Life And Death In The Age Of Fear

Authored by MN Gordon via EconomicPrism.com,

The general mood presently being fortified by the chattering classes is one of perpetual fear. The basic stratagem includes continuously implanting the populace with extreme panic. For a fearful populace is a subservient populace.

The current hobgoblin is the delta variant of the coronavirus. The bug, at this very moment, is dispersing through the population…as viruses do. And, per latest reports from the front lines, the lambda variant’s now on the loose too.

Nonetheless, there’s something on the loose that’s far more deadly to society than a mutated coronavirus. That is, the virus of fear. It originates with the control freak central planners. Then it’s showered on the populace in rapid succession.

Last Sunday, for example, at the conclusion of a meeting of Group of 20 finance ministers, Treasury Secretary Janet Yellen said she was, “…concerned that coronavirus variants could derail the global economic recovery and called for an urgent push to deploy vaccines more rapidly around the world.”

And to avoid catching the delta variant, Dr. Anthony Fauci – a complete doof – stated that, “…if you want to go the extra mile of safety even though you’re vaccinated when you are indoors, particularly in crowded places, you might want to consider wearing a mask.”

Certainly, the opportunities to spread the virus of fear are countless. New coronavirus variants. Cyberattacks. Climate change. Terrorism. The Russian menace. The China problem. UFOs.

You name it…the sky’s the limit…

Situation Perpetual Fear

The most advantageous kind of fear in the eyes of the political class is fear that can be tied to some sort of imminent economic calamity. Such fears are not entirely fabricated. Rather, they stem from a real threat, which is then whooped up and overblown to the max.

This presents the central planners with carte balance opportunities to go big…and save the people from a supposed otherwise disaster. When the fear’s orchestrated just right, the people actually demand it. They plead for the government to save them.

Perpetual fear, you see, is a prerequisite for perpetual government intervention. Fear means big spending programs. Fear means big centrally planned solutions. Fear means great big deficits. Fear means excessive levels of excessive nonsense.

Conversely, without fear spending programs are politically untenable. Without fear stimulus bills financed with credit created from thin air die on the Senate floor. Without fear stimmy checks go away. Without fear zombie corporations are left for dead.

Indeed, fear is an essential lubricant for all collective governments. What’s more, fear delivers the lard for inflationism…where the money supply is continually inflated to support expanding government obligations and promises.

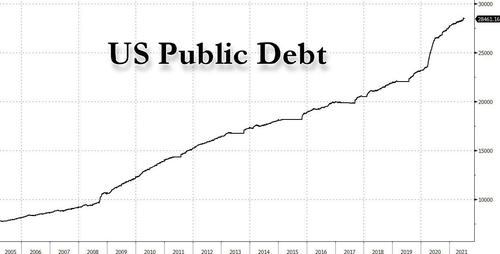

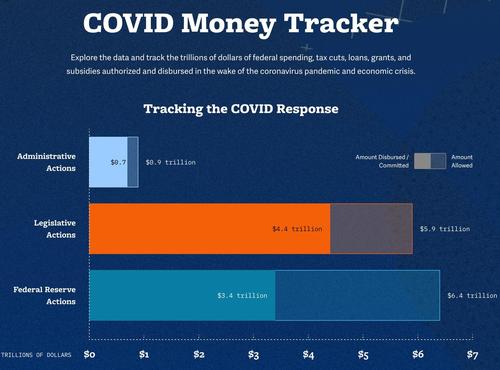

Inflationism is what makes a national debt of $28.5 trillion possible. Inflationism is what makes $3 trillion budget deficits possible. Inflationism is what makes unfunded liabilities of $153.5 trillion possible. Inflationism is what makes the exponential growth of government, and all its agencies and bureaucracies, possible.

Inflationism is what stimulates an ever expanding class of dependents…

No doubt, centralized control and power has been consolidating in Washington for well over 100 years. Since at least the reign of Teddy Roosevelt. These days many electorates advocate for it. They trip over themselves in their rush to vote for big government solutions.

These same voters, however, like to flatter themselves with an American narrative of freedom and liberty. Some may reject communism or socialism as a valid system of government. Just last week, for example, President Biden called communism a “universally failed system.”

