Waffle House Gives Nation First Glance At What Re-Opening The Economy Will Look Like

Above all things, Waffle House has made a reputation for itself as being reliable. The 24-hour diners, scattered mostly South of the Mason-Dixon line in the U.S. have become a staple for always being open and providing late-night (or early morning) eats for the kind of crowd that’s likely to drift into a diner at 2am on a random Wednesday night.

Now, as the country looks to try and figure out what a “re-opening” from the coronavirus pandemic could look like, one place they may want to turn is Waffle House, according to Bloomberg.

Waffle House surprised exactly no one when it was the first to take Georgia Governor Brian Kemp’s plans for re-opening to hear. The chain had closed 700 of its 2,000 locations is now preparing to see whether its customers come back.

Njeri Boss, a spokeswoman for Waffle House, said:

“We always have a contingency plan. We’re just going to have to adapt as we see whether customers return or not.”

And while Kemp drew the ire of many people by being one of the first to embrace re-opening his state, Waffle House gets a pass. Anyone who knows the chain isn’t going to be surprised that it’s opening back up as soon as possible.

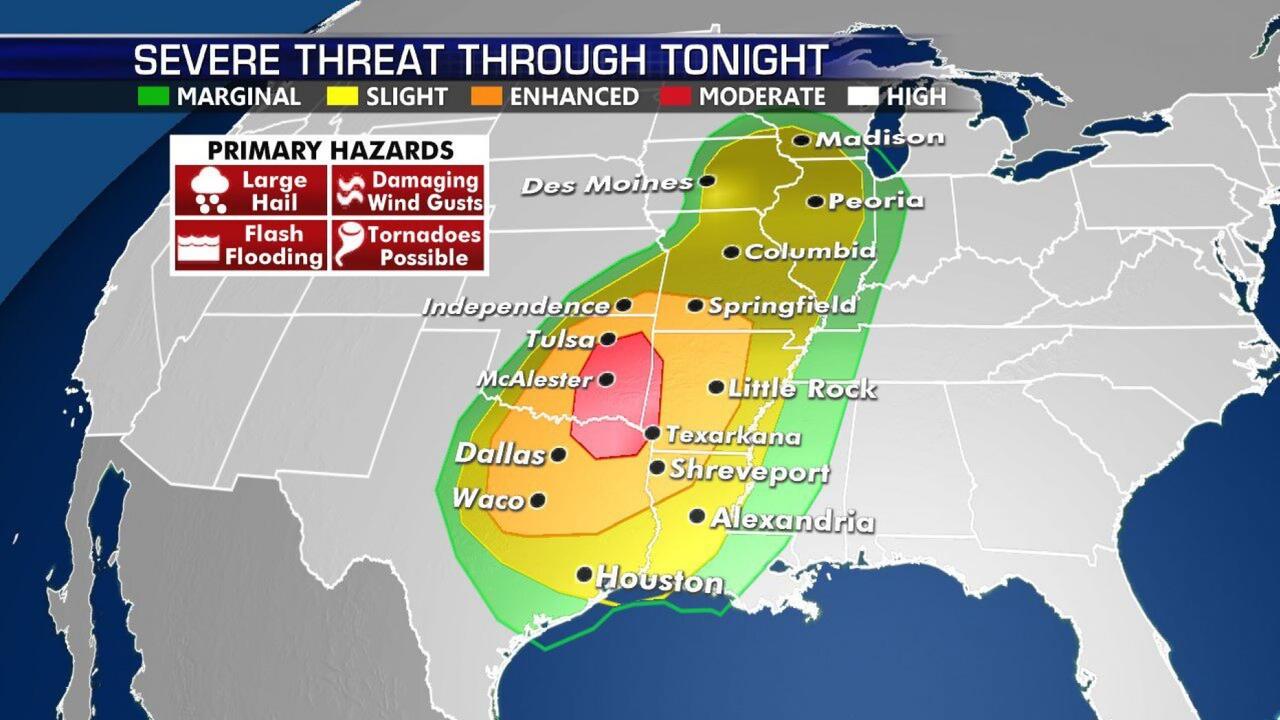

Waffle House locations are known for their resiliency, with FEMA occasionally gauging how bad a storm is by whether or not Waffle House shuts down, now called – and we swear we are not making this up – the Waffle House Index.

The index has three levels:

-

GREEN: full menu – restaurant has power and damage is limited or no damage at all.

-

YELLOW: limited menu – no power or only power from a generator, or food supplies may be low.

-

RED: the restaurant is closed – indicating severe damage or severe flooding.

One customer from Georgia, while picking up takeout food and hearing about Waffle House re-opening for sit-down service, said: “Waffle House never closes — rain, hurricanes. I think my wife and I will go in first before the kids.”

Georgia’s plan for re-opening was drawn up by a 20 person team that includes Joe Rogers III, Waffle House’s current EVP. The chain had kept 1,250 of its restaurants open for take-out during the lockdown. About 400 locations across Georgia and Tennessee opened for sit-down service again this week. From the get-go, reception of the re-opening was slow:

Three people came into a suburban Atlanta unit for takeout orders over a span of an hour Monday morning, but no one sat down. Waffle House employees joked that customers may have been scared off by the horde of news crews gathered outside to record the scene. A couple miles away at another Waffle House, two people sat at the counter as another man unfurled a newspaper at a booth.

The diners are sanitizing common items, like the jukeboxes and tables, more frequently. They are also taking measures to keep people apart:

The staff placed plastic bags over the backs of four of the six stools at the front counter to keep people apart, while sealing off certain booths with red tape. The traditional place-mat menus with their lists of smothered hashbrowns, eggs and biscuits aren’t on tables anymore, though customers can get paper ones or request the plastic variety.

Boss concluded:

“We weren’t expecting that we were going to be overwhelmed with customer demand right away. We knew it was going to take some time.”

Godspeed, Waffle House. Godspeed.

Tyler Durden

Tue, 04/28/2020 – 13:44

via ZeroHedge News https://ift.tt/2KGeAKP Tyler Durden