Not Even The Algos Have Any Idea What’s Going On Any More

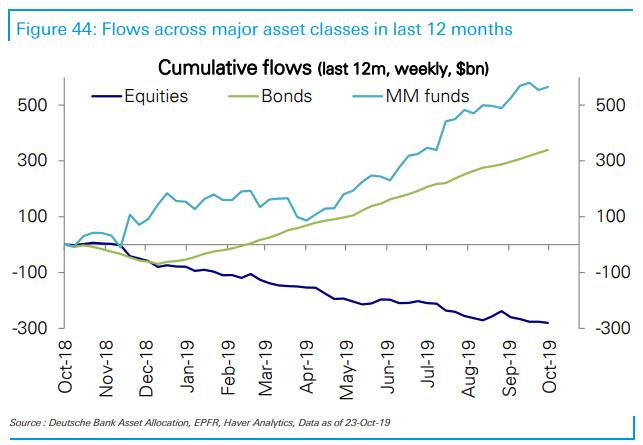

With the S&P hitting an all time high just as the Fed is set to cut rates for the 3rd time in four months due to the “slowing economy” amid an earnings season that will show the first earnings recession in three years, not to mention near record outflows from stocks (and inflows to bonds)…

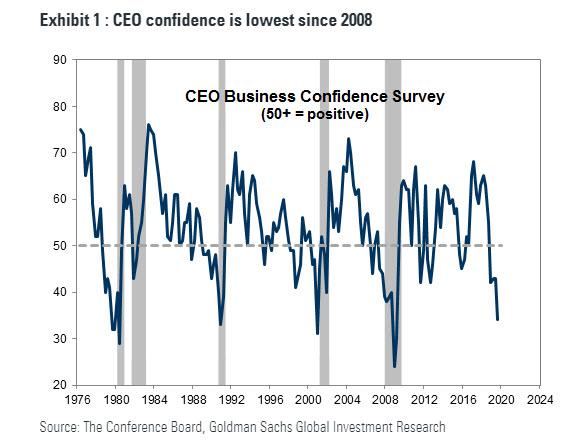

… which somehow has resulted in a surge in stocks, even as CEO sentiment crashes to financial crisis lows…

… it is safe to conclude that no human really has a clue what is going on.

But did you know that algos also no longer have any idea what to make of this market?

