Authored by Alasdair Macleod via GoldMoney.com,

On the fiftieth anniversary of the Nixon Shock, this article explains why fiat currencies have become joined at the hip to financial asset values. And why with increasing inevitability they are about to descend into the next financial crisis together.

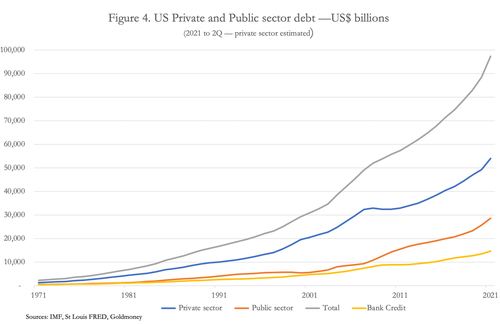

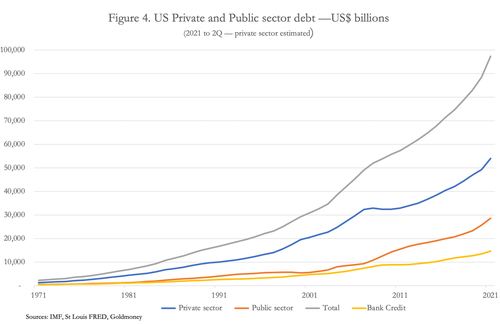

I start by defining the currencies we use as money and how they originate. I show why they are no more than the counterpart of assets on central bank and commercial bank balance sheets. Including bonds and other financial issues emanating from the US Government, the individual states, with the private sector and with broad money supply, dollar debt totals roughly $100 trillion, to which we can add shadow banking liabilities realistically estimated at a further $30 trillion.

This gives us an idea of the scale of the threat to asset values and banking posed by higher interest rates, which are now all but certain. The prospect of contracting financial asset values is potentially far worse than in any post-war financial crisis, because the valuation base for them starts at zero and even negative interest rates in the case of Europe and Japan.

I focus on the dollar because it is everyone’s reserve currency and I show why a significant bear market in financial asset values is likely to take down the dollar with it, and therefore, in that event, threatens the survival of all other fiat currencies.

Introduction

Dickensian attitudes to debt (Annual income twenty pounds, annual expenditure twenty pounds ought and six, misery) reflected the discipline of sound money and the threat of the workhouse. It was an attitude to debt that carried on even to the 1960s. But the financial world changed forever in 1971 when post-war monetary stability ended with the Nixon shock, exactly fifty years ago.

