By Michael Every of Rabobank

US Secretary of State Pompeo’s speech yesterday was momentous if not yet guaranteed to be portentous. It was held to commemorate 50 years of ‘Nixon going to China’ – and said this had been a well-intentioned mistake. “We’ll keep on talking,” said Pompeo. “But the conversations are different these days…The only way to truly change communist China is to act not on the basis of what Chinese leaders say, but how they behave…I say we must distrust and verify…We can’t treat this incarnation of China as a normal country, just like any other….I call on every leader of every nation to start by doing what America has done – to simply insist on reciprocity.”

He pointed fingers when addressing “a NATO ally of ours that hasn’t stood up in the way that it needs to with respect to Hong Kong because of the fear Beijing will restrict access to China’s market. This is the kind of timidity that will lead to historic failure, and we can’t repeat it.” Then he underlined “If we bend the knee now, our children’s children may be at the mercy of the Chinese Communist Party.” This was not about containment, he concluded, but: “We can’t face this challenge alone….Maybe it’s time for a new grouping of like-minded nations, a new alliance of democracies…If the free world doesn’t change Communist China, Communist China will change us.” Pompeo also spoke about empowering the Chinese people as a tool to push back against the CCP – which will almost certainly be taken as an attempt to undermine it by Beijing.

In short, as the media have noted, the speech was just a notch below calling for regime change – and at the very least for Western decoupling via reciprocity…unless China changes. That makes it momentous. Whether it is portentous depends on what Western businesses do. History shows they are unlikely to take any moral lead when dollars are involved, which means the onus will be on governments to force their hand: will it, or is this just rhetoric? We shall soon see. (Today’s latest update is that China is closing the US consulate in Chengdu…and that it may refuse to comply with the US request to close its consulate in Houston, which truly would be without recent diplomatic precedent.)

Meanwhile, as Pompeo’s speech takes US-China relations back to 1970, and leading some to recall the Korean War (1950-53) where the two sides were fighting each other, other momentous developments are unfolding in the US on a separate but related front.

Just as US initial claims spike back to 1.4m, today is the deadline for extended US unemployment benefits to end. They are going to lapse with no replacement. Until Congress can agree on something new, we are about to find out what an economy looks like when you throw tens of millions into unemployment, because you would not nationalise payrolls like in Europe, and then throw unemployment benefits out too. Reports suggest some Republicans have even been trying to sneak in backdoor cuts to social security in any stimulus bill too for good measure. This prompted left-wing commentator Matt Stoller to tweet: “Not to give strategic advice to Republicans, but it’s probably a bad electoral strategy to negotiate aggressively to ensure that the next coronavirus package includes mercenary style hunting games of the poor. To put it differently, a good Republican electoral strategy five months before an election is ‘here free money for all the voters.’” Is his view of impending electoral suicide really painless? And if so, for whom?

Of course, there is a free-market fundamentalist view that the more the government spends, the worse things get. The logical corollary is that the more you eat, the greater the risk of obesity and heart attack. Which is true. On the other hand, try eating nothing. You tend to die a lot more quickly than the other way round. We also have lots of history to lean on to back up that point. Greek austerity was a disaster; Italian austerity was a disaster; and Weimar Germany austerity under Brűning resulted in Nazism. We are talking about tens of millions of people being unemployed with virtually no income. Think of the snowball effect of that income slump: at least think of the landlords and the businesses that will suffer too. Perhaps that’s why US stocks dipped yesterday – and why the Fed immediately stepped in to widen the range of firms it can bail out. No free-market fundamentalism there, eh?

