Gold Is Now “Unobtanium”

By now it becoming clear to many that demand for precious metals, as the world ‘turns’, is far outpacing supply as major gold suppliers and sellers exclaim “there is no gold.”

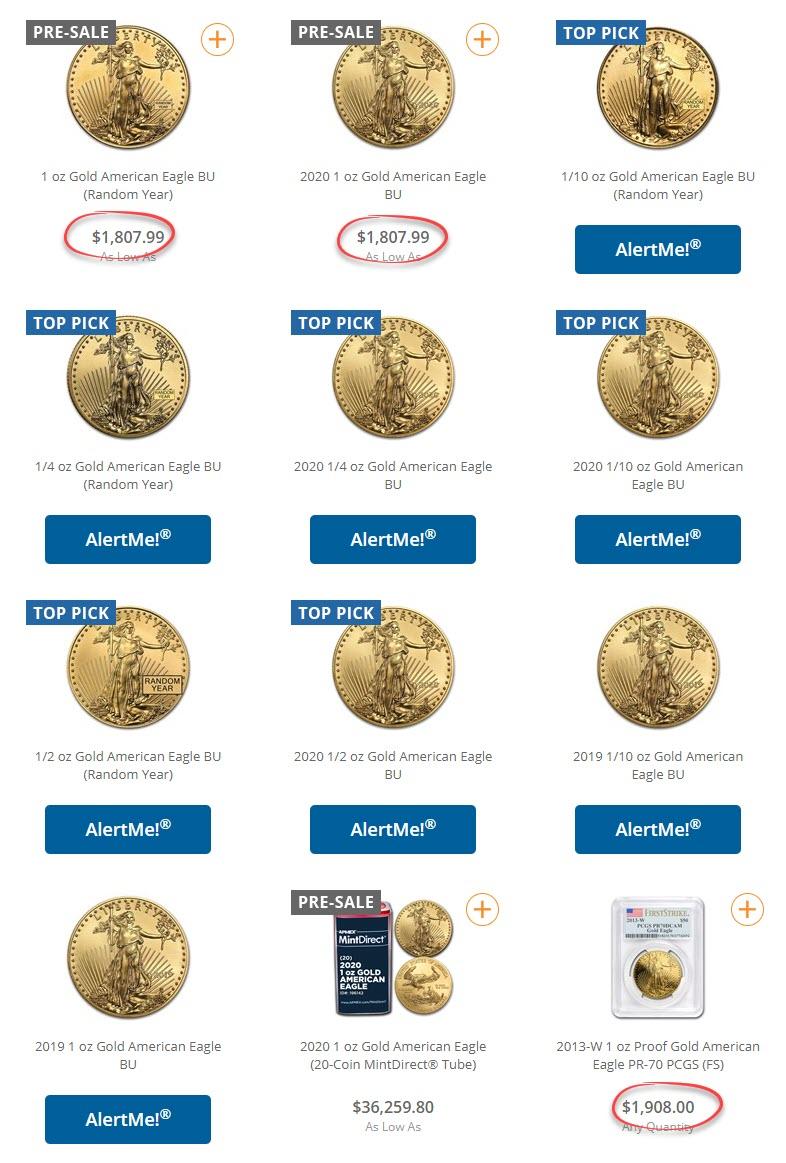

One glance at APMEX pages and two things are immediately clear:

1) There is no gold or silver….

2) And if there is, the premium for physical gold and silver over paper is massive…

