After a handful of mixed regional Fed survey, moments ago the Richmond Fed printed for the month of June, and if it serves as a tiebreaker, then the US economy is deep in a recession.

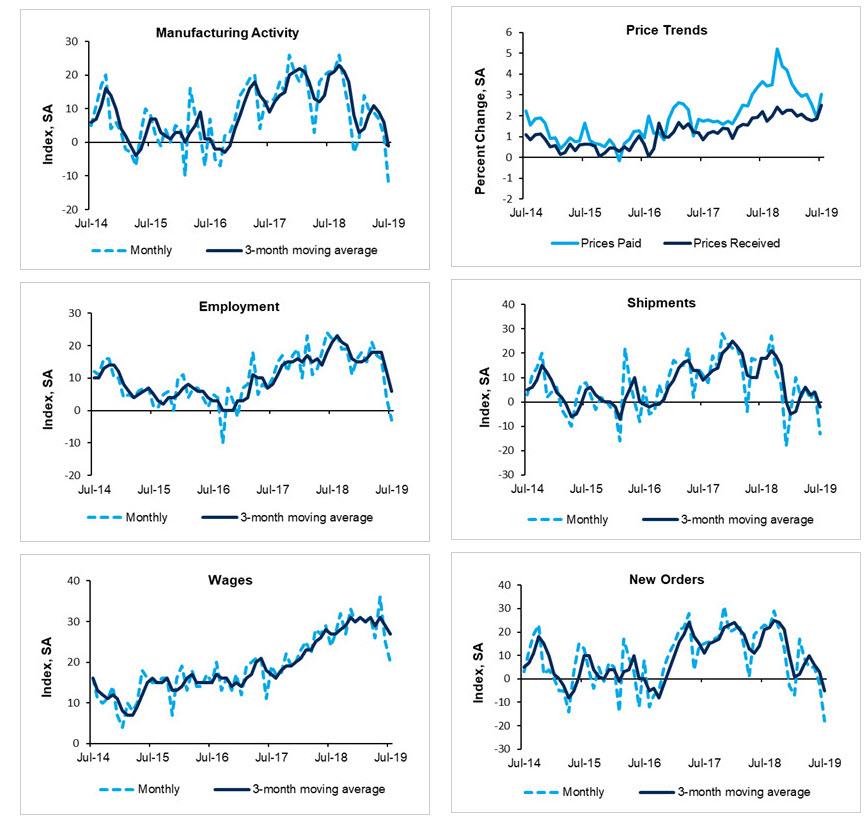

Expected to rebound modestly from already a near-contractionary print of 3 to 5 following the recent euphoric Philly Fed print, the mid-Atlantic index instead suffered its biggest drop in two years, dropping by 14 points to a whopping -12, the lowest print since January 2013…

… as all three components — shipments, new orders, and employment — registered declines.

The biggest reason behind the unexpected plunge – the orderbook has suddenly disintegrated as order backlogs fell to −26, the lowest reading since April 2009.

It gets worse: firms reported worsening local business conditions, as this index dropped from 7 to −18, its largest one-month drop on record. Of course, there was optimism, and respondents remained somewhat optimistic that conditions would improve in the coming months.

The weakness was broad based as Survey results further indicated that employment and the average workweek declined in July. However, wage growth continued among survey respondents. Firms continued to struggle to find workers with the necessary skills and expect that struggle to continue in the next six months.

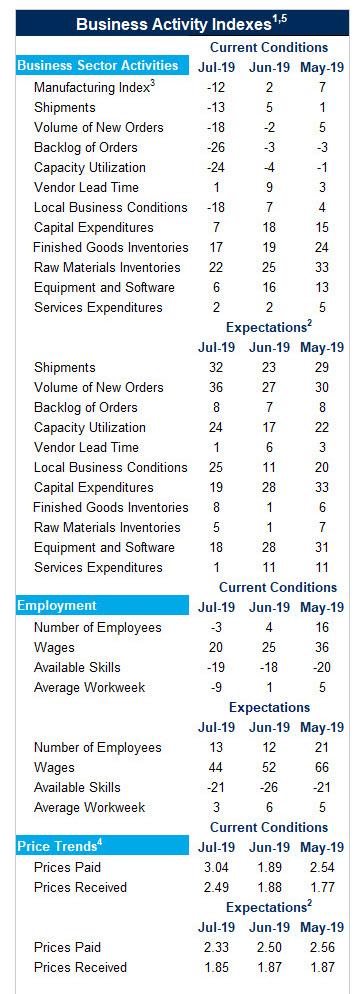

The full table of components is below:

and visually:

The growth rates of both prices paid and prices received rose in July, as growth of prices paid outpaced that of prices received. Survey participants, on average, expected growth of both prices paid and prices received to slow in the near future.

The biggest paradox, however, is that just last week the Beige Book for the Richmond Area reported the following:

Since our previous Beige Book report, the Fifth District economy grew at a modest rate. Manufacturers saw a slight increase in shipments and new orders, but continued to face challenges from the current trade environment. Import volumes remained strong and, at one port, the composition of imports is shifting from China to other Asian countries.

Meanwhile, the actual Richmond Fed survey shows collapsing orders, shipments and employment.

It’s almost as if the US is now desperate to overtake China in the completely made up economic bullshit department, simply to justify whatever policy measure the Fed is undertaking next.

via ZeroHedge News https://ift.tt/2Z5QtKZ Tyler Durden