of cases around the world had climbed to 349,211, per Johns Hopkins.

During a press conference on Sunday, New York State Gov. Andrew Cuomo warned that he expected up to 80% of the state’s population to ultimately contract the virus, and told residents to brace for disruptions to daily life that could last for as long as nine months.

As more governors ordered their citizens to stay home beginning on Monday, Reuters counted that roughly one in three Americans is now under orders to stay home to slow the spread of the coronavirus pandemic as Ohio, Louisiana and Delaware became the latest states to enact broad restrictions, along with the city of Philadelphia, according to Reuters.

We reported last night that Ohio, Louisiana and Delaware are now the latest states to enact broad restrictions (along with the city of Philadelphia), joining New York, California, Illinois, Connecticut and New Jersey, home to 101 million Americans combined.

Ohio’s order will go into effect at midnight EDT on Monday and stay in effect until April 6. Louisiana’s order goes into effect at 5 pm CDT on Monday and lasts through April 12. Delaware’s order begins at 8 am on Tuesday.

Texas’s Dallas County, home to more than 2.5 million people, and Philadelphia, with 1.6 million residents, told non-essential businesses on Sunday to close and residents to stay home.

In Kentucky, non-essential businesses must close by 8pm on Monday, but authorities stopped short of ordering residents to stay home.

The orders come as the US cracks 35k cases, leaving it on track to surpass other developed countries given the scope of its outbreak.

As the Empire State ramps up testing faster than many of its peers, thanks largely to the leadership of Gov. Andrew Cuomo, New York now comprises almost half of all diagnosed cases of COVID-19 in the US.

Source: FT

While confirming to the public that he had tested negative for the virus, Vice President Mike Pence said 254,000 Americans had been tested for the coronavirus as of Sunday, and that 10% were positive.

Source: Reuters

More news from the US: As more Americans prepare to rely on e-commerce to buy goods as traveling to the grocery store becomes taboo, Amazon is doubling overtime pay as the outbreak worsens, while other companies focus on mass layoffs. Although the Fed’s latest monetary bazooka blast has pushed futures back into the green, easing the pressure on lawmakers, another vote for the Senate’s $1 trillion-plus rescue package – the third bill to confront the outbreak.

Johns Hopkins is reporting more than 35,000 cases in the US, along with 417 deaths.

Last week, the New York Times reported that the virus total in India was surprisingly low, especially when factoring in the country’s endemic poverty and massive population. But as the country suspends public transit on Monday, hampering medical workers in their quest to get to work, many are beginning to wonder: If the situation in India is so optimistic, why is the government bothering with all of thee closures.

After a total suspension of services on Sunday, city buses began running again on Monday, but are only operating infrequent skeletal services.

“How are staff supposed to attend the hospital with no public transport,” said one doctor at a 595-bed private hospital in New Delhi.

“Hospitals are not run by doctors alone. Doctors all reached because they have their cars. But the electrician couldn’t reach because he didn’t have a scooter. All the staff nurses were calling saying, there is no bus how do we come?”

“Where was the planning for this?” the doctor asked.

It’s certainly curious…considering the country is also shutting down domestic air travel on Monday.

India, a country of 1.3 billion people, has only 425 “confirmed cases” of CV-19 and a handful of reported deaths.

But today they are shutting down domestic air travel.

All gov’ts are liars. Some lie more.#DontTestDontTell https://t.co/UcalVt1w50

— Ben Hunt (@EpsilonTheory) March 23, 2020

In other news, Australia joined Canada in withdrawing its athletes from the Tokyo 2020 Olympics, placing further pressure on the IOC to cancel the games. Japanese Prime Minister Shinzo Abe said Monday that the Tokyo Games “cannot be held” under the current circumstances.

Tokyo Olympic organizing committee President Yoshiro Mori said he supports the IOC’s decision to review plans to hold the Olympics.

“If I’m asked whether we can hold the Olympics at this point in time, I would have to say that the world is not in such a condition,” Abe told a parliamentary session, adding he hopes to hold talks with International Olympic Committee President Thomas Bach over the issue.

“It’s important that not only our country but also all the other participating countries can take part in the games fully prepared,” Abe said, according to Kyodo News.

Spain will become the next country to expand its lockdown for 15 days as deaths and confirmed cases in the country continue to soar, while the British government on Monday ordered 1.5 million people with serious health problems to self-quarantine at home for the next 3 months, the length of time during which PM Boris Johnson believes the UK can quash the virus is enough people follow the government’s guidelines.

Tyler Durden

Mon, 03/23/2020 – 08:22

via ZeroHedge News https://ift.tt/3dpuB59 Tyler Durden