Yet politics demands tell a different narrative…

Life and Death in the Age of Fear

The central planners, and the public adherents, are zealous supporters of bankrupt transfer payment programs. The mathematical flaws of social security and Medicare are conveniently ignored. Instead, they want more. They want bigger programs, and government contracts…so long as they get their cut.

At the same time, the general American populace isn’t ready to give up their pretenses and go whole hog in support of socialism. But feed them a steady diet of fear and they’ll line up and beat their chests in unison for the government to do something – anything – to save them.

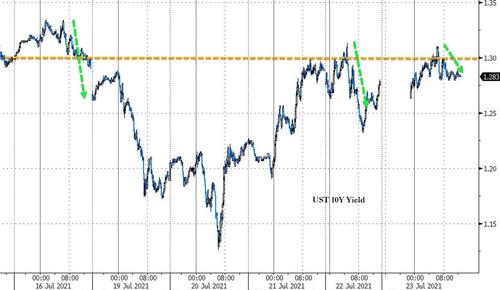

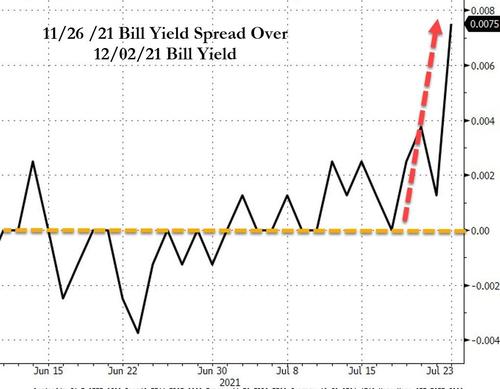

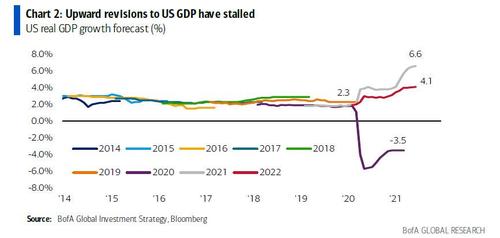

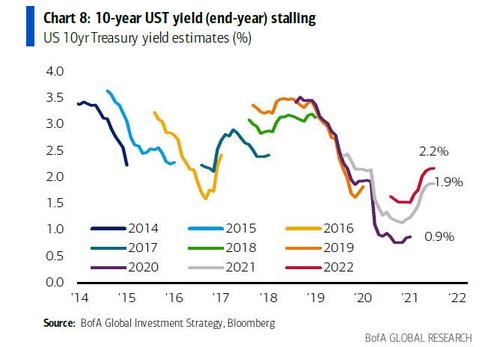

Currently, the post-pandemic boom is turning out to be a great big dud. The 10-Year Treasury yield is slumping towards 1.28 percent. Consumer prices are “officially” increasing at 5.4 percent. By all honest accounts, they’re rising at double that rate.

Here’s the point…

The federal government, and some state governments, have turned a large segment of the population into dependents. This ensures votes come election time…so long as the political class can deliver the goods.

And to deliver the goods they need to keep the free money flowing.

But to keep the free money flowing, in the form of massive spending programs and goodies, the public needs to be implanted with more fear… which brings us to the latest schemes making their way through the Senate…

The $1.2 trillion infrastructure bill. And the $3.5 trillion budget resolution bill to address climate change, child care, and expanded Medicare coverage for hearing, vision and dental care.

Perhaps the Republicans and Democrats will come to agreement on how to distribute the pork. This seems likely for the infrastructure proposal.

The budget resolution bill, however, will likely need an additional nudge. Specifically, it will need heavy doses of manufactured fear…

The delta variant. Lambda. Forest fires. Summer heat waves. Southern floods.

If these bills aren’t advanced before the Senate leaves for the August recess on August 6, the fear machine will spend the rest of August whooping things up to a matter of life and death.

Alas, a new round of lockdowns may be in order to get the job done.

Tyler Durden

Fri, 07/23/2021 – 16:20

via ZeroHedge News https://ift.tt/2V8Myjs Tyler Durden