When California’s Proposition 14 was debated and passed in 2010, thereby creating primary elections open to all voters regardless of party registration, activists on the outside of mainstream politics worried that it would amount to a death sentence for third parties. By graduating only the top two primary finishers to the general election, they warned, the new system would lock in the advantage of Democrats and Republicans.

When California’s Proposition 14 was debated and passed in 2010, thereby creating primary elections open to all voters regardless of party registration, activists on the outside of mainstream politics worried that it would amount to a death sentence for third parties. By graduating only the top two primary finishers to the general election, they warned, the new system would lock in the advantage of Democrats and Republicans.

So how did the outsiders fare in yesterday’s California primary? Just eight—five independents, two Greens, and one Libertarian—advanced to compete for one of the 166 electoral positions in November’s general election. And of those, only one finished within 30 percentage points of the front-runner.

The top vote-getter of the group actually won the first round: Steve Poizner, California’s insurance commissioner as a Republican from 2007-2011, ran for his old job this time as an independent, getting 41.3 percent of the vote to Democrat Ricardo Lara’s 40.6 percent. But Poizner will have a fight on his hands given that the third place finisher (with 13 percent of the vote) was also a Democrat, Asif Mahmood. Rounding out the insurance commissioner vote was Nathalie Hrizi of the Peace and Freedom Party with 5.1 percent, which was higher than any other third-party candidate for California’s eight statewide elected offices. (The best of the four Libertarian Party showings for those posts was Gail Lightfoot’s 2.4 percent for secretary of state, good for fifth place.)

Three of California’s country-topping 53 seats in the House of Representatives will be contested in November by candidates without a “D” or “R” next to their name. Independent Ronald Paul Kabat should be chum for Rep. Jimmy Panetta (D-Monterey), the Green Party’s Rodolfo Cortes Barragan will tilt at the windmill of Rep. Lucille Roybal-Allard (D-East L.A.), and Green Kenneth Mejia beat out Libertarian Angela McArdle, 12.1 percent to 8.5, for the opportunity to get clobbered by Rep. Jimmy Gomez (D-Los Angeles).

Two other Libertarians lost close races to non-major-party finalists for State Senate. In Sacramento, rising start L.P. activist Janine DeRose finished a close fourth, with 10.4 percent of the vote, while independent Eric Frame moved onto the gold medal round with 14.6. In the South Bay, Mark Herd fell just short of independent Baron Bruno, 11.4 percent to 13.2. In State Assembly contests, aerospace engineer Alan Reynolds, a self-described “independent moderate centrist,” finished second with 28.4 percent in a race against two Pasadena Democrats.

Two other Libertarians lost close races to non-major-party finalists for State Senate. In Sacramento, rising start L.P. activist Janine DeRose finished a close fourth, with 10.4 percent of the vote, while independent Eric Frame moved onto the gold medal round with 14.6. In the South Bay, Mark Herd fell just short of independent Baron Bruno, 11.4 percent to 13.2. In State Assembly contests, aerospace engineer Alan Reynolds, a self-described “independent moderate centrist,” finished second with 28.4 percent in a race against two Pasadena Democrats.

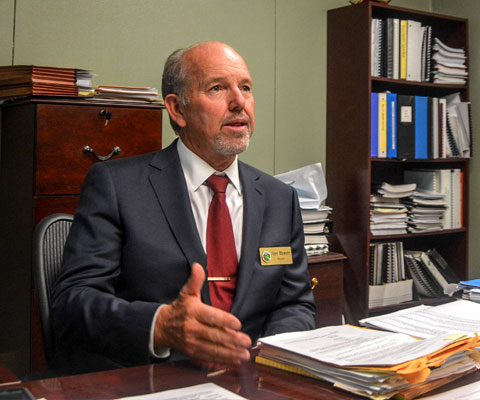

So is all hope lost for the Libertarian Party this November? No! L.P. State Secretary Honor “Mimi” Robson advanced to the knockout round for State Assembly representing the great city of Long Beach with 17.4 percent of the vote, elbowing out a Democrat (13.6 percent) and Green (10.1) for the right to go up against incumbent Democrat Patrick O’Donnell. And Calimesa Mayor Jeff Hewitt, arguably the most effective L.P. politician in the state, made it to the finals of the Riverside County Board of Supervisors election, running on a platform of reforming public-sector pensions.

Having 166 electoral slots contested by just eight non-traditional pols—seven of whom are massive underdogs—does not sound like much. And as the great Richard Winger of Ballot Access News points out, “It appears that in November 2018, there will be only four states with no third party candidates on the ballot for any statewide race: Alabama, California, Maine, and Washington.” That latter state pioneered the top-two open primary back in 2004.

Still, I recall in many election years past looking at a map of California districts and being able to draw a path for hundreds of miles before arriving at a contested House election; yesterday, only three of 53 House races featured just one candidate, and 25 had at least some third-party or independent challenger. I still think (unlike my former colleagues at the L.A. Times) that the law is a bad deal for third parties, which face obstacles enough in a system whose rules are largely crafted by our two 19th century holdovers. But the results are interesting to chew on.

from Hit & Run https://ift.tt/2LoSHhx

via IFTTT

In their haste to condemn the negative, unemployment-inducing effects of minimum wage laws, some free-marketeers are giving these forced pay hikes undue credit for spurring technological innovation.

In their haste to condemn the negative, unemployment-inducing effects of minimum wage laws, some free-marketeers are giving these forced pay hikes undue credit for spurring technological innovation. Social Security will be insolvent by 2034,

Social Security will be insolvent by 2034,

“What we’re seeing is a fast slide down a very slippery slope toward designer babies,”

“What we’re seeing is a fast slide down a very slippery slope toward designer babies,”

Within hours of President Donald Trump’s declaration last week that the United States will begin imposing steel and aluminum tariffs on Canada, Mexico, and the European Union, leaders of those countries offered sharp criticisms of Trump’s protectionism and defended the importance of free trade.

Within hours of President Donald Trump’s declaration last week that the United States will begin imposing steel and aluminum tariffs on Canada, Mexico, and the European Union, leaders of those countries offered sharp criticisms of Trump’s protectionism and defended the importance of free trade.