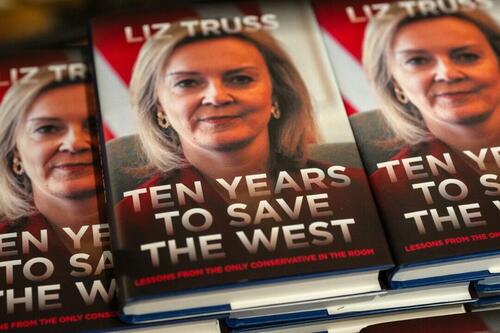

Former British PM Liz Truss Warns About Global Threat Of The Left

Former British Prime Minister Liz Truss spoke Monday at The Heritage Foundation about how the United States and the United Kingdom are facing very challenging forces in the global left, not just in terms of their extremist activists, but also in the power they hold in our institutions.

She warned that conservatives must create a stronger infrastructure to take on the left—which is well-funded, activist, and has many friends in high places—by recruiting more conservative activists and candidates who can fight in the trenches in the ideological war that we now face.

Excerpts from her remarks are below.

Why am I launching “Ten Years to Save the West” in the United States as well as in the United Kingdom? Well, I like to think of the United States of America as Britain’s greatest invention, albeit a slightly inadvertent invention. And if you look at our history, from Magna Carta to the Bill of Rights to the American Constitution, we have developed and perfected representative democracy.

And if you look at what is going on in our societies, first of all, the Brexit vote back in 2016 and then the election of President Donald Trump later that year, you can see the same desires of our people for change and the same desires for those conservative values and that sovereignty.

And if you look at the battle for conservatism now and the frequency with which we get new prime ministers in the United Kingdom and the frequency with which you get new speakers of the House here in the United States, we can see again that there is a battle for the heart and soul of conservatism on both sides of the Atlantic. And I think that battle is very important. Because, let’s be honest, we have not been winning against the global left.

If you look at the history since the turn of the millennium, the left have had the upper hand. And it’s not the old-fashioned left who used to argue about the means of production and economic inequality. It’s the new left who have insidious ideas that challenge our very way of life.

Whether it’s about climate extremism that doesn’t believe in economic growth, whether it’s about challenging the very idea of a man and a woman and biological sex, whether it’s about the human rights culture that’s been bedded into so much of our society that makes us unable to deal with illegal immigration—those new ideas have been promulgated by the global left and they have been successful in infiltrating quite a large proportion of society and a large part of our institutions.

Let’s just look at the state of economics. I am a supply-sider. I know that it works. We saw it work under [U.S. President Ronald] Reagan and [UK Prime Minister Margaret] Thatcher, and yet we’ve seen the domination of Keynesian economics in recent years, bloated size of government, huge debts in both of our countries.

On the immigration and human rights culture, look at what is going on now on American university campuses where it is not safe anymore to be Jewish, or the streets of London where a Jewish man could not cross the road during yet another appalling protest, or the fact that we can’t seem to deport illegal immigrants either from your southern border or the small boats that are crossing the channel.

Or take wokery, another bad neo-Marxist idea developed from [Michel] Foucault and all those crazy post-modernists in the 1960s, the idea that biological sex is not a reality.

We now have President [Joe] Biden introducing regulations around Title IX, which means that girls could see biological boys in their changing rooms, in their locker rooms, in their school restrooms and not be able to do anything about it. And if they complain about it, they could be the ones guilty of harassment. How on earth can that be happening in our society?

Or the climate extremists who aren’t satisfied with just stopping coal-fired power stations here in America, [liquefied natural gas] terminals being built, fracking in the United Kingdom, but want to go further. Whether it’s imposing electric vehicles or air-source heat pumps or extra taxes on the public. Meanwhile, our adversaries in China are busy building coal-fired power stations every week.

I see that as unilateral economic disarmament in the middle of what is a various, serious threat to the West.

So how has it ended up that after the turn of the millennium, despite the fact that we have many conservative intellectuals and politicians, why have our institutions, why has so much of our public discourse shifted to the left?

Well, first of all, too many conservatives have not been making the argument. Now, I call them conservatives in name only, CINOs. I know in America you call them RINOs. But these conservatives in name only, rather than taking on those ludicrous ideas, instead have tried to appease and meet them halfway.

Why have they done this? Well, first of all, they don’t want to look mean. They don’t want to look like they’re against human rights. They don’t want to look like they’re against the environment. They don’t want to be mean to transgender people. They’ve allowed those arguments to affect their views on what is right and wrong. But it’s also more cynical than that.

If you want to get a good job after politics, if you want to get into the corporate boardroom, there are a group of acceptable views and opinions that you should hold. And most of them are on that list. If you want to be popular and get invited to a lot of dinner parties in Washington, D.C., or London, there are reviews on that list that you should hold. And people have chosen dinner parties over principle.

But the other thing I think we’ve missed on the conservative side of the argument, and I put my hands up to this, is the rising power of the administrative state. The fact that power—which previously lay in the hands of democratically elected politicians, like them or not they can be voted out of office—is now in the hands of so-called independent bodies, whether it’s central banks, whether it’s government agencies, or whether it’s the civil service themselves.

And what we’re seeing in bureaucracy in the United Kingdom, and I think here in the United States as well, is a growing activist class of civil servants who have views on transgender ideology or climate or human rights, which they are keen to promote in their roles.

