The Department of Defense (DoD) Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Program, in conjunction with the United States Army, has recognized a critical technology gap in the modern battlefield that could temporarily leave soldiers vulnerable to direct enemy fire.

The DOD SBIR/STTR Program’s new objective has been to elicit innovative solutions from academic institutions and small businesses to develop the next generation of combat uniforms for Army personnel that can reduce their signature and decrease detection from ground surveillance radar (GSR) threats in the modern battlefield.

Battlefield and ground surveillance radar (BSR/GSR) has become an essential component of electronic warfare and detection capabilities on the 21st-century battlefield, which makes it extremely challenging for soldiers to run for cover.

It seems as the DoD is falling behind on developing radar-invisible uniforms. In 2016, Russia announced that its scientists had developed a new fabric that would make its troops harder to detect via electronic warfare systems.

Mine-protected Boots, Stealth Fabric in Russian Future Soldier Gear. (Source: World Defense Forum)

That is why the DoD is now frantically searching for radar absorbent textile for its combat uniforms, as it has recognized that its arch-nemesis, Russia, is leading the way in pioneering stealth fabric.

“Radar absorbing and shielding technology has attracted a growing interest due to the recent advances in enemy electronic warfare and detection capabilities, leaving U.S. forces, especially infantry forces, vulnerable to detection across the electromagnetic spectrum,” according to a new SBIR and STTR solicitation to academia and private industry. “Advanced Battlefield and Ground surveillance radar (BSR/GSR) are readily available in military markets that are highly effective, portable, and automated for large area monitoring.”

Here is a basic example of the battlefield and ground surveillance radar (BSR/GSR) used for detecting tanks, armored fighting vehicles, and personnel. The device can detect troops or combat vehicles from miles away. This is an inexpensive and readily available device for militaries around the world.

While radar absorbing material (RAM) composites exist for a wide variety of air and land-based military vehicles, the DoD points out, “there are currently no effective and lightweight wearable options to mitigate GSR detection of a dismounted Soldier.” The emphasis of this call is to focus on soldier signature management “by altering/functionalizing clothing with radar absorbing materials” to thwart detection from BSR/GSR systems.

The Army’s specifications on the stealth fabric, include absorption of radar waves in the Ku- and X-frequency bands at distance up to 12 kilometers and “the fabric must be flexible, durable and breathable” to operate from -30 degrees to 125 degrees Fahrenheit.

“Prototypes must demonstrate lab and field based capabilities within the X and Ku frequency bands at distances up to 12 km. Prototypes will range from a standardized 1 m2 test sample to representative operational clothing and/or operational equipment (e.g. body armor carrier, rucksack, etc.). The performance of the test samples and prototypes must be evaluated in laboratory and field settings and assessed in terms of radar cross section reduction, flexibility, durability, breathability and air permeability. The prototype materials must be tested and clearly demonstrate consistent functional properties under simulated operational use to include environmental factors such as a wide range of temperatures (-30 – 125ºF) and environmental factors (e.g. high humidity, rain, etc.) The final deliverable must also include a commercialization assessment and the viability of mass producing the developed technology.”

It is highly unusual for the DoD to publicize such a significant vulnerability gap in America’s military, but it seems as the Army is falling behind the curve on stealth combat uniforms. Meanwhile, as we mentioned above, Russia claimed to have developed stealth fabric some two years ago. While President Trump awarded the Pentagon the largest budget in history, let’s hope stealth combat uniforms come soon, otherwise, America’s military edge could be obsolete on the modern battlefield.