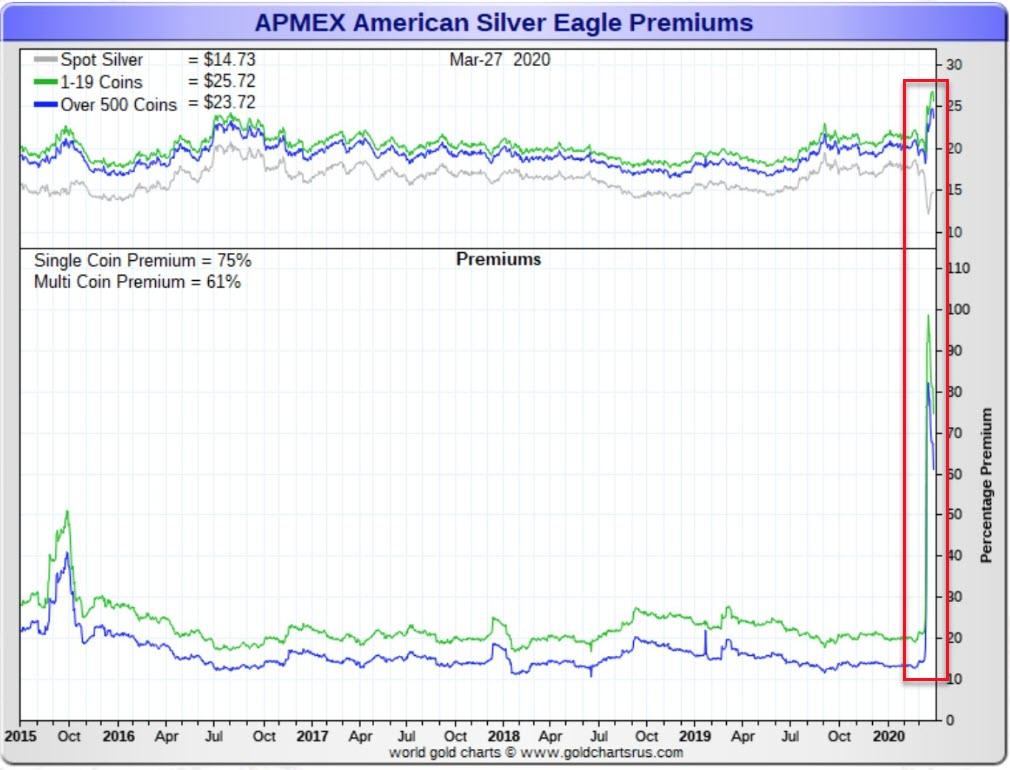

Put in context, this 100% premium for silver is shocking (h/t @JanGold_)

And the mainstream media is starting to notice as DollarCollapse.com’s John Rubino points out, The Wall Street Journal just published the kind of article gold bugs dream of… Here’s an excerpt:

Coronavirus Sparks a Global Gold Rush

Epic shortage spooks doomsday preppers and bankers alike; ‘Unaffordium and unobtanium.’

It’s an honest-to-God doomsday scenario and the ultimate doomsday-prepper market is a mess.

As the coronavirus pandemic takes hold, investors and bankers are encountering severe shortages of gold bars and coins. Dealers are sold out or closed for the duration. Credit Suisse Group AG, which has minted its own bars since 1856, told clients this week not to bother asking. In London, bankers are chartering private jets and trying to finagle military cargo planes to get their bullion to New York exchanges.

It’s getting so bad that Wall Street bankers are asking Canada for help. The Royal Canadian Mint has been swamped with requests to ramp up production of gold bars that could be taken down to New York.

The price of gold futures rose about 9% to roughly $1,620 a troy ounce this week and neared a seven-year high. Only on a handful of occasions since 2000 have gold prices risen more in a single week, including immediately after Lehman Brothers filed for bankruptcy in September 2008.

“When people think they can’t get something, they want it even more,” says George Gero, 83, who’s been trading gold for more than 50 years, now at RBC Wealth Management in New York. “Look at toilet paper.”

Worth its weight in Purell

Gold has been prized for thousands of years and today goes into items ranging from jewelry to dental crowns to electronics. For decades, the value of paper money was pinned to gold; tons of it sat in Fort Knox to reassure Americans their dollars were worth something. Today they just have to trust. President Nixon unpegged the dollar from gold in 1971.

Gold is popular with survivalists and conspiracy theorists but it is also a sensible addition to investment portfolios because its price tends to be relatively stable. It is especially in-demand during economic crises as a shield against inflation. When the Federal Reserve floods the economy with cash, like it is doing now, dollars can get less valuable.

“Gold is the one money that can’t be printed,” said Roy Sebag, CEO of Goldmoney Inc., which has one of the world’s largest private stashes, worth about $2 billion.

The disruptions this week pushed the gold futures price, on the New York exchange, as much as $70 an ounce above the price of physical gold in London. Typically, the two trade within a few dollars of each other.

That gulf sparked a high-stakes game of chicken in the New York futures market this week. Sharp-eyed traders started snapping up physical delivery contracts, figuring banks would have trouble finding enough gold to make good and they would be able to squeeze them for cash. That set off a scramble by banks.

Goldmoney’s Mr. Sebag said bankers were offering him $100 or more per ounce over the London price to get their hands on some of his New York gold.