I saw this firsthand and one of the key points the book is about is my battles that I had with that institutional mindset. And there’s a phrase that we use in Britain called “consent and evade.” Quite often the officials will be very polite on the request, but it will take a very long time to do if it’s something like helping deport illegal immigrants or sort out the Rwanda scheme. If it’s something that they like, like dealing with climate change, that will be expedited.

And I think it’s very difficult for people who haven’t worked in government to understand just how cumbersome and how treacle-like it has become. And I don’t know if that’s a product of the modern era, if it’s a product of the online society, but it is very, very difficult now to deliver conservative policies.

Now, I did many jobs in many different government departments. I was in the justice department, the environment department, the education department, the treasury, I was in trade, I was in the foreign office, and I faced battles against activist lawyers, against environmentalists, against left-wing educationalists.

But what I thought when I ran to be prime minister in 2022 is I thought I had the opportunity to change things because that was surely the apex of power. I hadn’t been able to change it as environment secretary or trade secretary, but as prime minister, surely that was the opportunity for me to be able to really change things.

Now, there’s a bit of a spoiler alert about the book. It didn’t quite work out. I ended up being the shortest-serving British prime minister as a result of trying to take on these forces. And the particular thing that I tried to take them on was the whole issue of our economy.

* * *

I come today with a warning to the United States of America. I fear the same forces will be coming for President Donald Trump if he wins the election this November. There is a huge resistance to pro-growth supply-side policies that will deliver economic dynamism and help reduce debt.

What the international institutions and the economic establishment want to see is they want to see higher taxes, higher spending, and more big government, and more regulation. They do not want to see that challenged. And we’ve already heard noises from the Congressional Budget Office and elements of the United States market about the financial stability situation.

So, what have I learned from my experience? What have I learned from my time in office? I have learned that we are facing really quite challenging forces of the global left, not just in terms of their virulent activists making extremist documents, but also the power they hold in our institutions. And that leads me to believe that what conservatives need is what I describe as a bigger bazooka.

Now, what do I mean by a bigger bazooka? Well, first of all, I mean that we need really strong conservative political infrastructure to be able to take on the left. They are well-funded, they are activists, they have many friends in high places. And we need strength and depth in our political operation.

That’s why I’m working on a new political movement in the UK called Popular Conservatism, which is about bringing in more activists, more candidates, more potential legislators, more operators who can actually fight in the trenches against the left in the ideological warfare that we now face.

The second thing we need to do is we need to dismantle the administrative state. And there are lots of people I speak to who say, “It’s just because you ministers aren’t tough enough. If only you were a bit bolder in taking on things, if only you had a bit more political will, you would be able to deliver.”

Those people are not right. Until we actually change the system, we are not going to be able to deliver conservative policy such as the depths of resistance in our institutions and our bureaucracy that we do have to change things first.

And what does that mean? Well, you’re ahead of us in the United States in that the president gets to appoint 3,000 people into the government positions. In Britain it’s only 100 people. And those 100 people are relatively junior. They’re not in charge of departments. So, I believe we need to change that in Britain. We need to properly appoint senior figures in our bureaucracy.

We also need to deal with the proliferation of unaccountable bureaucratic bodies. They have to go. There has to be a real bonfire of the quangos.

But even here in the United States, policies like Schedule F are going to be very, very important in order to be able to deliver a conservative agenda. And the project that Heritage is sponsoring, Project 2025, is another vital part of building that institutional infrastructure that can actually deliver conservative policies. Having seen what I’ve seen on both sides of the Atlantic, I think both of those things are vital in order for conservative policies to deliver.

But we can’t just deal with the administrative state at a national level because what we’ve also got is the global administrative state. We have the United Nations, the World Health Organization, we have the [Conference of the Parties] process.

And one of the things I tried to do was stop Britain hosting COP in Glasgow. I failed. But I want to see us in the future abandon that process. The best people to make decisions are people that are democratically elected in sovereign nations. It is not people sitting on international bodies who are divorced from the concerns of the public.

The final thing conservatives need to do is end appeasement. And by ending appeasement, I’m talking about the appeasement of woke Orwellianism at home as well as the appeasement of totalitarianism abroad. We have to do both of those things because both of those things are threatening our way of life.

Totalitarian regimes like China, Russia, and Iran have to be stood up to, the only thing they understand is strength. And now the military aid budget has been passed through Congress. There needs to be more clarity about how Russia can be defeated and how China and Iran will also be taken on. And in order to achieve that, we are going to need a change in personnel at the White House.

Now, I worked in Cabinet whilst Donald Trump was president and while President Biden was president. And I can assure you, the world felt safer when Donald Trump was in office. 2024 is going to be a vital year, and it’s the reason that I wanted to bring my book out now. Because getting a conservative back in the White House is critical to taking on the global left. And I hate to think what life would be like with another four years of appeasement of the woke left in the United States, as well as continued weakness on the international stage.

But my final message is that winning in 2025 or winning in 2024 and going into government in 2025 is not enough. It’s not enough just to win. It’s not enough just to have those conservative policies. That there will be huge resistance from the administrative state and from a left in politics that has never been more extremist or more virulent.

And that is why it will need all the resources of the American conservative movement, think tanks like Heritage, and hopefully your allies in the United Kingdom to succeed. But you must succeed because the free world needs you.

Reprinted by permission from The Daily Signal, a publication of The Heritage Foundation.

Tyler Durden

Fri, 04/26/2024 – 02:00

via ZeroHedge News https://ift.tt/jit3L8I Tyler Durden