Rabobank: “Oil Vey”

Submitted by Michael Every of Rabobank

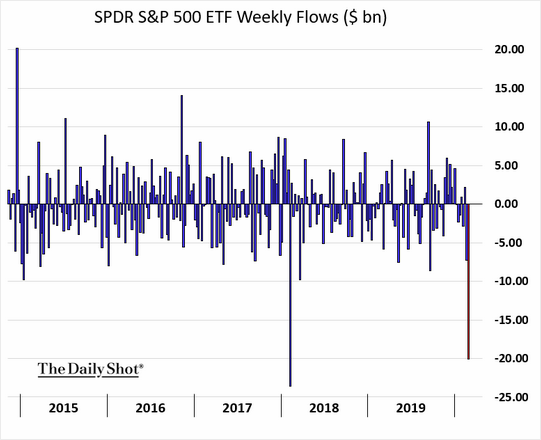

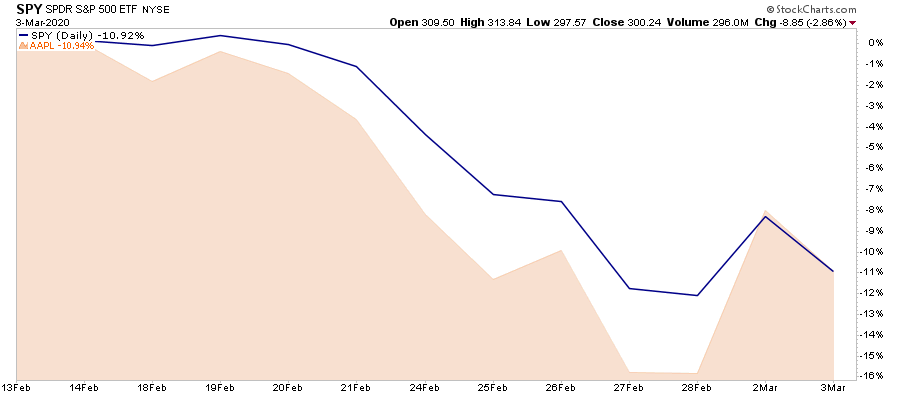

What do you say about a Friday where nobody but Larry Kudlow Donald Trump cares a jot about the strong US labour market; where equities tumble again; where the US credit markets start to show stress; and where the 30-year US Treasury declines nearly 30bp in one day? What do you say when OPEC and Russia can’t agree on oil price cuts to match collapsing global demand?

What do you say about a Saturday where Saudi Arabia decides to turn the taps on full and increase output massively, and to offer discounts of USD8-10 per barrel to key customers? What do you say when oil prices collapsed nearly 10% on Friday and then a further 31% this morning in the first few minutes of Asian trading, and Brent was at USD35.76 at time of writing? That’s the biggest drop since 1991! What do you say when even US shale, and all the high-yield credit attached, is going to be under huge stress – to say nothing of the Saudi and Russian budgets, and oil-related currency pegs?

What do you say when the 10-year US Treasury has fallen another 24bp today and is right now as type below 0.50% energy and commodity prices collapse? What do you say when the Aussie stock market has fallen 6.4%, the Hang Seng is -3.5%, the Nikkei -5.8%, even though Japan is a huge energy importer, and S&P futures are -4.5% again, close to limit down? What do you say when EUR/USD is over 1.14, and USD/JP at 102.5?

“Oil vey”

This is without even mentioning that Italy has locked down 25% of its population properly this time – though apparently the orders are being ignored, and the decree was leaked early, allowing many to flee the virus zone before the cordon sanitaire came down.

Without mentioning that Israel, very small but ahead of the virus policy curve in some respects, is about to insist all arrivals must go into 14-day quarantine, which will effectively close off all incoming flights.

Without mentioning that Chinese exports for January and February were -17.2% y/y, taking its trade into a deficit: with nobody to export to as things look like they may stand, might we be seeing more such deficits even if China can genuinely get production up, rather than just leaving the lights on, and without a new virus outbreak?

Without mentioning that the shoe has now finally dropped and major events like SXSW in the US have shown that, yes, this virus matters too and it is not just $X$W: it has been cancelled at short notice.

Anecdotally, I am seeing/hearing three groups around me in how people react to all this:

- The ones fighting over toilet rolls in supermarket aisles, which shows that in times of crisis people will still stick with fiat money given they obviously see actual toilet paper as a form of currency.