via RSS https://ift.tt/2GnUHUj Tyler Durden

In March 2017, Sen. Rand Paul (R-Ky.) successfully delayed for

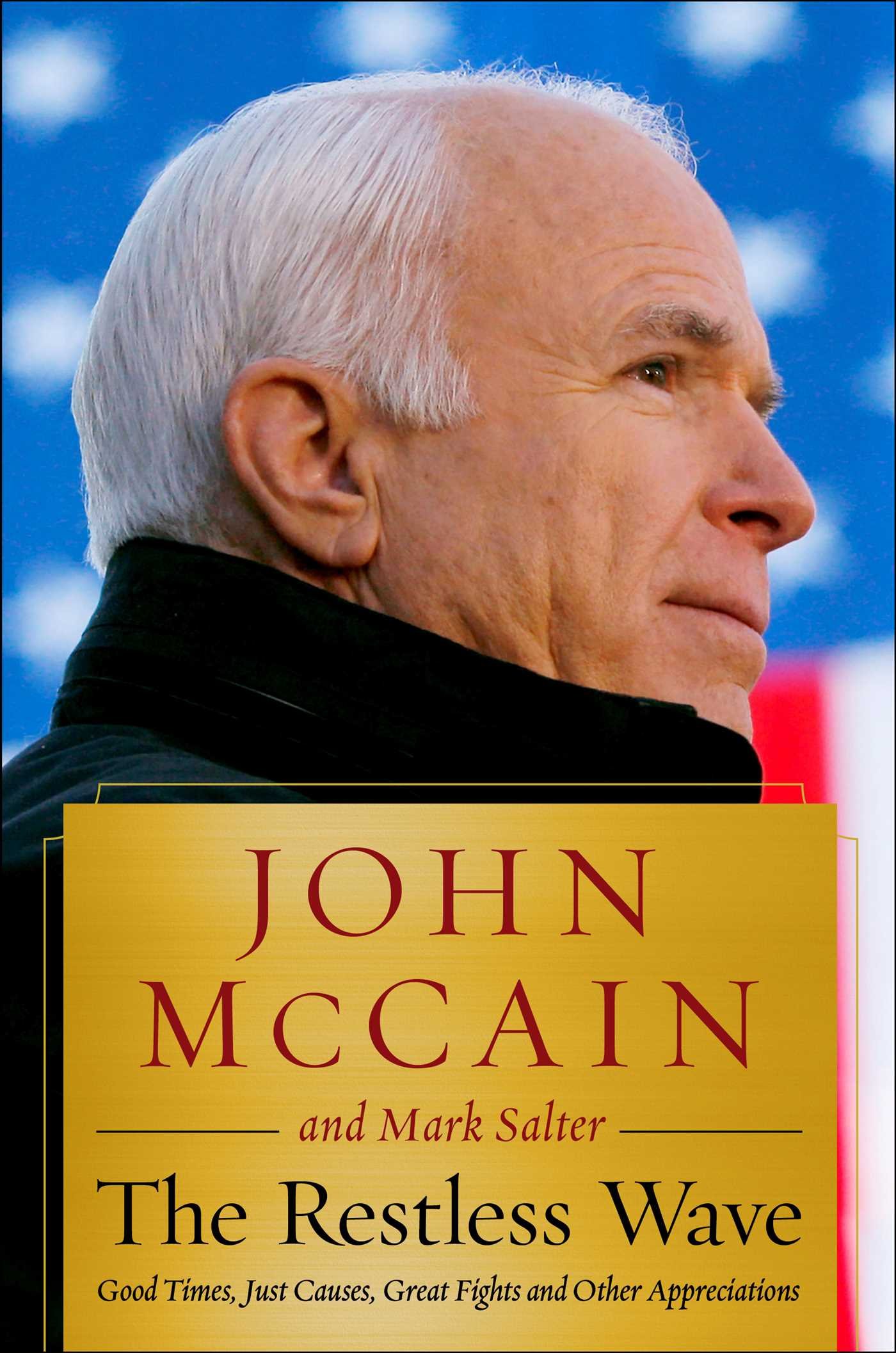

In March 2017, Sen. Rand Paul (R-Ky.) successfully delayed for  * Early in the book, McCain recounts with some bemusement the end of the 2008 GOP presidential primary season after chief rival Mitt Romney had dropped out: “[Mike] Huckabee remained in the race, as did libertarian Ron Paul [Rand Paul’s father]. Huckabee won a few more southern contests but formally withdrew in March after I had accumulated enough delegates to secure the nomination. Paul stayed in until June, when he suspended his campaign having never won a single primary or caucus, but having made a point of some kind to his passionate followers.”

* Early in the book, McCain recounts with some bemusement the end of the 2008 GOP presidential primary season after chief rival Mitt Romney had dropped out: “[Mike] Huckabee remained in the race, as did libertarian Ron Paul [Rand Paul’s father]. Huckabee won a few more southern contests but formally withdrew in March after I had accumulated enough delegates to secure the nomination. Paul stayed in until June, when he suspended his campaign having never won a single primary or caucus, but having made a point of some kind to his passionate followers.”

California’s assisted suicide law is in jeopardy after a judge ruled Tuesday that state lawmakers had

California’s assisted suicide law is in jeopardy after a judge ruled Tuesday that state lawmakers had