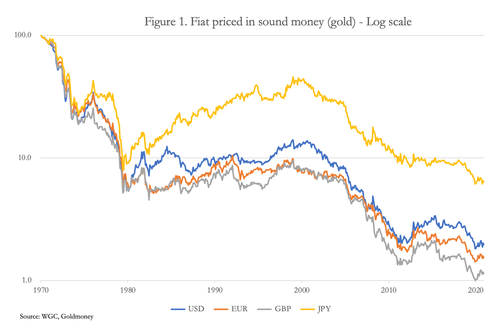

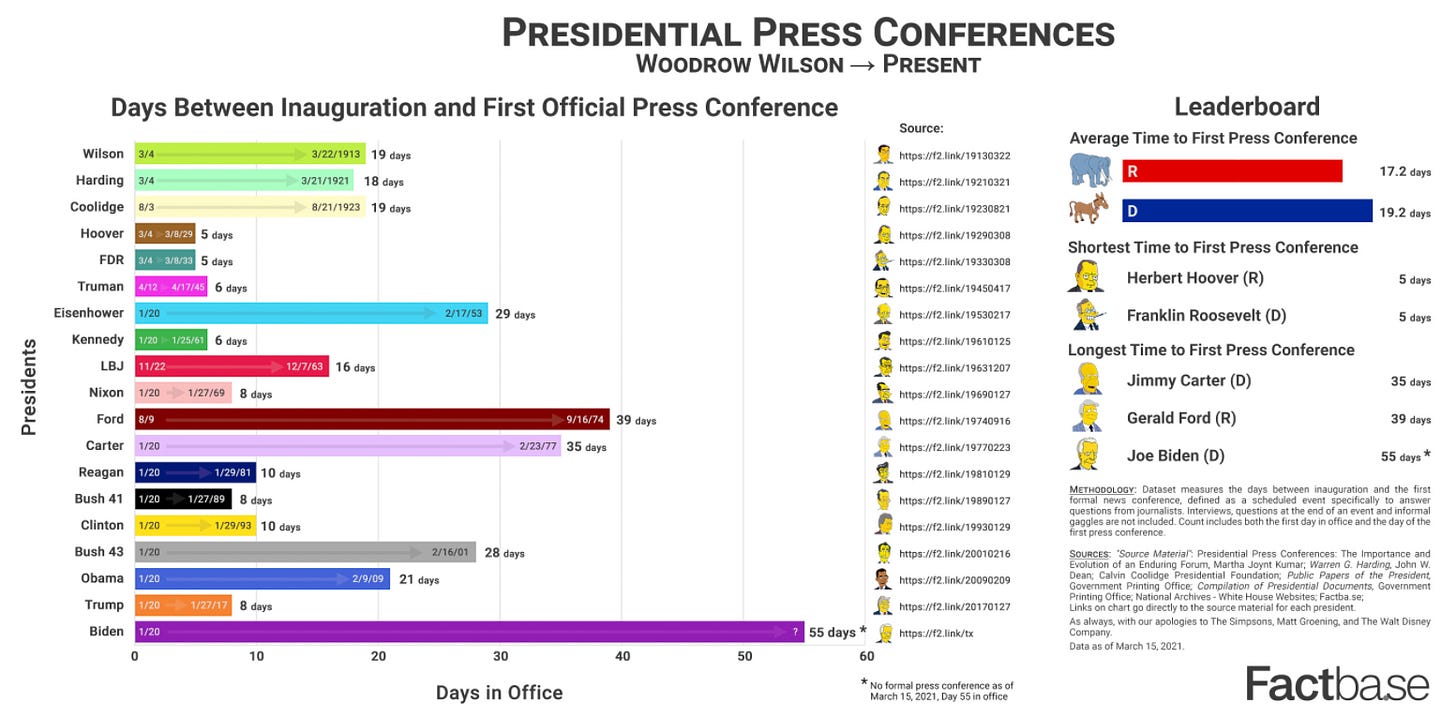

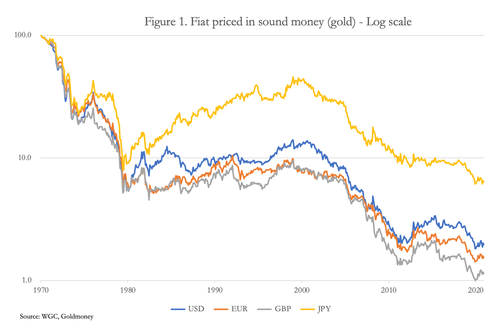

Micawber’s aphorism was aimed at personal spending. It was advice given to a young David Copperfield, rather than a recipe for life. But since money’s transmogrification into pure fiat and as soon as youngsters in the fiat-currency world began to earn, Micawberism no longer held. Figure 1 shows the decline in purchasing power of fiat currencies in which earnings are paid relative to the sound money (gold) that had underpinned the post-war Bretton Woods agreement.

In the four major currencies, Micawber’s advice turns out to have been inappropriate and the opposite of being the path to riches. To benefit from a lender’s losses, a borrower merely had to ensure two things: that he could always service his debt and that the lender could not reclaim the debt before it was due so long as it was serviced according to the contract.

Unsurprisingly, everyone who could dismiss Micawberisms did so and increasingly turned borrower, financing house purchases with mortgages and supplementing earnings with borrowing for consumption. Since 1970, average house prices in the UK have increased from £4,057 to £256,000 today. But as a means of hedging the fall in the pound’s purchasing power, it has underperformed sound money. Instead of buying a house, if £4,057 had been hedged into gold it would now be worth £100,000 more. And according to the St Louis Fed’s statistical base, median sales prices of houses sold in the US rose from $23,000 in 1970 to $375,000 today, an increase of 16.3 times. Invested in gold, it would have risen to $1,162,000.

These figures assume no mortgage borrowing, which would have made all the difference. The message for those who speculated in residential property is to have borrowed as much as could be afforded. 90% loan-to-value mortgages would have knocked the socks off the long-term decline in fiat money’s purchasing power.

The basic lesson hasn’t been lost on industry either. It has moved on from borrowing with a view to repayment from the profits of production to running debt permanently, further encouraged by the practice of private equity using debt to leverage returns. Governments too have exploited the dubious benefits of debt: it enables them to spend without increasing unpopular taxes. And today, according to the Congressional Budget Office’s baseline budget projections for the current fiscal year, 44% of government spending is financed by debt.

