WeSleep? Casper Lowers IPO Range Amid No Love For Unicorns

Update (Feb. 05): Casper Sleep Inc. reminds us of the WeWork implosion late last summer when the shared workspace company failed to IPO, ran out of cash, and was then bailout out.

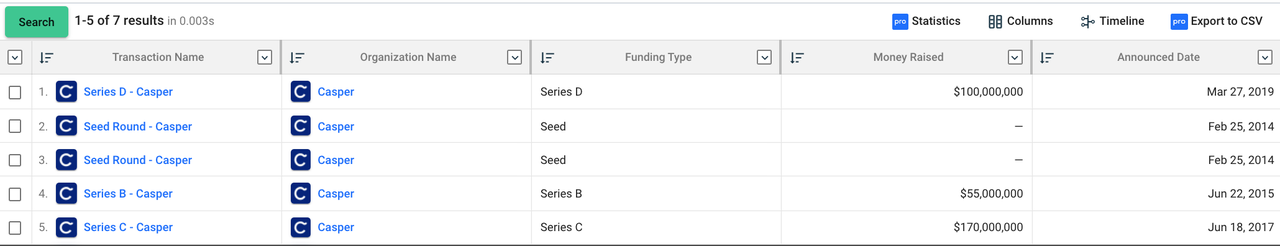

The unicorn mattress retailer slashed its IPO price in the latest filing, now between $12 and $13 per share, a far cry from $17 to $19 last week. The move in price reduced the company’s valuation to $500 million, down from $768 million last week, and down from $1.1 billion in the latest private funding round. This means the company has lost more than half of its value in about one year.

Morgan Stanley, Goldman Sachs, and Jefferies are some of the underwriters on the deal.

This appears to be yet another move by VC firms and investment banks to dump trash onto the public markets to save their high net worth clients of financial elites, politicians, Hollywood actors, and sports icons, which some in the latest round, could take a massive haircut on their investment.

And what does Twitter have to say about Casper’s IPO attempt?

Casper valuation on private markets early 2019: $1.1 B

Casper hoped-for IPO valuation last month: ~$750 M

Casper hoped-for valuation now: ~$500 M

— Eliot Brown (@eliotwb) February 5, 2020

$CSPR Feb 5 (Reuters) – Casper Sleep Inc is seeking a much lower valuation in its initial public offering than it had initially expected as the money losing online mattress retailer tries to lure investors in a tepid market for IPOs following WeWork’s debacle last year.

— c lark (@7LadyQ) February 5, 2020

My simplistic initial takeaway from skimming Casper IPO: Being significantly unprofitable with only 20 percent revenue growth is not a great place to be in this environment

— Jason Del Rey (@DelRey) January 10, 2020

Another WeWork?

Casper IPO valuation dwindles from peak of $1 billionhttps://t.co/EfusRX6Eo6

— Stalingrad & Poorski (@Stalingrad_Poor) January 27, 2020

* * *

“Smart money” investors, such as some Hollywood actors and sports icons, are linked up with top VC firms and investment banks, have been stung by the VC bubble of overinflated unicorns that see a valuation collapse right before IPO.

Think WeWork, and what happened to the office-sharing space company last fall, it’s valuation plunged as it attempted to IPO. The company then ran out of money and was bailed out by its largest shareholder, SoftBank.

Leonardo DiCaprio and rapper 50 Cent have been the latest “smart money” investors to feel the pain of plunging valuations, after their investments in Casper Sleep Inc., an online mattress retailer, saw valuations fall as it attempts to IPO.

Reuters notes that the unicorn mattress company will issue 9.6 million shares between the $17 to $19 level, which is at the top part of the range, giving the company $182.4 million in IPO proceeds. Such a level would also give the company a $768 million valuation, or about a -23% drop in book value from its latest funding round.

In 1Q19, the money-losing company was valued at $1.1 billion, which is a -30% decline in today’s valuation versus what was seen early last year.

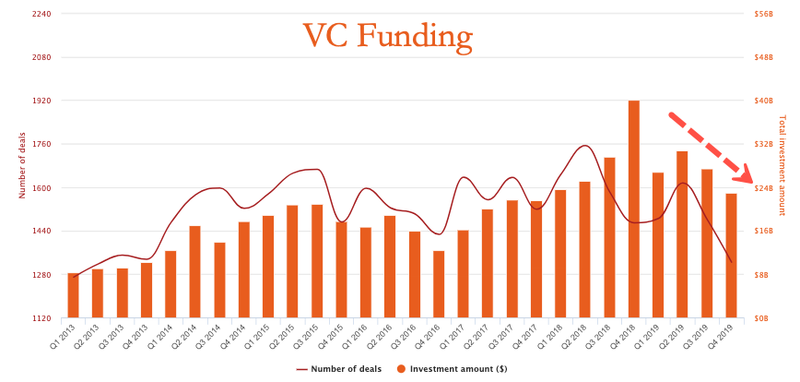

We noted since WeWork imploded last fall, investors’ risk appetite for money-losing companies has collapsed. This has also marked the top of not just the VC bubble, but also the IPO bubble.

“Valuations in the private market are currently under the microscope, especially with unicorns, as they attempt to tap the public markets,” said Jeff Zell, a senior research analyst at IPO Boutique.

“The biggest hurdle that Casper Sleep is going to have during the roadshow process is proving to investors a viable path to profitability while competing in a highly competitive industry,” Zell said.

Even “smart money” in Hollywood is feeling the pressure as the bubble of everything deflates.

Tyler Durden

Wed, 02/05/2020 – 15:30

via ZeroHedge News https://ift.tt/2U4NS4E Tyler Durden