Authored by Alastair Crooke via The Strategic Culture Foundation,

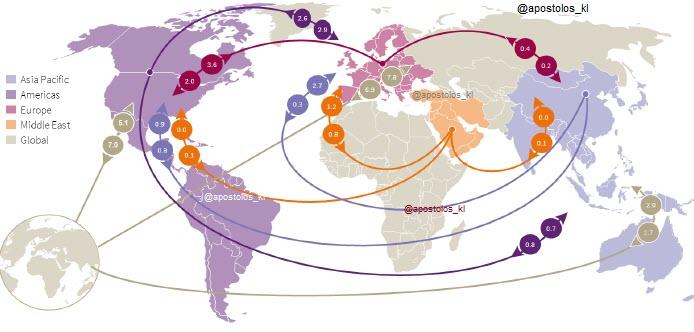

Conflict is popping up everywhere: A major portion of the Turkish army stands ready to invade parts of Syria (though invasion may have been averted for now); PM Modi may just have ignited the next round of Kashmir wars with Pakistan with his Hindu ‘nationalist’ putsch to annex Muslim majority Jammu-Kashmir; Japan has started a mini trade war with South Korea; Turkey is bracing for a face-off with Greece and Cyprus over energy exploration in the East Mediterranean; the Yemen war is heating up with the war increasingly being fought inside southern Saudi Arabia; the US-Iran and the Syria conflicts simmer, and Hong Kong has boiled-over into violence.

What is going on? Is there some unifying thread connecting this sudden outbreak of widespread global tension? Of course all these conflicts have their separate background contexts. But why so many at the same time? Well, in a word, it’s all about change — about the recognition that we are at the cusp of major changes. The world is beginning to pre-position.

Take, for example, the about-turn by the UAE (heretofore, a major agitator for an Iran confrontation) reaching out to Iran. Much of this Gulf State fervour for confrontation with Iran arose on the rebound from the Obama move to normalise with Iran (through the JCPOA). The Gulf States feared losing the umbrella of the US protection which, it was believed, inoculated these monarchies as much from repression of their internal reformists, as from Iran. Then, with the arrival of President Trump, the opportunity seemed to present itself again to lock-in that US ‘guarantee’ by inciting the new President, already obsessed with his notion of Iranian ‘malignity’ into action.

But suddenly, the Gulf chimaera of Trump retarding a resurgent Iran through inflicting a couple of generations worth of missile damage on its infrastructure faded under the desert heat. When Iran took the initiative with its counter-pressures, the US finally did not react, either to Hormuz, or to the loss of its high-spec drone.

It’s not over yet: Iran remains a grave flash-point, but in the region it is understood that the US neither has the political will, nor the capacity, for protracted military action (as opposed to a quick ‘one and done’, to which Iran has promised substantial retaliation). This sense of a ‘shift’ has been reinforced by Trump’s repeat last month of his call for withdrawal from Syria, and by his almost indecent haste in trying to exit Afghanistan. The omens are plain: America is on its way out from the Middle East.

Gulf States need to re-position – and they are. They are repositioning into the security architecture being led by China and Russia. Ten days ago, via a document officially approved by the United Nations, the Russian Foreign Ministry advanced a new concept of collective security for the Persian Gulf. The Russian initiative should be interpreted as a sort of counterpart of, and mostly a complement to, the Shanghai Cooperation Organization, writes Pepe Escobar.

Add to this that China is toying with giving Chinese naval protection to its own vessels in the Gulf (from US or UK-style tanker hijacking); and that Russia and Iran have agreed to mount joint naval exercises in Hormuz (which will give Russia access to the Bandar-e-Bushehr and Chabahar naval facilities), to understand that the notion of a Russo-Chinese security architecture is assuming substance. It makes sense for Gulf States to seek out a new protector. And they are.