The origin of all this debt is monetary expansion, mostly from the banking system but topped up by the central banks. It is a mistake to view it as deposit money originating from savers, which is the common fallacy, as we shall now illustrate.

The origin of debt

Many economists and financial commentators assume that deposits equate to savings, when instead they equate to debt. The error arises from not understanding how deposits are created. To explain it we shall start with the central bank. A central bank acquires assets in the form of bills, bonds, and loans, by issuing deposits matched by them to the government’s account and to commercial banks, along with bank notes to the public.

The point is that the central bank issues deposits and bank notes to acquire assets, and they do not arise by any other means.

It is true that bank notes can be deposited at a bank, in return for which a customer’s deposit account is credited, but this is a minor part of total bank deposits. The origin of the rest of deposit money is always the consequence of credit creation. A bank lends money to a borrower by recording the loan as an asset, and at the same time it credits the borrower’s deposit account with the proceeds. This is because through double entry book-keeping a credit in its asset column must always match an equal debit on the liability side. It is through this process that deposits are created. And as a bank loan is drawn down, both the bank’s assets and liabilities reflect the change in balances.

The borrower draws down his loan from the bank to pay his creditors, and in turn they pay the proceeds into their bank accounts. To the latter, they have earned the money, but its origin nonetheless is bank credit, or if they are paid in bank notes, central bank credit. Consequently, it is a mistake to look at a bank’s balance sheet, observe that it has, say, $100 billion of deposits and conclude that the bank possess it. It doesn’t. Among its assets, it will have a small amount of vault cash (bank notes) and some assets that can be liquidated immediately to meet withdrawals if need be. And all the deposits on a bank’s balance sheet showing as liabilities are debts to its lending customers.

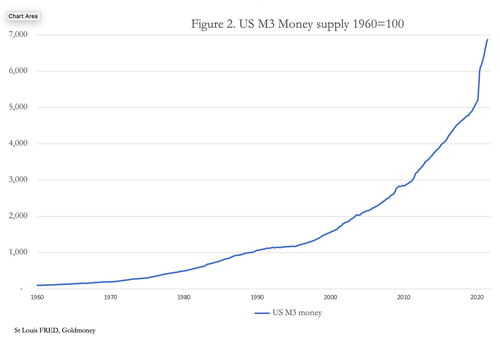

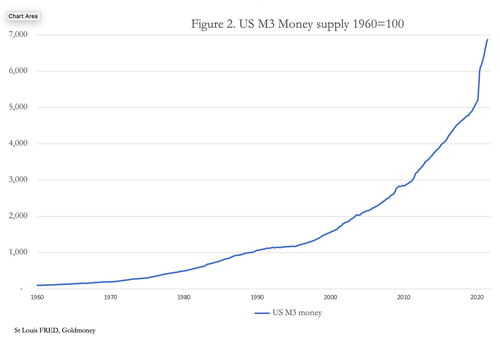

So, what about savings? Savings are simply unspent bank credit and hoarded bank notes. The only true money, a medium of exchange whose origin is not debt, is physical gold. Otherwise, savings in the form of bank deposits and bank notes owe their origin entirely to debt. We can now explain the mystery of the accumulation of money supply. It is not an accumulation of savings, but an accumulation of the counterpart to debt financed by the expansion of bank credit. Figure 2 shows how dramatically bank and central bank credit have expanded over time.

M3 is the US’s broadest measure of currency and has expanded nearly seventy times since 1960. Since 1971 when Bretton Woods was suspended, the expansion has been 34 times, while the US population increased by just under 59%. The average of all bank liabilities therefore rose from $2,881 per head of population to $61,562. The subtle point is that they are not to be regarded as currency owed to depositors, but debt owed by the banking system to the public.

But banks are not the only source of debt. Capital markets create further debt obligations through the recycling of bank deposits. Let’s say that a corporation raises a billion-dollar loan in the capital markets. Subscribers for the loan draw down on their bank deposit balances to transfer them to the agent’s bank for transmission to the corporation’s deposit account with its own bank. In the process, some banks will see net withdrawals while others will see net deposits. The differences are ironed out through wholesale money markets, which operate as a centralised clearing system, so that commercial banks individually are always in balance. Consequently, the fund-raising corporation has a debt facilitated through the banking system but owed directly to investors. Governments and financial borrowers do most of their funding in this manner, and while the US banks owe their customers an indicated (M3) $20.5 trillion, the total of private sector and government debt is estimated to be more than a further $70 trillion. Altogether, including bank obligations US debt is approaching $100 trillion (see Figure 4 below). And that’s before we account for shadow banking.

