Submitted by Lance Roberts via RealInvestmentAdvice.com,

President Obama Creates 15M Jobs

In a recent op-ed by President Obama for the economist wrote that his team has created a “more durable, growing economy” with “15 million new private-sector jobs since early 2010.”

No. Not Really.

But, hey let’s give him, and the mainstream media that recirculated this overly-optimistic spin, an “A” for effort. The chart below shows the total number of jobs created by each President going back to Ronald Reagan. Since the President takes office on January 20th, I have calculated the job gains from February 1st through the end of their Presidency. (Importantly, President Bush only served one term following Reagan.)

“But, hey, he still created almost 11 million jobs. That’s good, right?”

But even this measure of job-creation is inaccurate for several reasons.

First, the President DOES NOT create jobs but hopefully fosters an economic environment that is beneficial for job growth. Given the onset of a massive number of additional regulations, the attack by the EPA on companies progress the Administrations “climate change agenda,” higher levels of taxation and higher health care costs due to the Affordable Care Act, it is actually surprising job growth has been as strong as it has. According to the NFIB, small businesses make up roughly 80% of all businesses that hire employees in the country. It is difficult for them to hire when their top three concerns are Government Regulations, Taxes and Labor Costs. (Note: When labor costs become a rising concern, as they are now, it has generally been a decent leading indicator of a recession.)

Most likely, had the President not done anything, job growth would have actually been the same or better. This is simply due to the fact that employment increases are affected by increases in the working-age population. Which brings me to my second point.

What is never discussed in the monthly job reports are the number of jobs created versus the growth in the working-age population of the country. This is an important and overlooked concept. If 1-million jobs are gained, but the working-age population gains 2-million, there is a deficit of sufficient job creation to keep up with those needing work. When comparing job creation to working-age population, a different story emerges.

With the exceptions of Presidents Reagan and Clinton, the working age population has significantly outpaced the level of actual job growth leaving a rising level of individuals unemployed.

Importantly, as opposed to the total labor force calculation, this measure includes ALL individuals available, and of age, to work.

It is here that we find the problem with the employment reports. The problem shown above is most often explained away by a rather sweeping statement:

“The problem with the labor force is due to the large number of ‘baby boomers’ retiring.”

As I discussed recently in “Don’t Blame Baby Boomers For Not Retiring,” that argument doesn’t fly.

