US Reports Biggest Jump In COVID-19 Cases Since May 1 As Florida Sees 3rd-Straight Record: Live Updates

Tyler Durden

Sat, 06/20/2020 – 12:25

Summary:

- US reports 30k new cases

- India now 4th largest outbreak with ~400k cases

- India reports another record jump

- Florida reports 3rd straight record jump

- Russia reports fewer than 8k new cases

- South Korea reports 67 new cases, largest jump since May

- China reports just 27 new cases

* * *

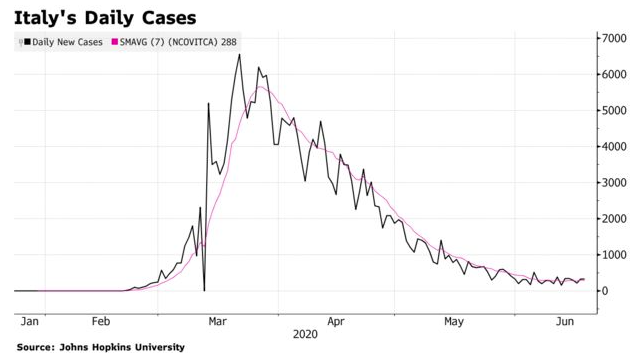

For the first time since May 1, the US reported more than 30,000 coronavirus cases in a single day as Texas, Florida, Arizona and a handful of other states reported their latest record totals for the 2nd or 3rd day in a row, for some cases. While NY, NJ and a handful of surrounding states see cases continue to decline to negligible levels, following a pattern seen in Europe, roughly 20 states have seen numbers continue to rise, and about half of those are seeing new cases hit record levels well above where they were during the US’s ‘peak’ back in April.