Micawber would have a fit — but it’s only paper.

The history of credit expansion

Banking has worked in this manner since London’s goldsmiths began to operate as lenders against deposited specie during the English Civil War (1642—1651). To pay the 6% interest common at the time depositors recognised that goldsmiths would have to take in deposits as their own property to be able to earn the interest by trading with it as they saw fit. Under this agreement they were not trustees of the money, but its proprietors, and therefore they received it as bankers.

Naturally, the funds deposited bore little relationship to the goldsmiths’ own capital and they quickly learned that depositors were unlikely to demand their funds returned to them all at once. Therefore, goldsmiths and the bankers that they evolved into were able to multiply their liabilities to pay on demand and keep sufficient liquidity to ensure immediate payment of all claims likely to be demanded at any one time.

This was fine, so long as trading in currency and credit progressed with a reasonable degree of stability. But when the quantity of credit expanded more rapidly, typically under the influence of undue lending optimism, it led to a liquidity crisis; an event that through the nineteenth century was recorded every ten years or so and is approximately still the pattern in recent times.

It is that instability which matters in our efforts to divine future trading conditions. Figure 2 above shows the rapid expansion of US dollar money and bank credit culminating at an annualised 25% rate which has taken place since March 2020. That much of this expansion of deposits originated at the central bank is immaterial.

The change that we have seen since the 1980s is that the expansion of credit has increasingly shifted from non-financial borrowers to financing purely financial activities. This does not invalidate systemic risk from lending cycles; rather, it alters its character. Lending to customers to speculate in financial assets while taking in those assets as loan collateral is one example of how this risk is likely to materialise, which when interest rates increase — the inevitable consequence of a prior increase in circulating currency — will force bankers to liquidate loans to protect their own capital.

Figure 3 shows the recent level of investor leverage, which at the end of July stood at $844bn, which represents the initial margin calls that will occur in a market downturn.

Another aspect of the current situation stems from the leverage given to capital issues of debt outside the banking system by the increase in bank deposits. Figure 4 below shows the summation of bonds and bank credit. Including bank credit, total US dollar debt will shortly exceed $100 trillion if it hasn’t already.

Debt is not a problem so long as it is productive, and overall it increases at a stable rate. Neither is true today. Private sector debt is increasingly used for ephemeral consumption and to prop up zombie corporations and their malinvestments. Government debt is rapidly increasing on the back of escalating statist social responsibilities and self-serving cheap borrowing costs. A projection of debt levels into the future is unlikely to see any diminution of the pace of its increase, with a further acceleration appearing to be more likely. And this is only the on-balance sheet evidence.

Shadow banking

Banking and debt statistics exclude shadow banking — including but by no means limited to non-bank mortgage lending, leveraged lending, student lending and some consumer lending (according to Jamie Dimon in his 2019 annual letter to JPMorgan Chase’s shareholders) for which there are no reliable estimates. A figure of $52 trillion in 2018 has been suggested in the media.

Shadow banking refers to financial businesses that are not regulated as conventional banks and which originate or act as intermediaries in lending money, such as payday lenders, hedge funds, insurance companies, asset managers, credit card providers, payment systems, mortgage servicers, and even auctioneers who make loans to wealthy clients. More recently we can add stablecoins. It is not clear to what extent shadow banking is funded by entities acting as agents for regulated banks and as arrangers of securitisations, such as the creation and funding of mortgage-backed securities. But it seems likely that significant quantities of shadow funding originate from credit additional to that recorded in licenced banks. A clear illustration would be the issuer of the stablecoin Tether, which runs a balance sheet similar to a central bank, with assets on one side and stablecoin currency tokens, nominally tied to the dollar by being the counterpart to dollar-denominated assets, as liabilities on the other.

The Financial Stability Board (a subset of the Bank for International Settlements) now uses the term non-bank financial intermediation as a substitute for shadow banking. The FSB’s last estimate of perhaps the most relevant category, other financial institutions’ (OFIs), in the US was estimated by the FSB to have assets of $30 trillion in 2018. We can reasonably add this to the $100 trillion of the outstanding currency and debt liabilities recorded in Figure 4, without allowing for any further growth in the last few years.

