VW Shares Continue To Scorch Higher On EV Promise As Tesla Slumps

It was inevitable that some reversion to the mean would have to happen between names like Tesla and, well, the rest of the auto industry. While Tesla shares are lower on Wednesday in early trade, VW might be the leading frontrunner to meet the mean from the other direction. Shares of VW common and preferred have continued to scorch higher, adding to yesterday’s gains.

This extends yesterday’s monster gains which saw VW shares climb over 30% at one point. And, as you can see below, VW is starting to look a bit like Tesla’s chart over the last 18 months. The key exception is, of course, that VW is a consistently cash generating legacy automaker with decades of history behind it.

The reversion to the mean could be very bad news for Tesla, as VW could be just the first of many valuation “reality checks” that Musk’s company could be in for. Eventually, people are destined to realize that legacy automakers can make quality EVs that are inevitably going to compete – seriously – with Tesla. Recall, names like Apple, BMW, Jaguar and Audi – just to name a few – are also throwing their hats into the respective ring.

“This may be driven in part by U.S. retail investors jumping on the electric vehicle train,” Louis Capital Markets cross asset sales trader Frederic Benizri told Bloomberg on Wednesday. MPPM EK head of trading Guillermo Hernandez Sampere says that he suspects an orchestrated short squeeze in the name: “GameStop was the blueprint for deals of that sort — it was only a matter of time before someone would copy it”.

Recall, yesterday VW upgraded its profit guidance laid out plans for expanding the company’s EV offering out through 2030 which also includes dethroning Tesla as the reigning EV world champ. VW hosted its “Power Day” yesterday and revealed plans to build six “gigafactories” with a total capacity of 240 gigawatt hours per year.

“The company is aiming to achieve an operating margin between 7% and 8% after 2021. VOW also confirmed it is looking to finish the year at the upper and of a 5% – 6.5% range in 2021. Higher profitability will be achieved through lower costs with as much as 2 billion euros savings identified for 2023 compared to 2020,” the company said yesterday, according to StreetInsider.

Chief Executive Herbert Diess said on CNBC: “This period is probably the most crucial for the whole industry. Within the next 15 years we will see a total turnover of the industry. Electric cars are taking the lead and then software really becomes the core driver of the industry.”

“Electric cars already today are very, very competitive and they’re becoming more competitive over time. that gives us the certainty that this is the right way going forward. Electric cars actually will bring down the cost of individual mobility further,” he continued.

VW also disclosed yesterday that it was working on a “new unified battery cell” to be launched in 2023. Diess said: “The one size fits almost all cell design will radically reduce battery costs … by up to 50% compared to today. Lower prices for batteries means more affordable cars, which makes electric vehicles more attractive for customers.”

Also probably contributing to its ascent is the fact that VW is a “less liquid” share listing, as Bloomberg notes that it is “owned by major shareholders Porsche SE, the German state of Lower Saxony and Qatar”.

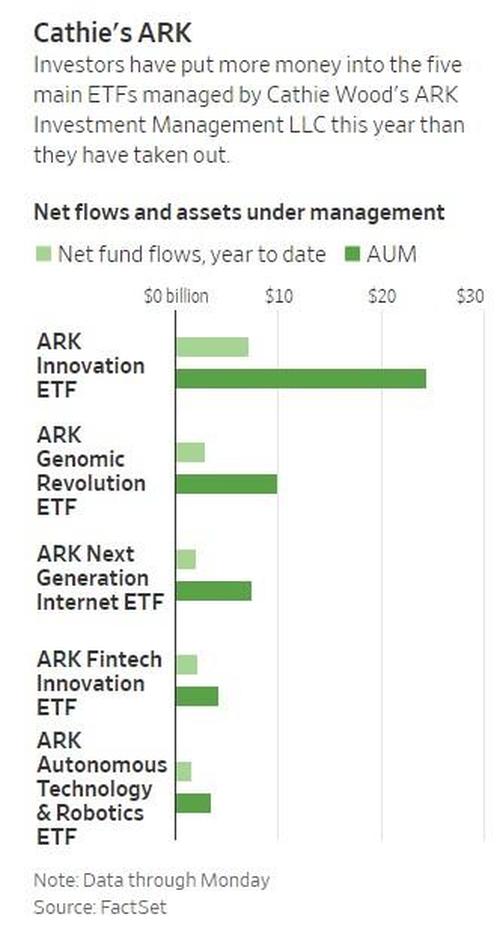

The move is also part of a general hysteria surrounding EV stocks. Recall, we wrote days ago that Rob Arnott of Research Affiliates referred to it as a “big delusion”. Arnott’s predictions could eventually rope in valuations across the board in EVs, not just for any one player.

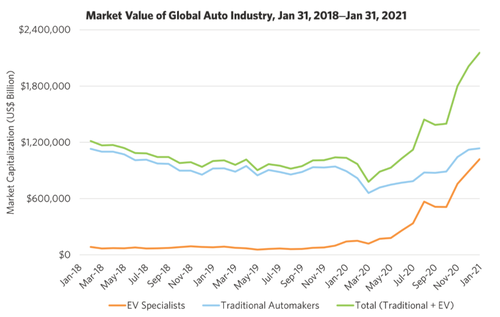

Current valuations in EVs are due to “pricing delusion”, Arnott said in a new paper calling EVs the “Big Market Delusion” last week. “The electric vehicle industry, with its astronomical growth in market-cap over the 12 months ending January 31, 2021, is a prime example of a big market delusion,” he wrote.

In his paper, he defines a big market delusion as “when all the firms in an evolving industry rise together, despite that fact that they are competing against each other.” He used airlines as an example of the BMD in the past. Technology “does not translate into great fortunes for investors unless it is associated with barriers to entry that allow a company to earn returns significantly in excess of the cost of capital for an extended period,” he argued.

Tyler Durden

Wed, 03/17/2021 – 11:11

via ZeroHedge News https://ift.tt/3qTu1Cc Tyler Durden