Today’s AM fix was USD 1,222.75, EUR 891.22 and GBP 750.89 per ounce.

Yesterday’s AM fix was USD 1,243.50, EUR 902.79 and GBP 758.51 per ounce.

Gold fell $26.40 or 2.11% yesterday, closing at $1,226.50/oz. Silver slid $0.79 or 3.89% closing at $19.52/oz. Platinum dropped $19.01, or 1.4%, to $1,360.74/oz and palladium fell $20 or 2.7%, to $715.25/oz.

Gold has spiked higher in late morning trade in London and is 0.6% higher on the day and 0.35% higher for the week. A higher weekly close this week will be positive from a technical perspective.

What Should Depositors Do To Protect Against Bail-In? 9 Key Considerations

Gold saw a sharp move lower by over 2% yesterday, despite little market moving data or news and other assets seeing less price movement. The price fall could have been due to heightened speculation of a Fed taper as soon as next week. However, if that was the case, one would have expected stocks to have seen similar price falls. Rather stocks were only marginally lower and remain near record highs.

Gold in U.S. Dollars, 10 Day – (Bloomberg)

Peculiar gold price falls have been common in recent weeks and months and have contributed to the 25% price fall we have seen this year.

Therefore, those who have diversified into gold in order to protect their wealth will welcome the move by the German financial regulator Bafin to widen their investigation into manipulation by banks of benchmark gold and silver prices.

The FT reports on the front page today that German banking regulator Bafin has demanded documents from Germany’s largest bank, Deutsche Bank, as part of a probe into suspected manipulation the gold and silver markets by banks.

Gold Prices / Fixes / Rates / Volumes – (Bloomberg)

Currently, gold fixing happens twice a day by teleconference with five banks: Deutsche Bank, Bank of Nova Scotia-ScotiaMocatta, Barclays Bank Plc, HSBC Bank USA, NA and Société Générale. The fixings are used to determine prices globally. Deutsche Bank is also one of three banks that take part in the equivalent process for silver.

The German regulator has been interrogating the bank’s staff over the past several months. Since November, when the probe was first mentioned similar audits in the U.S. and UK are also commencing.