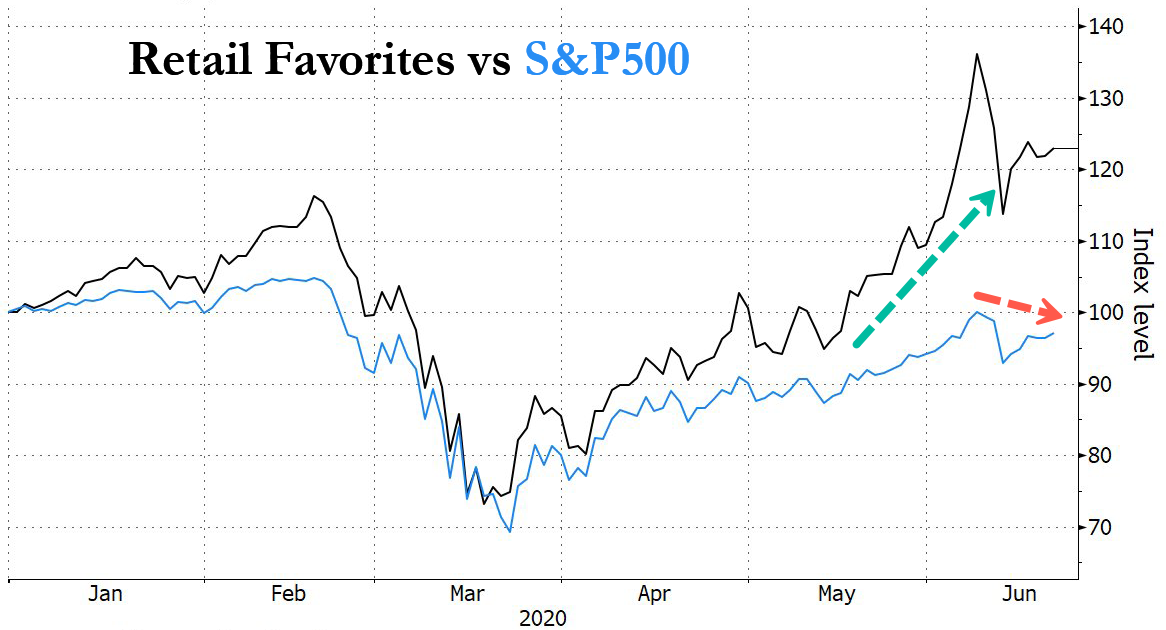

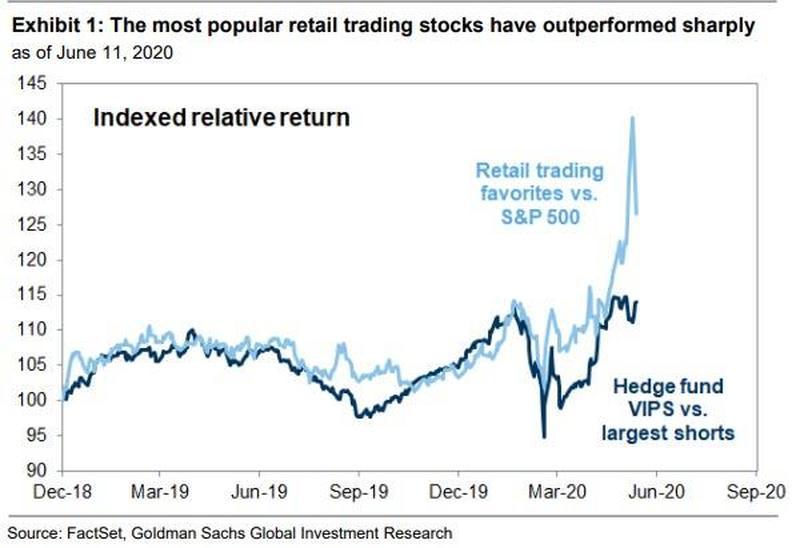

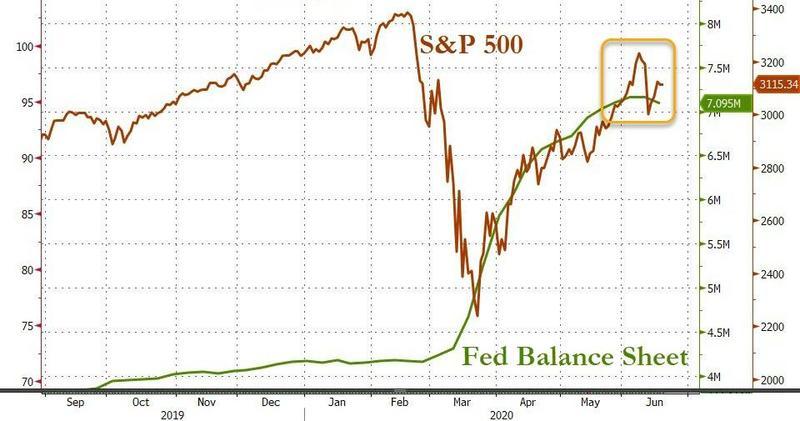

Even stocks are beginning to notice as the market sold off last week in recognition of the fact that even if states don’t go the shutdown route, as the White House has insisted won’t happen, the spike in infections, and the inevitable jump in deaths to follow, will ensure that the V-shaped recovery doesn’t happen.

The US tallied 31,630 new confirmed cases on Friday, according to data from the Washington Post. The last time new daily cases in the United States topped 30,000 was on May 1, when 33,263 new infections were reported. That was right as the US ‘peak’ was beginning to pass. Around the world, 177k new cases were reported yesterday. Ironically, the number of new cases reported in the city of Tulsa hit a new high on Friday, one day before Trump’s big campaign rally.

Thanks to the flurry of red states like Arizona, Florida, Texas etc. that lowered their guard too quickly, the US just can’t seem to bend that curve.

More than 2.1 million cases of the virus have been confirmed across the US as of Saturday morning. With 119,158 confirmed deaths, the US is on the cusp of passing 120k fatalities, while closely watched projections suggest that number could hit 200k by October.

As Brazil passed the 1 million-case mark, a major milestone in what has become Latin America’s biggest and most threatening outbreak, the WHO’s Dr. Tedros warned yesterday that the pandemic “was accelerating”.

In other US news, Florida on Saturday reported yet another record jump in new cases, its third in a row and fourth in the last 8 days. Florida health officials reported 4,049 new cases as well as 40 deaths across the state. Saturday’s numbers bring the total number of cases in the state to 93,797 and the death toll to 3,144.

ANOTHER RECORD: #COVID19 update from @HealthyFla this morning reports 4,049 new positive cases of #coronavirus in #Florida. Total # of cases now at 93,797

CONTEXT: Started off the week reporting over 2,000 cases… Experts expect us to see 6,000 a day in just 2 weeks @10TampaBay pic.twitter.com/0E7E5ixfAG

— Angelina Salcedo (@AngelinaWTSP) June 20, 2020

US State Department said Saturday that COVID-19 infections have been reported at its embassy in the Afghan capital and the staff who are affected include diplomats, contractors and locally employed staff.

It didn’t say how many were impacted, though another source told AJ that as many as 20 could be impacted.

“The embassy is implementing all appropriate measures to mitigate the spread of COVID-19,” the US State department said. The infected staff are in isolation in the embassy while the remainder on the compound are being tested, said the embassy official, who also said the embassy staff have been told they can expect tighter isolation orders.

Russia reported 7,889 new cases of the virus, pushing its nationwide tally to 576,952 since the crisis began. The national coronavirus response center said 161 people had died in the last 24 hours, bringing the official death toll to 8,002.

India, meanwhile, recorded its highest single-day jump yet with 14,516, bringing its total to 395,048, according to health officials. Another 375 deaths brought the death toll to 12,948 as India registered over 10,000 cases for the ninth day in a row. This latest batch of cases put India over the top on Saturday, making it the world’s fourth largest outbreak behind the US, Brazil and Russia. Several countries and Hong Kong continued with plans to evacuate their citizens from India, amid concerns hospitals in major cities such as Delhi and Mumbai may be overwhelmed.

In its biggest daily increase in weeks, South Korea reported 67 new cases of coronavirus, 16 of which health authorities said were from Pakistan. And as Beijing continues to bring its latest flare up under control, China reported 27 new coronavirus cases in the last 24 hours, including 22 new cases in Beijing.

via ZeroHedge News https://ift.tt/2NlnGxL Tyler Durden