- The ones who keep saying this is all an over-reaction, largely because they want to differentiate themselves from those who are fighting over toilet paper; but also because they are clinging to comforting facts like “This is just flu”, “More people due from slipping in the shower”, and the classic “98% of people will be OK”. Generally that means THEY will be OK, as they aren’t in the high-risk health or age bracket: yet there are also lots of elderly folks I know who are also happily saying “Keep Calm and Carry On” while making no changes to their lifestyle at all. In markets, this group tends to work in the kind of analyst space where you are always “bullish 12 months out” – the kind of people Keynes was laughing at when he made his “In the long run, we are all dead” quip: today it’s been inverted to “In the long run, we are all alive”.

- The ones who aren’t buying toilet paper but who aren’t buying that this is just a flu that will go away when the sun comes out either. Those who can see this virus is extremely easy to spread and very dangerous to some demographics – and that if they will be OK personally, if everyone gets sick at once (40-80% of the population), and 20% of those sick need to be in hospital (8-16% of the population), healthcare systems will be overloaded, ensuring even moderately ill people can’t get normal treatment and can hence die: so we can indeed end up with mass casualties of at least 2% of that 40-80% in short order, Wuhan- and Italy-style, albeit centred on the elderly and sick. (Which tend to be called ‘family members’ for most people.) The ones who also see that aggressive lockdowns/quarantines, along with mass testing, have managed to reduce the R0 (or infectiousness) of the virus from 2-3 to around 0.3 where they have been implemented, and hence recognise that is the route that governments will all eventually go down, even if the economic hit will be massive.

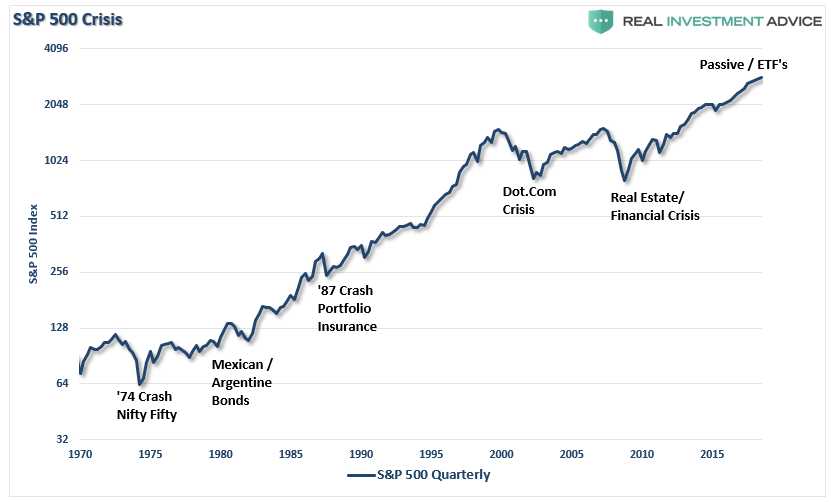

Now briefly back to oil. The bull argument du jour from our group 2 above is that lower energy prices will juice the global economy. Perhaps – unless you are an energy exporter. They will also ensure central banks are confronted by deflation, not inflation; and, as already noted, by severe credit stress in the energy sector.

Yet will cheaper petrol/gas really encourage the group 1 people bunkered down at home to buy more of anything except toilet paper? Moreover, once this virus has passed which, yes, one day it will, even if it is perhaps not truly over until a vaccine is available in 2021 or 2022, then energy demand will go back up again and so will oil prices. In other words, cheap energy is a coincident and not a leading indicator for once, and it is not going to juice the economy right now any more than ultra-low (and about to get ultra-lower) interest rates are.

But what about fiscal stimulus, I hear group 2 people say? Well even that won’t do much beyond damage control. Don’t believe me again? Look at the share of household spending and business investment in GDP vs. public investment–it’s easy to do–and imagine how much the latter needs to rise to compensate for a coming collapse in the first two categories. An extension of paid sick leave, as proposed in the US, is better than nothing but also nothing much.

Like I already said, “Oil vey.”

Tyler Durden

Mon, 03/09/2020 – 11:47

via ZeroHedge News https://ift.tt/2Q0t6jP Tyler Durden