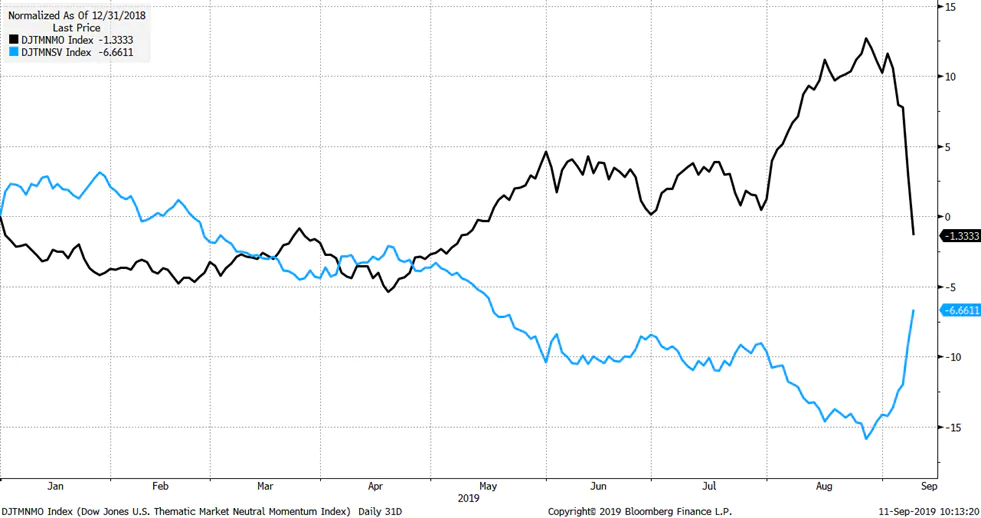

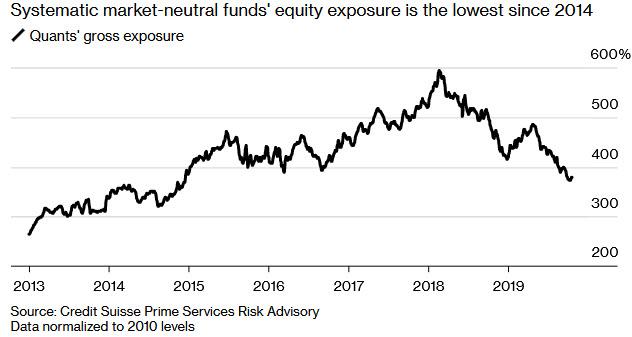

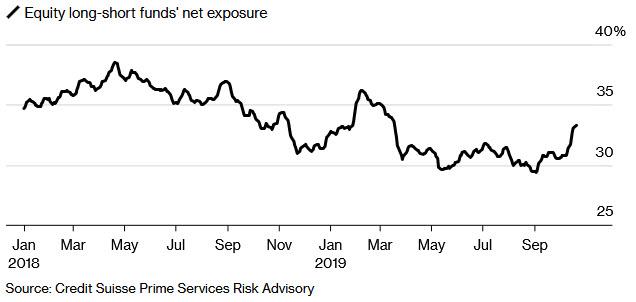

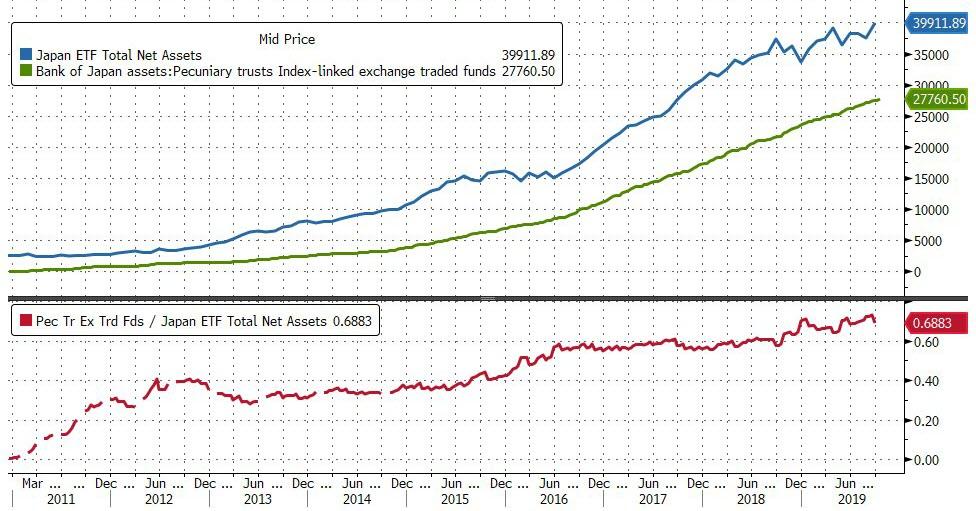

According to Credit Suisse prime brokerage data, market-neutral quants, the ones who got crushed hardest during the September quantastrophe that sent growth stocks tumbling and value stocks surging…

… have cut their gross stock allocations to the lowest in nearly five years, as the following Bloomberg chart shows.