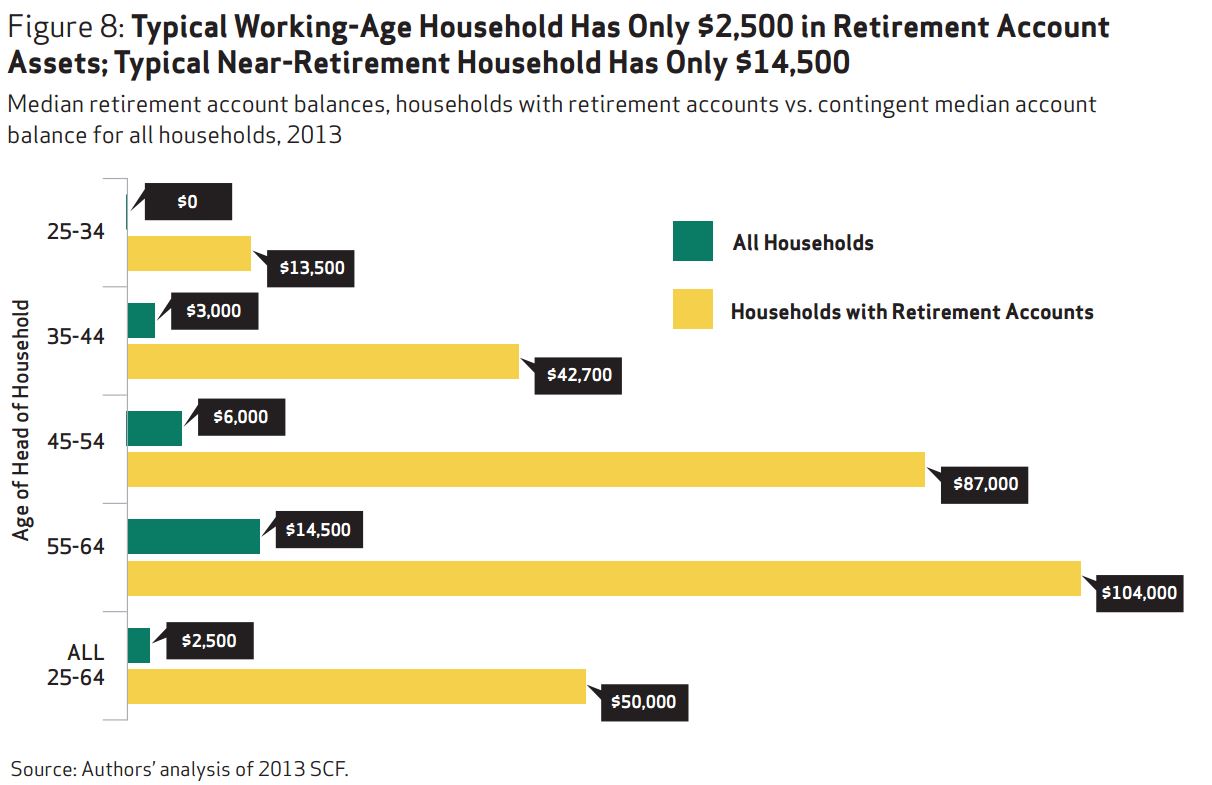

“This divide is clearly seen in various data and survey statistics such as the recent survey from National Institute On Retirement Security which showed the typical working-age household has only $2500 in retirement account assets. Importantly, ‘baby boomers’ who are nearing retirement had an average of just $14,500 saved for their ‘golden years.’”

With 24% of “baby boomers” postponing retirement, due to an inability to retire, it is not surprising the employment level of individuals OVER the age of 65, as a percent of the working-age population 16 and over, has risen sharply in recent years.

This should really come as no surprise as decreases in economic and personal income growth was offset by surges in household debt to sustain the standard of living. The reality is “baby boomers” are not retiring at a record clip. They simply can’t afford to.

If You’re Not Counted, Do You Not Count?

The most recent release from the Bureau of Labor Statistics on employment for the month of September was mostly disappointing with fewer jobs created than originally thought. But that begs the question of who is actually counted:

In order to be considered as unemployed by the BLS one must be:

- Unemployed, obviously, AND;

- Have ACTIVELY looked for work in the prior 4-weeks, AND;

- Are currently available for work.

If you do not fit that criterion you are not counted in the “official” employment report known as the U-3 report. Today there are more than 94-million individuals that do not fit the criteria and are simply not counted.

This is where the employment measures get a lot more obscured. As stated, out of the total population of 254,091,000 working-age individuals (16 and over) more than 94-million are not counted as part of the labor force currently. In other words, 37% of the working-age population is excluded from the employment statistics.

However, even with the exclusion of 1/3 of those of working-age, the labor-force participation rate, the number of individuals employed versus those counted as part of the labor force is still hovering at the lowest levels since the 1970’s.

Importantly, there is also a stark difference between today and the 1980-90’s where the LFPR was rising versus a steady decline. Demographic trends, structural shifts in the employment makeup, and statistical measures all feed into this phenomenon and there is little data on the horizon which suggests this will change anytime soon.

If we really want to know how each President has fared in creating a better economic environment for average American’s, we should measure how they fared in improving the overall participation in the workforce. The chart below shows each President’s performance in the monthly net changes of the LFPR.

This paints a very different picture about the success of job creation in the country post the last recession. This is particularly the case when:

- 1 out of 5 households has NO ONE employed,

- 1 out of 3 individuals are dependent on some sort of social support program, and;

- Over 20% of personal incomes are comprised of government transfers.

But, despite all of the rhetoric, discussions, debates, excuses and finger-pointing in regards to the latest jobs report; there is only one chart of employment that truly matters: the number of full-time employees relative to the working age population. Full-time employment is what ultimately drives economic growth, pays wages that will support household formation, and fuels higher levels of government revenue from taxes.

Since this is a real measure of economic success, we can once again compare each President’s performance of the growth of full-time employment under their tenure.

The “good news” is that for those that are currently employed – job safety is high. Businesses are indeed hiring, but prefer to hire from the “currently employed” labor pool rather than the unemployed masses. More importantly, businesses are hiring only enough to keep up the incremental demand of population growth rather than expanding on the assumption of future growth.

This is the “new normal” of an economy where real economic prosperity remains elusive as the Federal Reserve’s interventions continue to create a wealth effect for market participants which, unfortunately, is only enjoyed by a small minority of the total population. For the other 80%, it remains a daily struggle to make ends meet.

More Deaths Than Births

But here is the real problem for President Obama’s victory lap. IF employment was indeed growing at the fastest pace since the 1990’s, then wage growth, and by extension, economic growth should be at much stronger levels as well. That has YET to be the case outside of mandated minimum wage increases.