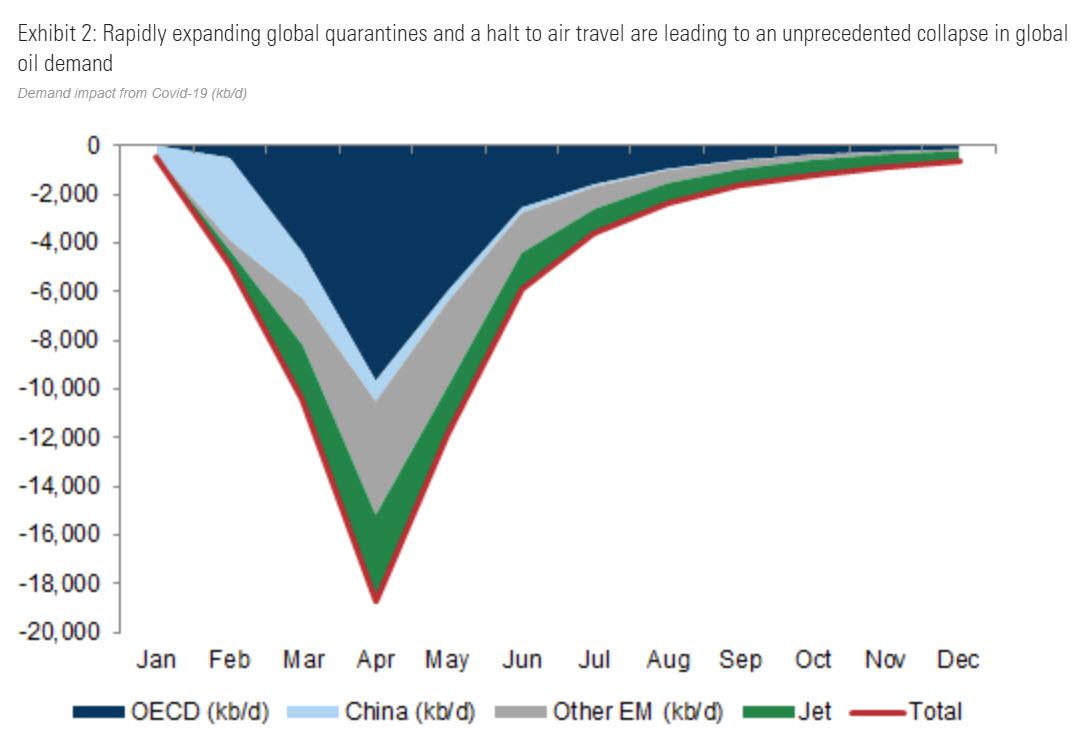

What’s more, there is limited new supply. Mines in countries such as Peru and South Africa are shut down because of the coronavirus. Once-busy Swiss refineries that turn raw metal into gold bars closed earlier this week as the country’s coronavirus cases neared 10,000.

David Smith owns a wristwatch business in northern England and said Tuesday his bullion dealers weren’t taking any more orders. He has been scouring social media for individuals who might sell to him.

“You can’t really get physical gold and silver anywhere at the moment,” he said.

He began investing personally in metals a few years ago after watching videos from Mike Maloney, creator of the website goldsilver.com. Like other online dealers, the site currently has a notice saying products are back-ordered up to 12 weeks and that there is a $1,000 delivery order minimum.

The title of Mr. Maloney’s latest podcast: “Unaffordium and unobtanium.” (The latter has popped up in the plots of science fiction movies).

To sum up:

A pillar of the mainstream financial media just acknowledged gold’s multi-millennia role as a store of value, quoted someone calling it “money,” and noted that since the world left the gold standard, we “just have to trust” governments to maintain their currencies.

The article quotes the CEO of GoldMoney and GoldSilver’s Mike Maloney, and calls gold “a sensible addition to investment portfolios.”

It mentions the divergence between paper and physical prices and attributes it to the same kind of buying panic that has emptied stores of toilet paper. “When people think they can’t get something, they want it even more.”

Now pretend you’re an editor at a city newspaper or regional magazine and you’ve just finished reading the above article. What do you do? You immediately call in one of your finance reporters and tell them to look into this “gold shortage” thing.

So prepare for millions of anxious people to get their first exposure to the gold story, just as the supply dries up.

Tyler Durden

Sun, 03/29/2020 – 13:55

via ZeroHedge News https://ift.tt/2xCNIbd Tyler Durden