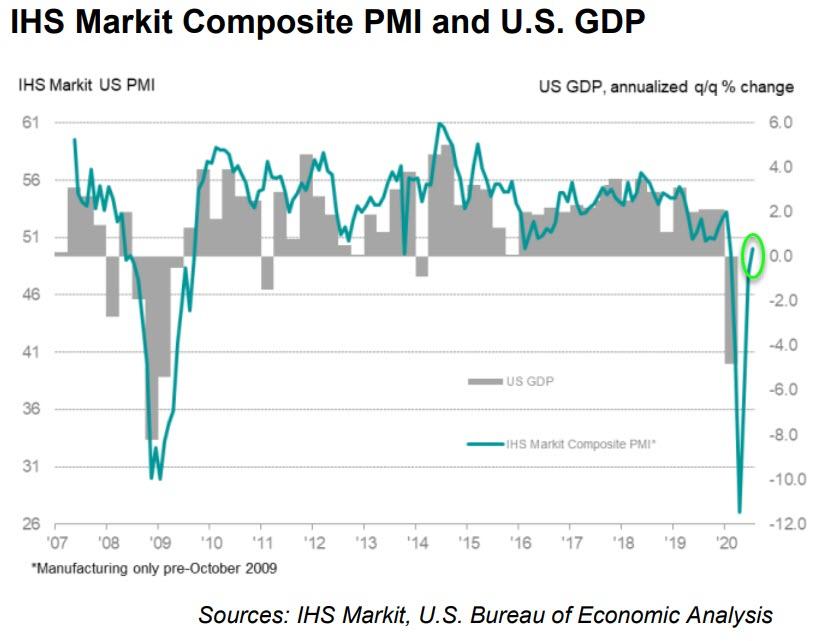

So markets can now contemplate a serious escalation in US-China tensions that runs far beyond the risk of mere tariffs; and of a looming lurch lower in the US economy, which might necessitate even more focus on foreign policy as a distraction. They can also worry about India-China, UK-Europe, and now France-Turkey tensions too; the latter as President Macron calls for sanctions against Ankara to support Greece against Turkish maritime claims aimed at natural gas resources.

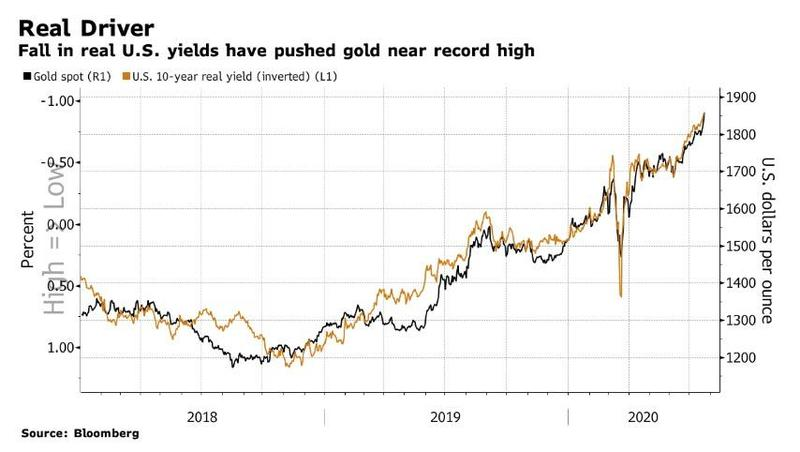

Is it any wonder bond yields are going down again, and that even stocks are wobbling? Or that risk-off FX is (very, very tentatively) risk off? Not at all. Indeed, with ideological fixity and the Korean War in mind, it’s hard not to conclude we are in a M*E*S*S and so to hum:

Through early morning fog I see; Visions of the things to be

The pains that are withheld for Xi; But Republicans just cannot see

That suicide is painless; It brings on many changes

And they can take or leave it if they please

Games of politics are hard to play; Trump’s gonna lose now anyway(?)

The final card McConnell lay; As jobless lose all hope today

Suicide is painless; It brings on many changes

And they can take or leave it if they please

The fiscal sword will pierce our skin; It hurts like hell when it begins

But as it works its way on in; The pain grows stronger – yet DC grins

Suicide is painless; It brings on many changes

And they can take or leave it if they please

A brave Republican once requested me; To answer questions that are key

“Trump or Biden will it be?”; And I replied, “Cut benefits: you’ll soon see”

Suicide is painless; It brings on many changes

And voters can do it to them if they please