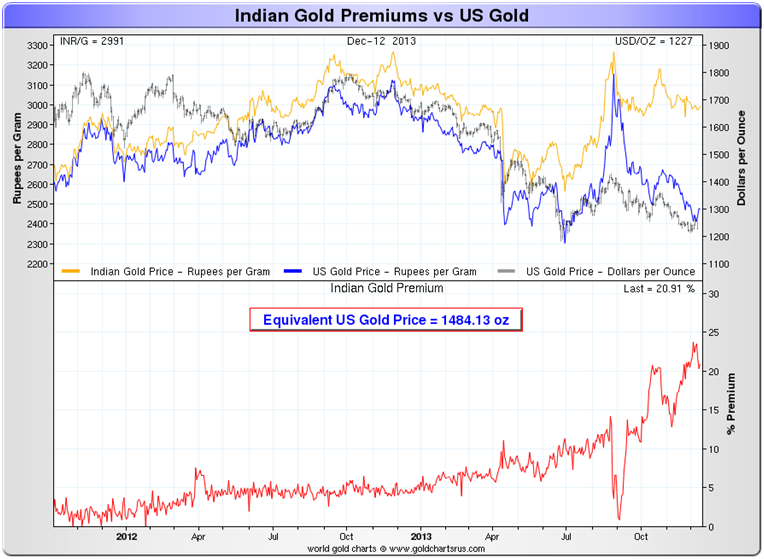

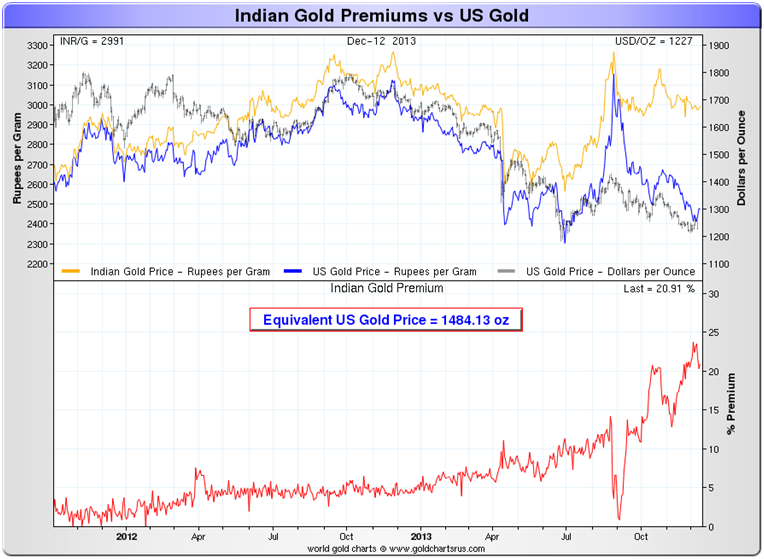

Premiums in China and India remained robust overnight and way over western premiums. Gold on the Shanghai Gold Exchange closed at $1,258.38 at 0700 GMT – a premium of $29.18 per ounce over spot.

Bullion premiums in western markets have seen little movement again this week. One ounce gold bars are trading at $1,276.44/oz or premiums of between 3.75% and 4.5%, and larger 1 kilo gold bars are trading at $40,832/oz or premiums of between 3% and 3.5%.

Indian demand declined yesterday but remains robust as dealers were not able to source gold.

Premiums remained steady at $120 per ounce over London prices. Last week, Indian premiums hit a record high of $160/oz. Imports into India have dropped off sharply this year after the Indian government raised the import duty to 10% earlier this year and tied imports volumes to exports, in a bid to curb a rising trade gap and the rush to gold by Indians concerned about the continuing devaluation of their rupee.

If the Fed defer a taper, we should see gold bounce from oversold levels which could help it test $1,300/oz again.

We do not believe the Fed will ‘taper’ next week as the U.S. economy remains very fragile and any reduction on bond purchases could lead to turbulence in financial markets, a rise in bond yields and affect the wider economy.

But if the Fed does reduce its massive bond buying programme marginally next week, gold will likely fall to test strong support at $1,200/oz again.

Gold looks likely to bounce back next year and the positive drivers for gold are strong store of wealth physical demand, particularly in China, due to macroeconomic, systemic and monetary risk.

The eurozone debt crisis is far from resolved and sovereign debt issues in Japan, the UK and the U.S. will likely rear their ugly heads again leading to safe haven demand for gold.

U.S. Treasury Amount of Outstanding Debt – Price/Billion – (Bloomberg)

We pointed out yesterday why it is important to remember that the Federal Reserve is printing nearly $20 billion every single week. The U.S. National Debt is now over $17.2 trillion and continuing to rise and the U.S. has unfunded liabilities (Social Security, Medicare and Medicaid) of between $100 trillion and $200 trillion.

Staggering numbers which suggest alas that the U.S. politicians are rearranging chairs on the titanic.

What Should Depositors Do To Protect Against Bail-In?

Depositors in G20 or FSB regulated countries should examine the financial health of their existing bank or banks.

Some issues to watch would include institutions with legacy issues such as a high level of non-performing loans, a possible need for recapitalisation and low credit ratings. These banks should be avoided, as they have a higher chance of needing restructuring and hence a higher chance of a bail-in.

Deposits are insured for up to €100,000, £85,000 and $100,000 per person, per account in the EU, the UK and the U.S. respectively. Although there is no guarantee that an insolvent government will be able to fund its deposit insurance scheme, it is uninsured deposits which are more at risk of a bail-in.

Therefore, it would be prudent for depositors not to hold bank deposits in excess of these figures in any one financial institution since –

a) they are not insured, and

b) deposits in excess of those arbitrary figures are more likely to be bailed in

There is an assumption that in the event of bail-in, only bank deposits of over these arbitrary figures would be vulnerable. However, there is no guarantee that this would be the case. Should a government be under severe financial pressure, it may opt to only protect deposits over a lower amount (e.g. €50,000, £50,000, $50,000).