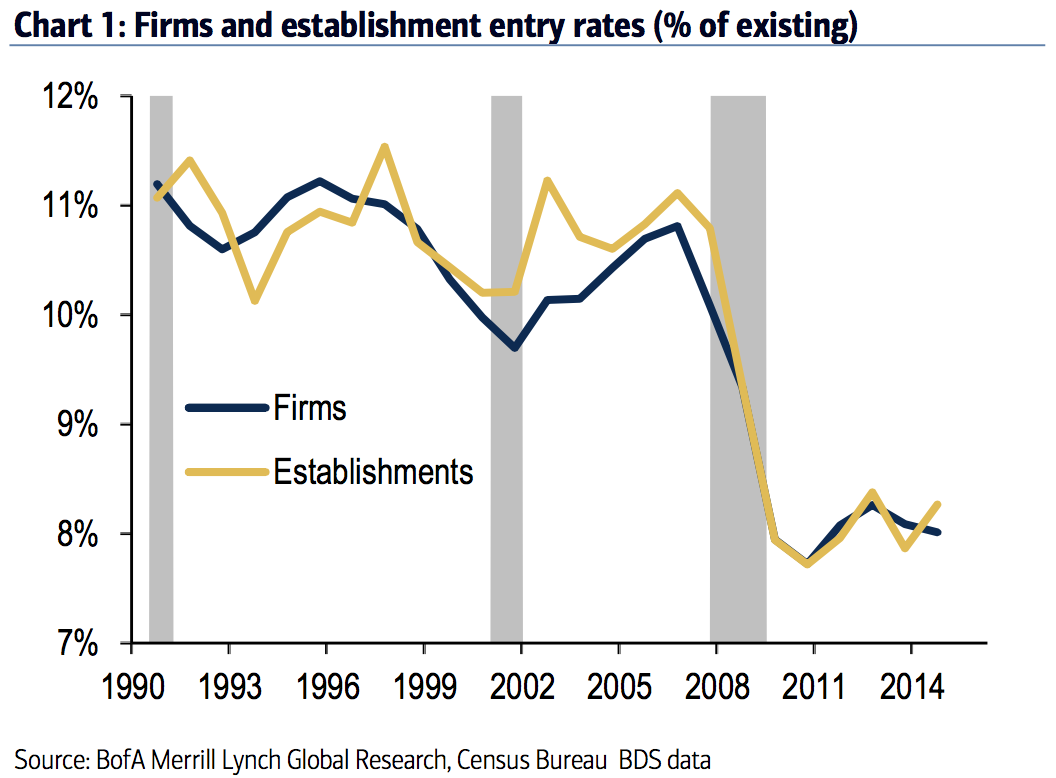

However, if the economy was actually growing we should see an expansion of businesses created by entrepreneurs stepping out their own. As I have addressed previously, this has NOT been the case.

“Both the formation of firms and establishments, have dropped off precipitously since the financial crisis and remained low.

This is important because new businesses typically hire faster and produce higher levels of productivity than firms that have been around for a while. Thus the decline in business formation can explain some of the labor market’s post-recession problems, and is at least part of the reason for the steep drop in productivity.”

This decline in business formation is crucial to the issue of the employment reports. Part of the reporting problem, which has yet to corrected by the BLS, is the continued overstatement of jobs through the“Birth/Death Adjustment.”

“This chart CLEARLY shows that the number of “Births & Deaths” of businesses since the financial crisis have been on the decline. Yet, each month, when the market gets the jobs report, we see roughly 180,000 plus jobs.

Included in those reports is an ‘ADJUSTMENT’ by the BEA to account for the number of new businesses (jobs) that were “birthed” (created) during the reporting period. This number has generally ‘added’ jobs to the employment report each month.

The chart below shows the differential in employment gains since 2009 when removing the additions to the monthly employment number though the “Birth/Death” adjustment. Real employment gains would be roughly 5.26 million less if you actually accounted for the LOSS in jobs discussed in the first chart above.”

Actually, I am being generous. The chart above just assumes NO births or deaths of businesses. However, given that we have been LOSING businesses since 2008, the differential is markedly worse.

So, before President Obama takes his final victory lap with claims of creating the most robust employment recovery since the 1990’s, the data clearly suggests otherwise.

Of course, if you ask the 37% that are no longer counted as part of the labor force, they will tell you the same thing.

Just some things I am thinking about.

via http://ift.tt/2elslRS Tyler Durden