So, how does this link to these other effusions of conflict? One aspect concerns the evolution of Trump’s ‘maximum pressure’ thesis: Its lack of any major success to date has already been widely remarked. But the telling factor is that this ‘Art of the Deal’ approach lacks any means to metamorphose this US maximum ‘pressure’ into any meaningful political or strategic diplomatic path. It has attenuated down to ‘capitulate’, or we can make the pain worse. It is in short, the further radicalisation of US exceptionalism. John Bolton formulated it thus: “The greatest hope for freedom for mankind in history is the United States, and therefore protecting American national interest is the single best strategy for the world.” Or, in other words, your interests are irrelevant to me.

What may have initiated as an Art of the Deal strategy has evolved over time from ‘great-power rivalry’, into unabashed new ‘Cold War’. The consequence of this ‘to the devil with yourinterests’ approach, is that most likely now, neither China, nor Iran, nor Turkey actively want a ‘deal’ with US.

This has been particularly relevant in the case of Turkey. As a key NATO member, Turkey largely has been taken for granted in terms of the US pursuit of its own interests, but reciprocity has not recently been on offer: Turkey was simply assumed to have no interests that NATO or the United States felt duty bound to respect. NATO membership was in itself, accolade enough. And, with Turkey’s anger at the 2016 coup attempt, and with its dismay at Centcom’spursuit of its Kurdish autonomy project, NATO simply shifted to raising the NATO-positioning of (an all too willing) Greece – Turkey’s ancient nemesis. Thus, the single-minded pursuit of US interests (in Syria) has resulted in the setting-up of a new struggle between Turkey and Greece in the East Mediterranean, threatening too, to unstitch the precarious status of Greek-dominated Nicosia. Not surprisingly, Turkey is re-discovering its old role as a Eurasian power, with China and Russia according Turkey appropriate esteem. Like others, it seems to be embracing the Chinese-Russian architecture.

This is not to imply that America’s beggar-my-neighbour trade and geo-political approach, nor its shying from wars, can alone account for the present crop of troubles. The radical leverage of US interests to the point of zero-tolerance of others’ interests however does raise the question: why is there no ‘plan B’ if China, Iran, Russia and North Korea refuse to capitulate?

Is it then, that a pathway to a ‘deal’ was never what some in Washington wanted? Is it that the objective from the outset was to use tariffs to break Asian supply lines – and to force them, via tariffs, to be reconstructed in the US. Is it that a new ‘nuclear deal’ with Iran was never actively sought by certain DC constituencies: that it was always about regime change?

The other, wider factor, accounting for this sense of a world in metamorphose precisely is the western cultural implosion, or ‘Great Switch’ (as the founder of the Rousseau Institute terms it). So little time ago, the western liberal, cultural and economic vision was at its apogee. It seemed inevitable. It seemed irrefutable. It stood as the western centre of gravity. But as President Putin recently observed, (so few years later), liberalism and the European so-called Enlightenment is viewed as ‘obsolete’ by much of the world. This quite sudden Great Shift has left the Liberal camp – that was partying ‘on top of the World’ – distraught, angry and apprehensive. In the polarised US and the UK, the antagonisms are causing people to eat each other alive.

The ‘civil war’ within the western paradigm allows other (non-western) states new space to find their own path. Sometimes this path can be potentially destructive — as in Modi’s Hindu-nationalist annexation of Jammu-Kashmir (during the Bush Administration Modi was denied a visa on grounds that he supported Hindu extremism during anti-Muslim riots in 2002). But the reality is that there is no longer any need to pay obeisance to the western moralising Shibboleths, when they are being violently challenged within the liberal citadels themselves. In short, if the West is fighting over its values, what price these values as the basis for the western-led Global Order?