Since capital controls have already been imposed on one Eurozone country, Cyprus, it seems quite likely that they will be imposed in other countries in the event of new banking crises or a new global systemic crisis.

Cypriot authorities imposed restrictions on bank money transfers and withdrawals, including a daily cash withdrawal limit of €300 per day. Many banks had to restrict withdrawals to €100 per customer per day in order to prevent them running out of euros. Electronic wire transfers were suspended for a number of days, prior to being allowed but with a low maximum daily limit.

Therefore, having some of one’s savings outside of

the banking system makes sense. It should be held in a form that is highly liquid, such as gold, and can be converted back into cash in the event of cash withdrawal restrictions. Cypriots who owned gold were less affected by the deposit confiscation or ‘haircut’ as they could sell their gold in order to get much needed euros.

In the coming years, the role of gold in an investment portfolio will become more important due to its academically and historically proven safe haven qualities. Now, with the risk of bail-ins, savers and corporate treasurers should consider diversifying their savings portfolio and allocate 5% to 10% of the overall savings portfolio to gold.

However, it will not be enough to simply allocate funds to some form of gold investment. In the same way that certain banks are more risky than others, so too are many forms of gold speculation and investment more risky than others.

It is vitally important that those tasked with diversifying deposits do not jump out of the frying pan and into the fire.

An allocation to actual physical gold owned with the safest counterparties in the world will help depositors hedge the not insignificant risk of keeping money on deposit in many banks today.

It is important that one owns physical gold and not paper gold which could be subject to bail-ins.

Physical gold, held in allocated accounts conferring outright legal ownership through bailment

remains the safest way to own gold. Many gold investment vehicles result in the buyers having very significant, unappreciated exposure and very high counterparty risk.

Owning a form of paper gold and derivative gold such as an exchange traded fund (ETF) in which one is an unsecured creditor of a large number of custodians, who are banks which potentially could be bailed in, defeats the purpose of owning gold.

Potentially, many forms of gold investment themselves could be bailed in and the FSB’s inclusion of Financial Market Infrastructures in potential bail-ins including “central counterparties, insurers, and the client assets held by prime brokers, custodians and others” underlines the importance of owning unencumbered assets that are owned directly.

Extensive research shows that owning gold in an investment portfolio enhances returns and reduces the entire portfolio’s volatility over the long term. In the coming years, a diversified savings portfolio with an allocation to gold, will reduce counterparty risk and compensate for very low yields.

The wise old Wall Street adage to always keep 10% of one’s wealth in gold served investors well in recent years. It will serve those attempting to safeguard deposits very well in the coming years.

In general, people should avoid holding euros or other cash outside of their bank accounts, however there is now a case to be made that holding a small amount of cash outside of vulnerable banks would be prudent. Just enough cash to provide for you and your family’s needs for a few weeks.

However, this should never be done unless the cash is held in a very secure way, such as a well hidden safe or safety deposit box. It would be safer not to keep assets in a safety deposit box in a bank.

Overall, diversification of deposits now has to be considered.

This means diversification across financial institutions and across countries or jurisdictions globally.

Safest Banks

Financial institutions should be chosen on the basis of the strength of the institution. Jurisdictions should be chosen on the basis of political and economic stability. A culture and tradition of respecting private property and property rights is also pertinent.

While depositors need to do their own due diligence in which banks globally they may wish to open a bank account, Table 1 (see From Bail-Outs to Bail-Ins: Risks and Ramifications) illustrates that there are numerous banks globally which are still perceived to be financially strong. The banks in table 1 have been ranked by taking the average long term issuer credit rating applied to the bank by the main global credit rating companies, Moody’s, S&P and Fitch.