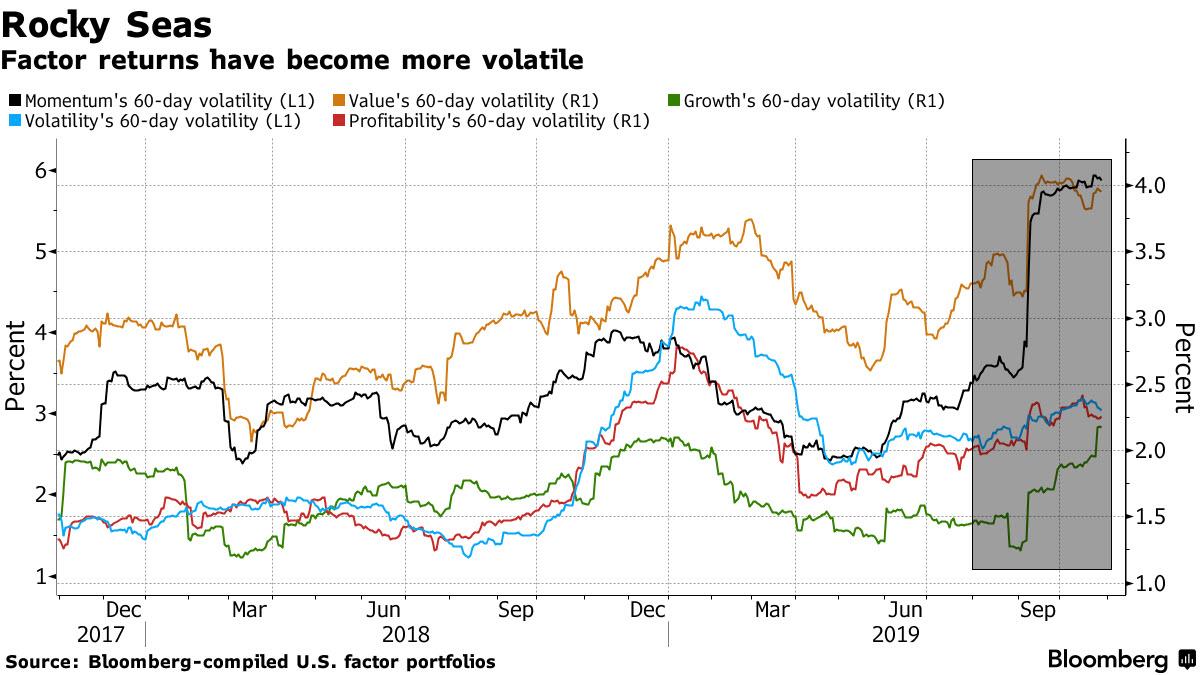

The main reason for the deleveraging – or degrossing – is that quants no longer have a sense of what the market may do at any moment; meanwhile the violent whiplash that market neutral quants suffered during the early-September growth scare, has forced them to take down gross exposure further amid rising factor volatility as the anxiety-ridden rally of 2019 rolls on.

“It looks nice – the market’s up 20%, but it’s been a wild ride underneath the covers,” Mark Connors, global head of risk advisory at Credit Suisse told Bloomberg. “The factor path has been unpredictable.”

And sure enough, after it was left for dead following a decade of underperformance, last week the “value” strategy revived once more as hopes for a U.S.-China trade deal buoyed economic prospects, just weeks after a rotation in the opposite direction driven in part by recession fears.

As Bloomberg notes, while the initial take on such violent, unexplained moves is that they are due to late-cycle fragility as investors turn on every economic and political headline on a dime, Bloomberg also notes that some suspect the choppy rotations have been exacerbated by deleveraging among systematic funds, who find market’s bizarre moves to be too volatile for their current risk profile.

“Quants sometimes can be a canary in the coal mine,” said Melissa Brown, managing director of applied research at Qontigo. “Maybe we are going to see going forward more volatility in style factors as funds need to deleverage or people pull their money.”

Maybe. And if we do, we will see another circular loop emerge, as deleveraging funds force other funds to deleverage, resulting in even less liquidity, more volatility, and even more deleveraging, until some “bottom” is finally reached.

Meanwhile, some factors are becoming even more sensitive to shifts in positioning. The strength of the recent rally – short squeeze if you will – in cheap cyclical shares, for instance, caught many by surprise given the lack of a fundamental catalyst, Bank of America strategists wrote.

Pointing out the blatantly obvious, Los Angeles Capital Management’s Hal Reynolds said that “we are in a choppier environment,” noting that “compression in returns and pick-up in risk have both occurred this year, leading to the reduction in risk budgets.”

Meanwhile, as quants turned tail, some other – more-carbon driven – hedge funds turned more bullish. For example, macro funds and commodity trading advisors, which mostly trade index futures rather than individual stocks, have expanded their long bets this month, according to Credit Suisse data. Meanwhile, conventional long-short stock pickers boosted their net exposure to the highest since March as they covered shorts amid the surprise resurgence this month of “economic recovery” trades betting on higher inflation and growth.