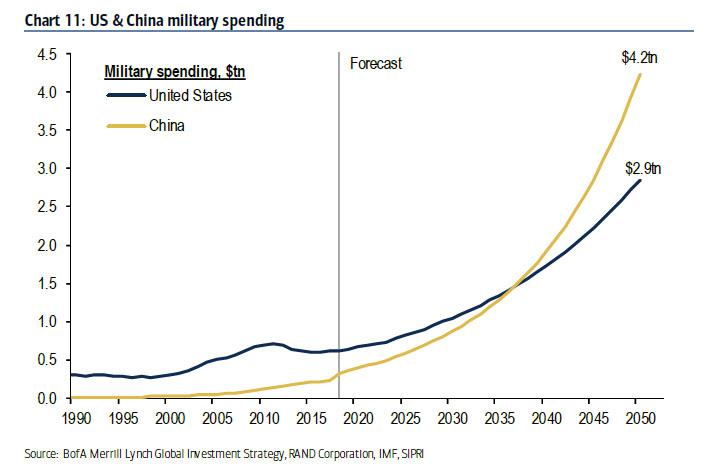

We are indeed at a point of inflection. Some westerners may muse that the status quo ante is somehow recoverable (if only Trump is gone, and the ‘populists’ contained). That is delusional. The external world is transforming. China, Russia and Asia will replace US hegemony – not with another hegemony – but with a loose coalition of states espousing a different values and civilizational model. And with their values differing from the Protestant paradigm of the John Locke, John Hume and Adam Smith, they will arrive at other economic perspectives.

And the status quo ante will not be available even domestically in the West. For, the western party political system itself is in irreversible transformation, too. Western politicians of all spectra are trying to adjust to a public life in which the old world is still around, whilst the new one is only emerging.

The post-war party political system of family and community ties to either Centre-Left and Centre Right (with not a great difference between the two) is dying in western democracies.The Centre-Left is expiring because its original mission is no longer relevant to a large enough proportion of the electorate. What is the point of parties that existed to represent the interests of trade unions and the industrial proletariat when mass employment in heavy industry has come to an end? Post-industrial economies are a global phenomenon.

“The popular conscience today is not exercised by the plight of great numbers of workers being exploited by factory owners. It is more concerned, if anything, by the prospect of factory closures. The old Left-wing battles over working conditions and pay are largely over. The new problem is much more subtle, and less amenable to socialist solutions: how to maintain an industrial sector which offers large-scale employment particularly to those with low (or no) skills. Globalisation has a great deal to do with this, but the decline of the factory-based economy is at the very heart of it” (as in Trump’s appeal to the ‘deplorables’ from a stance on the Nationalist-Right, rather than the Left, strongly suggests), writes Janet Daley.

So here we are at the western dilemma: The moderate forces of Centre-Left and Centre Right are still hoping to represent the people they always have: middle class voters who want to display their decency by voting for a party that espouses some notion of ‘social concern’. But, as the preoccupations of the élite, metropolitan consciousness have turned to more specific ‘disadvantaged’ groups – ethnic minorities, women, and gender non-conformists – the less likely it is that they will give any regard or understanding to the everyday impact of failed mass immigration and multiculturism on the majority (the ‘Sixty-Percent’). And so the polarisation grows, with each group retreating into its enclave. And the Centre Parties wane, in line with a shrinking, economically-struggling Middle Class.

Three major political forces are gathering strength in this political environment where global warming (for the former Centrists), and immigration (for the sixty per centers) are the new defining issues.

-

Nationalist right-wing parties, once marginal, are now a structural element of Europe’s political landscapes.

-

The Centre is struggling everywhere,

-

and the third force is becoming the Green movement. Its spectacular rise – as voters reject the traditional parties and press their leaders on the urgency to act against climate change – is mostly attributable to a mobilisation of the young.

It is this cloistered élite ‘blind spot’ of discounting the adverse effects of globalisation on the ‘Sixty-Percenters’, in favour of pursuing their ephemeral identity preoccupations, that has become toxic for what remains of the old working class. Daley suggests this blind spot “probably cost Hillary Clinton the presidency: women in the depressed rust belt states were not worried about “glass ceilings”, they were worried about putting food on the table and whether their men would ever work again. What happened next? They voted, as the angry and disenfranchised are inclined to do, for a demagogue who did not regard them with contempt, and who gave voice to their frustration”.

The status quo ante is no longer available – even domestically – in the West, let alone externally. The Great Switch is underway. Society has lost its cultural centre of gravity. The old way of life is fading, and is close to extinction.

via ZeroHedge News https://ift.tt/2KOMlJx Tyler Durden