As a footnote, it is worth recording that financial leverage in some OFI categories can be extreme, imparting extra unaccounted systemic risk to the financial system. And in his letter to JPMorgan Chase shareholders referred to above, Dimon pointed out that when the next downturn begins, “Banks will be constrained — both psychologically and by new regulations — from lending freely into the marketplace, as many of us did in 2008 and 2009. New regulations mean that banks will have to retain liquidity going into a downturn, be prepared for the impacts of even tougher stress tests and hold more capital…. In the next financial crisis, JPMorgan Chase will simply be unable to take some of the actions we took in 2008…

It is alarming to think that the Fed’s reliance on commercial banks pulling together to prevent a financial crisis bankrupting financial and non-financial businesses, such as was dramatically achieved following the Lehman failure, will not be available to central banks today due to tighter regulations. To further illustrate the point, Dimon might add today that the risk weighted asset provisions of Basel 3, due to apply from 2023 will require banks to increase their equity capital even more; or alternatively, reduce their balance sheet exposure.

In summary, quantifying shadow banking in the context of additional debt and currency to that recorded officially is like trying to nail a jelly to the wall. But there is no doubt that the figure is substantial and there are systemic risks in the sector in addition to the official banking system. And even on a conservative assumption, in the US it is 50% larger than regulated banking activities.

The inevitability of rising interest rates

The consequences for the purchasing power of an accelerating rate of inflation of credit and currency are manifest in rising commodity prices, rising manufacturing price inputs and rising consumer prices themselves. The US’s official CPI has risen by 5.4% over the last year, and despite the fervent hopes of the Fed’s FOMC members shows no sign of abating. Shadowstats calculates the true increase at 13.4%.

In truth, changes in the general price level cannot be calculated, being no more than a concept. But what we can say is that the purchasing power of the dollar is probably falling at a rate faster than 10% annualised, and given the continuing inflation of credit, it is unlikely to stabilise in the foreseeable future. If the Fed is unable to raise interest rates sufficiently to stem it, the rate of decline for the dollar in terms of its purchasing power is likely to accelerate. In short, interest rates are bound to rise by more than a trivial amount.

Instead of facing this reality, the Fed is dismissing rising prices by claiming that they are due to temporary factors. Furthermore, there are now signs that the US and other economies are either stalling or slowing after an initial bounce, which encourages central bankers to hope that pressure for prices to rise further will subside. But on examination it is an argument that barely holds water.

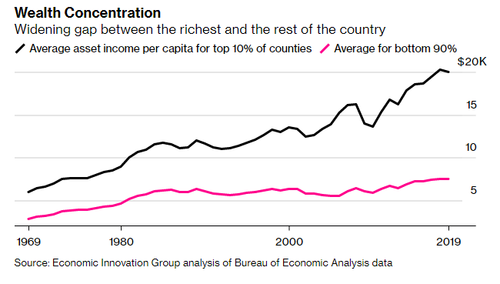

Behind the error is a belief that price rises are predominantly caused by increasing demand, and that overall demand has been temporarily boosted by the ending of coronavirus lockdowns at a time of supply disruption. But there is an inconvenient truth to consider. Possibly other than some short-term countertrend effects, there is no recorded instance of a substantial monetary debasement that has not led to significantly higher prices, particularly for essentials such as food and energy, while at the same time economic activity enters a significant downturn. The reason is simple: currency debasement transfers wealth, and therefore buying power in real terms, from its users to the issuer, impoverishing the former and benefiting the latter. Everyone with a salary and savings suffers a reduction in their real values, while the state and the early receivers of the newly-issued currency get the benefit.

Therefore, driven by a falling purchasing power for the currency on the back of an inflation of its quantity, we will either see a further substantial fall in the dollar’s purchasing power, fully reflecting its dilution, or we will see a rise in interest rates which may or may not be sufficient to encourage holders not to dispose of the currency immediately. The group most likely to dump the dollar first is foreign holders, who currently hold dollar deposits and financial assets totalling over $30 trillion. But the foreigners’ problem is that with all fiat currencies tied to the dollar as their reserve currency, there is no alternative sounder currency in exchange. Consequently, the loss of all currencies’ purchasing power will be reflected in commodity prices and the prices of everything else.