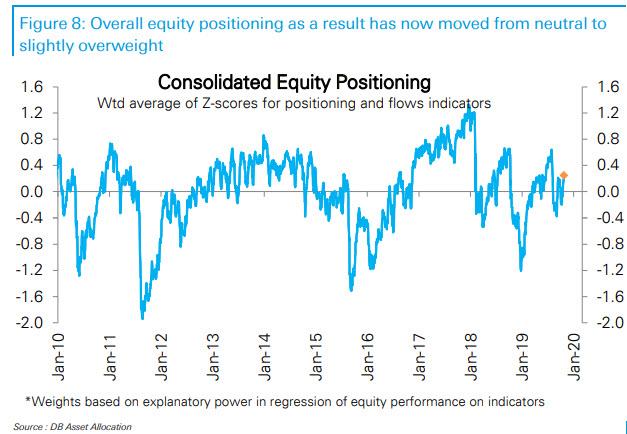

Financial stocks have outperformed, while defensive sectors from consumer staples to utilities have lost money — a reversal of market trends seen earlier this year. Meanwhile, Deutsche Bank’s consolidated equity positioning index shows that overall equity positioning has now moved from neutral to slightly overweight.

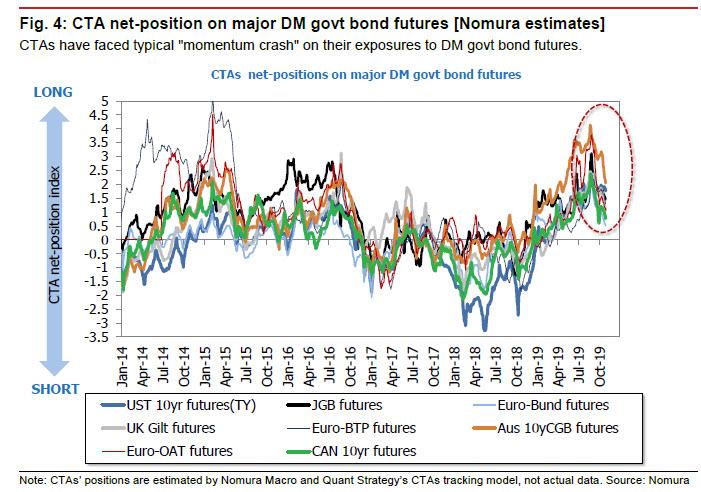

Ironically, the deciding factor whether equity quants return to the market and boost their equity allocation, may be in the hands of bond CTAs, whose performance has been critical to explain not just the recent plunge in bond yields and surge in negative yielding debt to a record notional of $17 trillion, but also to understand the performance of defensive, “bond-like” stocks in recent months.

Commenting on the risk of a potential positioning reversal by bond CTAs, Nomura’s Masanari Takada writes that “the rise in yields thus far accompanying the recovery in sentiment can, of course, be interpreted positively as part of the general move toward healthier markets. But we see something troubling in recent movements by systematic trend-following players. Trend-following algo traders, as typified by CTAs, have built up substantial long bond futures positions over the past year. While developments differ by region, CTAs have now reduced these long positions by only around 40-50% from their peak in summer 2019. Considering the collapse in upward momentum for bond prices, we see a risk that trend-followers could cut their longs further in the interest of avoiding losses. While the figures we give below are merely estimates of the room for a further rise in yields based on CTAs’ positions, we hope they will be of use when looking for near-term inflection points and thinking about a risk scenario in which CTAs completely close out these positions.”

Looking at the potential liquidation risk, Nomura’s quants note that CTAs have unwound their long positions by roughly 45% from the peak (28 August 2019), and point out that potential triggers at 10yr UST yields of

- around 1.76% (the average cost of CTAs’ net buying since June),

- around 1.90% (average cost since April), and

- around 2.05% (average cost since March).

In the near term, the threshold to pay attention to is the second of these, 1.90%. In the extreme case in which yields were to break above 2.05% (the third trigger line), Nomura would expect an across-the-board collapse in CTAs’ long UST futures positions, which could cause yields to shoot up to around 2.5%.

In the end, however, as Nomura correctly notes, “whether CTAs close out their long bond futures positions and make a clear shift to long equity futures positions tends to be determined by the state of the global economy.” And considering the lack of upward economic momentum at present, the risk of an extreme mechanistic sell-off of bond futures that ignores the economic facts on the ground is unlikely to materialize.

Tyler Durden

Tue, 10/29/2019 – 21:25

via ZeroHedge News https://ift.tt/36j5VaC Tyler Durden