A credit rating is an assessment of the solvency or creditworthiness of debtors or bond issuers according to established credit review procedures. These ratings and associated research help investors analyse the credit risks associated with fixed income securities by providing detailed information of the ability of issuers to meet their obligations. A rating is continuously monitored. It enables investors and savers to measure their investment risk.

Long term credit ratings of the major agencies take into account factors such as financial fundamentals, operating environment, regulatory environment, corporate governance, franchise value of the business, and risk management, as well as the potential financial support available to the bank from a parent group, or a local or national government.

While credit ratings express an opinion on a bank’s vulnerability of defaulting, they don’t quantify the probability of default. However, credit ratings are still widely used and are one of the most commonly used ways of ranking the relative financial strength of banks.

The credit rating reflects the credit risk or general paying ability of the issuer, and so reflects the solvency or creditworthiness of the issuer from the point of view of investors who, along with depositors, are the main creditors of the bank. Certain countries host more financially strong banks than others as can be graphically seen in the table.

Notice that many of the safest banks in the world are in Switzerland and Germany.

Indeed, it is interesting to note that despite the Eurozone debt crisis, many of the safest banks in the

world are in the EU or wider Europe. These include banks in the Netherlands, Luxembourg and France – despite many French banks being very vulnerable as is the French sovereign.

Outside of Europe, Singapore has some very strong banks, as does Norway, Australia, Canada and Sweden.

There are only a few UK and U.S. banks on the list of global top banks that should give pause for thought.

There are a number of institutions in jurisdictions such as Hong Kong, Chile, Japan and some Middle Eastern countries. As of yet, banks in the large emerging markets have not made their mark but we would expect banks in China, Russia, Brazil and in India to begin moving up the table in the coming years. The sounder sovereign position and lack of public and private debt in these countries will help in this regard.

There are no banks from problem European economies on the list for good reason. Their banks do not have high enough credit ratings. In fact, banks from Cyprus, Greece, Portugal, Spain, Italy and Ireland consistently had relatively low long term ratings from the ratings agencies. In terms of ratings, they rank nowhere near the top 20 banks in the world and most are ranked between 200 and 400.

Besides considering the relative safety of different banks, with interest rates so low on bank deposits and increasing taxes on interest earned on deposits leading to negative real interest rates – depositors are not being rewarded with adequate yields to compensate for the risk to which they are exposed.

Thus, as is often the case, savers need to consider alternatives to protect their wealth

Without a clearly thought out plan, many will be prey for the financial services sales machine and brokers and their array of more risky investment and savings products – including so called “capital guaranteed” products – many of which are high risk due to significant and unappreciated counterparty risk.

It is vitally important that investors have independent custodians and trustees. This greatly reduces counterparty risk should a broker, fin

ancial adviser, insurance company or other financial institution become insolvent.

9 Key Considerations

Depositors internationally should examine the financial health of their existing bank or banks. Overall, diversification of deposits now has to be considered. However, it is vitally important that those tasked with diversifying deposits do not jump out of the frying pan and into the fire. This means diversification across financial institutions and across countries or jurisdictions globally.

Financial institutions should be chosen on the basis of the strength of the institution. Jurisdictions should be chosen on the basis of political and economic stability. A culture and tradition of respecting private property and property rights is also important.

1. Diversify savings across banks and in different countries

2. Consider counterparty risk and the health of the deposit-taking bank

3. Attempt to own assets outright and reduce risk to custodians and trustees

4. Own physical gold in allocated accounts with outright legal ownership

5. Avoid investments where there is significant counterparty risk, such as exchange traded

funds and many structured products

6. Avoid banks with large derivative books and large mortgage books

7. Monitor banks’ and institutions’ financial stability

8. Monitor deposit and savings accounts’ terms and conditions

9. Monitor government policy pertaining to banks and bank deposits

Download Protecting your Savings In The Coming Bail-In Era (11 pages)

Download From Bail-Outs to Bail-Ins: Risks and Ramifications – Includes 60 Safest Banks In World (51 pages)

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/VhYqMwYYaU8/story01.htm GoldCore

Canada’s

Canada’s