Driven by neo-Keynesian beliefs, central banks will be conflicted between maintaining easy monetary policies to support economic activity, and raising interest rates to combat rising prices by supporting their currencies. The history of similar instances tells us that they are likely to err in favour of suppressing interest rates, and even supporting price controls rather than raising interest rates sufficiently. It is not because the monetary authorities necessarily believe in these measures — it’s just they will see no alternative.

There is bound to come a point where the monetary authorities lose control over interest rates, and if it has not yet occurred by then, control over markets themselves. They will then find it increasingly difficult to fund government budget deficits. And with the outlook being for ever higher prices, despite price controls (if they are introduced) the pressure for financial asset values to decline will be set to overwhelm all attempts by the authorities to support them. There is no doubt that bonds and equities are in a bubble to end all bubbles, priced based on zero, and in many cases negative interest rates. Never in the course of financial history has a bubble burst on such excessive valuations.

Returning to the dollar, if Shadowstats estimate of price inflation at over 13% is correct, then the recognition of the true loss of the dollar’s purchasing power in the domestic economy will be that all financial assets are horribly mispriced as well. The reality will then dawn on market participants about the true state of government finances. In America, net interest will rise from the CBO’s estimate of $331bn to close to a trillion and then two the following year, because of the relatively short-term average maturity profile of USG debt.

Tapering QE will not be possible

As if to illustrate the confusion on Wall Street and in the FOMC, there is talk of introducing a taper of quantitative easing in the fourth quarter of this year or early in 2022. But other than reflecting zero interest rates, the reason markets are at current levels of overvaluation is because of the monthly injection of $120bn QE into pension funds and insurance companies in return for government and agency debt. They invest the cash in riskier bonds and equities. Any attempt by the Fed to ween them off this monthly injection will make markets fall, something which the authorities have been keen to avoid. There can only be one of two conclusions: either the FOMC members do not understand the true purpose of QE (which is unlikely) or they are bluffing. The bluff must be to pretend that economic conditions have improved enough to support markets without as much as $120bn monthly being injected into them, without any actual intention of tapering.

More realistically, when the interest rate outlook clarifies into one where the risk is of significant increases, the Fed may be forced into increasing QE substantially to support equities and ensure bond yields remain suppressed.

The fates of financial assets and fiat currencies are joined at the hip

In this article, we have seen that all currency is the result of credit expansion either by the central bank or by the banking system. And to the latter, we must add the shadow banks who similarly create credit with matching deposit entitlements. We have focused on the dollar because it is the reserve currency. But all other currencies have the same fiat characteristics and none of them have a sound money alternative underpinning them or available to the public in the form of gold coin.

We have noted that financial assets owe their current valuations to zero or even negative rates, and that prices are further supported by QE, which in the US at $120bn every month amounts to nearly two trillion dollars since March 2020. Some other jurisdictions have aggressive QE programmes, notably the Japanese, but it is the US that matters because global capital markets take their cue from those of the US.

At some stage soon, due to imminently rising interest rates and/or a further acceleration in the declining purchasing power of the dollar, financial asset values are bound to face a sharp contraction. The one topic we haven’t explored is the relationship between falling asset values and their effect on the fiat currency.

In the initial stages of a market bubble bursting, there is a dash for cash. Investors will try to rescue what they can by selling, and we can be certain that the lenders providing margin loans will be calling them in and causing further selling. We can therefore expect a currency to remain steady, perhaps rising slightly on the foreign exchanges (depending on the counter-acting degree of foreign liquidation) while bond yields begin to rise, and stock prices fall.

We then enter a second phase, when banks begin to call in loans more widely, because collateral values have fallen, and loans not related to market speculation are no longer secured. Both the asset and liability sides of bank balance sheets will contract through a combination of non-performing loans being written off and loans being successfully called in. Dollar debt, totalling at our estimate as much as $130 trillion will be under threat for all holders of it, and their losses will be substantial. And for those with debt obligations, who for too long have become accustomed to very low, suppressed bond yields, their economic calculations will have become seriously undermined.

The response from central banks can only be to rapidly increase their balance sheets to compensate for the losses in the commercial banks, flooding the financial system with extra deposits to bolster bank reserves. It will take many trillions of dollars to stabilise a tottering $130 trillion mountain of debt and its matching credit, and the equivalent task for central banks managing all the other major currencies, to stop the global banking system from going under. The collapse in the purchasing power of all currencies will then resume with a vengeance, because attempts to stop bank credit and deposits liquidating into a black hole of currency destruction can only accelerate.