Portnoy Rips Deutsche Bank For Being “Catastrophically Wrong” About Penn National

Tyler Durden

Thu, 10/01/2020 – 15:59

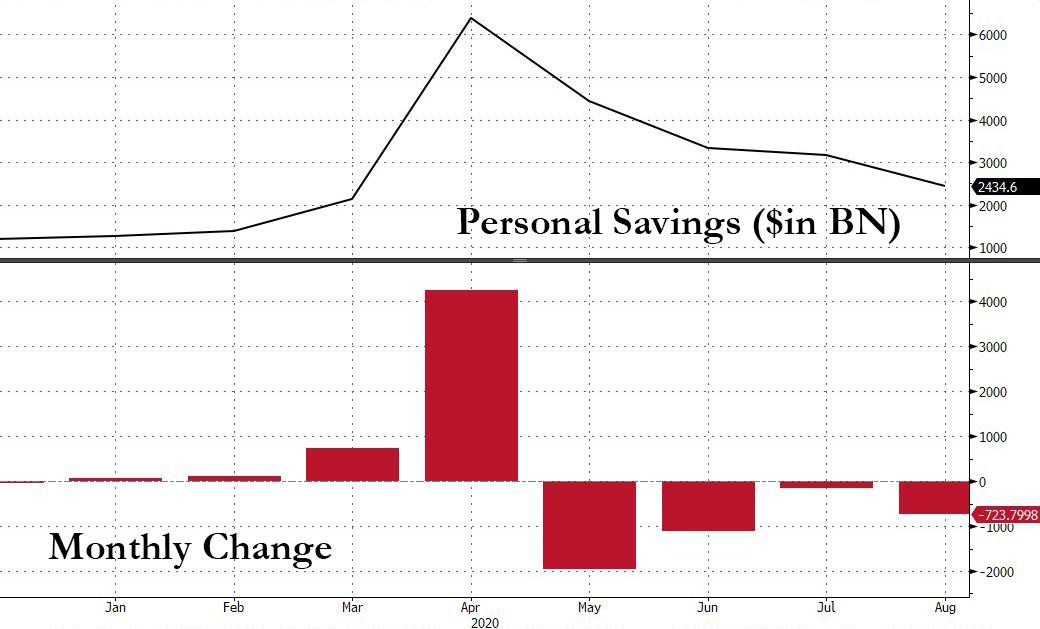

Barstool Sports’ Dave Portnoy, the stock market’s crazy genius, boarded a plane Thursday morning to Texas with only one piece of advice for his 1.8 million Twitter followers: “BUY EVERYTHING – STOCKS ONLY GO UP.”

Portnoy is right: the market mania this year fueled by central bankers injecting trillions of dollars into the financial system has resulted in stocks only going up since mid-March. In fact, Portnoy’s Barstool Sports, which is 36% owned by Penn National Gaming, has seen its shares rally more than 800% from March’s lows.

About a week after PENN announced a public stock offering, selling upwards of 14 million shares of its common stock, shares of PENN have been unable to break above the $76 handle for about ten sessions.

Meanwhile, Deutsche Bank’s analysts Carlo Santarelli and Steven Pizzella are out with an apocalyptic warning that shares could plunge 57% over the next 12 months, reported Business Insider. The bank also reiterated its “sell” rating for the casino and sports betting company.

“We think PENN has largely benefited from the retail community turning the ticker into an internet meme of sorts, thereby creating momentum in the stock that has attracted institutional investors from verticals outside of the traditional gaming arena,” noted DB’s analysts.

They said: “We believe the fundamental and valuation support under PENN is lacking… We would anticipate a considerable contraction in shares.”

The analysts expect the sports betting competition to heat up and would pressure PENN’s profit growth. They said the positive narrative around the sports betting market is set to “crack” – and investors should be aware that “very few states at present are even considering” online sports betting legislation. DB’s price target for PENN is $31, while Wall Street’s average is around $68 per share. PENN is ultra-popular with young retail traders using Robinhood.

Portnoy responded to DB’s sobering report in a Thursday tweet, by saying:

Dr . Wrong ….Carlo Santarelli is back at it Face with tears of joyFace with tears of joyFace with tears of joy. For those keeping score at home his target prices since I’ve been involved has been $12, $22, and now 33. He keeps raising his target by 50% while still being wrong by 100% Imagine being this bad at anything.

Portnoy continued:

Just to clarify Carlo had $penn at 12 bucks in May. He upgraded to 22 bucks after getting embarrassed. Now he upgraded to 33 after being embarrassed again. He has upgraded us by almost 200% in 4 months while trashing us everytime. Our biggest critic has 200% upgrade! Face with tears of joyFace with tears of joyFace with tears of joyMan shrugging

Portnoy then tweeted at CNBC’s Jim Cramer:

Hey @jimcramer do analysts ever get fired for being catastrophically wrong? Like how long can Carlo Santarelli be off by 200% and still get his work published or have a job? It honestly seems criminal what he is doing to his clients.

The problem with PENN is supply and demand – who will soak up the 14 million shares from last week’s stock offering?

Judging by Barstool Sports’ constant promotion of PENN – maybe Robinhood traders…

Readers may recall Morgan Stanley downgraded PENN in late August, though Portnoy gave them no flak.

Is a Portnoy versus DB rivalry in the making ?

via ZeroHedge News https://ift.tt/36qpn8e Tyler Durden